[News Focus] Caught between the US and China, Korean chipmakers on edge

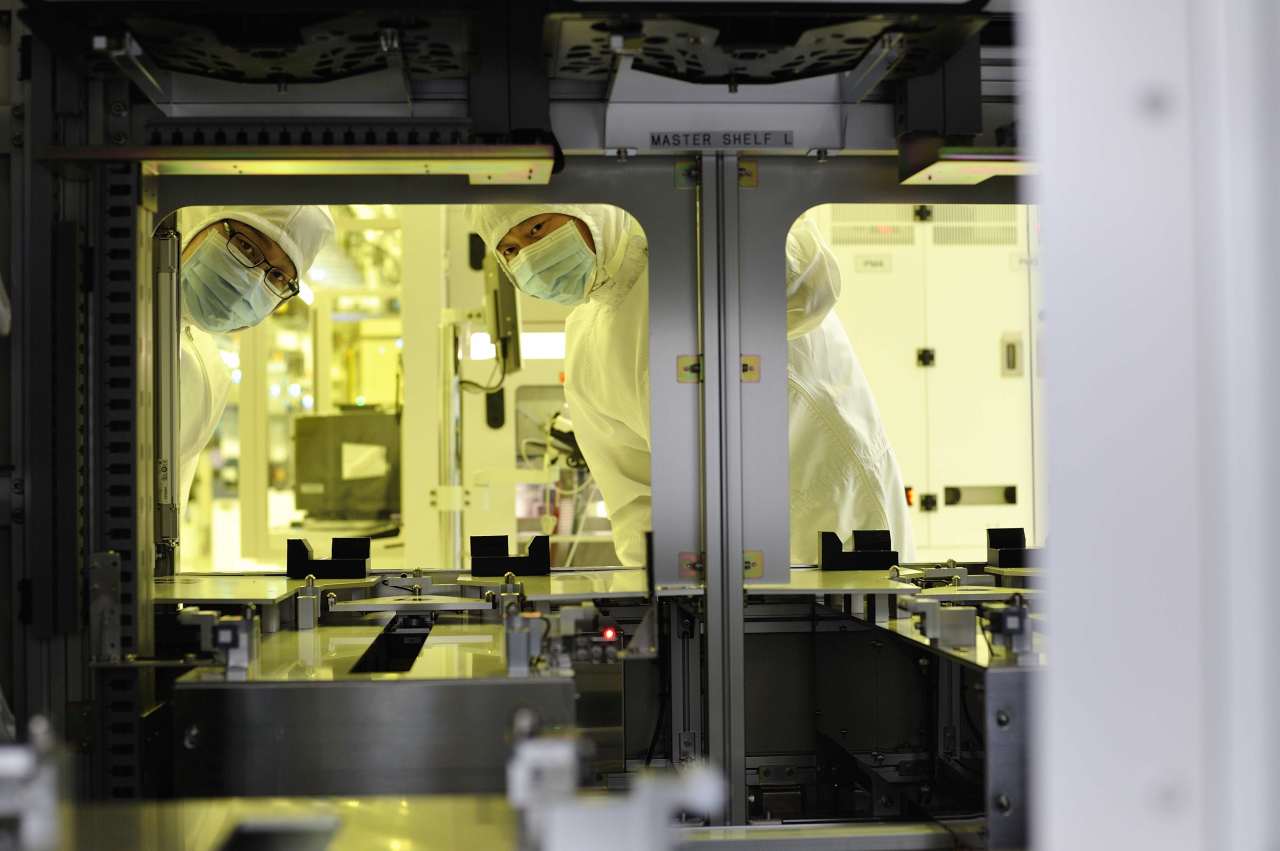

South Korea’s chipmakers are again on edge over the second round of technology war between the United States and China involving semiconductors, according to industry sources Monday.

Although the flagship businesses of Samsung Electronics and SK hynix pivot on memory products, which aren’t yet subject to the new US sanctions on China’s tech giant Huawei Technologies, worries are growing over the their dependence on US technologies broadly applied to the comprehensive processes of chip production from designing and manufacturing to packaging, industry insiders noted.

On May 15, the US announced new restrictions imposed on Huawei with the intention to limit China’s ability to use any American technologies to design and manufacture semiconductors produced for the Chinese tech titan.

The US Commerce Department said most chip design and manufacturing equipment used in chip plants around the world are US-made, so the new rule targets foundry firms that produce customized chips for Huawei, like Taiwan’s TSMC that has been churning out Huawei-designed mobile processor Kirin.

According to data released by Korea International Trade Association, Korea imported $320.2 billion worth equipment needed for chipmaking from the US last year, which is the second largest.

Japan was the largest chip manufacturing equipment exporter to Korea with $329.6 billion last year, followed by the Netherlands with $174.5 billion.

“To simply put, the US technologies account for around 30 percent of chip production, whether it’s memory or non-memory,” said an official at a Korean semiconductor business. “It varies by product type, but in a broad sense, it is impossible to forgo the US technologies throughout the entire manufacturing process.”

The US has granted a 120-day grace period for foreign foundries. During that period, the chips already produced for Huawei can be supplied as planned. The new rule is expected to be implemented in September.

That is why rumors are circulating that Huawei has rolled up its sleeves to bring around Samsung and SK hynix in order to preorder memory and logic chips needed for its digital devices before September.

Huawei is one of five largest customers in the memory business of both Samsung and SK hynix.

A likely scenario is that Huawei may ask Samsung to supply its mobile processor Exynos in addition to memory chips, as the Chinese company is now cut off from TSMC supplies after the US tightened the restrictions.

Samsung declined to comment on that possibility.

The Korean chipmakers yet find the latest US announcement about the new restrictions ambiguous, and say it is hard to accurately predict the impact of the US-China battle on them, some industry sources say.

“It is difficult to define which software and technologies are on the US Commerce Control List regarding semiconductor designs,” a source said.

“It would be very hard to apply that rule to memory chips, because those chips are very standardized and easily available through indirect channels in any countries,” another source said.

In the short run, the Korean companies’ memory business wouldn’t take a direct blow from the new US sanctions on Huawei, the sources said.

“However, such uncertainty looming large in the semiconductor industry will make the Korean companies edgy and probably have some negative impact in the long run,” they said.

By Song Su-hyun (song@heraldcorp.com)