PDI: I Can't Get Excited At A 10% Premium

by Dividend SeekerSummary

- PDI has been hit hard during the market turmoil, although it has seen a nice rebound in the short term.

- Despite its drop since my last review, PDI still trades at a premium price, which makes me leery of recommending positions.

- My outlook for non-agency MBS and high yield credit remains cautious. While both will rally if the risk-on mode resumes, there is plenty of downside risk too.

Main Thesis

The purpose of this article is to evaluate the PIMCO Dynamic Income Fund (PDI) as an investment option at its current market price. PDI is a fund I reiterated a cautious tone on back when the sell-off began, and that caution was timely. Now that markets have settled down, I took another look at PDI given its strong historical track record, to see if I should revert back to a bullish rating on this fund. Despite this longer term track record, I continue to see merit for caution in our current climate. PDI, while typically found trading at a premium, sits at a price of almost 10% above its NAV. This premium price is easier to stomach when my economic outlook is less clouded. Further, the fund's income production metrics continue to decline, which is a bearish sign. Finally, the fund's top sectors, such as non-agency MBS and high yield credit, lack support from the Fed, unlike other fixed-income sectors. While these lower rated sectors help support a higher yield, they also present unique risks.

Background

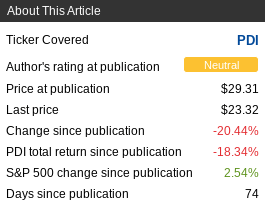

First, a little about PDI. It is a closed-end fund with a primary objective to "seek current income, with a secondary objective of capital appreciation." Currently, the fund is trading at $23.32/share and pays a monthly distribution of $.2205/share, translating to an annual yield of 11.35%. PDI is a fund I often recommend, but turned more cautious on in Q4 last year. As the market sell-off began, PDI was beginning to look more tempting, but I continued to have a cautious outlook on it, due to the nature of the fund's leverage and non-investment grade holdings. In hindsight, it was smart to remain cautious, as PDI has performed quite poorly since my last review, as shown below:

Source: Seeking Alpha

With the market rebound giving investors more confidence than they had just a few months ago, I thought it was worth another look at PDI to see if I should change my rating. After review, I continue to believe a neutral outlook is most appropriate, and I will explain why in detail below.

Premium Is Still Where It Was Two Months Ago

To begin, I want to take a look at PDI's valuation, because that is often a metric I use to either start, or avoid, new positions. Back in March, I saw PDI beginning to sell off and considered buying in. However, the fund's premium, while much lower than its average trading range over the past year, still sat near 10%. As such, I opted to avoid buying the fund, as I saw too much downside left if the market continued falling.

As it turns out, my caution was warranted, as PDI moved into steep discount territory, albeit for a short time period. Therefore, for investors willing to dive in when the fund was trading below its NAV, they would have been handsomely rewarded. However, in order to decide if buying now continues to make sense, I want to see relative value in the fund and unfortunately, I do not. To see why, consider that PDI's current premium is just under 10%, and it is almost identical to where it stood in March, right before the fund saw a sharp drop in value:

| Fund | Current Premium | Premium in March Review | YTD Premium High | YTD Premium Low |

| PDI | 9.6% | 9.3% | 21.6% | (12.1%) |

Source: PIMCO

As you can see, PDI's valuation has remained the same, in terms of premium. Further, when looking at its high and low valuations, we see the fund could truly move in either direction from its current level. Since it is difficult to gauge what the next move is going to be, it helps support my neutral outlook.

But wait, you might ask, how can PDI's premium still be over 9%, when the fund has dropped 18% since March? The answer is bad news, and it stems from the fact that PDI's underlying value has dropped substantially this year. To illustrate, consider the chart below, which tracks PDI's NAV from when I wrote my last piece, and its current NAV:

| NAV on 3/6/20 | NAV on 5/22/20 | YTD Change |

| $26.67/share | $21.28/share | (20%) |

Source: PIMCO

It goes without saying that this is a very poor development. Over the past few months, leveraged funds with lower quality assets have been widely out of favor. The underlying value of those assets dropped substantially as investors fled risk for safety, and they are only now starting to get back into these riskier sectors. While PDI has rebounded nicely off its low, and this rebound could continue from here, I am going to discuss next why my outlook for the underlying sectors in the fund remains cautious.

Underlying Sectors Have Clouded Outlook

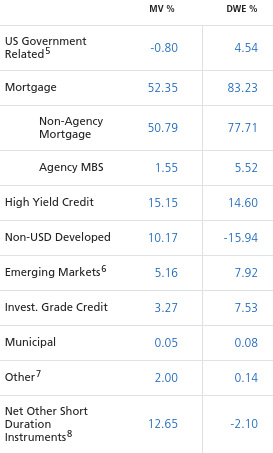

I will now shift gears to the underlying holdings of PDI. This is a fund that is heavily invested in mortgage-related debt, which has been the case for some time. Specifically, half the fund's holdings are non-agency MBS, although it does have quite a bit of exposure across other sectors, as shown below:

Source: PIMCO

For this review, I will discuss my take on both the high yield credit and non-agency MBS sectors, as they both will impact overall performance the most.

First, I will offer my take on high yield credit. While this is not a huge part of PDI, at 15% of total assets its performance is still quite relevant for the fund. This exposure has helped provide PDI with a bit of a boost recently, but it was instrumental to its slide over the past few months. This is because high yield credit was one of the sectors investors fled from during the sell-off, as fears over corporate revenues and profits sparked a wave of worry about potential defaults. While the Fed has offered support in the corporate debt space, this support has been limited to investment grade corporate credit, with the exception of recently downgraded bonds to just one notch below investment grade. This leaves out most of PDI's high yield holdings, although investors have bid up the sector recently in hopes that the worst of the virus-induced sell-off has passed.

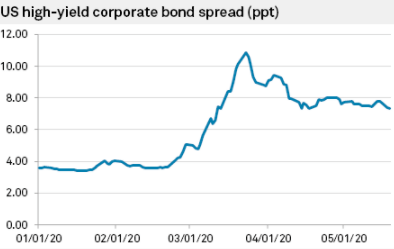

Looking ahead, I continue to see an environment that could move in either direction. While this is not entirely helpful, it does support my neutral view. Simply, I do not see a clear buy or sell signal, and when that environment exists, I tend to look for better values. The reason for this broad outlook on high yield credit stems from the current yield spreads for the sector. While spreads spiked in March, they have since narrowed to the point where they are sitting right in the middle of their range for the year, as shown below:

Source: S&P Global

My takeaway here is that high yield credit offers both risk and potential reward right now, so it is up to each individual investor to determine their own risk tolerance. Spreads have a long way to narrow before they reach their lows for the year, so plenty of upside remains. However, as the sell-off showed us, the spreads can widen in a hurry, so investors need to prepare themselves for the potential for a loss of capital if we see a second wave of virus cases, or if economic data continues to disappoint. For me, I see a reality where the easy money has been made already, so chasing returns here, once I consider the risks involved, does not seem prudent.

Non-Agency MBS Also Lack Fed Support

The next sector I will consider is non-agency MBS, which has been fundamental to PDI's long-term success. Over the past few years, this is a sector I heavily supported, as I saw continued strength in the housing market and little downside risk. It was a great way to pump up the yield in my portfolio, benefiting from rising employment figures, rising home prices, and declining delinquency rates.

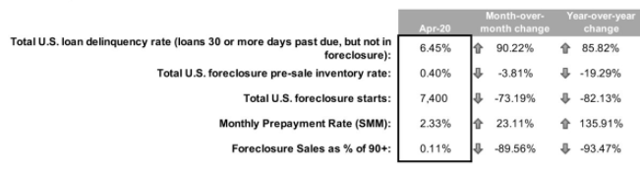

Fast forward to 2020, and my outlook on non-agency MBS has cooled. Mortgage forbearance has become a major theme of this current crisis, with more and more homeowners opting to forgo their mortgage payments. While these forbearance programs mainly apply to MBS backed by federal agencies, another pain point is actual delinquencies (mortgages currently in forbearance do not count as delinquent) are also on the rise. In fact, according to data compiled by Black Knight, delinquencies soared in April, as shown below:

Source: Black Knight

Clearly, this is a negative trend, and it should concern any investor in MBS. Further, many homeowners are opting for forbearance and those mortgages are not considered delinquent, yet. But those programs do not wipe away any debt, they are simply delaying payment. If a homeowner is struggling to make their payments now, due to a lost job or other income source, we have to hope they are able to return to work soon. We do not know yet, even as states are beginning to open back up, how many jobs that were lost are going to return, and how quickly.

Further, for many in the non-agency space, these are borrowers who could not qualify for traditional mortgages. While this can mean multiple things, often it is because of lower incomes/credit scores, and thus a higher risk profile. These are the type of borrowers who are likely being hit the hardest right now. Even if jobs do return, it is going to be challenging for these individuals to stay current on their mortgages if they have already fallen behind. They will have to find funds for their make-up payments in addition to what they will owe going forward. That is going to put a strain on the homeowner, and raises the probability that the mortgage could move from delinquency to foreclosure.

Importantly, the scenarios I just described are worst-case examples. It is entirely possible state re-openings go well, jobs return, and mortgages in forbearance or delinquency get caught up quickly. My point here is not to predict a doomsday scenario, but rather to explain what the risks are, because investors have many choices when considering the mortgage space. Non-agency MBS is just one sub-sector, investors could choose agency MBS for a safer play, albeit for a lower yield.

In my view, this is exactly what investors should be doing for two reasons. One, I like the agency MBS space simply because the risk is lower, and I view that positively at the moment. Two, the Fed has announced support for agency MBS, but has distinctively left out non-agency MBS. This Fed support has helped stabilize the agency MBS sector, and raised the underlying asset prices within. Further, the Fed, while initially limiting its purchases in the areas that it chooses to support, has expanded its buying power. Specifically, minutes from the Fed's April meeting indicate support is virtually unlimited, as seen below:

continue to purchase Treasury securities and agency MBS in the amounts needed to support smooth market functioning and effective transmission of monetary policy to broader financial conditions"

Source: Federal Reserve

Simply, the Federal Reserve has launched a massive stimulus program aimed directly at stemming losses in agency MBS, and that provides a nice tailwind for the sector's underlying value going forward. Non-agency, on the other hand, does not currently have that backstop. This reality makes me cautious of buying into it, when inherently safer options exist.

Income Production Metrics Are Bearish

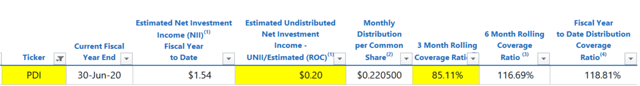

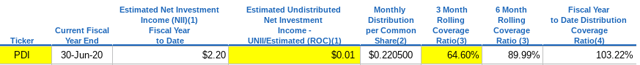

My final point concerns the fund's income production. This was an area I viewed quite critically during my last review, as I saw negative trends on PIMCO's UNII report. The good news is, PDI has managed to keep its distribution intact since that review, which is clearly a positive for investors seeking income. The bad news, however, is PDI's metrics continue to display a negative trend. This is quite worrying, and has me questioning the sustainability of the fund's income stream. To illustrate, the charts below are the UNII reports from February and May, shown below, respectively:

Source: PIMCO

As you can see, PDI's UNII balance has dropped remarkably in a short time period, which is quite rare for the fund. Also, its short-term coverage ratios have both dropped markedly lower, which tells us the trend is clearly not in our favor. While PDI's UNII numbers could certainly move higher as we see macro-economic clarity, the continued weakness in these figures prevents me from being bullish at this time.

Bottom Line

PDI is down quite a bit since my last review, yet the buy-in price is the same. This is due to a sharp loss in underlying value, as the non-agency MBS market has deteriorated. As delinquencies have risen, jobs have been lost, and PDI's income metrics have declined, it is difficult to warrant buying this fund right now. While I could see the fund trading much higher if we get back to normal, I do not know how quickly normal is going to be the reality. While I could be too cautious here, I am comfortable missing out on some upside to limit downside risk. Rather than PDI, I continue to view other options more favorably. For similar exposure, but at a cheaper price, I would look at the PIMCO Dynamic Credit Income Fund (PCI), which has a premium of only 3.6%, well below PDI's level. Another option for those interested in MBS would be BlackRock Income Trust (BKT), which exclusively holds agency MBS, which I prefer right now. Therefore, I continue to caution investors to be careful with entry points into PDI, and would recommend alternative options at this time.

Disclosure: I am/we are long PCI, BKT. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.