We Are Going To Need A Lot More Stimulus

by Lawrence FullerSummary

- This is a weekly series focused on analyzing the previous week’s economic data releases.

- The objective is to concentrate on leading indicators of economic activity to determine whether the economy is strengthening or weakening, and the rate of inflation is increasing or decreasing.

- This week we examine the PMI Composite FLASH, existing home sales, housing starts and weekly unemployment claims.

PMI Composite FLASH

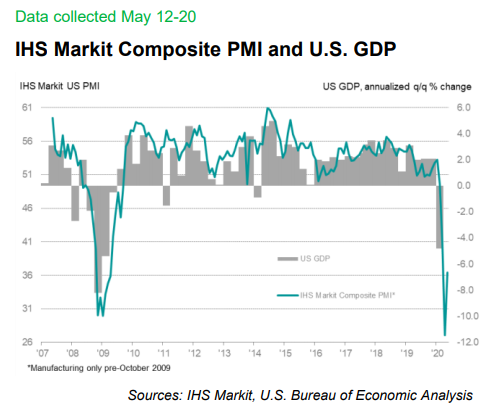

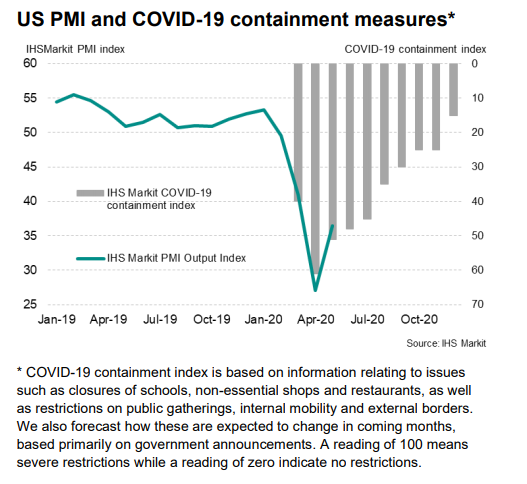

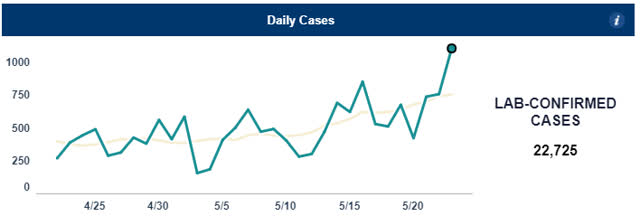

The PMI Composite FLASH finally bounced, marking what could be the trough in economic activity when the entire country was under some form of shelter-in-place order. The Composite index rose from a low of 27 in April to 36.4 in mid-May, as several states started to reopen. This comes as no surprise. We could continue to see improvement next month, as every state has now reopened to some extent. I was expecting this indicator to identify the inflection point in economic activity when the rate of change would start to improve, but I was also expecting that we would not reopen until the original guidelines of a 14-day declining case count had been met. Since we never met that threshold, a resurgence of new cases in many states is underway. I am concerned the index will roll back over. Consumers are likely to retrench when the fear of infection intensifies again.

Additionally, the bounce in activity is still reflecting the second-sharpest decline since the Great Financial Crisis. The month prior was the worst, so I can't get too excited about the improvement yet. Markit is now forecasting the path for the index based on the easing of containment measures, but there is no consideration for a second wave in the fall that forces more restrictive containment measures.

Existing Home Sales

Sales collapsed 17.8% in April to an annual rate of 4.33 million, which is down 17.2% from a year ago. The supply of homes for sale also collapsed, falling 20% to 1.47 million. It was obvious that supply would shrink as sellers decided they didn't want strangers walking through their homes. The decline in inventory to a record low level drove sale prices higher with the median price rising 7.4% in April to $286,800. Tightening credit conditions and job losses are both serving as headwinds now to the existing home market.

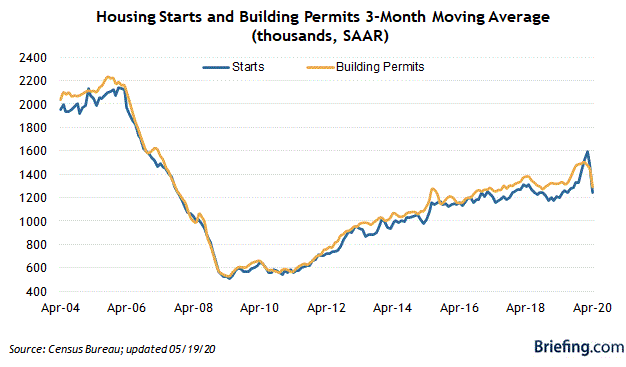

Housing Starts

Starts plunged 30.2% in April to an annual rate of just 891,000, while permits to build declined 20.8% to annual rate of 1.07 million. The number of units under construction for the month, which is the figure used to calculate GDP, fell 1.7% to 1.19 million

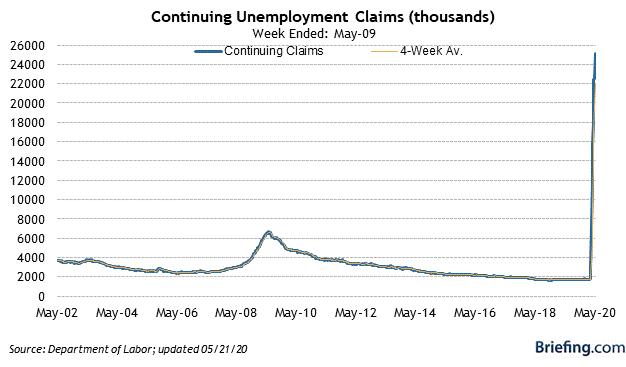

Unemployment Claims

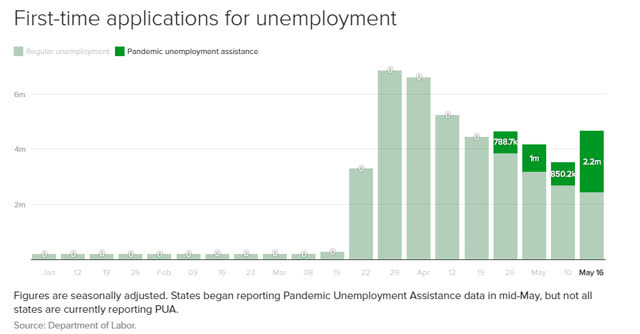

Initial claims for the week ending May 16 were 2.4 million, bringing the total unemployed to 38.6 million, which is nearly 25% of the labor force. Continuing claims rose to an all-time high of 25 million.

Yet when we include new applicants for pandemic unemployment assistance, the number jumps by an additional 2.2 million to 4.6 million. This is a program for the self-employed and gig workers. Last week was the first week these workers were included in the figures, bringing the total unemployed to 43 million.

Conclusion

The federal government is playing a dangerous game. It is allowing, if not encouraging, the reopening of the economy without states having met the federal guidelines for a safe and successful reopening - that being a 14-day declining number of new cases. In fact, some states never saw any decline at all, like my home state of North Carolina. We just entered phase 2 of our reopening on Friday, and the following day we had the highest number of new cases in a single day, surpassing 1,000. The belief is that continuing to shut down the economy is worse than the increase in new cases that may result if we reopen. I guess that depends if you are the one that ends up getting infected in the process, right?

My concern is that if we have a second wave, because we reopened too soon, consumers will retrench for fear of being infected. Therefore, reopening will not generate a level of business that makes doing business viable. Then we will not only have a second wave, but we will also have delayed the eventual recovery.

Another false hope is that if we reopen it will avoid the necessity to continue enhanced unemployment benefits for some 43 million unemployed workers, which ends on July 31. The assumption is that most workers will return to work, which will further fuel consumer spending and economic growth, leading to even more workers returning to work. The issue is that half of the unemployed will likely not have a job to go back to anytime soon, and a quarter may have lost their job entirely.

At the same time enhanced benefits are scheduled to end, states are required to balance their budgets and the shortfalls are massive. Without federal aid, we are likely to see another round of layoffs from state and local governments that employ approximately 13% of the workforce.

We are going to need a lot more fiscal stimulus if we want to consider the possibility of a recovery in the second half of the year.

Lots of services offer investment ideas, but few offer a comprehensive top-down investment strategy that helps you tactically shift your asset allocation between offense and defense. That is how The Portfolio Architect compliments other services that focus on the bottom-ups security analysis of REITs, CEFs, ETFs, dividend-paying stocks and other securities.

The Portfolio Architect was defensively positioned at the beginning of this year in anticipation of the bear market that followed, but were you? If not, consider a two-week free trial to see how it may help you be better positioned for the next major turning point in the markets.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Lawrence Fuller is the Managing Director of Fuller Asset Management, a Registered Investment Adviser. This post is for informational purposes only. There are risks involved with investing including loss of principal. Lawrence Fuller makes no explicit or implicit guarantee with respect to performance or the outcome of any investment or projections made by him or Fuller Asset Management. There is no guarantee that the goals of the strategies discussed by will be met. Information or opinions expressed may change without notice, and should not be considered recommendations to buy or sell any particular security.