Short-term rates fall by 30 bps, ease working cap stress

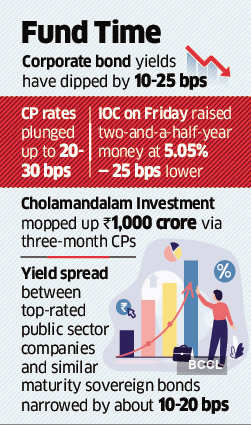

Corporate bond yields dipped 10-25 bps while CP rates plunged up to 20-30 bps lower than levels seen earlier before the impromptu central bank policy announcement last week, dealers said.

by Saikat Das

Mumbai: Working-capital loans will likely become less expensive for Indian companies after short-term borrowing costs dropped significantly, in tandem with the record decline in the central bank’s benchmark repurchase rates.

Rates in shorter duration bonds of up to three-year maturities and commercial papers (CPs) with less than one-year maturities plunged up to 30 basis points (bps) immediately after the central bank slashed rates to the lowest on record.

Corporate bond yields dipped 10-25 bps while CP rates plunged up to 20-30 bps lower than levels seen earlier before the impromptu central bank policy announcement last week, dealers said. Yield differentials between government and private company bonds, a barometer of calmness, also narrowed.

“Short-term rates dropped immediately, mirroring the RBI rate action, while long-term rates would take time to come down,” said B Prasanna, head — global markets group of ICICI Bank. “Companies need short-term money to navigate through the crisis. The fall in rates should help ease the scene.”

The yield spread between top-rated public sector companies and similar maturity sovereign bonds narrowed about 10-20 basis points to 60-65 bps in the aftermath of the RBI slashing repurchase rate to 4% in its policy announcement on Friday.

“Falling CP rates make it easy for companies to raise working capital,” said Ajay Manglunia, managing director and head of fixed income at JM Financial. “Shorter-duration papers are yielding lower, prompting many capital-starved companies to tap the bond market.”

The RBI slashed interest rates for the second time in less than two months to a record low.

“Yields had gone up due to a combination of factors, including the government’s additional borrowing and selling pressure from mutual funds,” said Lakshmi Iyer, chief investment officer (debt) & head products, Kotak Mahindra Mutual Fund.