Gulfport Energy: Stock Appears To Be Overvalued Now Due To The Still High Restructuring Risk

by Elephant AnalyticsSummary

- Gulfport's borrowing base was reduced to $700 million, and it is limited to $20 million for further unsecured note repurchases.

- It has plenty of liquidity for now (and probably for the next couple years), but will have challenges in dealing with its unsecured debt maturities.

- Common stock appears to be significantly overvalued, as it may require over $3.00 natural gas and $55 oil to have reasonable upside from $1.53.

- Unsecured bonds are roughly trading around fair value, except for the 2023 maturity, which is priced higher due to some anticipation of repayment.

Gulfport Energy's (NASDAQ:GPOR) stock has rebounded significantly with the improvement in natural gas strip. However, I still believe that it will be difficult for the company to avoid restructuring in the long run.

I had already assumed that 2021 natural strip would improve to around $2.75 when I discussed in early April that Gulfport would have challenges avoiding restructuring. At that time, 2021 strip was around $2.55, and it more recently reached $2.80 before dropping down a bit towards the $2.65 to $2.70 range now.

Due to the high risk of eventual restructuring, I am bearish towards Gulfport's common stock at its current price. I am neutral towards Gulfport's bonds at their current price.

Borrowing Base Redetermination

Gulfport's May 2020 borrowing base redetermination reduced its borrowing base from $1.2 billion (elected commitment was $1.0 billion) to $700 million. It also added Senior Secured Debt to EBITDAX covenant of 2.0x or under, and put a $20 million cap on voluntary repurchases of its unsecured notes.

The secured debt covenant replaces Gulfport's 4.0x total debt covenant, and that solves Gulfport's potential future covenant issues. The borrowing base reduction and repurchase limit does indicate that Gulfport will need to address its future debt maturities via refinancing with new unsecured debt or exchange/refinancing with second-lien debt though.

Updated 2020 Outlook

Gulfport has withdrawn its production guidance for 2020 due to various factors including the potential for the coronavirus pandemic to cause delays in new drilling and completion activities. It has also shut down near 20 MMcfe per day in production (mostly SCOOP wells) due to low oil prices and may also be affected by non-operated well shut-ins.

Thus I am now modeling Gulfport's average 2020 production at a bit under 1,100 MMcfe per day. At $2.05 Henry Hub gas and $35 WTI oil in 2020 (roughly current strip), Gulfport is projected to end up with $819 million in revenue, net of hedges. Gulfport monetized its oil hedges in April and then added a smaller amount of new hedges as replacements for the second half of the year.

| Type | Units | $/Unit | $ Million |

| Natural Gas [MCF] | 363,562,500 | $1.30 | $473 |

| NGLs (Barrels) | 4,527,500 | $11.00 | $50 |

| Oil (Barrels) | 1,716,250 | $30.25 | $52 |

| Hedge Value | $244 | ||

| Total Revenue | $819 |

Gulfport noted that its capital expenditures are now likely to come in at or below the low end of its $285 million to $310 million guidance range. This is due to improved efficiency and service cost deflation. As a result, I am now modeling its 2020 capex at $280 million.

| Expenses | $ Million |

| Gathering and Processing | $232 |

| LOE | $61 |

| Production Taxes | $22 |

| G&A | $70 |

| Interest | $116 |

| Capex | $280 |

| Total Expenses | $781 |

At strip prices, Gulfport is now projected to end up with $38 million in positive cash flow in 2020, not including the $50 million it received for its SCOOP water infrastructure divestiture.

Debt Situation At The End Of 2020

As of May 1, Gulfport had repurchased $73.3 million in unsecured notes for $22.8 million in cash. It is only allowed to spend another $20 million repurchasing its unsecured notes.

Gulfport is now projected to end up with $175 million in credit facility debt at the end of 2020. This assumes that it spends another $20 million to repurchase debt at a 50% discount, as well as reduces its working capital deficit by $100 million.

| $ Million | |

| Credit Facility | $175 |

| Unsecured Notes | $1,747 |

| Construction Loan | $22 |

| Total Debt | $1,944 |

Gulfport would then end 2020 with $1.944 billion in long-term debt.

2021 At $2.70 Natural Gas

Natural gas strip for 2021 is currently around $2.65 to $2.70. At $2.70 natural gas, Gulfport would deliver $840 million in oil and gas revenue in 2021 at 2020 production levels (and no shut-ins).

Source: Gulfport Energy

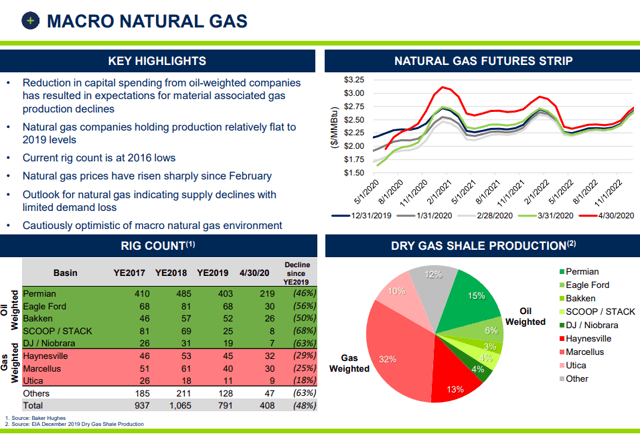

Natural gas futures have improved with the expectation that associated natural gas production will fall significantly. The problem for Gulfport is that it is limited in doing further discounted debt repurchases now and it needs roughly $2.75 gas (at least while oil prices remain low) to reach break-even cash flow without hedges. Natural gas futures for 2021 are close to that level, but this drops back down to $2.50 for 2022 currently.

| Type | Units | $/Unit | $ Million |

| Natural Gas [MCF] | 369,562,500 | $1.95 | $721 |

| NGLs (Barrels) | 4,927,500 | $13.00 | $64 |

| Oil (Barrels) | 1,916,250 | $31.25 | $60 |

| Total Revenue | $845 |

Gulfport's improved efficiencies could help reduce its maintenance capex down to around $350 million. This would then result in it having around $22 million in 2021 cash burn if it wanted to maintain production levels at $2.70 natural gas.

| Expenses | $ Million |

| Gathering and Processing | $236 |

| LOE | $62 |

| Production Taxes | $34 |

| G&A | $70 |

| Interest | $115 |

| Capex | $350 |

| Total Expenses | $867 |

Valuation

At $45 WTI oil and $2.50 Henry Hub natural gas (reasonable longer-term prices for natural gas, and probably a bit conservative for oil), Gulfport can generate around $400 million EBITDAX at estimated 2021 production levels. A 3.0x to 3.5x EBITDAX valuation would put Gulfport's total value at $1.2 billion to $1.4 billion. Gulfport's secured debt (credit facility debt and construction loan) may be $450 million at that point, including the effect of the elimination of its working capital deficit and potential restructuring costs.

That would leave around $750 million to $950 million in value left over after its secured debt. Given that Gulfport may end 2020 with $1.75 billion in unsecured notes, commodity prices would have to be noticeably higher than $45 WTI oil and $2.50 Henry Hub natural gas for Gulfport's common stock to have intrinsic value.

Around $55 WTI oil and $3.00 Henry Hub natural gas would be required for Gulfport to be worth its current price of $1.53 per share even if a higher 4.0x EBITDAX valuation was used.

Conclusion

Gulfport remains at high risk of long-term restructuring despite some improvement in natural gas prices. Gulfport is only able to repurchase a modest amount of additional unsecured debt at a discount. This leaves it in a position of needing to refinance its 2023 and later debt maturities.

At estimated 2021 production levels, it would probably take close to $3.50 long-term natural gas prices for Gulfport's leverage to be reduced to a level where refinancing with new unsecured notes becomes a viable option. At $2.50 natural gas, Gulfport's leverage may end up over 5.0x EBITDAX.

Due to its relatively modest amount of credit facility debt, a debt exchange involving unsecured notes for second-lien notes may be viable and could buy Gulfport some additional time. Gulfport's common stock doesn't appear to have a good risk/reward ratio at $1.53 per share though, given that it already prices in at least $55 WTI oil and $3 Henry Hub natural gas.

Free Trial Offer

We are currently offering a free two-week trial to Distressed Value Investing. Join our community to receive exclusive research about various energy companies and other opportunities along with full access to my portfolio of historic research that now includes over 1,000 reports on over 100 companies.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.