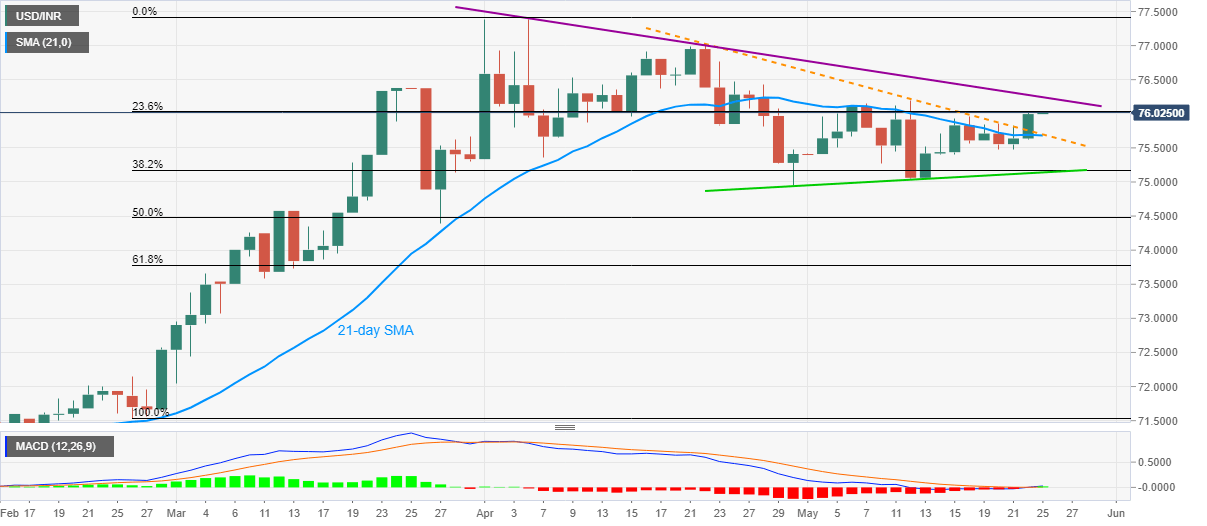

USD/INR Price News: Indian rupee bears cheer break of monthly support line, 76.25 in focus

by Anil Panchal- USD/INR takes the bids after breaking monthly resistance line.

- A descending trend line from April 06 on bulls’ radar for now.

- 21-day SMA adds strength to the resistance-turned-support.

- MACD teases bulls for the first time in seven weeks.

While extending its break of the monthly resistance line, now support, USD/INR stays positive around 76.03 amid the initial Indian session on Monday.

Considering the sustained trading above short-term key resistance as well as bullish MACD, the pair is likely extending the recovery moves towards another falling trend line from April 06, at 76.25.

Though, a successful break of 76.25 will fuel the bids toward 77.00 ahead of pushing the bulls to challenge April month top near 77.40.

Meanwhile, 21-day SMA joins the resistance-turned-support line, near 75.70/65, to strengthen the immediate support.

Should there be a daily closing below 75.65, the monthly support line around 75.15/10 could grab the bears’ attention.

USD/INR daily chart

Trend: Bullish

Additional important levels

| Overview | |

|---|---|

| Today last price | 76.025 |

| Today Daily Change | 0.0299 |

| Today Daily Change % | 0.04% |

| Today daily open | 75.9951 |

| Trends | |

|---|---|

| Daily SMA20 | 75.6864 |

| Daily SMA50 | 75.7852 |

| Daily SMA100 | 73.8282 |

| Daily SMA200 | 72.5673 |

| Levels | |

|---|---|

| Previous Daily High | 76.0223 |

| Previous Daily Low | 75.62 |

| Previous Weekly High | 76.0223 |

| Previous Weekly Low | 75.4707 |

| Previous Monthly High | 76.975 |

| Previous Monthly Low | 75.14 |

| Daily Fibonacci 38.2% | 75.8686 |

| Daily Fibonacci 61.8% | 75.7737 |

| Daily Pivot Point S1 | 75.736 |

| Daily Pivot Point S2 | 75.4768 |

| Daily Pivot Point S3 | 75.3337 |

| Daily Pivot Point R1 | 76.1383 |

| Daily Pivot Point R2 | 76.2814 |

| Daily Pivot Point R3 | 76.5406 |