Pharma emerges as most preferred sector among MFs

Earnings downgrade in the sector is likely to be the lowest among all sectors.

by Ashutosh Shyam, Rajesh Naidu

Indian pharma is the fl avour of the season, and mutual fund exposure to drugmakers is rising at a faster clip than ever before, and capital goods is getting the short shrift.

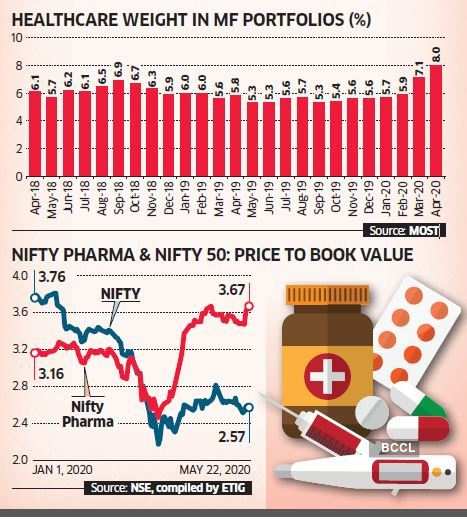

Institutional exposure of pharmaceuticals stocks is at a 40-month high, according to Motilal Oswal. The weightage of pharma stocks in the portfolio of fund houses has improved by 200 basis points to 8% in April 2020. And the sector is the biggest ‘overweight’ for domestic funds, replacing capital goods.

In April, the sector’s weightage rose by 90 basis points sequentially in just a month. Out of the top 20 asset management companies by AUM, 14 are overweight on the sector by 110-670 basis points compared with its 6.2% weight in the BSE 200 index. Aditya Birla AMC has the largest allocation to the pharma sector at 12.9%, followed by L&T and Canara Robeco at 12.4% and 11.7%, respectively.

Earnings downgrade in the sector is likely to be the lowest among all sectors. Some stocks have witnessed earnings upgrade after gradual improvement in business outlook in the US market for the generic business. Exports account for more than twothirds of the revenue for pharma companies.

Hence, increase in approvals for Indian companies, improving product mix, and favourable currency movement add to their earnings visibility. Quarterly sales of pharmaceuticals products in the US were in the range of $1.66-1.75 billion, suggesting that pricing pressure is easing. Consequently, the price to earnings multiple of pharma companies has been re-rated. They trade close to the long-term average level.

The Nifty Pharma is trading at 41.6% premium to the Nifty 50 compared with 8% discount at the beginning of the year.

The Nifty Pharma index has outperformed the Sensex by 41% in the last three months, and it is one of few indices delivering a positive return in the same period.