European consumers stockpile savings, adding to economic drag

Bank deposits surge as households seek to shield themselves from impact of coronavirus

by Olaf Storbeck, Martin ArnoldBank deposits are surging across Europe as people respond to the economic and social upheaval of the coronavirus crisis by saving more, fuelling fears among economists that consumers will not come to the rescue of the continent’s shrinking economy.

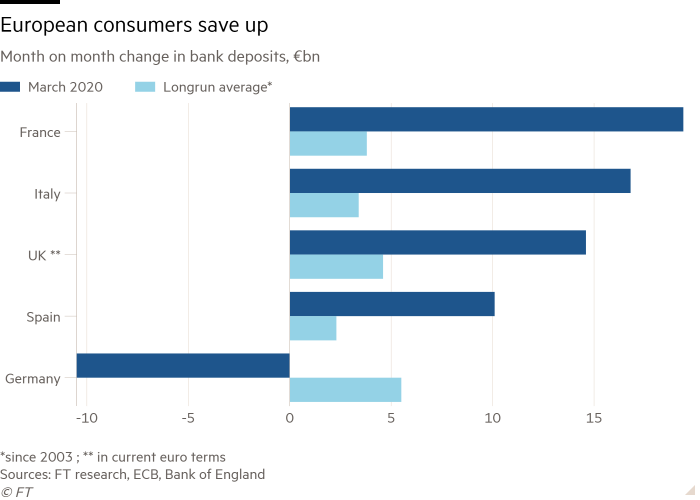

Savings rates in four of Europe’s five largest economies rose sharply to well above long-run averages in March, according to recently published data from the European Central Bank and the Bank of England.

French savers put aside nearly €20bn in March, well above the long-run average monthly change in bank deposits of €3.8bn. Separate figures from the Banque de France show that by mid-May, the total had risen by more than €60bn since the country’s lockdown began — indicating that the growth of savings accelerated as the crisis deepened.

Italian savers put aside €16.8bn in March, the ECB data show, compared with a long-run monthly average of €3.4bn, while Spanish households saved €10.1bn, up from an average of €2.3bn. UK household bank deposits jumped by £13.1bn in March, a record monthly rise, according to the BoE.

Bank deposits in Germany fell sharply, but this was a sign that households had withdrawn cash. Germans tend to prefer to hold their savings in cash during a crisis and a similar phenomenon occurred at the height of the 2008 financial crisis. The German central bank reported that cash in circulation rose by €39.7bn between late January and early May.

The longer we are in this slo-mo mode, the more these changes will become anchored in people’s behaviourLudovic Subran, Allianz

“There has been a really remarkable increase in household savings this year,” Philip Lane, chief economist at the European Central Bank, said in a webinar last week. “This is one of the big macro issues, which is how long will households defer spending.”

The sharp increases in savings suggest that consumers’ thrift could hinder the scope for a consumption-driven economic recovery. Although savers may choose to boost their spending after the initial crisis period is over, pumping some cash back into the economy, the European Commission forecasts high savings rates will persist this year.

The commission predicted in its spring forecast that eurozone household savings would rise from 12.8 per cent of disposable income last year to a record high of 19 per cent this year, before falling back somewhat to 14.5 per cent next year.

Economists warn that consumers’ reluctance to spend the extra money they have saved risks depriving Europe’s pandemic-stricken retailers of the boost they need to recover from what is expected to be the worst recession of the postwar era.

“A lot of households will have accumulated involuntary savings over the past few weeks, so their bank balances will be healthier than they were before the crisis,” said Melanie Debono, economist at Capital Economics. “But many will be reluctant to spend as freely as they did in the past because they will be wary of crowded places, public transport and foreign travel.”

New car sales, holiday bookings and visits to restaurants are not expected to fully recover for months. Apart from food retailers, which mostly thrived after being allowed to stay open, many other shops in Europe have been hit hard by the lockdown.

German insurer Allianz forecasts that by the end of 2020 European consumers will still have €400bn of extra savings, equal to 3 per cent of the EU economy. Private consumption in much of Europe fell by more than a third as strict lockdowns forced many businesses to shut and consumers to stay at home, Allianz said.

Ludovic Subran, chief economist at Allianz, said the widespread economic uncertainty was reshaping people’s spending and saving patterns. “The longer we are in this slo-mo mode, the more these changes will become anchored in people’s behaviour.”

Some central bankers and economists say the savings trend could have a positive effect: higher household savings could be channelled to invest in sovereign bonds, helping to support the large amounts of debt that many countries need to raise to finance their responses to the pandemic.

The ECB expects European government debt levels to rise by about 20 percentage points of GDP as a result of the coronavirus crisis, but Mr Lane has expressed hopes that European savers would step in to buy up more of this debt.

“As shown by the examples of China and Japan that also saw their debt levels surge [during economic crises], if the bulk of that debt is held by households in their own countries, a high public debt does not generate external economic pressure,” said Mr Lane in a recent interview with Dutch newspaper De Telegraaf.

Recommended

Eurozone economy

Confidence evaporates among Europe’s crisis-hit consumers

Italy’s sale last week of a record-breaking €22bn bond issue — of which €14bn was bought directly by retail investors — was an early indication that extra household savings are finding their way into local bond markets.

Yet as the lockdown restrictions are partially lifted, there are signs that consumer spending is tentatively starting to recover.

After surveying about 32,000 people across the EU this month, the commission said its consumer confidence indicator had risen slightly to minus 19.5 points, up from its lowest point since the 2008 financial crisis at minus 22 last month.

In Germany, the number of shoppers venturing into physical stores in the second full week of May rose to its highest level since the lockdown started in mid-March, although it remained 38 per cent below the average levels at the start of the year. In Italy, which was hit harder by the virus, retail customers have also been returning, albeit more slowly. Their numbers were down more than 60 per cent in mid-May compared with the first two months of the year.

And some products are still selling well.

Ismail Cakal, owner of Frankfurt-based bicycle shop Kettenesel, said that demand for bicycles had gone “through the roof” as many people in Germany’s financial capital try to avoid public transport.

“Springtime is always very busy, but this year demand is just extraordinary,” said Mr Cakal, adding that delivery times for many popular bike brands such as Giant have increased significantly and many 2020 models have sold out.

“For us, the recent weeks have just been crazy,” he added.

In an earlier version of this story, it said that separate figures from the Banque de France show that by mid-May, the total had risen to more than €60bn since the country’s lockdown began. It has risen by more than €60bn. This has now been amended.