Bank OZK: Further Margin Attrition And Elevated Provision Expense To Hurt Earnings

by Sheen Bay ResearchSummary

- OZK will most likely need to increase its loan loss reserves in the second quarter, leading to another quarter with high provision expense.

- The rate-sensitive net interest margin will likely decline further in the second quarter, thereby pressuring earnings.

- The probability of a negative earnings surprise is higher than normal this year due to the risks and uncertainties.

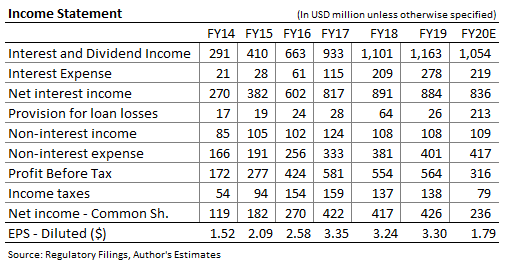

Bank OZK's (NASDAQ:OZK) earnings plunged by 89% sequentially in the first quarter due to a surge in provision expense amid the COVID-19 pandemic. Earnings in the remainder of the year will likely decline on a year-over-year basis, but improve over the first quarter. High provision expense will be the major contributor to an earnings decline this year. Provision expense will likely remain elevated for another quarter because the worsened economic outlook will require an increase in loan loss reserves. Moreover, further compression of the rate-sensitive net interest margin, following the federal funds rate cuts, will likely pressurize earnings. On the other hand, modest loan growth will likely support the bottom line. Overall, I'm expecting earnings per share to decline by 46% year-over-year to $1.79 in 2020. There are chances that the actual results will miss estimates due to the uncertain economic environment. The December 2020 target price suggests a high upside from the current market price; however, due to the risks and uncertainties, I'm adopting a neutral rating on OZK.

Deterioration of Economic Forecasts, Hotel Exposure to Drag Earnings

OZK's provision expense surged to $118 million in the first quarter from $5 million in the last quarter of 2019. As mentioned in the first quarter's 10-Q filing, the management used Moody's baseline economic scenario as of March 27, 2020, to determine the loan loss provisioning for a majority of its portfolios. The scenario assumed an unemployment rate of nearly 9% and a GDP contraction of 18% in the second quarter. The national unemployment rate reached 14.7% in April and is likely to remain elevated in the remainder of the second quarter. Hence, OZK will need to adjust its loan loss reserves upwards for a majority of its portfolios.

For the second half of the year, I'm expecting provision expense to decline sharply from the first half's level. OZK's real-estate heavy portfolio is safer than portfolios of other banks that are geared towards consumer or commercial and industrial loans. However, there is some risk from OZK's exposure to the hotel industry. As mentioned in the first quarter's investor presentation, hotels made up 11% of total loans as of March 31, 2020. A low weighted-average loan-to-value ratio of 40% for the hotel portfolio somewhat mitigates the risk. Considering these factors, I'm expecting provision expense to increase to $213 million in 2020 from $26 million in 2019.

Decline in Rate-Sensitive Margin to Pressurize Earnings

The 150bps federal funds rate cuts in March will likely pressurize yields in the second quarter, leading to a contraction in the net interest margin, NIM. However, interest rate floors will mitigate the adverse impact of the rate decline on NIM. As mentioned in the conference call, 53% of the variable rate loan balance was at floors as of March 31, 2020. Moreover, the management is targeting to decrease deposit costs throughout the remainder of the year, which will relieve some of the pressure on NIM.

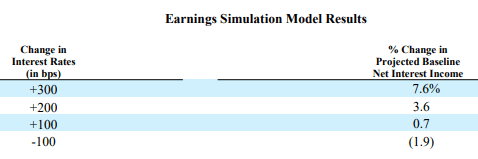

A simulation conducted by the management shows that NIM is somewhat sensitive to interest rate changes. According to the results of the simulation, a 100bps dip in interest rates can reduce net interest income by 1.9%. The following table, taken from the 10-Q filing, shows the results of the simulation.

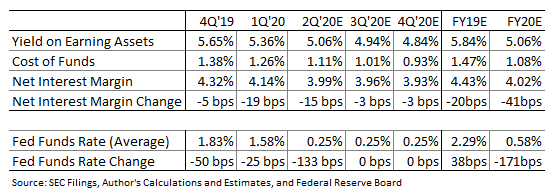

Considering the factors mentioned above, I'm expecting OZK's NIM to dip by 15bps in the second quarter, and by 41bps in the full-year 2020. The following table shows my estimates for yield, cost, and NIM.

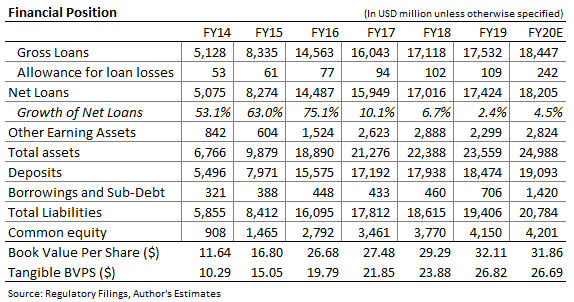

Modest loan growth will likely offset part of the adverse effect of NIM compression on net interest income. OZK's participation in the Paycheck Protection Program, PPP, will likely drive loan growth in the second quarter. As mentioned in the presentation, OZK had funded $477 million worth of loans under PPP in the second quarter till May 5. I'm expecting a majority of these loans to get forgiven in the third quarter, which will lead to a fall in loan balances. Overall, I'm expecting loans to increase by 2.75% in the second quarter and then decline by 2.0% in the third quarter on a linked-quarter basis. For the full year, I'm expecting loans to increase by 4.5% year-over-year, as shown below.

Expecting Earnings to Decline by 46%

The expected hike in provision expense and NIM contraction will pressurize earnings this year, while modest loan growth will offer some support. Overall, I'm expecting OZK's earnings to decline by 46% year-over-year to $1.79 per share in 2020. The following table shows my income statement estimates.

The probability of a negative earnings surprise is unusually high this year due to the uncertainties surrounding the COVID-19 pandemic. If the hotel business remains stalled for longer than expected, or if property values plunge more than expected, then provision expense can exceed its estimate. To a lesser extent, the uncertainty surrounding the duration of PPP loans is also a source of risk. If PPP loans remain on the books beyond 2020, then actual net interest income can miss estimates.

I'm expecting OZK to maintain its quarterly dividend at the current level of $0.27 per share in the remainder of 2020. Despite the likelihood of an earnings decline, I'm not expecting a dividend cut because the dividend and earnings estimates suggest a payout ratio of 60%, which is manageable. Moreover, there is barely any threat of a dividend cut from the regulatory front because OZK is currently well-capitalized. The company's common equity tier I capital ratio was reported at 13.04% as of March 31, 2020, which is far above the minimum requirement of 7.0%. The dividend estimate for 2020 implies a dividend yield of 5.1%.

Risky OZK Offering an Opportunity for High Return

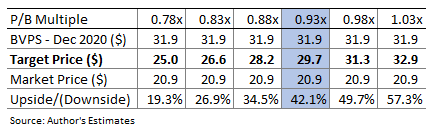

I'm using OZK's average price to book value multiple, P/B, of 0.93 in 2019 to value the stock. Multiplying the forecast book value per share of $31.9 with the average P/B multiple gives a December 2020 target price of $29.7. This target price implies an upside of 42% from OZK's May 22 closing price. The following table shows the sensitivity of the target price to the P/B multiple.

The high upside shows that OZK has the potential for a high return. However, the risk level is also quite high due to the uncertain economic environment and the likelihood of an earnings surprise. Based on the risks and uncertainties, I'm adopting a neutral rating on OZK.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Disclaimer: This article is not financial advice. Investors are expected to consider their investment objectives and constraints before investing in the stock(s) mentioned in the article.