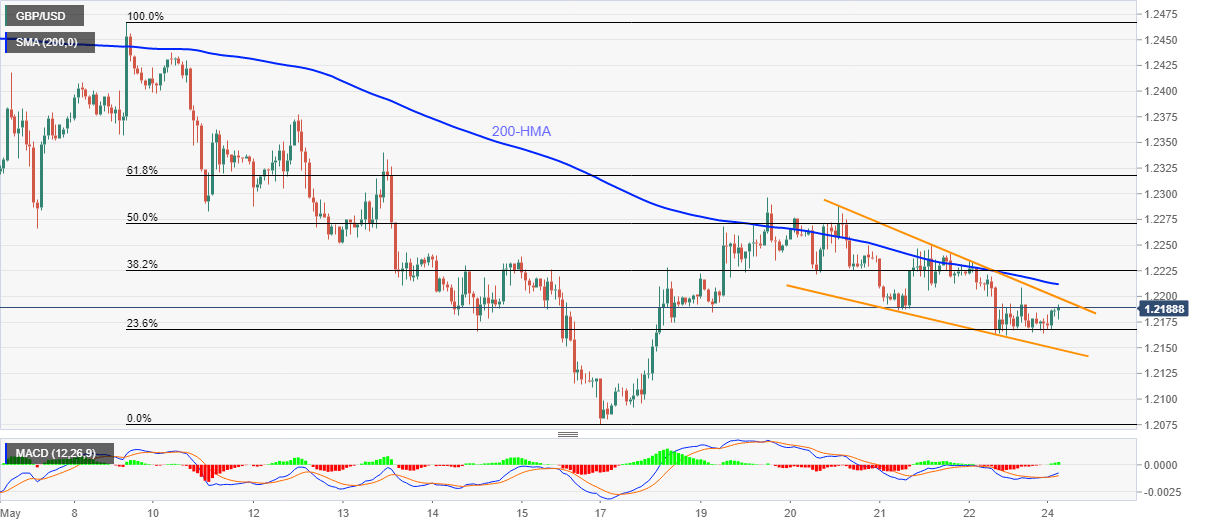

Pound Sterling Price News and Forecast: GBP/USD portrays falling wedge on hourly chart below 1.2200

by FXStreet TeamGBP/USD Price Analysis: Portrays falling wedge on hourly chart below 1.2200

GBP/USD rises to 1.2191, up 0.15% on a day, during Monday’s Asian session. In doing so, the Cable pair extends its recoveries from Friday’s low of 1.2162 while staying inside a bullish chart formation.

Considering the pair’s sustained trading below 200-HMA, bulls are less likely to enter immediately on the upside break of falling wedge resistance, at 1.2200 now.

However, a successful break of 1.2215, comprising 200-HMA, could propel the quote towards the last weekly top near 1.2300.

GBP/USD Forecast: Negative rates and Brexit talks undermine Pound

The GBP/USD pair has fallen for a third consecutive day on Friday, settling at around 1.2170. Demand for Sterling was undermined by UK Retail Sales, which fell in April by 18.1% MoM, much worse than the -16.0% expected. When compared to a year earlier, sales were down by 22.6%, also much worse than anticipated. The UK currency was also weighed by the BOE talking about negative rates, and Brexit-related concerns, as, despite no progress in talks with the EU, the kingdom refuses to extend the transition period beyond December this year.