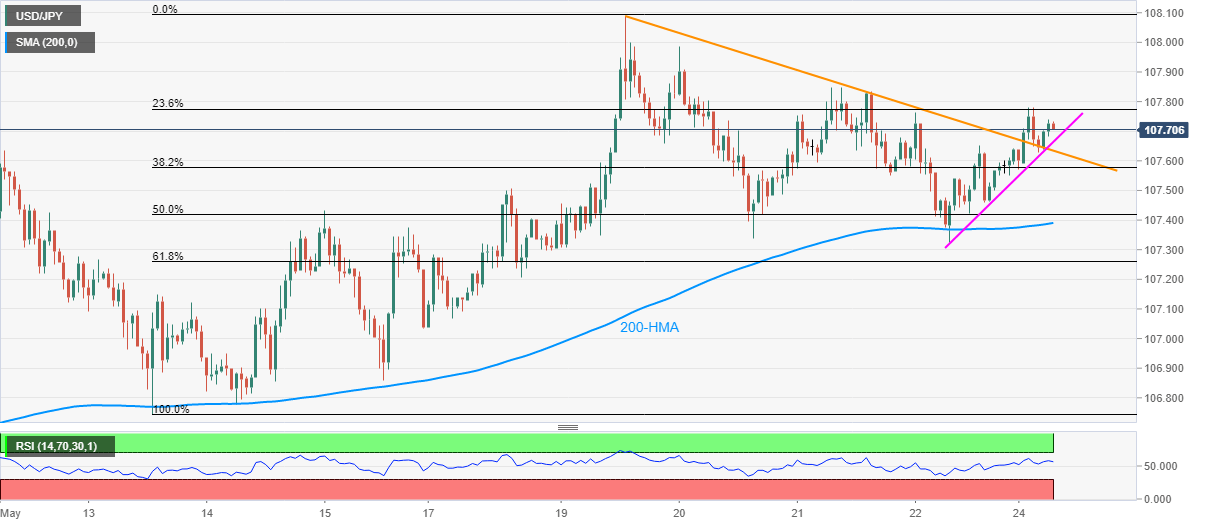

USD/JPY Price Analysis: Keeps mild gains above previous resistance line, 200-HMA

by Anil Panchal- USD/JPY bounces off immediate support line to print three-day winning streak.

- Thursday’s high appears on the bulls’ radar as immediate resistance.

- 107.00 could lure the bears below 200-HMA.

USD/JPY rises to 107.73, up 0.08% on a day, while heading into the European session on Monday. That said, the yen pair recently took a U-turn from a four-day-old resistance-turned-support line.

As a result, buyers are currently aiming for Thursday’s high near 107.85 as immediate resistance ahead of the previous week’s top near 108.10.

Though, it should be noted that the pair’s ability to cross 108.10 on a successful basis can push the bulls towards 109.00 and then to April month peak nearing 109.40.

Meanwhile, sellers will wait for entries below the said resistance, now support, around 107.60, while targeting a 200-HMA level of 107.40 and then to 107.00 round-figure.

If at all the quote remains weak below 107.00, the mid-month low near 106.85 will return to the charts.

USD/JPY hourly chart

Trend: Further recovery expected

Additional important levels

| Overview | |

|---|---|

| Today last price | 107.72 |

| Today Daily Change | 8 pips |

| Today Daily Change % | 0.07% |

| Today daily open | 107.64 |

| Trends | |

|---|---|

| Daily SMA20 | 107.06 |

| Daily SMA50 | 107.89 |

| Daily SMA100 | 108.43 |

| Daily SMA200 | 108.32 |

| Levels | |

|---|---|

| Previous Daily High | 107.76 |

| Previous Daily Low | 107.32 |

| Previous Weekly High | 108.09 |

| Previous Weekly Low | 107.04 |

| Previous Monthly High | 109.38 |

| Previous Monthly Low | 106.36 |

| Daily Fibonacci 38.2% | 107.59 |

| Daily Fibonacci 61.8% | 107.49 |

| Daily Pivot Point S1 | 107.39 |

| Daily Pivot Point S2 | 107.13 |

| Daily Pivot Point S3 | 106.95 |

| Daily Pivot Point R1 | 107.83 |

| Daily Pivot Point R2 | 108.01 |

| Daily Pivot Point R3 | 108.27 |