Bitcoinist.com News

U.S. Sanctions against China Tailwind for Bitcoin’s Bullish Moves

by Yashu Gola- Bitcoin anticipates market growth as White House National Security Advisor Robert O’Brien threatens China with economic sanctions over Hong Kong national security law.

- The warning could lead the People’s Bank of China to devalue yuan that, according to Naeem Aslam of AvaTrade, could prove disastrous for all currencies.

- Bitcoin and Gold could attract more buyers amid the distressing geopolitical crisis.

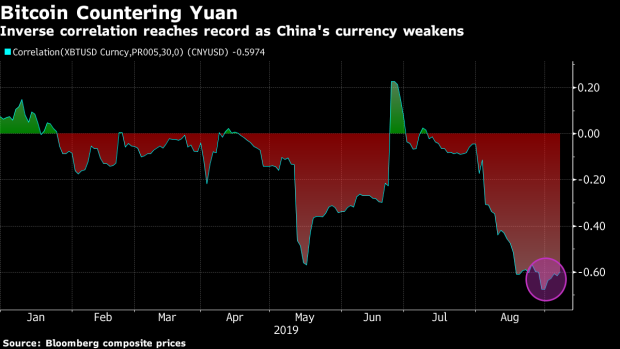

Bitcoin once shared a near-perfect negative correlation with the Chinese Yuan. As the national currency fell, the cryptocurrency popped higher.

The starkly different assets established proximity in mid-2019 at the heights of the U.S.-China trade war. Bloomberg reported that investors used Bitcoin as a hedge against yuan’s intentional devaluation by the People’s Bank of China. Demand for the cryptocurrency was so high that people were willingly paying a $300 premium for it.

Correlation between Bitcoin and yuan in mid-2019 | Source: Bloomberg

Now, a year later, Bitcoin is anticipating a similar market growth as the U.S. and China engage themselves in a new form of “cold war.”

U.S. Sanctions on China

Bitcoin’s bullish bias improved as White House National Security Advisor Robert O’Brien threatened to impose sanctions on China in retaliation to their proposed Hong Kong national security law.

“It looks like with this national security law they’re going to basically take over Hong Kong and if they do … Secretary [of State Mike] Pompeo will likely be unable to certify that Hong Kong maintains a high degree of autonomy.

“And if that happens there will be sanctions that will be imposed on Hong Kong and China,” O’Brien told NBC.

Sanction-hit countries have witnessed higher demand for Bitcoin in the last five years. The tech-savvy people of Venezuela, for instance, resorted to the cryptocurrency as their bet against criminally higher inflation. In Iran, citizens started using Bitcoin to circumvent the ban on international banking, and as a measure to protect their savings against a falling Rial.

Meanwhile, a 2019 survey conducted by analytics firm Gate Trade found that 25 percent of Iranians earned $500 to $3,000 a month from their bitcoin-related businesses.

Bitcoin against Currency War

If the U.S. goes ahead with its plans to impose economic sanctions against China, then it could lead PBOC to devalue yuan. Naeem Aslam, the chief markets analyst at Avatrade, told BI that he sees a weaker yuan creating a ripple effect across all the emerging market currencies.

“There could be a currency war with every central bank looking to devalue its currency,” the analyst said. “With another US-China trade war, renminbi will weaken considerably and the exchange rate will be around 7 yuan per US dollar.”

The distressing geopolitical scenario could lead to more and more retail investors to the safety of Bitcoin – even Gold that behaves as a hedge against currency-led inflations. The cryptocurrency is already up by more than 120 percent from its mid-March lows.