Campari: Stock Is Too Expensive As Restaurants Remain Closed

by Action BiasedSummary

- First impact from COVID-19 could be seen in Q1 results, where profit halved compared with the same period last year.

- Further drop in sales and profit is expected in the most important Q2, as the restaurants either remain closed or operate at reduced capacity.

- DCF valuation prices the shares at EUR 5, similar to relative valuation, meaning 26% downside for the stock.

Davide Campari-Milano S.p.A.'s (Campari) (OTCPK:DVDCF, OTCPK:DVDCY) bottom line will suffer from COVID-19, halving the profit for this year. This effect might not have fully been reflected in the share price.

The first indication of the COVID-19 impact can be seen in Q1 2020 results, where organic revenues have declined by EUR 20mn or 5.3% to EUR 360mn and the pretax profit was down 52% or EUR -33mn to EUR 31mn.

Campari generates 60% of its revenues from off-premise sales with such brands as Wild Turkey, Cabo Wabo, SKYY Vodka liqueur, which have a lower margin than on-premise beverages such as Aperol, Campari, etc. We expect the sales ratio to shift significantly towards off-premise sales this year as the restaurants and bars remain closed or operate at limited capacity in the US and Europe. However, this shift will have a negative impact on the profit margin, as the more profitable segments have been temporarily wiped out by the lockdown policies.

According to the company, the first quarter started strong but then it was impacted by the lockdown policies in Italy in March. Company's sales in Italy suffered a dramatic 24% decline. Campari's biggest market is the US, accounting for 34% of sales (and Americas for 51%), whereas Italy delivers 16% of the top line. In the US, the temporary closures of restaurants and bars only started at the end of March and continue into May. It means that their effect will be most pronounced in Q2 results. If we take the drop in Italy in Q1 as a benchmark and account for the fact that the shelter-in-place restrictions in North America have been less strict than in March-April in Italy, but lasted for most of the second quarter, then a similar 24% drop in sales should be expected in Q2 2020.

Campari's main quarter of the year is Q2, due to the surge in consumption in aperitifs, which are company's main brands (Aperol with 16% of sales and Campari, including Campari soda, accounting for 14% of sales). These beverages see increase in consumption in Q2 when it gets warmer and people spend more time socializing. Aperitifs are also highly profitable. However, due to COVID-19 limitations in Q2 this year, we expect half of Q2 profit being wiped out. Last year the company generated EUR 109mn in Q2 EBIT, or 28% of annual EBIT. This year, we expect at most EUR 50mn in EBIT to be generated in Q2.

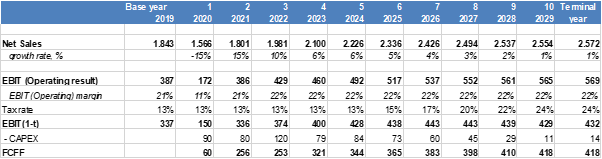

As for the full year 2020, negative growth of -15% is expected in revenues and we estimate that only half of the EBIT of last year will be generated this year, meaning EUR 172mn (see DCF model below). We also expect some recovery in 2021, with 15% growth in sales and are optimistic about the return to the historical profitability of 22% EBIT margin already in 2021.

Discounted Cash Flow Valuation

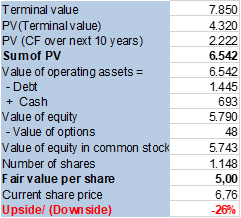

According to our DCF model, with the WACC of 6.2% and incorporating the impact from COVID-19, fair value per share for Campari equals EUR 5. Compared to the current price of EUR 6.76, it will mean 26% downside potential.

Source: Company's filings, author's DCF model

As for taxes, we assumed historical effective tax rate of 13% for the next years and its eventual increase to the corporate tax level in Italy of 24%.

For CAPEX we followed Campari's management guidelines of EUR 94mn this year and along those levels for the years going forward.

According to our model, Campari's Enterprise value (value of operating assets) is EUR 6.5bn, which translates to EUR 5.7bn fair value of common stock (or market cap) and respectively EUR 5 per share.

Relative Valuation

Campari's stock currently trades at 26x P/E, which is somewhat overvalued compared to its peers, such as Diageo (DEO) (22x P/E), Pernod Ricard (OTCPK:PDRDF) (24x P/E).

The company produced EPS of EUR 0.23 last year, which at P/E multiple of 23x would mean fair share price of EUR 5.3.

We note that Campari has been trading at high multiples in the past and the trend might continue into the future.

Balance Sheet

As of March 31, 2020, Campari had EUR 693mn in cash and cash equivalents. At the same time, the company indicated that EUR 580 in bond payments will expire during the year and there are additional EUR 128mn in payables to banks. It means that company's cash will not suffice to cover the current liabilities for the year and the company might need to borrow on the market with less favorable terms than in the past.

Campari paid 5.5 cents in dividends (EUR 62mn cash outflow) in April 2020, but announced the plan to buy back EUR 350mn worth of stock over the next 12 months. If that plan is carried out, that would mean around EUR 30 cents boost for the share price. The company announced the share buyback on February 20 and haven't commented on the plan since. However, the share buyback might be at risk due to the strain on the company's cash position.

Conclusion

Campari faces some tough quarters, which will further reveal the damage caused by COVID-19. The worst quarter to come is Q2 2020, where we expect company's EBIT to all to be EUR 50mn compared to EUR 109mn last year. In our opinion, this drop in profitability is not fully reflected in the current share price.

The fair value for the company's stock, taking into consideration the impact of COVID-19, according to our DCF model, is at EUR 5/share. Also on relative valuation, Campari's shares are trading at a slight premium compared to its peers. Share buybacks could have given the stock around a 30-cent boost; however, the plan might be at risk due to the strain in liquidity.

To watch: the company will announce the half-year results on July 28, 2020.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.