Visa Is Gaining Momentum

by Opportunity TraderSummary

- Visa has been one of the best-performing, large-cap stocks over the last decade.

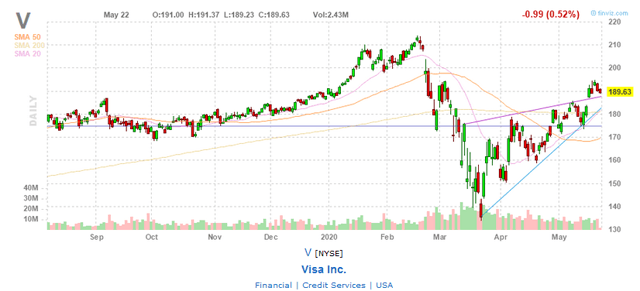

- The stock is currently rebounding from the Covid-19 low levels.

- Free cash flow generation remains rock-solid.

- Call options offer the best risk-reward ratio to benefit from the uptrend.

Visa (NYSE:V) hardly needs an introduction, as most people are using its products and services on a daily basis. Together with Mastercard (NYSE:MA), the company dominates the global payments processing market. Visa's cards are being used in over 200 countries, where Visa facilitates a global network to secure payment transactions.

Both Visa and Mastercard have seen their revenues and earnings rise strongly as more and more payments are being executed digitally.

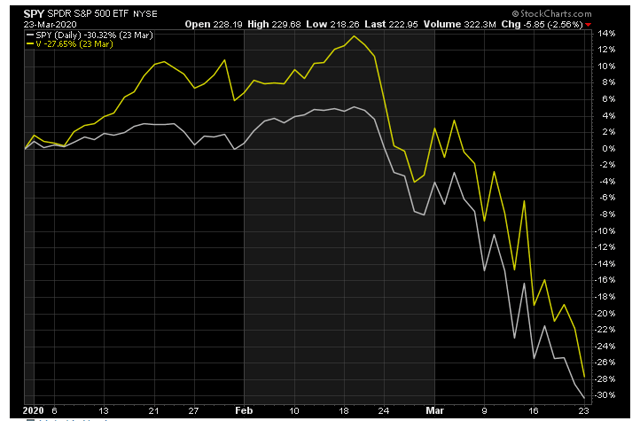

Visa's success has not gone unnoticed, and the stock price has grown in line with the strong fundamentals of the company. More specifically, the stock has been outperforming the stock market (SPY) by 1,500% since it went public in 2007.

The stock price has recently declined from its previous high levels as the Covid-19 correction swept the financial markets. The stock has now been rebounding from its correction and is well on its way to penetrate the $200 price level again.

In this article, we will have a look at the long-term fundamentals of Visa, the recent impact of the Covid-19 virus, and we will present a trading idea to benefit from the upward potential of this company.

Historical Performance

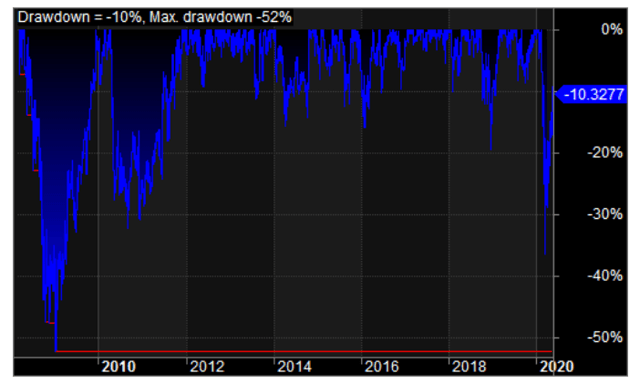

The stock price has been rallying since the company's inception in 2007, growing almost exponentially in value. Almost every time you would have bought Visa stock in the past, you would have ended with a profit by simply holding the stock in your portfolio. Only occasionally has the stock price made minor corrections, only to continue its way again to new high levels.

Source: Stockcharts.com

The share price of Visa is currently at $190, bringing the total market capitalization value to $400 billion. This makes Visa the tenth-largest company by market cap, right after Berkshire Hathaway (NYSE:BRK.A) (NYSE:BRK.B), and before Johnson & Johnson (NYSE:JNJ).

Business Model

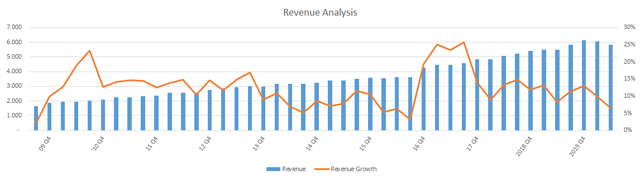

The revenue of Visa is currently $23 billion for the end of the fiscal year 2019 (up from $20.6 billion for 2018). When we look at the revenues for the past quarters, we can see the growth pattern has been consistent throughout the past 10 years, often reaching double-digit levels:

Source: Created with data from visa.com

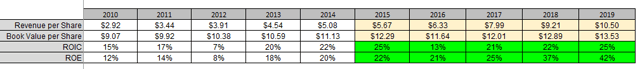

When we look at the historical ROIC and ROE rates, we can see the company has yearly achieved double-digit returns.

Source: Stockrow.com

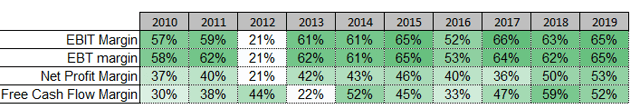

The fundamental business model of Visa does not require high maintenance costs, resulting in low operational expenses which allow the company to achieve high levels of profitability. Net profit margin has been above 50% in the past three years, and almost half of the earnings were converted into free cash flow.

Source: Macrotrends.net

Visa has been using these cash flows to return money to its shareholders by buying back its own stock (in the past five years for $31.9 billion) and paying out dividends. We expect the buybacks to continue in the future, and they add evidence to the bull case for Visa.

Covid-19 impact & price correction

Visa started 2020 initially strong, but declined in value as the Covid-19 virus started to impact the stock market. Visa declined 27% while the S&P 500 index lost 30% (measured from the beginning of 2020 to the lowest point of the calendar year on 23 March 2020).

Source: Stockcharts.com

The stock price lost 1/3 from its high level, as investors started to sell stocks in anticipation of the economic impact of the Covid-19 virus.

Source: Chart created by the author with Amibroker

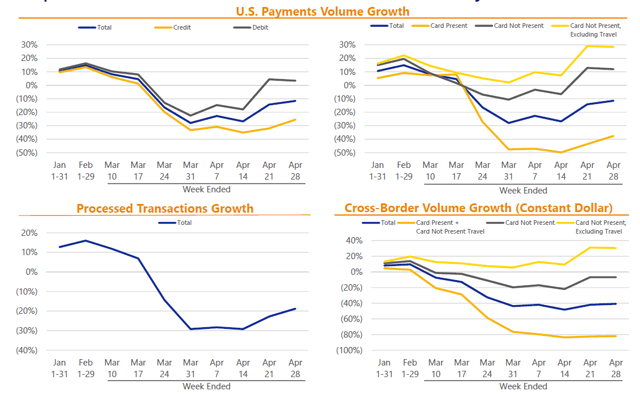

The recent price action of Visa seems understandable, as global economic growth is expected to slow down as major countries have implemented lockdown policies, which lower consumer spending. This has a direct impact on the earnings drivers of Visa, with a double-digit decline in its processed transactions and cross-border volumes:

Source: Visa corporate website (FY-20 Q2)

In the same FY-20 Q2 earnings report, the management summarized the impact as follows:

COVID-19 impacted both card present and card not present cross-border travel related spending, initially in Asia during February, and then globally and more significantly in March as the outbreak spread to the rest of the world. As countries imposed social distancing, shelter-in-place or total lock-down orders, domestic spending, most notably in travel, restaurants, entertainment and fuel, sharply declined week on week with significant deterioration in volume and transaction trends in the latter part of March.

While we do expect the coronavirus will still have an effect on the earnings of Visa in the next two quarters, we consider this adverse impact to be temporary. In the long run, Visa still benefits from the ongoing digitalization of payments and the fundamental business model is still intact.

The stock market appears to agree with us on this point of view, as investors again have been purchasing the common stock of Visa, driving the price back up strongly.

Source: Finviz.com

We expect the stock price to reach the previous high level of $214 in the second half of 2020, as the impact of the coronavirus on the global economy will gradually fade away. As consumer spending will likely pick up again, Visa is strongly placed to benefit from an economic recovery thanks to its business model.

Trade proposal

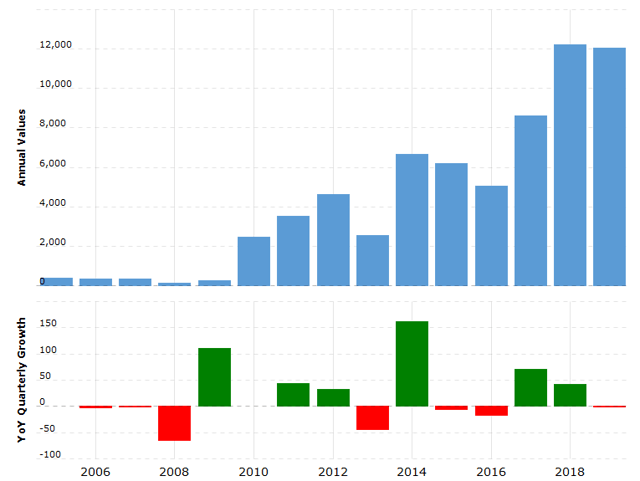

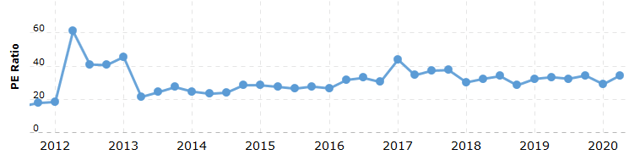

Considering the points discussed above, we think Visa remains a solid investment for the second half of 2020 and the years to come. The stock is currently priced at 34x its earnings, which appears justified given its double-digit growth rates and strong profitability ratios. When we look at the historical valuation levels, we can see the current P/E ratio is in line with its historical average:

Source: Macrotrends.net

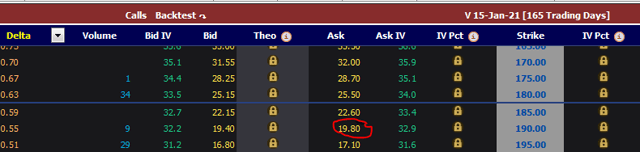

In order to benefit from the upward potential of Visa, we suggest initiating a long position in call options on the company. These contracts allow the purchaser to benefit from the upward potential of the stock price while minimizing the total risk. In this case, we would suggest purchasing the call option contract expiring on 15 January 2021 with a strike price of $190 for a premium of $19.8.

Source: Marketchameleon

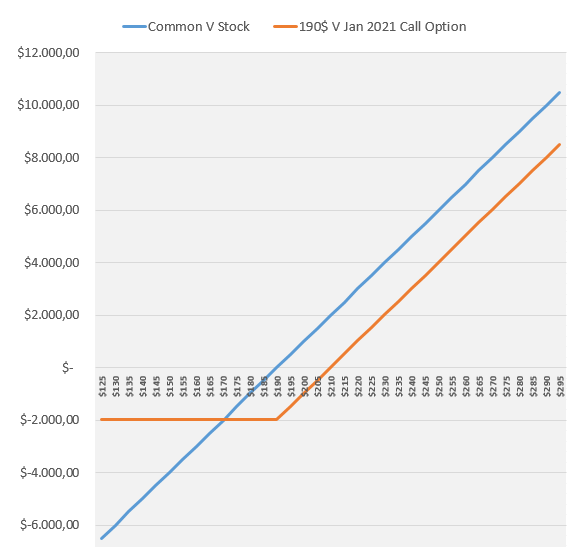

This call option contract gives the holder the right to buy 100 shares of Visa for $190 at any time until 15 January 2021. The total cost of the call option contract will be $1,980 ($19.80 per common share).

The trade has the following benefits:

- The call option contract expires at the beginning of 2021, giving a wide time span to the stock to appreciate in value.

- The purchase of the call option contract only requires a capital outlay of $1,980 whereas an investment in 100 common shares of Visa would require a capital investment of $19,000 at the current price level.

- The downside risk of the call option is limited to $1,980, while the upside potential is similar to the profit potential of a common stock investment.

Risks Associated With The Trade Proposal

The following risks are involved with the fundamental view discussed above and with the proposed options trade:

- Stock markets can decline again if the coronavirus starts spreading again globally. We have already seen a sharp market selloff in March 2020 and a similar price correction could occur again.

- Visa could see a drop in its earnings if the number of global transactions declines as a consequence of lower consumer spending.

-The call option contract grants the right to purchase 100 common stocks of Visa at $190 until 15 January 2021. If the stock price would be below $190 before this date, the contract will expire worthlessly.

We want to emphasize this risk is inherently linked to an investment in call options. If one would invest in the common stock of Visa, there is no time horizon limitation before which the trade has to work out. In this case, the total loss would remain limited up to the amount paid for the premium.

Disclosure: I am/we are long V. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.