NZD/USD Price Analysis: Sellers look for entry below 0.6080/75 support confluence

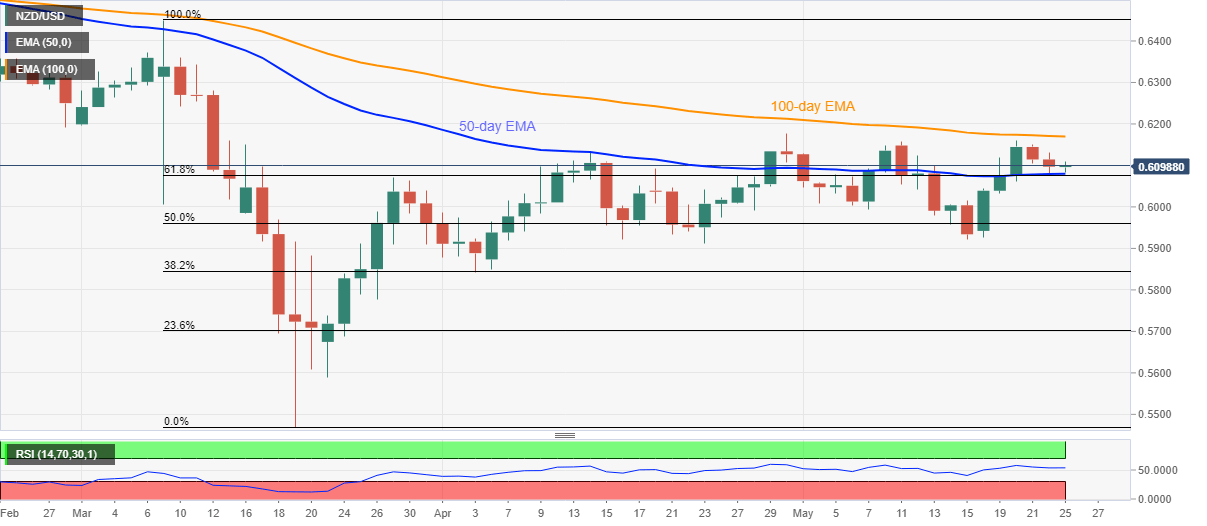

by Anil Panchal- NZD/USD struggles for a clear direction below 100-day EMA.

- 50-day EMA, 61.8% Fibonacci retracement limits immediate downside.

- April top adds to the upside barrier.

NZD/USD again attempts recovery towards 0.6100 while bouncing off 0.6083 during Monday’s Asian session. Even so, the pair stays below 100-day EMA after the recent two-day losing streak.

While the pair’s repeated failures to break 100-day EMA keeps the sellers hopeful, a clear downside below 0.6080/75 support confluence, comprising 50-day EMA and 61.8% Fibonacci retracement of March month fall, becomes the key for fresh entry.

If at all the NZD/USD prices slip below 0.6075, 0.6000 could gain the bears’ attention ahead of the monthly low near 0.5920.

Alternatively, an upside clearance of a 100-day EMA level of 0.6170 could propel the quote towards April month high nearing 0.6175/80.

NZD/USD daily chart

Trend: Sideways

Additional important levels

| Overview | |

|---|---|

| Today last price | 0.6099 |

| Today Daily Change | 2 pips |

| Today Daily Change % | 0.03% |

| Today daily open | 0.6097 |

| Trends | |

|---|---|

| Daily SMA20 | 0.6066 |

| Daily SMA50 | 0.5995 |

| Daily SMA100 | 0.622 |

| Daily SMA200 | 0.6321 |

| Levels | |

|---|---|

| Previous Daily High | 0.6131 |

| Previous Daily Low | 0.608 |

| Previous Weekly High | 0.6159 |

| Previous Weekly Low | 0.5927 |

| Previous Monthly High | 0.6176 |

| Previous Monthly Low | 0.5843 |

| Daily Fibonacci 38.2% | 0.6099 |

| Daily Fibonacci 61.8% | 0.6112 |

| Daily Pivot Point S1 | 0.6074 |

| Daily Pivot Point S2 | 0.6052 |

| Daily Pivot Point S3 | 0.6023 |

| Daily Pivot Point R1 | 0.6125 |

| Daily Pivot Point R2 | 0.6154 |

| Daily Pivot Point R3 | 0.6176 |