Pros and cons of investing in NPS for retirement saving

National Pension System is an investment product to save for retirement. However, among millennials, very few like to invest in such a product with a long lock-in period but this pension scheme has everything an investor looks for in a retirement plan.

by Babar Zaidi

Indranil Halder wants to reduce his tax but won’t invest in an option that can shave off more than 20% from his tax liability. “I’m not interested in the NPS because it has a long lock-in and other complications,” the Pune-based IT professional wrote to ET Wealth last year. Indeed, the 25 year old will have to wait till 2055 before he can access the money poured into the pension scheme. Very few millennials like to think in such long terms.

This is something that is worrying Supratim Bandyopadhyay, the newly-appointed chairman of the Pension Fund Regulatory and Development Authority (PFRDA). “A lot of people do not realise the importance of saving for retirement. They postpone the decision to save till they are in their late 40s,” he says.

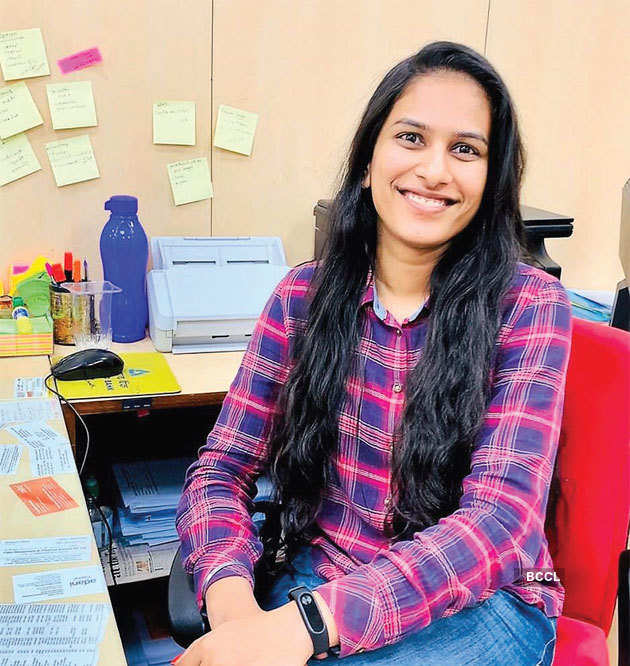

At the same time, awareness about the need to start early is gradually growing. “We are seeing a growing interest in the NPS among younger people. More than 62% of the investors in NPS are in the age group 26-45 years,” says Bandyopadhyay. One of them is Mumbai-based PSU banker Priti Kawara. As part of her retirement benefits, Rs 13,500 is invested in her NPS account every month by her employer. She puts another Rs 50,000 in the scheme every year to claim the additional tax benefit under Section 80CCD(1b).

In Pic: Priti Karawa, 27 years, Mumbai

Being a PSU employee, NPS is mandatory for her, though she also invests an additional Rs 50,000 on her own under Sec 80CCD(1b). Has been investing for the past three years but never gave attention to the asset mix or changed her allocation.

"Given the downturn in the equity market, this is a good time to hike equity exposure in NPS to the maximum 75%."

Indeed, the triple tax benefits of NPS are a big draw for investors. Firstly, NPS investments are eligible for deduction under Section 80C. If one has already exhausted the Rs 1.5 lakh ceiling under Section 80C, one can claim an additional deduction of up to Rs 50,000 under Section 80CCD (1B). For an investor in the 30% tax bracket, this means additional tax savings of Rs 15,450. More tax can be saved if one’s employer signs up with NPS and puts up to 10% of the basic salary in the NPS under Section 80CCD(2). “NPS offers significant tax benefits. If your company offers NPS, don’t miss the opportunity to cut your tax,” says Archit Gupta, CEO of tax filing portal Cleartax.in.

Unfair to tax annuity

The other ‘complication’ that Halder refers to are the NPS rules on annuity. Over the years, the NPS has shed its rigidity and become more tax friendly. The entire 60% of the corpus that can be withdrawn on maturity is tax free. However, the remaining 40% has to be compulsorily put into an annuity to earn a pension that is fully taxed as income. This effectively means an investor does not save tax but only defers it.

Experts point out that the tax situation of a retiree is different. The basic exemption is higher and there are other benefits such as tax exemption to interest income up to Rs 50,000 under Section 80TTB. Even so, the tax on annuity is a tad unfair because the pension received is a mix of the principal and investment returns.

Being taxed on investment returns is acceptable, but the tax on the principal portion is galling. “Tax on annuity makes NPS unattractive and unfair compared to other retirement products such as EPF and PPF,” says Chirag Mehta, a finance professional based in Kolkata. He says if not the entire annuity, at least the principal component should be exempt from tax. “There should also be indexation benefit while taxing the profit element,” he says.

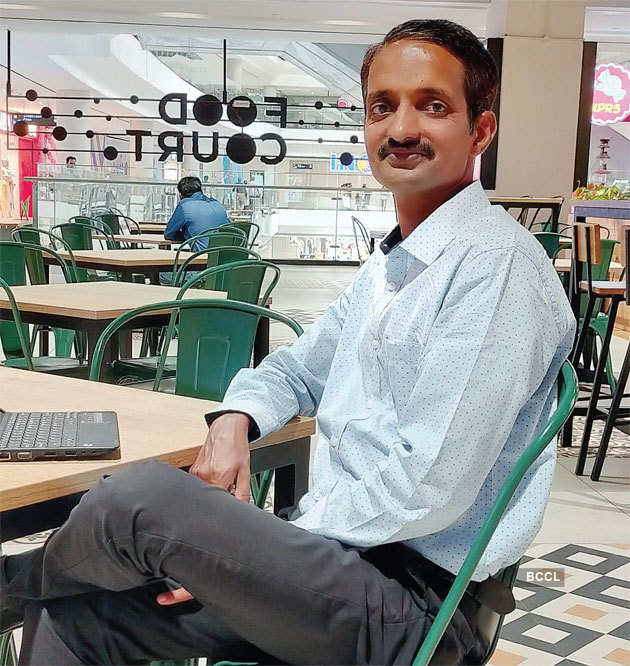

In Pic: Chirag Mehta, 33 years, Kolkata

He has opted for NPS contribution by his company under Sec 80CCD(2) and also contributes on his own under Sec 80CCD(1b). His combined contribution is Rs 1.62 lakh per year, which saves him over Rs 50,000 in tax.

"I regularly make changes in the asset mix. In December 2019, I switched from aggressive mix with 75% in equities to conservative mix with 25% only."

For several years now, tax exemption for annuity pension has been on the Budget wishlist that the PFRDA sends to the Finance Ministry. This year, the insurance regulator Irdai also joined the chorus, but to no avail. “If the Finance Ministry agrees and annuity becomes tax free, it will be a gamechanger for the pension sector in India,” says Bandyopadhyay.

Apart from the tax benefits, the NPS is also an ultra low-cost investment option. The fund management charges are 0.01%. To be sure, this is not the only expense for investors. They also have to shell out one-time charges at the time of on-boarding and pay a flat fee on every transaction. Despite this, the NPS is still by far the cheapest market-linked investment product.

Automatic rebalancing

Several studies have shown that rebalanced portfolios deliver better returns in the long run than static portfolios that don’t make any changes. Financial planners recommend that investors should rebalance their portfolios at least once a year or after a major market development, where a particular asset class moves up or down by more than 10-15%. “Rebalancing protects the portfolio against volatility,” says Rohit Shah, Founder and CEO of Getting You Rich.

The NPS also offers a terrific advantage to investors by way of automatic rebalancing. Investors can choose from three lifecycle funds—aggressive, moderate and conservative. The aggressive portfolio allocates 75% to equities, moderate puts 50% and conservative invests only 25%. The portfolios get rebalanced on the investor’s birthday every year. “The lifecycle funds of NPS are the only products which automatically rebalance the corpus every year,” points out Bandyopadhyay.

Best performing pension funds

If you are convinced that NPS is good for you, the next step is to open an account and start investing. You also need to choose from the seven pension fund managers. The returns of individual NPS schemes do not reflect the actual returns for the investor because the portfolio is usually a mix of 2-3 different classes of funds. ET Wealth studied the blended returns of four different combinations of the equity, corporate debt and gilt funds.

Also Read: Performance of different types of NPS funds

Ultra-safe investors are assumed to have put 60% in gilt funds, 40% in corporate bond funds and nothing in equity funds. A conservative investor would put 20% in stocks, 30% in corporate bonds and 50% in gilts. A balanced allocation would put 33.3% in each of the three classes of funds while an aggressive investor would invest the maximum 50% in the equity fund, 30% in corporate bonds and 20% in gilts. Aggressive investors can now put up to 75%, but this allocation does not have a very long track record. We have also not considered the 5% allowed to be put in alternative investments.

Ultra-safe investors who stayed away from equities have earned the highest returns. They may have missed the stock market rallies in the past few years but also didn’t suffer when markets crashed with a thud in March. The long-term returns of these investors are also higher than what the Provident Fund or small savings schemes churned out in the past 3-5 years. Unsurprisingly, the LIC Pension Fund is the best performing pension fund for the ultra-safe allocation, generating 16.32% returns in the past one year and SIP returns of 10.50% in the past five years.

Conservative investors, who put a sliver of their corpus in equity funds, have also done well. But these funds have not managed to beat the returns of the Provident Fund. Newcomer Aditya Birla Sun Life Pension Scheme is the best performing fund in the short term, but HDFC Pension Fund stays ahead in the longer term and in the SIP mode.

In Pic: Milind Gawade, 44 years, Pune

He has been investing in NPS for the past five years, primarily to save tax. He invests around Rs 1 lakh in the scheme every year, claiming tax benefit under Section 80C and Section 80CCD(1b). Gawade invests in mutual funds for equity exposure and uses the NPS for the debt portion of his portfolio.

"My entire corpus is in a gilt fund. It has generated better returns than debt mutual funds."

Balanced investors who divided the corpus equally across all three fund classes suffered from the exposure to equities. Though gilt funds rallied, the crash in equity funds pulled down the overall returns. Here again, Aditya Birla Sun Life Pension Scheme has delivered the most impressive numbers. Aggressive investors, who put the maximum 50% in equity funds, have lost money in the past one year. Some even lost money in SIPs in the past three years, underlining the risks of investing in equities.

Incidentally, the Provident Fund has also started investing in stocks. In August 2015, it started by putting 5% of fresh inflows in Nifty ETFs. This was raised to 10% of inflows in 2017 and later hiked to 15% in 2018. However, though it notched up good gains in the first few years, the stock crash in March this year has pushed its equity exposure into the red. Our calculations show that due to the losses in equity investments, the Provident Fund may not be able to give out more than 7% in 2019-20.