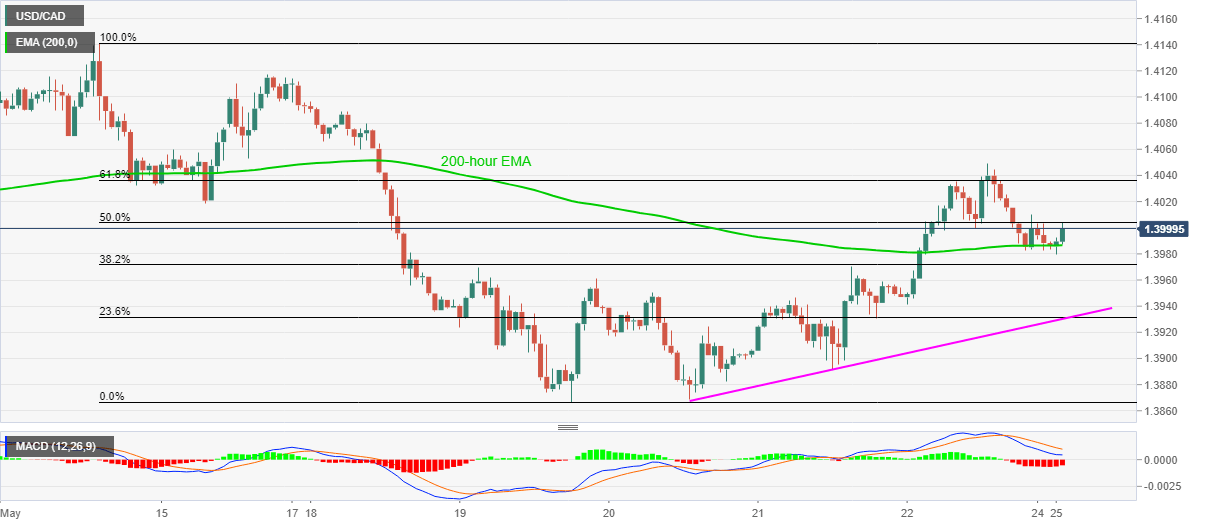

USD/CAD Price Analysis: Bounces off 200-hour EMA to probe 1.4000

by Anil Panchal- USD/CAD extends pullback moves from 1.3980.

- 61.8% of Fibonacci retracement acts as immediate resistance.

- A three-day-old rising trend line, recovery from the key EMA keep buyers hopeful.

USD/CAD takes the bids near 1.4000, up 0.05% on a day, during the early Monday’s trading. Despite failing to cross 1.4050 resistance, the pair’s recent bounce from 200-hour EMA keeps buyers hopeful.

That said, bulls may again target 1.4050 resistance while also aiming 61.8% Fibonacci retracement of May 14-19 fall, around 1.4035 as immediate upside barrier.

In a case where the buyers manage to dominate past-1.4050, 1.4100, 1.4120 and May 14 top near 1.4140 could return to the charts.

On the downside, the pair’s break of a 200-hour EMA level of 1.3985 can drag it back to a short-term support line near 1.3930.

Though, 1.3900 round-figure and May 19 low near 1.3870/65 could challenge the bears afterward.

USD/CAD hourly chart

Trend: Further recovery expected

Additional important levels

| Overview | |

|---|---|

| Today last price | 1.399 |

| Today Daily Change | -10 pips |

| Today Daily Change % | -0.07% |

| Today daily open | 1.4 |

| Trends | |

|---|---|

| Daily SMA20 | 1.4011 |

| Daily SMA50 | 1.4089 |

| Daily SMA100 | 1.368 |

| Daily SMA200 | 1.3446 |

| Levels | |

|---|---|

| Previous Daily High | 1.4049 |

| Previous Daily Low | 1.3942 |

| Previous Weekly High | 1.4114 |

| Previous Weekly Low | 1.3867 |

| Previous Monthly High | 1.4299 |

| Previous Monthly Low | 1.385 |

| Daily Fibonacci 38.2% | 1.4008 |

| Daily Fibonacci 61.8% | 1.3982 |

| Daily Pivot Point S1 | 1.3944 |

| Daily Pivot Point S2 | 1.3889 |

| Daily Pivot Point S3 | 1.3837 |

| Daily Pivot Point R1 | 1.4052 |

| Daily Pivot Point R2 | 1.4104 |

| Daily Pivot Point R3 | 1.4159 |