MB Fund April 2020 Performance

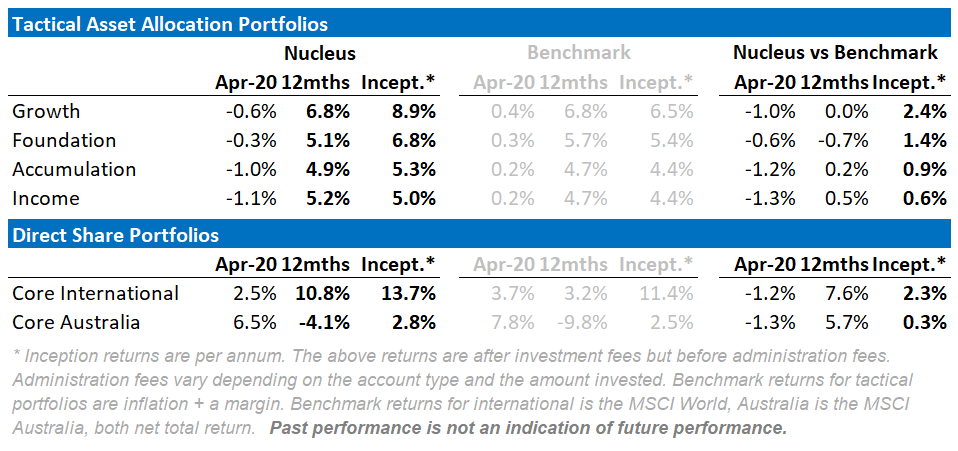

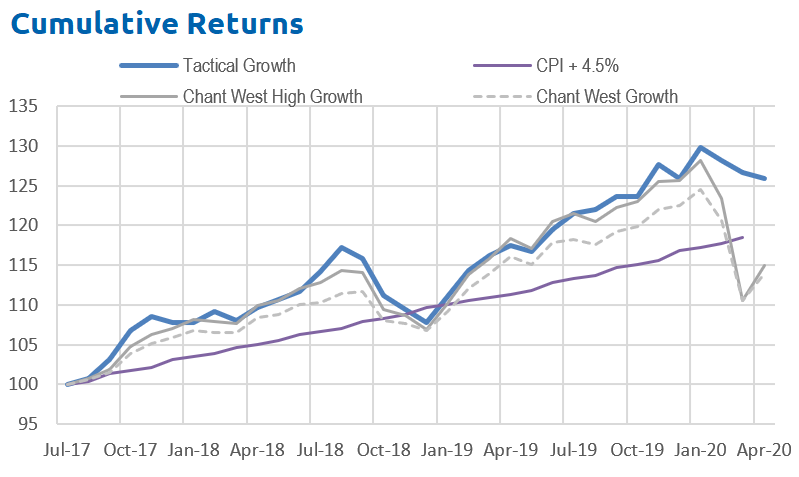

by Damien KlassenApril saw a bounce back in share markets after March was one of the worst months ever. Our portfolios continue to be positioned defensively and so only took a limited part in the bounce. Over the last year, our Tactical Growth fund is beating the Chant West median superannuation fund by 10%. In our direct equity portfolios, we have long preached the idea of holding a mix of quality and value to provide downside protection – and that showed this year. Our International fund is beating the MSCI World by 7.6%, our Australian fund is beating the MSCI Australia index by 5.7%.

Asset Allocation

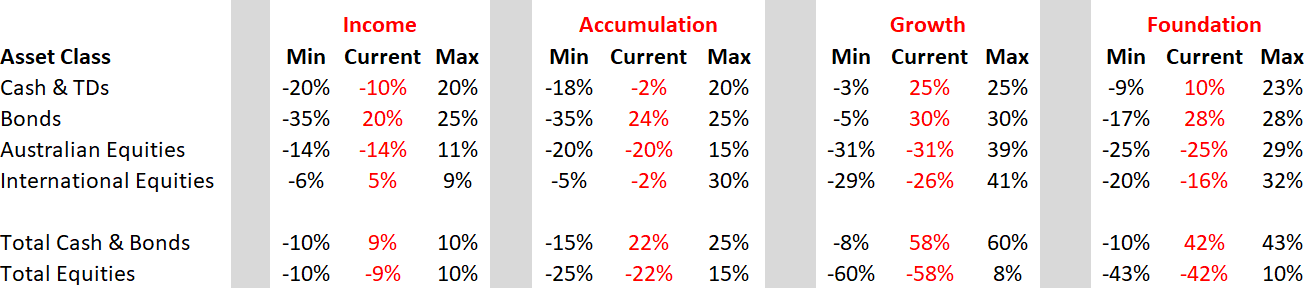

Our portfolios “went to ground” before the crisis hit, selling stocks and investing in bonds/cash/international currencies. All of our funds have a low weight to shares. This is a significant deviation and one that we have not undertaken lightly.

Digging into the April Performance

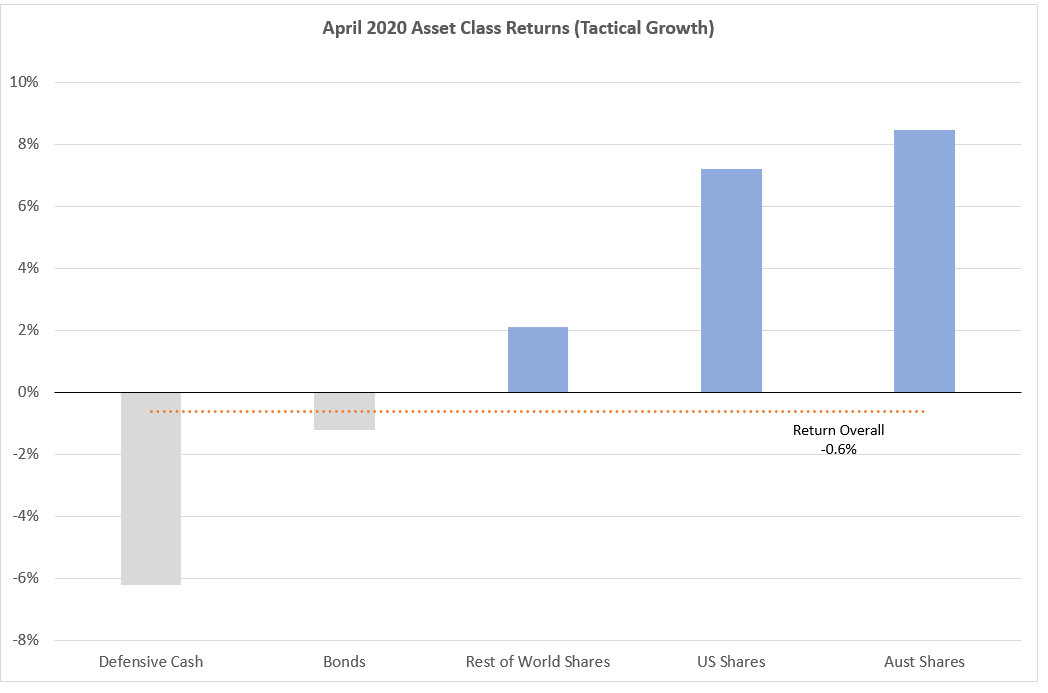

After the precipitous equity lows of late March, April saw a strong spring back as the expectation of a V-shaped recovery gained favour, and Covid-19 curves began to flatten. Consequently, all equity markets had a solid month, while Bonds softened and Australian dollar retraced. We maintained our defensive stance in the Tactical portfolios, so the equity gains were offset by the currency resurgence (Defensive Cash) and bond weakness.

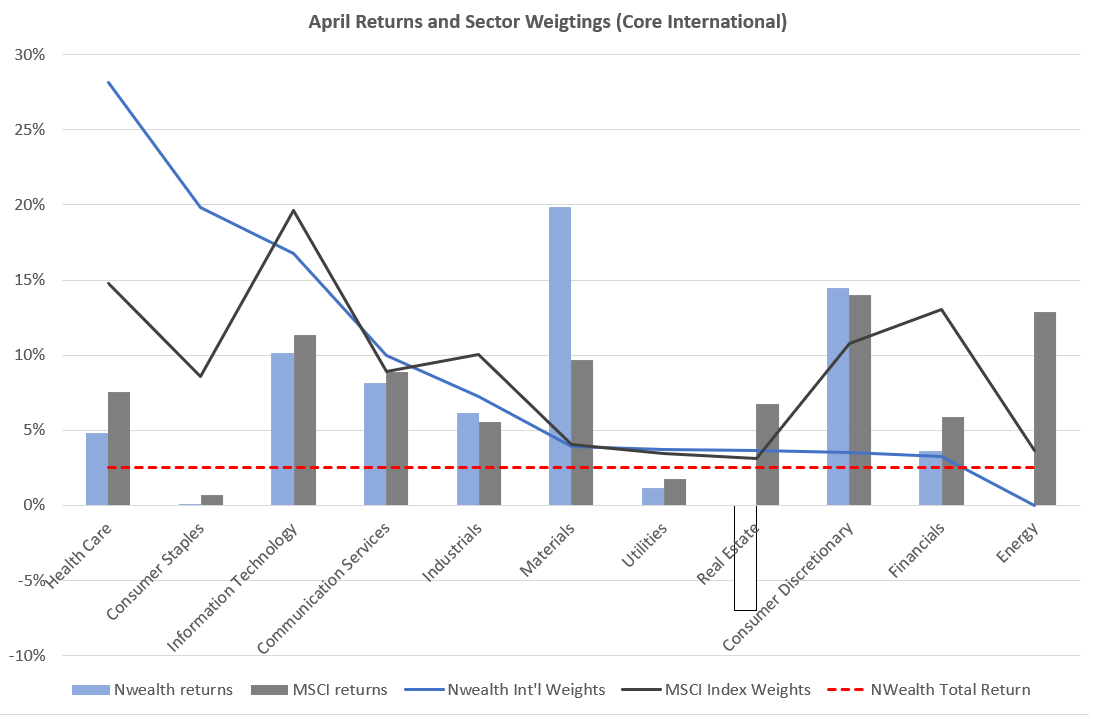

Sectorally, it was our Gold mining exposures (Materials) that were the best performers with Consumer Discretionary (largely eBay) and Info-Tech the other strong performers. We did venture from the bunker to pick up beaten-down oil and iron stocks given they represented value relative to the underlying commodity.

Managing volatility

A key area of focus for the funds is the management of volatility. The direct international and Australian share funds both exhibit materially lower volatility than the market:

For the tactical funds, this is further enhanced by the use of active allocations into bonds and currencies.

How we are positioning our share portfolios

Pandemic Agnostic Stocks

To reduce risk, we hold a core of the pandemic-agnostic stocks. The issue is these tend to be expensive relative to other stocks. The strategy within this cohort is to rotate out of more expensive stocks and into cheaper ones as opportunities arise. In this cohort, we own software stocks like Microsoft, online shopping companies like eBay, and supermarkets like Coles, Woolworths and Ahold Delhaize.

There are also some unexpected beneficiaries, for instance, we have done well from pet food supplier JM Smucker. While we did expect pet food to hold up, we weren’t expecting the increase in pet numbers and pet care driven by the isolation.

One pandemic agnostic stock we held through the crisis but recently sold down was Johnson & Johnson. It is a massive US stock that is in many ways a lot like a healthcare managed fund: quality operations across almost the entire health spectrum. While we like the exposure, Johnson & Johnson is back trading at pre-crisis levels, and management guidance (in our view) reflects a “V-shaped” recovery. We believe this to be unlikely. I’m more than happy to own this stock, but it looks like its already pricing a full recovery, leaving limited room for growth and a reasonable amount of room for disappointment.

Pandemic Beneficiaries

We also have a lot of pandemic beneficiaries – which is why our Australian and International portfolios outperformed by so much.

We are holding on to these stocks (subject to not being too expensive) with the view that an extended crisis is more likely than a sudden solution.

Within the beneficiaries, we have a time-frame within which the effects will fade. For example, toilet paper manufacturers like Kimberly Clark have benefitted in the short term, but we are not expecting a permanent change in demand.

On the other hand, some of the hygiene and cleaning manufacturers may see several years of increased demand before returning to trend. Essity, a large Swedish company that supplies hospitals globally with sanitiser and hygiene products, is a core holding for us in this space.

Clorox, the leading producer of bleach and other cleaning products in the US, is also likely to see years of increased growth. Clorox made our clients a lot of money over the past two months. However, it has risen to valuation levels more appropriate to companies with far more intellectual property than a formula for bleach and some marketing. So at almost 30x earnings, it was time to take profits.

Pandemic Losers

We hold hardly any pandemic losers. However, we do have a shopping list of our favourites. We will start buying these when the recovery is clear or individual stock prices reach a low enough level relative to other stocks. Earlier in May, we began to buy some oil stocks with the view that despite continued demand weakness, prices had fallen to an attractive level.

There is a lot of nuance within the pandemic losers group.

Some stocks will recover quickly once lockdowns are eased, many, like international travel, will take years to return to trend growth. I’m not that keen to front-run my own purchases in this cohort, so I can’t give you direct names. What I will say is that we have a shopping list ready and relative pricing metrics where we will likely buy these stocks regardless of the pandemic situation.

While debt levels are essential if you want to buy these stocks early, the debt level will be less important once the recovery is in full swing. We don’t really play in the high-risk/low-quality stock space, but they will be the ones that bounce the most. The best returns will come from the oil companies, airlines and banks that almost go broke but don’t.

With commodities, one of the few areas of the market to discount growth appropriately, we have bought back some of the gold, oil and iron ore resources plays that we sold going into the crisis.

Tactical Moves

With volatile share markets, within each cohort, we are continually looking to increase the quality of the portfolio where possible. As some of the stocks become expensive, we look to trade into cheaper or better quality stocks.

The plan is that if effective treatments or widespread rapid exits from the lockdown appear likely, then we are ready to switch out of the pandemic winners and into our pandemic losers.

But, for the present, we are taking the view that the market has already priced in a V-shaped recovery. Therefore, there is far more downside from a V-shaped recovery not occurring than there is upside if the return is faster than we expect.

My key areas of concern

Concern 1: Lack of consumer demand

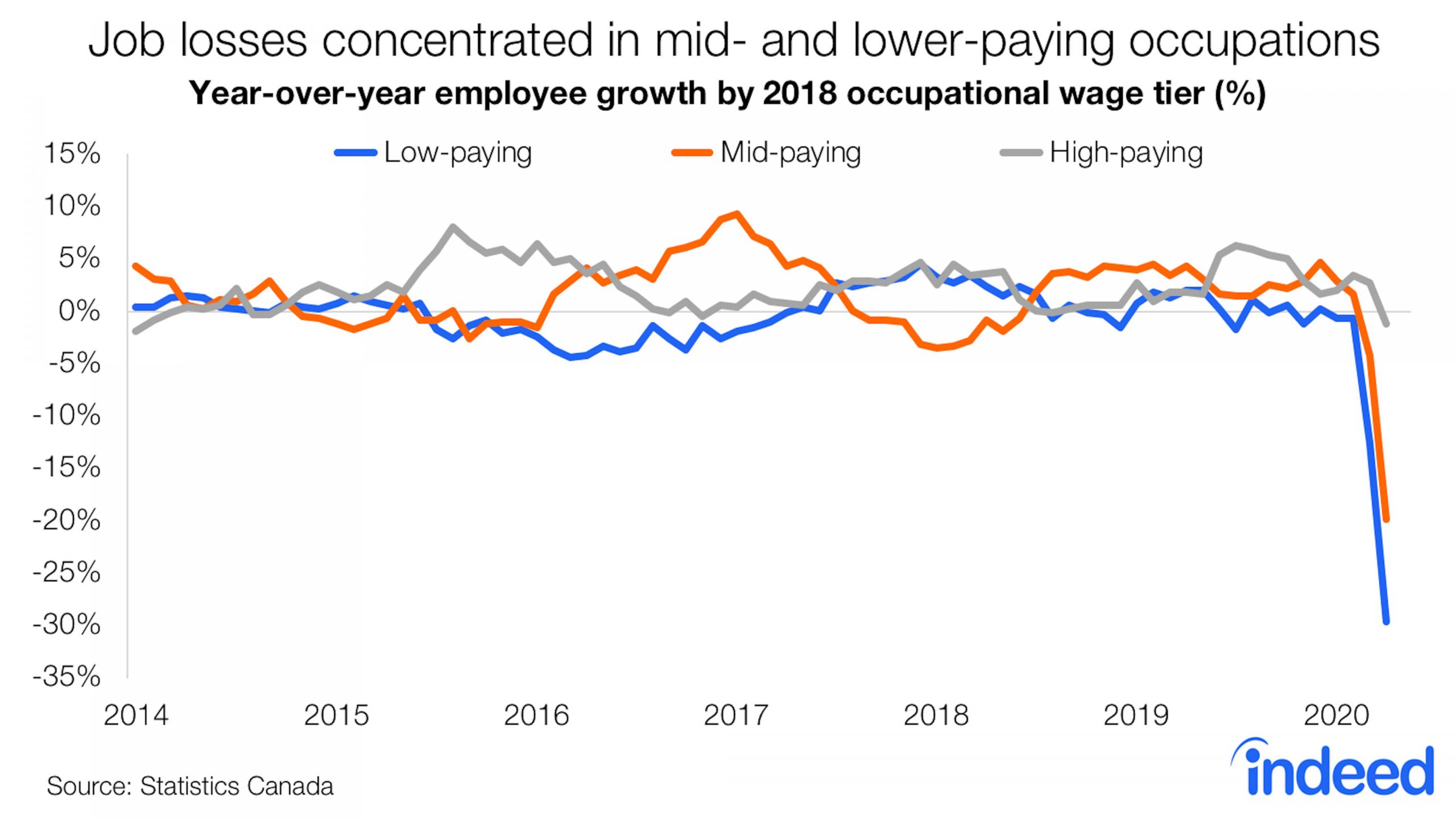

Before Covid-19 consumer demand was weak, even though consumers had been growing debt faster than income for years. Now consumers have lost jobs in record numbers, been locked at home, face threats of future lockdowns and banks are tightening lending criteria. All the evidence so far suggests that it will be a long time before consumer demand returns.

I’m looking for arguments to suggest this won’t be the case.

An often-cited one is there will be pent up demand from people stuck at home unable to spend money. This is a rich person’s argument:

There will definitely be winners. But the impact of a few winners spending more money will be drowned out by the legion of people with less money. And rich people won’t be able to spend on travel for some time. And there will be winners who decide to save money in case there is a second wave.

Concern 2: Debt Crises

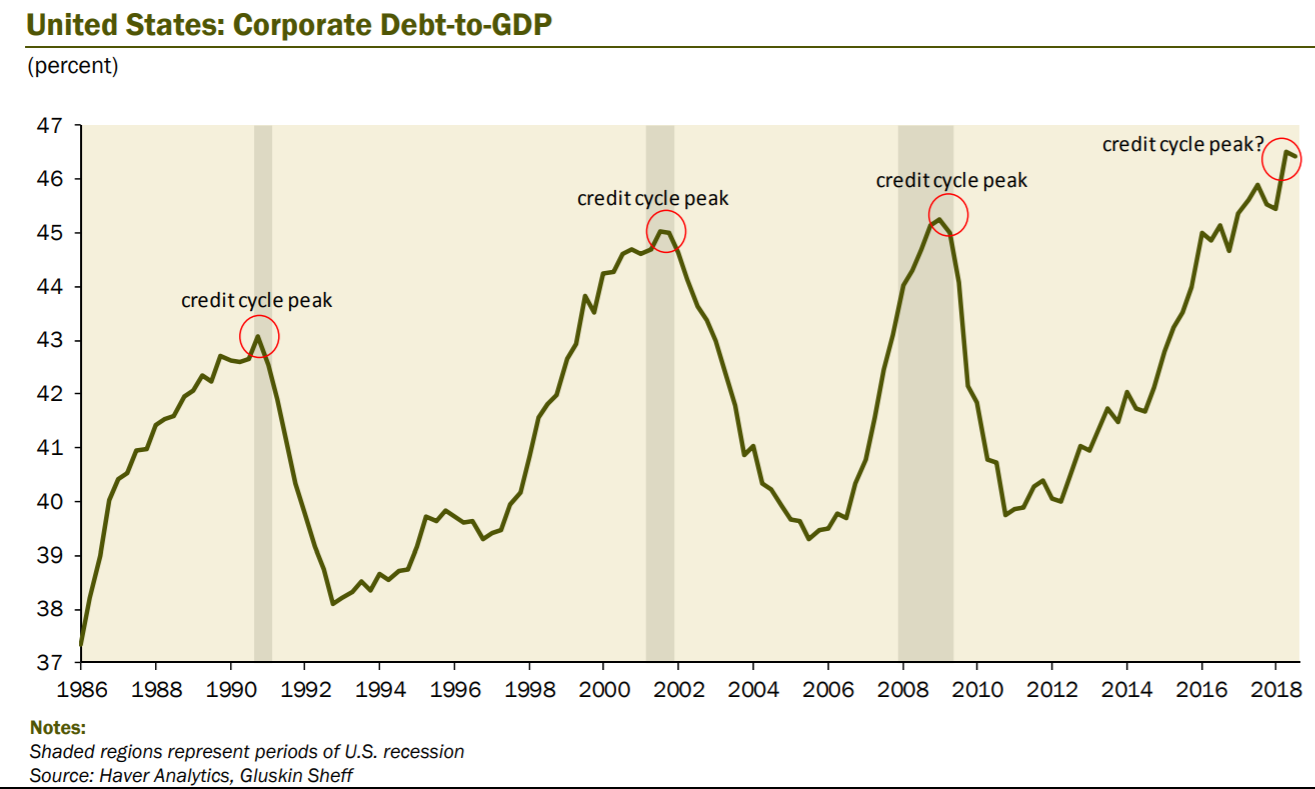

Consumer debt is close to record highs. Corporate debt in the US is at cyclical highs. Add in weak consumer demand, job losses and supply shocks. All the conditions are present for a debt crisis.

Central banks are now buying corporate debt to prevent a debt crisis for large companies. But what will central banks do about small and medium businesses which make up 50-70% of the economy?

The best argument is that central banks and governments will “do something” when it becomes an issue. They might. I have no idea what, but it would be hugely expensive and incredibly prone to fraud. Effectively it would be suspending capitalism.

Concern 3: Corporate Earnings and Valuation

On top of the above problems, I see companies:

- Running lower debt levels.

- Adding more redundancy into systems.

- Adding more fat into supply chains.

- Diversifying supply chains away from China.

All of these will reduce earnings even further. And I’m not talking about the one-off impact this year, I’m talking about a sustained decrease in earnings.

World stock markets were more expensive in February than any other time except one: the tech wreck. Since then, forward earnings have fallen further than prices, so now stock markets are even more expensive.

The counter-argument to this tends to be that central banks are going to crowd investors out of every other asset and then start buying equities.

Wrap up

There is little to glean from how far GDP or earnings fall, or how far unemployment rises. The numbers are going to drop a lot and will eventually bounce back.

The focus for investors should be on where earnings can get back to over the next few years. I’m struggling to find anyone with a credible earnings scenario that justifies paying current prices.

The best bullish argument? Capitalism is dead, therefore buy equities. Such “new age” arguments can hold water in the vacuum of no earnings, but how will they react as profits tumble?

The stock market has already priced a V-Shaped recovery meaning that if it arrives there is limited upside. Conversely, if the recovery is more subdued then there is a lot of downside.

—————————————————-

Damien Klassen is Head of Investments at the Macrobusiness Fund, which is powered by Nucleus Wealth.

The information on this blog contains general information and does not take into account your personal objectives, financial situation or needs. Past performance is not an indication of future performance. Damien Klassen is an authorised representative of Nucleus Wealth Management, a Corporate Authorised Representative of Integrity Private Wealth Pty Ltd, AFSL 436298.

Follow me

Damien Klassen

Damien has a wealth of experience across international equities (Schroders), asset allocation (Wilson HTM) and he helped create one of Australia’s largest independent research firms, Aegis Equities. He lectured for over a decade at the Securities Institute, Finsia and Kaplan and spent many of those years as the external Chair for the subject of Industrial Equity Analysis.

Follow me

Latest posts by Damien Klassen (see all)

- MB Fund April 2020 Performance - May 25, 2020

- Banks go badly with flat yield curve or debt crisis, we face both - May 20, 2020

- MB Fund March performance on top of the world - April 28, 2020