Newmont Stock Has Doubled. Is It Still A Buy?

by John Dorfman

Newmont NEM , the largest U.S.-based gold mining stock, has doubled in the past year. Too late to buy? I don’t think so. I believe there are more gains to come.

Despite the bear market brought on by the coronavirus, close to 4% of all U.S. stocks with a current market value of $500 million or more have doubled in the past year.

Many of them lack a history of profitability. Many others labor under a heavy debt load. And still others sell for extravagant prices. But Newmont, to my way of thinking, has none of these flaws.

Cheapened Currencies

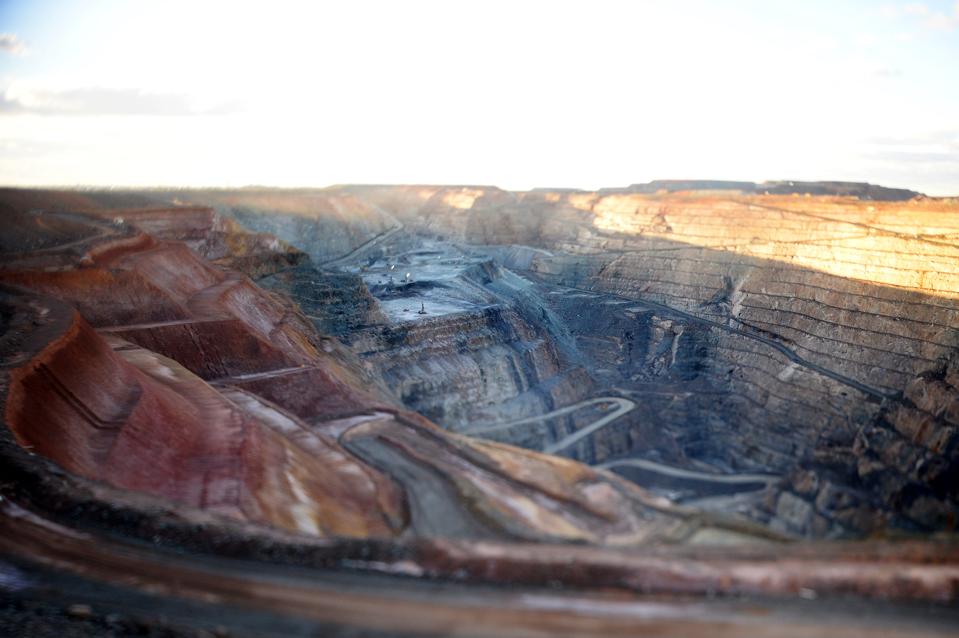

Newmont, based in Greenwood Village, Colorado, is the largest U.S.-based gold mining company, and one of the largest in the world. It mines for gold in the U.S., Canada, Mexico, Australia, Peru, Chile and Argentina. Oh yes, and the Dominican Republic, Suriname and Ghana.

With central banks printing money all over the world, they are arguably cheapening their currencies. That could make gold worth more, measured in dollars or euro or yen. Gold tends to hold a fairly constant purchasing power. You can’t really say that about paper currency.

Personally and for most of my clients, I have about a 10% position right now in SPDR Gold Trust (GLD), certificates indicating ownership of physical gold.

That’s a fairly conservative way to play the rise in gold prices that I anticipate. But if you want to raise the risk-and-return stakes, mining stocks might be your thing. The price of mining stocks generally jumps around more violently than the price of gold itself. One might naturally expect that the price of gold mining stocks should rise when the price of the metal itself rises, and vice versa. That is often true–but far from always true.

A lot of the gold that’s fairly easy to find was found a long time ago–in the California gold rush of 1848-1855, for example. Today, gold is more likely to be found in places far from towns and roads, and deep in the ground, in places where it’s expensive to mine.

Risk and Reward

So the price arc for physical gold is one thing, and the price arc for mining stocks is another. The miners are riskier, but also more likely to yield a quick, dramatic gain.

A mine that’s uneconomic with gold at $1,300 an ounce might be highly lucrative with gold at $2,000 an ounce. (Gold stands at $1,735 per ounce at this writing.) For a mining company in the neighborhood of breakeven, a modest move in gold could mean a big swing between profit and loss.

Newmont has had four losses in the past 15 years, but was nicely profitable last year. And the central-bank dynamic I described above hadn’t kicked in yet. At present, Newmont shares trade for a little less than 15 times the past four quarter’s earnings. That’s on the cheap side for this stock, which has averaged about 21 times earnings for the past ten years.

Past Trajectory

I admit to an instinctive preference for stocks that have been whacked, rather than crowd favorites. But I profoundly believe that a stock’s past trajectory–in either direction—doesn’t tell you where it’s going next.

That’s why I’ve written a total of 12 columns since 2001 on stocks that have doubled, and that I think are still good buys. (In 2016 and 2019, I couldn’t find any that I liked, and had to settle for writing about stocks that were up 50% or more.)

Stocks that double in a year are likely to be up or down a lot in the next year. For example, in 2015 I wrote about MGP Ingredients (GMPI) and NewLink Genetics (The former rose another 79%; the latter fell 74%.

Of the 12 sets of recommendations, eight were profitable and seven beat the Standard & Poor’s 500 Index. However, my average 12-month gain was only 9.5%, while the index returned an average of 10.9%.

Last year was a good one. I recommended three stocks. Molina Healthcare MOH returned 38% and PCM (PCM) gained 33%. Great Lakes Dredge & Dock GLDD declined 15%. My average was 18.4%, versus 4.6% for the S&P 500.

Bear in mind that my column recommendations are hypothetical: They don’t reflect actual trades, trading costs or taxes. These results shouldn’t be confused with the performance of portfolios I manage for clients. Also, past performance doesn’t predict future results.

Disclosure: As noted, I own SPDR Gold Trust personally and for most of my clients. One client owns MGP Ingredients.

——