Cree Stock Headed Below $35?

by Trefis Team

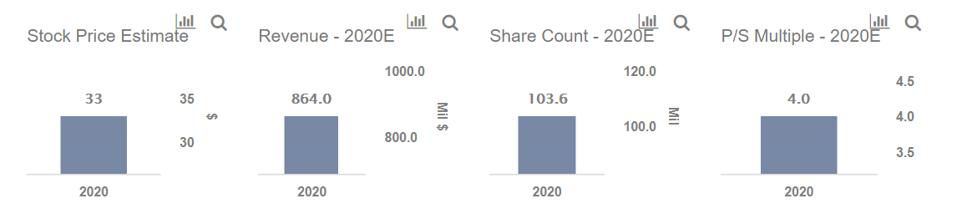

Due to the spread of the novel Coronavirus that has rattled the stock markets and the broader economy, at the current price of $50 per share, we believe Cree stock (NASDAQ: CREE) could see significant downside if there are no signs of abatement of the crisis by June 2020. The key is that Cree stock is up around 7.5% this year, and almost 35% since the start of 2018. We further estimate that Cree’s stock price could decline to levels of around $33 (worst-case scenario) if Cree revenue falls by 20% vs. FY’19, and its valuation multiple drops to 4x, a little below the 2019 low of 4.4x. Below, we summarize this possible downside case for Cree, which is detailed in our interactive dashboard analysis Cree Downside: How Low Can Cree Stock Go?

So what’s the likely trigger and timing to this downside?

- The global spread of coronavirus has led to a slowdown in industrial and economic activity, thus affecting manufacturing activities and consumer demand. This will lead to lower demand for non-essentials such as electric vehicles and new mobile devices, leading to lower demand for Cree’s power and RF products. We believe Cree’s Q4 ’20 results in August will confirm the hit to its revenue, with the management having already warned that the next few quarters will be difficult.

- Specifically, we believe the full-year revenue expectations formed by the market may be closer to $860 million, 20% lower than its 2019 revenue of $1.1 billion, and around 7% lower than the 2018 revenue of $925 million.

- We believe this could drag Cree’s P/S multiple to 4x, around 20% lower than the current 4.8x, and 10% lower than the 4.4x seen in 2019.

- This, in turn, would translate into a stock price drop of around 35%, close to $33.

Will such a drop be justified? Absolutely not. However, investors who are first out the door in a panic selling situation take a smaller hit to their portfolio.

The actual recovery and its timing hinge on the broader containment of the coronavirus spread. Our dashboard forecasting US COVID-19 cases with cross-country comparisons analyzes expected recovery time-frames and possible spread of the virus.

We do believe these trends are likely to reverse in later quarters of 2020, and as the Coronavirus crisis is tamed during late Q2, higher revenue and earnings expectations will replace the dire scenarios that are easily imagined during difficult times.

Further, our dashboard -28% Coronavirus crash vs. 4 Historic crashes builds a complete macro picture. It complements our analyses of the coronavirus outbreak’s impact on a diverse set of companies. The complete set of coronavirus impact and timing analyses is available here.

You can see how COVID-19 has affected Cree’s semiconductor peer Applied Materials, in our dashboard 2007-08 vs. 2020 Crisis Comparison: How Did Applied Materials Inc Stock Fare Compared With S&P 500?

See all Trefis Price Estimates and Download Trefis Data here

What’s behind Trefis? See How It’s Powering New Collaboration and What-Ifs For CFOs and Finance Teams | Product, R&D, and Marketing Teams