Honeywell Sales Down 7% But Stock Up 60%; Why?

by Trefis Team

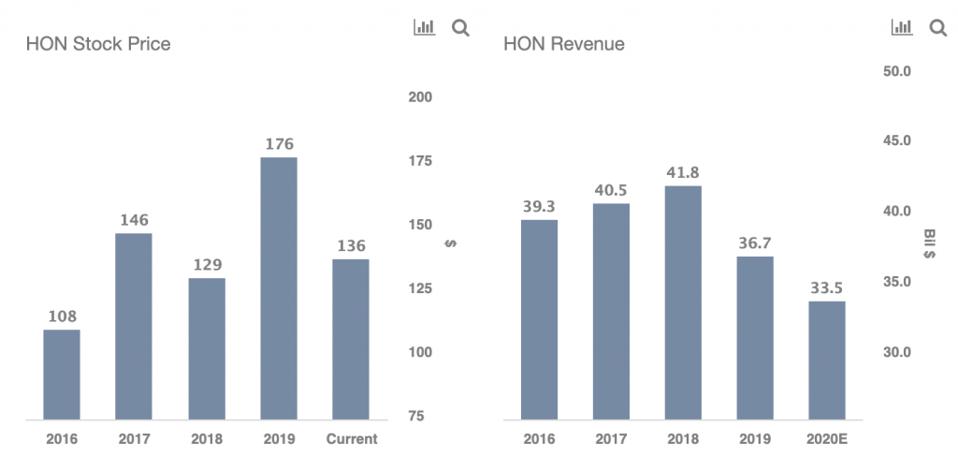

Honeywell’s stock (NYSE: HON) gained over 60% in 3 years, with the stock price rising from $108 at the end of 2016 to about $176 at the end of 2019. Though the stock price dropped in 2020 to $136 as of 18th May 2020 due to the COVID-19 pandemic, the stock has still registered a cumulative return of 25% between 2016 and May 2020.

But how did they pull this off with Honeywell’s revenue down -7% from 2016 to 2019? Well, of course there is a reason – it’s earnings, the profits earned after all the expenses and taxes. Turns out Honeywell’s earnings margins (adjusted profits as a % of revenue) expanded over the last few years from 13.5% in 2016 to close to 16.2% in 2019. That’s a strong 25% growth. So how did Honeywell get its earnings margins to expand like that? Our dashboard, ’Why Is There A Mismatch In The Rate At Which Honeywell International’s Revenues And Stock Price Have Changed?’, summarizes key factors that drove Honeywell’s stock over the past 3 years.

What Caused Margins To Grow?

fisfOne big change – the company decided to de-consolidate its low-margin Transportation Systems, and Building Products business, which unlocked more value for its shareholders. This partly explains the revenue decline as well. The company is now focused on higher margin businesses, including Aerospace and Healthcare. The Aerospace business in particular should benefit from growing commercial and military production.

Though things have taken an unexpected turn in 2020 with the COVID-19 pandemic, and the airlines sector being the worst hit, it will also impact Honeywell’s business. This explains the 25% decline in the stock price thus far in 2020. We estimate a 9% drop in revenues for the full year 2020, as detailed in our Honeywell’s Revenues dashboard.

A combination of these factors: margins rising by 25%, while revenue decreasing by 7% from $39.3 billion in 2016 to $36.7 billion in 2019, clubbed with a 5% decline in number of shares outstanding meant earnings per share (adjusted EPS) in fact grew from $6.60 in 2016 to $8.16 in 2019.

During the same period, Honeywell’s P/E multiple was also up from 16.4x to 24.6x. However, following the outbreak of the COVID-19 pandemic and a subdued outlook for the aerospace industry, the P/E multiple declined in 2020 and stands at 18.6x currently, based on expected EPS of $7.33 for the full year. We also considered an outlier scenario for Honeywell, with a significant impact of a 15% drop in sales and over 27% drop in EPS, owing to the impact COVID-19 on the company’s business, resulting in much lower levels of under $100 for Honeywell stock.

Care about Honeywell’s stock, 3M compared to Honeywell could be a better opportunity at the current levels.

See all Trefis Price Estimates and Download Trefis Data here

What’s behind Trefis? See How It’s Powering New Collaboration and What-Ifs For CFOs and Finance Teams | Product, R&D, and Marketing Teams