Southern Company: Still A Stock To Own?

by Roger ConradIn March 2008, Southern Company (SO) became the eighth US electric company within a year to announce construction of new nuclear reactors. The Nuclear Regulatory Commission then expected as many as 33 applications, most of them using Westinghouse’s AP1000 design with its self-contained cooling system.

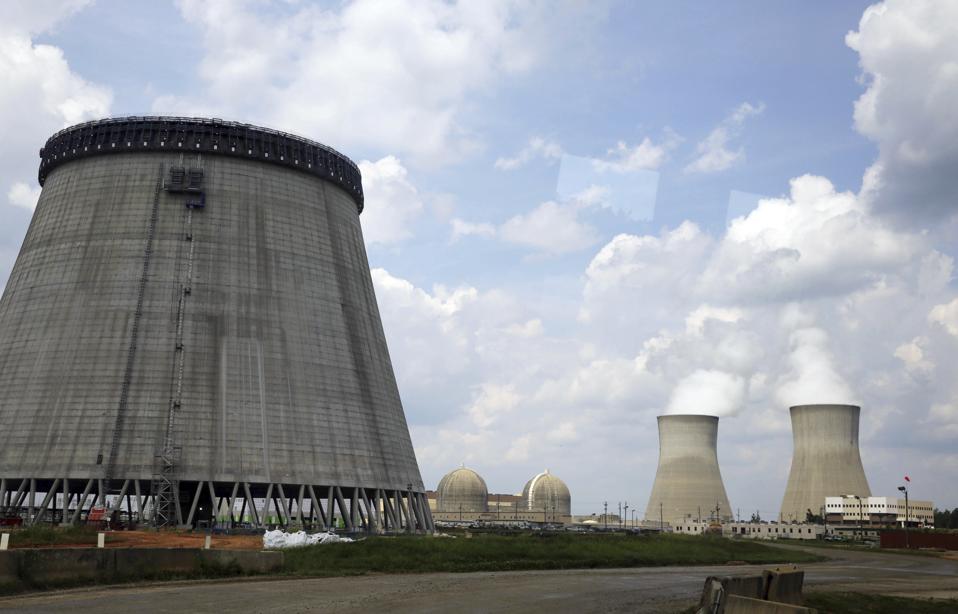

A dozen years later, Southern’s pair of 1.1 gigawatt capacity reactors at the Vogtle site in Georgia are the only AP1000s under construction in America. And the company’s projected startup date has slid from 2016 to 2022.

There were already two operating reactors at Vogtle, which Southern co-owns with Oglethorpe Power (30 percent), Municipal Electric Authority of Georgia (22.7 percent) and Dalton Utilities (1.6 percent). And the partners were at first fully on board with building Units 3 and 4, helping Southern win the approval of the Georgia Public Service Commission.

Regulators also granted financial safeguards for the utilities the original Vogtle project did not enjoy. First, the projected cost of $14 billion was a hard number. Principal contractors Westinghouse and Shaw Corp would be responsible for cost overruns, not the utility owners.

Second, the partners could pass along construction costs to customers as incurred, rather than as one big rate case at completion. That immediately reduced financing costs, as investors still remembered the write-down following Vogtle units 1 and 2 entering service in 1987 and 1989, respectively.

The U.S. Department of Energy further sweetened the pot by guaranteeing low cost loans; the latest installment $3.7 billion was finalized in March 2019. By that time, the Vogtle project was more than five years behind schedule and the projected cost had doubled to roughly $28 billion.

Bankrupt lead contractor Westinghouse could no longer honor its contract, an event that induced cancellation of AP1000 construction at the Summer site in South Carolina. Lead owner SCANA was shortly after acquired by Dominion Energy (D) to avoid financial disaster.

Though Westinghouse and its parent Toshiba also walked away from Vogtle, Southern resolved to push ahead. And as a far larger and stronger company than the former SCANA, it’s had the financial power to, especially after acquiring cross-town Atlanta gas utility AGL and 50 percent of the primary gas pipeline serving its territory, operated by Kinder Morgan Inc (KMI).

The partners, however, demanded concrete assurances they would be off the hook for further overruns. And the result was the September 2018 agreement that effectively shifted remaining completion risks to Southern, though with incentives for beating the new schedule.

Prodded by then-Governor Nathan Deal, Georgia regulators signed off. But many investors and analysts still called the agreement a "Pyrrhic victory" that would lead to financial ruin. And bearish sentiment on Southern peaked shortly after, with Wall Street sell recommendations trebling in a matter of months.

In the September 27, 2018 Conrad’s Utility Investor Alert "Sticking with Southern After Another Vogtle Deal," we affirmed our buy rating for five reasons. First, the agreement posed no immediate threat to management guidance of 4 to 6 percent annual earnings growth, or the policy of 2 cents per share annual boosts in the quarterly dividend.

Second, the $5 billion at risk to a write-off of recovered financing costs was a manageable 4.4 percent of total assets. Third, Southern hired Bechtel Corporation, with its long history of getting big projects over the finish line. Fourth, shares were well discounted for risks, yielding 2 percentage points more than the Dow Jones Utility Average.

Five was Southern’s greatest weapon against its skeptics: The China National Nuclear Power Company successfully started up an AP1000 reactor earlier in 2018. By the end of December, four were producing electricity, pushing up Chinese nuclear generation 18 percent by early 2020.

China’s new AP1000 facilities did take longer to build and cost more than initially expected. But the fact these units are up and running does answer the most critical question: AP1000 technology does indeed work.

Better still, Southern has had boots on the ground at Chinese projects for a decade through an agreement to share knowledge for mutual benefit. That’s given management the ability to learn from the mistakes at those plants, and therefore the potential to bring the new Vogtle reactors over the finish line more efficiently.

And that’s precisely what’s happening, as affirmed by Southern Company CEO Tom Fanning during the utility’s Q1 earnings call. Direct construction is more than 90 percent complete, with the next milestones "cold hydro testing" for Unit 3 in early summer followed shortly by "hot functional testing."

Management’s "aggressive completion plan" of 2 percent a month for the entire project slowed to 1.25 percent progress in April, due largely to workplace safety measures to prevent COVID-19 spread to staff. But the company now needs just 1 percent a month to meet the required November 2022 completion date. And the new target of May 2022 for Unit 4 is still just two months behind management’s guidance prior to COVID-19 fallout.

Further, during the call Fanning noted the Chinese projects were able to move from loading fuel to being in service "in four and a half months," adding "we think we can meet or beat China." That compares to an allotted six months currently on the Vogtle schedule, meaning it’s possible Unit 4 may be able to start up even earlier. And at the least, it shows management has more flexibility to meet deadlines than it may first appear.

Southern still has some heavy lifting to do at Vogtle. And while Georgia’s reopening will likely lift retail electricity sales this summer, there’s a risk it could complicate worker safety issues. But with Unit 3 setting its 475,000-pound Integrated Head Package into place in mid-May, work still appears on track, and management reports no material supply chain interruptions.

That’s hopeful news indeed for Southern Company shares, which again trade at a substantial discount to the Dow Jones Utility Average on both a P/E (10 percent less) and dividend yield basis (1.3 percentage points higher). Southern is a buy up to $60.