Stock Market Boost: Unemployment Outlook Shifts To Positive

by John S. Tobey

Surprise! Those widely discussed, horrible unemployment numbers are showing improvement.

Economists continue to generate dire omens as described in The Wall Street Journal's May 23 article, "The Job Market’s Long Road Back." However, those forecasts are overly reliant on improper analysis. Moreover, remember this absolute truth: Economists are excellent at analyzing the past and terrible at forecasting the future - even the next week, month or quarter.

Unemployment numbers reveal improvement

You know the routine. Take the latest, weekly "initial unemployment claims" report and add it to all the others going back to mid-March, when the U.S. economy seized up. Last Thursday's (May 21) release, covering the week ended Saturday, May 16, showed the weekly new claims at 2.4 M. That brought the nine-week, cumulative claims up to 38.6 M.

Now to what's wrong with that view and how those dismal statistics hide the improvement going on.

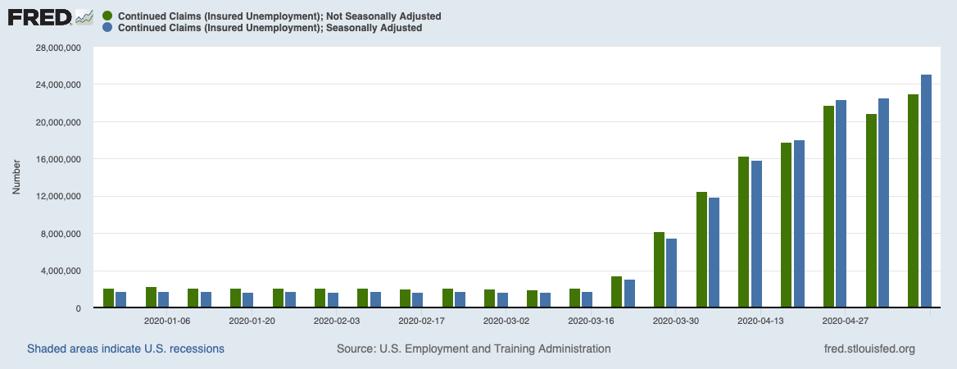

Seasonal adjustment (SA) is wrongly applied. In a previous article, I described the error of using seasonal adjustment (i.e., altering data to make it comparable month-to-month). It is okay for normal times, but highly flawed for abnormal ones, like now.

Using the actual, "not seasonally adjusted" (NSA) data produced a cumulative number of 35.3 M. Obviously, that is still a large number, but it removes the 3.3 M non-existent people created by seasonal adjustment.

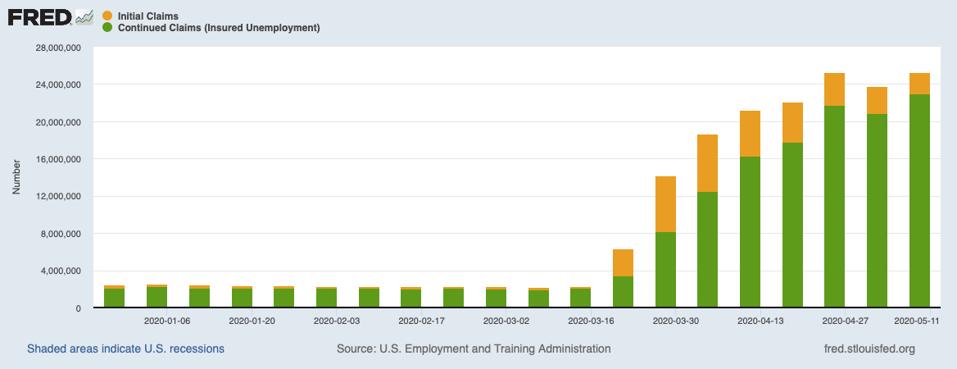

Focusing on initial claims hides the dynamics. Unemployment benefits are paid weekly and are based on a person's employment status the week before. Therefore, once a person has filed an initial unemployment claim, they must file a weekly "continued unemployment claim." The weekly report of that data represents a key indicator of overall unemployment status. So, why don't we hear more about that report? For the simplistic reason that it is comes out a week later, just as everyone turns to the latest initial claims data.

Here are the data. As with initial claims, the important amounts are the NSA bars.

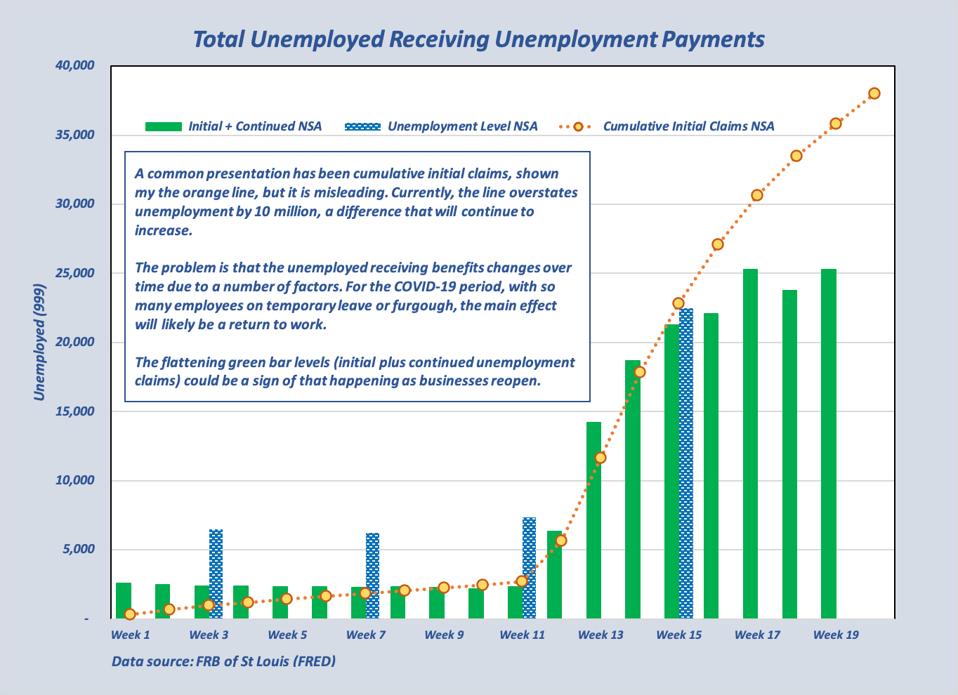

The unemployment benefits number to focus on is the total of both initial and continued claims

This key combination number is likewise ignored because of the one-week lag. However, it is key because it shows the actual change resulting from all the dynamics at work. Once the initial claim is filed, an unemployed person can disappear from a subsequent continued claim roll because of any of a variety of reasons, such as:

- The person's initial claim was rejected

- The person is called back to work

- The person finds another job

- The person runs out of unemployment benefits

Put it all together, and what've you got? A surprisingly positive picture

The graph below shows that the unemployment status has leveled off over the past four weeks. That is clearly not the impression we get from reading about what is happening. Look especially at the contrast between actual and that cumulative line - a difference of 10 M and increasing with each week's reports.

The one, additional item added to this graph is the monthly "unemployment level" data that includes all the unemployed, including those who do not qualify for unemployment benefits. (The next monthly report, for May unemployment, will be released on June 5.) Because of the recency of furloughs and layoffs, plus the expanded benefit qualification allowances, the current unemployed benefit totals are close to the overall unemployed number.

The bottom line

Unemployment is clearly high, but the rising trend has ceased. Moreover, the recent flattening pattern is based on data that precedes the recent, increased reopening of businesses. Therefore, there is now the potential for a declining trend coming soon. That improvement is not being discussed, meaning the stock market could have a positive push coming.

And now, about that economist June 30 forecast of 20% unemployment...