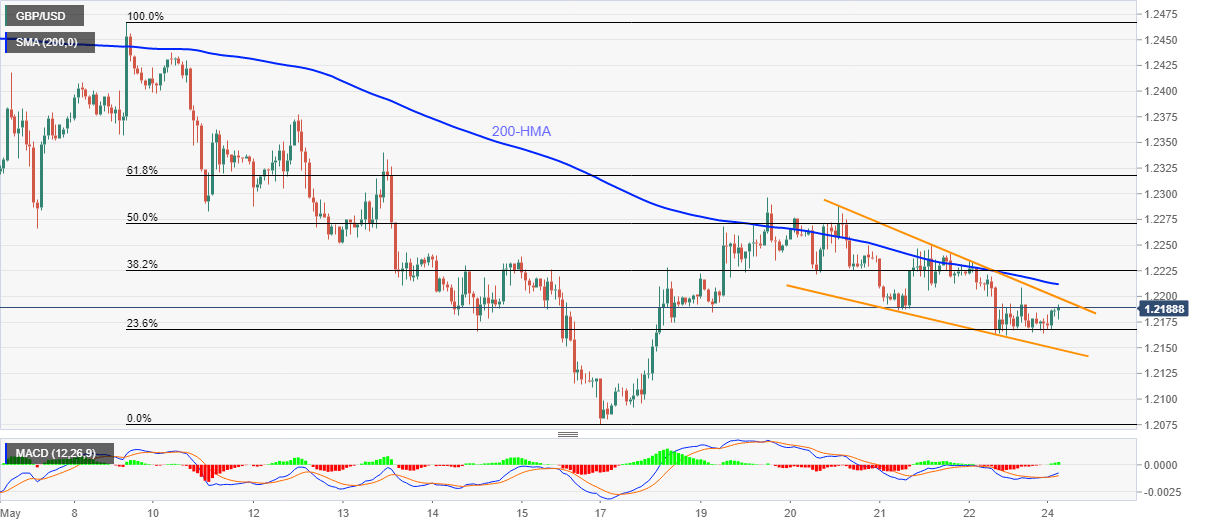

GBP/USD Price Analysis: Portrays falling wedge on hourly chart below 1.2200

by Anil Panchal- GBP/SD extends recoveries from 1.2162 to intraday high of 1.2191.

- 200-HMA adds to the upside resistance.

- Bears can refresh monthly low amid a gradual weakening.

GBP/USD rises to 1.2191, up 0.15% on a day, during Monday’s Asian session. In doing so, the Cable pair extends its recoveries from Friday’s low of 1.2162 while staying inside a bullish chart formation.

Considering the pair’s sustained trading below 200-HMA, bulls are less likely to enter immediately on the upside break of falling wedge resistance, at 1.2200 now.

However, a successful break of 1.2215, comprising 200-HMA, could propel the quote towards the last weekly top near 1.2300.

Meanwhile, a downside break below the formation’s support line of 1.2148 could challenge the monthly low near 1.2075.

Though, the pair’s extended fall below 1.2075 might not hesitate to challenge 1.2000 round-figures.

GBP/USD hourly chart

Trend: Bearish

Additional important levels

| Overview | |

|---|---|

| Today last price | 1.2188 |

| Today Daily Change | 14 pips |

| Today Daily Change % | 0.11% |

| Today daily open | 1.2174 |

| Trends | |

|---|---|

| Daily SMA20 | 1.2334 |

| Daily SMA50 | 1.2274 |

| Daily SMA100 | 1.2623 |

| Daily SMA200 | 1.2666 |

| Levels | |

|---|---|

| Previous Daily High | 1.2234 |

| Previous Daily Low | 1.2162 |

| Previous Weekly High | 1.2296 |

| Previous Weekly Low | 1.2076 |

| Previous Monthly High | 1.2648 |

| Previous Monthly Low | 1.2165 |

| Daily Fibonacci 38.2% | 1.2189 |

| Daily Fibonacci 61.8% | 1.2206 |

| Daily Pivot Point S1 | 1.2146 |

| Daily Pivot Point S2 | 1.2118 |

| Daily Pivot Point S3 | 1.2074 |

| Daily Pivot Point R1 | 1.2218 |

| Daily Pivot Point R2 | 1.2262 |

| Daily Pivot Point R3 | 1.229 |