RIL Rights Entitlement: An opportunity for retail shareholders and arbitragers

The overall risk profile to the trade is similar as was before which is exposure to Reliance Industries equity and its price movements.

by Moneycontrol ContributorNarendra Solanki

Reliance industries has announced the rights issue and currently the issue is open for subscription which would last till June 3, 2020. This Rights Issue looks and is also similar to most rights issues opened in the past for various companies except one thing which has set this issue apart from others in past.

Yes, from this current Reliance Rights Issue we have been experiencing a historical first trading of Rights Entitlements through exchange mechanism which was also happening earlier but only in offline market and with physical form mostly.

This new introduction has opened opportunity for many retail investors to either participate in the rights issue like normally and also sell their eligible/entitled portion of shares to other willing investors who may have missed the opportunity due to lapse of record date or want to bid for higher number of shares than originally entitled ration of one rights share for every fifteen equity shares of Reliance Industries.

Not only this, the current mechanism has also opened up various opportunities for arbitrage seeking players who could benefit from the momentary mispricing between rights issue and fully paid up equity shares. Hence providing both depth and liquidity in the markets during the process.

Now without taking much time, let's look what are the details of this offer and what kind of opportunities are or could arise out of the present situation.

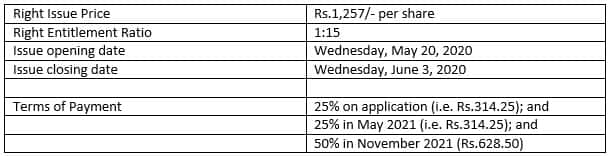

Firstly, let us see the details of the offer briefly below;

So, above is the snapshot of the rights issue offer presently on offer by Reliance Industries which the shareholders can apply through provided mechanism detailed by the company.

Now coming to the new exchange traded entitlement mechanism which has been effected from this and hopefully continue to forthcoming issues as well. Let us understand how this works.

Exchange Traded Entitlement Mechanism:

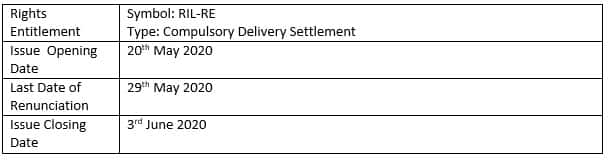

The exchange traded entitlement (Rights Entitlement) which has been effective as mentioned in below table is basically a mechanism where the participants who want to subscribe for more than the allotted shares in the rights issue can buy such rights entitlements from the exchange window and become eligible for the application and similarly vice versa.

Now, with this the new mechanism an opportunity arises for both the normal shareholders as well as the arbitragers who could gain whenever mispricing is available in the markets. But before detailing that, let us first simply understand what is the actual value of rights issue since, it is not paid in full on June 3, 2020 but in three instalments over eighteen months timeline.

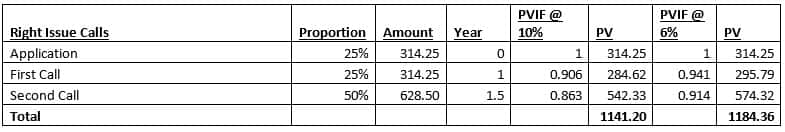

In the above table we have calculated a simple present value of the payments any person is going to make to subscribe to the rights issue. As already known that payments are scheduled in three parts over next eighteen months hence an investor is just paying only 25 percent of the amount initially and remaining amount is paid over eighteen months. Hence, this remaining amount is available to an investor in cash to earn either interest if deposited in banks or earn capital gains if invested in markets.

Thus, we have assumed two scenarios wherein we assume that an investor could earn 10 percent or 6 percent of the remaining 75 percent of amount till he is called in to pay these instalments by the company. So in this case we have discounted back the instalments with these assumed rates and calculated that the estimated present value of the rights issue which is available at Rs 1,257 per rights share at 10 percent discount rate is Rs 1,141 and at 6 percent discount rate is Rs 1,184.

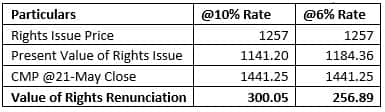

Now in below table we see how to calculate the value of rights renunciation (Rights Entitlement), in this case RIL-RE which is currently trading in exchanges.

There are two aspects namely fixed and variable while pricing rights renunciation as mentioned in above table. The fixed aspect is arrived by deducting present value calculated from rights price of Rs 1,257 which in this case is Rs 115.8 at 10 percent discount rate and Rs 72.64 at 6 percent discount rate, since the rights price is fixed hence it is called fixed component.

To arrive at the variable component we have to take into account the difference between current prices of the Reliance Industries fully paid equity shares and rights price and then add it to the previous fixed component. In this case it is Rs 184.25 and because the CMP of Reliance changes daily hence this difference is dynamic and called as variable component.

Thus, the value of rights renunciation (RE) should theoretically be about Rs 300 at 10 percent and Rs 257 at 6 percent discount rates, respectively.

Execution aspects of the trade:

As we have arrived at the present value and estimated the value at which Reliance RE units should trade and also similarly after the allotment of rights share the rights share should also trade with similar values while adding the paid amount to the already calculated RIL-RE values.

However, as an investor or a trader let's look at various execution strategies one could do to benefit out of this mechanism.

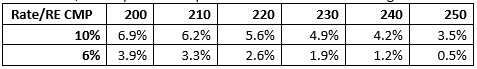

1.> Buying Rights Entitlement units: Any investor who wants to have an exposure in Reliance equity shares can instead subscribe for rights issue by simply buying the Reliance Industries - Rights entitlement units (RIL-RE) from exchanges at prices lower than his/her discounted rates as shown in above examples and could earn some additional returns over and above the return given by the underlying Reliance shares. Table below shows relationship between discount rate, RIL-RE price and expected return an investor could generate.

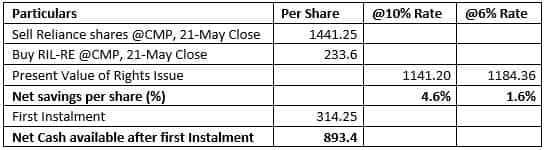

2.> Selling Existing shares and buying same through RIL-RE mechanism: Any investor who already has invested in the fully paid Reliance shares have an opportunity to lower their cost of acquisition by executing below mentioned trades. As seen in the table below an existing share can lower his acquisition cost by this strategy. And also enjoys an additional liquidity of Rs 893.4 per share for the next one year as second instalment is due not before May-2021 and can generate additional returns from this amount by investing in any asset class of his/her choice.

The overall risk profile to the trade is similar as was before which is exposure to Reliance Industries equity and its price movements.

(Author is Head- Equity Research (Fundamental) at Anand Rathi Shares & Stock Brokers.)

Disclaimer: Reliance Industries Ltd. is the sole beneficiary of Independent Media Trust which controls Network18 Media & Investments Ltd.

The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Moneycontrol Ready Reckoner

Now that payment deadlines have been relaxed due to COVID-19, the Moneycontrol Ready Reckoner will help keep your date with insurance premiums, tax-saving investments and EMIs, among others.

Download a copy Get best insights into Options Trading. Join the webinar by Mr. Vishal B Malkan on May 28 only on Moneycontrol. Register Now!