Canopy Growth: Only Faint Positives

by Stone Fox CapitalSummary

- Canopy Growth beat consensus estimates for FQ3.

- The Canadian cannabis company still had a massive free cash flow loss of C$360 million.

- The stock has a fully diluted market cap of $8.4 billion and FY21 revenue estimates only topping $550 million after this quarter.

- The company still needs a major reorg and a better valuation to become an investment.

The market is celebrating the FQ3 results of Canopy Growth (CGC), yet the numbers were not warranting of a stock rally, especially the initial 20% jump. The Canadian cannabis company beat some irrational analyst estimates and easily exceeded the hurdle from the prior quarter impacted by product returns, but the results still lead to massive losses. My investment thesis remains highly negative as the market value surged back above $8 billion for company not even generating quarterly revenues above $100 million.

Image Source: Canopy Growth website

Better Than Expected

The quarterly results were hard to analyze considering the financials impact from the product returns and pricing adjustments in the prior quarter. The market is celebrating the FQ3 revenue beat listed at C$18.9 million, yet the company reported Canadian cannabis revenues up only 9% sequentially. Excluding the revenue adjustments from last quarter, net revenues grew from C$109.3 million to C$123.8 million.

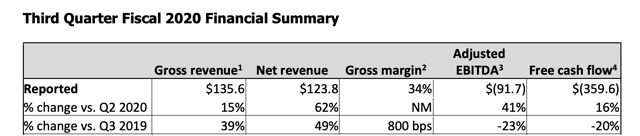

The following table in the earnings release highlights the confusing quarter. Canopy Growth had improving revenues from prior quarters with or without the revenue adjustments included in the analysis, but the company still generated a large EBITDA loss of C$91.7 million and negative free cash flow of C$359.6 million in the quarter.

Source: Canopy Growth FQ3'20 earnings release

The problem here for shareholders is that Canopy Growth continues to expand into new markets such as CBD in the U.S. and via This Works acquisition in Europe. The bottom line isn't improved by these numbers while revenues continue to expand and gross margins rebounded.

The adjusted EBITDA loss for FQ1 (prior quarter without revenue adjustments) was a nearly equal C$92.0 million loss. Canopy Growth only had net revenues of C$90.5 million in that quarter.

Even more concerning were the statements by the CFO insinuating some improvement in the cost structure which were all generally related to non-cash items.

We delivered significant gross improvement in the third quarter driven by stronger revenues and higher capacity utilization. Actions taken earlier this year are expected to meaningfully reduce stock-based compensation in FY21, and we have started to implement tighter cost controls across the organization. We plan to take further steps to reduce our costs and right-size our business to ensure that we can generate a healthy margin profile and cash generation in the coming years.

Canopy Growth still spent more on operating expenses at C$150.3 million than the company generated in net revenues in the quarter. The sequential changes in quarterly operating expenses were as follows:

- S&M: C$62.1M vs. C$60.5M, up C$1.6M

- R&D: C$20.8M vs. C$11.9M, up C$8.9M

- G&A: C$67.4M vs. C$87.9M, down C$20.5M

- Total: C$150.3M vs. C$160.3M, down C$10.0M

So despite the company reducing operating expenses by C$10.0 million for the linked quarter and boosting gross margins to 34%, the bottom line was still horrendous. The company burned C$360 million during the quarter with a near equal amount spent on operations and capital spending.

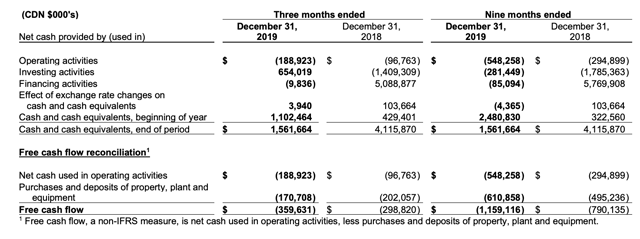

Source: Canopy Growth FQ3'20 MD&A

The company has turned a sizable cash position into only a C$2.3 billion remaining balance after burning C$1.2 billion on the business during 2019 with no signs of a slowdown. When counting a debt balance of C$536 million, Canopy Growth is down to a net cash position of only C$1.7 billion. The large cash cushion is suddenly down to only a net balance of $1.3 billion.

Multiple Contraction Ahead

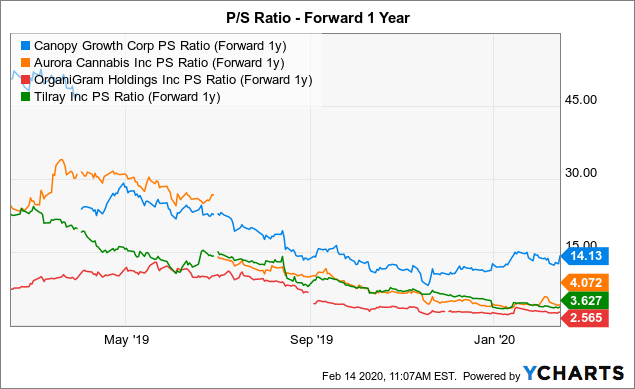

The prime reason Canopy Growth has maintained a higher P/S multiple than other sector stocks like Aurora Cannabis (ACB), OrganiGram Holdings (OGI) and Tilray (TLRY) is the cash balance. The company doesn't have any better operations and shouldn't warrant a higher valuation multiple of trading at 14x FY21 sales while the competitors are all down around 4x FY21 sales.

Data by YCharts

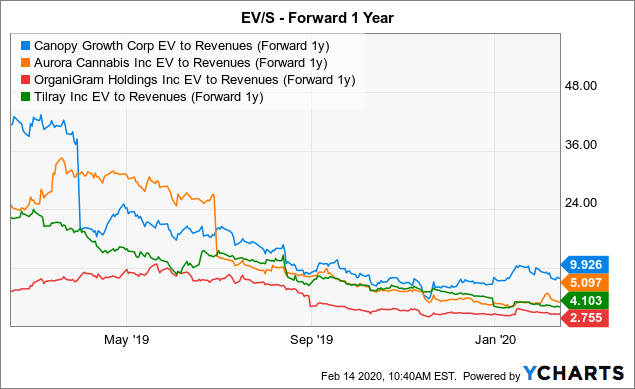

Even counting the large cash balance (one quickly dwindling), Canopy Growth still trades at double the EV/S multiples of the competitors. No justification exists to pay a premium price for Canopy Growth when the company still has to reorg the business while the others have already taken major steps to realign costs with the actual revenue base.

Data by YCharts

Takeaway

The key investor takeaway is that Canopy Growth only reported faint positives for the quarter. If it wasn't for the horrible quarter from competitor Aurora Cannabis and the huge revenue adjustments in the prior quarter for Canopy Growth, investors wouldn't view this December quarter as impressive at all.

The failed breakout of the stock reinforces our conviction that Canopy Growth heads lower. With a fully diluted share count at ~380 million shares, the stock has a market valuation of nearly $8.4 billion.

Looking for a portfolio of ideas like this one? Members of DIY Value Investing get exclusive access to our model portfolios plus so much more.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.