Macy's: Closing Stores Is Only One Piece Of The Puzzle

by Shock ExchangeSummary

- M is closing 125 stores and cutting 2,000 corporate jobs.

- Cutting corporate costs is only the first step.

- M must get more throughput from remaining stores and rapidly grow online sales.

- Until it arrests it comparable sales decline, the stock remains a sell.

Source: Barron's

Traditional retailers have been facing headwinds to their top lines. Macy's (NYSE:M) is closing 125 stores and axing 2,000 corporate staff in an effort to rightsize the company. The company will also consolidate its headquarters by closing its site in downtown Cincinnati, as well as its macys.com headquarters in San Francisco and offices in Lorain, Ohio. Macy's will have over 550 stores open after this round of closings.

The decision comes amid declining retail sales for traditional retailers. For the month of December, retail sales through department stores declined over 5% Y/Y, yet rose by double digits through non-store retailers. This implies fewer customers are shopping at physical locations owned by Macy's.

In its most recent quarter, Macy's net sales of $5.2 billion were down 4% Y/Y; credit revenue also fell 1%. Comparable sales for owned plus licensed fell 3.5%. With revenues falling, management must improve margins to spur the bottom line. That could prove difficult in a heavy promotional environment. Macy's reported a gross margin of 40.0%, down 30 basis points versus the prior-year period. The current retail environment is marked by a high level of promotions in order to drive traffic to stores. Heavy discounting hurt margins for retailers like Macy's, Kohl's (NYSE:KSS), and L Brands (NYSE:LB).

EBITDA was $301 million, down by double digits. EBITDA margin was up 80 basis points versus the year-earlier period. If Macy's wants to arrest the decline in EBITDA, then it must act soon. That likely explains the store closings and cuts to corporate expenses.

Opportunity For Efficiency Gains

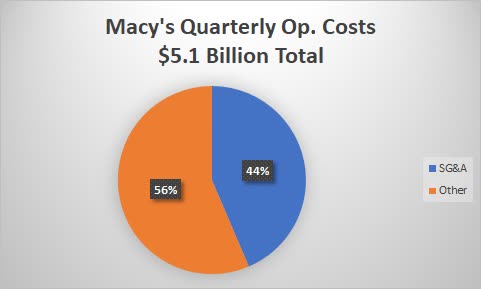

In its most recent quarter, Macy's had operating costs of $5.1 billion, of which about 44% was related to SG&A costs.

SG&A and corporate overhead could be reduced by culling underperforming physical locations. It could be difficult to reduce cost of sales simply by reducing the store count.

The other ways Macy's could become more efficient are by selling more online and getting more throughput from its existing stores. Its online sales growth was fueled by Vendor Direct and the mobile app. Since online sales for the industry appear to be cannibalizing sales through physical locations, Macy's needs to transform itself into more of a digital player. Management only talked of culling stores. It never mentioned how the company was going to marshal more of its resources to generate online sales to compete with Amazon (NASDAQ:AMZN), Target (NYSE:TGT) and Walmart (NYSE:WMT).

J.C. Penney (NYSE:JCP), L Brands, and Bed Bath & Beyond (NASDAQ:BBBY) are all culling underperforming stores. Bed Bath & Beyond is also monetizing some of its real estate portfolio. If Macy's made a similar move, then the company could signal it is throwing in the towel as a retailer. Cost cuts could create headlines and generate buzz for the stocks of these retailers. However, unless these companies have or can build an effective digital strategy, then culling stores could be the equivalent of running in quicksand. Macy's could get results from cost cuts over the short term. If the company does not improve its online prowess, then it may be ceding large pools of online sales to the competition. Rightsizing its cost structure to better match a digital world is only one piece of the puzzle.

The Survival Of Macy's Is Not In Question At This Point

Several retailers are retrenching. Some are fighting for their survival. J.C. Penney's $4 billion debt load is over 8.5x full year 2019 estimated EBITDA. Its debt appears untenable as the company seeks to build out its nascent digital sales channel. BBBY's has $1.5 billion in debt at 2.1x EBITDA. Its EBITDA is declining Y/Y by double digits, so its credit metrics could capture the attention of the rating agencies at some point.

Macy's does not have these problems at this juncture. The company has $4.6 billion in debt and last 12 months ("LTM") EBITDA of $2.9 billion. Debt/EBITDA is around 1.6x, which appears manageable. However, its quarterly EBITDA is falling by double digits. A few more quarters of double-digit declines and its credit metrics could deteriorate to the point where they become a concern.

The company also has $301 million in cash on hand amid declining free cash flow ("FCF"). Through the first 39 months of the year, FCF was -$451 million. Macy's must continuously improve its digital platform in order to keep pace with Amazon, Target, and Walmart. That means it could be difficult to cut capex even if revenue and margins are in decline. I would like to see Macy's arrest its cash burn and preserve as much capital as possible while it rightsizes its cost structure. The company does not need to sell real estate to save itself at this juncture. However, a few more quarters of EBITDA declines and cash burn could force management to put all options on the table.

Conclusion

Culling underperforming stores is the right thing to do. Until Macy's arrests its comparable sales decline, the stock remains a sell.

I also run the Shocking The Street investment service as part of the Seeking Alpha Marketplace. You will get access to exclusive ideas from Shocking The Street, and stay abreast of opportunities months before the market becomes aware of them. I am currently offering a two-week free trial period for subscribers to enjoy. Check out the service and find out first-hand why other subscribers appear to be two steps ahead of the market.

Pricing for Shocking The Street is $35 per month. Those who sign up for the yearly plan will enjoy a price of $280 per year - a 33% discount.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.