Pluralsight: Playing The Value Game

by Gary AlexanderSummary

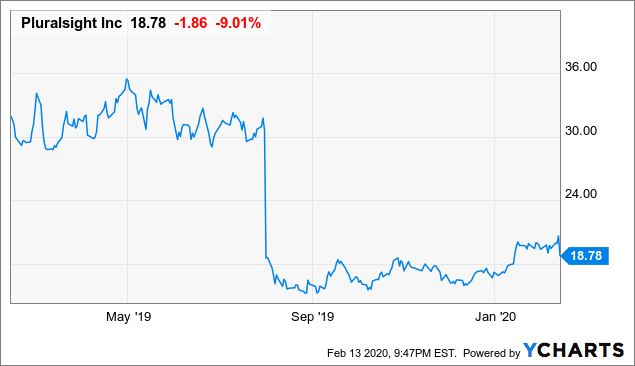

- Shares of Pluralsight plummeted nearly 10% after reporting fourth-quarter results, despite beating Wall Street estimates on the top and bottom line.

- Investors mulled an in-line revenue guidance for FY20 calling for 25% y/y revenue growth.

- Given Pluralsight's billings growth clocked in at a stronger 28% y/y this quarter, there's likely room for overachievement on Pluralsight's initial 2020 guidance.

- Shares look cheaply valued at ~6.5x forward revenues.

This article was highlighted for PRO+ subscribers, Seeking Alpha’s service for professional investors. Find out how you can get the best content on Seeking Alpha here.

Hunting for value seems to be harder and harder in the tech space, after the market continues to stubbornly reach for new all-time highs. And while we must look past some of the flashiest stocks in the sector, there are certainly bargains to be had in some of the "fallen angels" of the group that experienced sales execution issues in 2019 and whose shares are still in the penalty bucket for it.

Sitting in this bucket is Pluralsight (PS), a software company dedicated to training tools for technical IT workers, and a class of 2018 IPO that debuted at $15 per share. Immediately post-IPO, Pluralsight was one of the hottest stocks in the SaaS space (and a rare victory for a Utah-based startup) and more than doubled in its early run. A spate of quarters that showed decelerating billings growth in 2019, however, brought the stock back down to earth. And still today, investors are less-than-trusting of Pluralsight's results. After closing out its fiscal 2019 and reporting fourth-quarter results, shares of Pluralsight are down nearly 10%:

Data by YCharts

The perennial question for investors contemplating an unloved name: is Pluralsight a value stock or a value trap? Should the earnings dip be bought?

In my view, investors should take advantage of the fall to build a position in Pluralsight. This is a company that has fallen sharply on poor sentiment, but the underlying fundamentals are much stronger than at first glance.

Low valuation in the context of an overly conservative guidance outlook

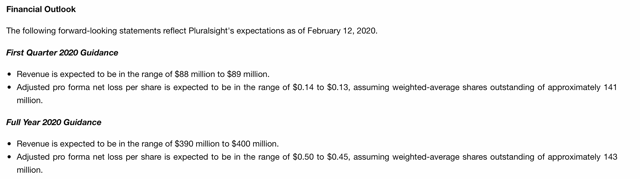

To me, Pluralsight's negative earnings movement is a knee-jerk reaction to what seems, at face value, to be an expression of deceleration and lack of momentum heading into 2020 in the form of an in-line guidance. For FY20, Pluralsight guided to $390-$400 million in revenues, representing a growth range of +23-26% y/y over FY19 revenues of $316.9 million. This falls approximately in-line with Wall Street's FY20 consensus of $395.3 million, per Yahoo Finance.

Figure 1. Pluralsight FY20 guidance updateSource: Pluralsight Q4 earnings release

But there's plenty of evidence to suggest that Pluralsight's lackluster guidance for the coming year may just be a conservative position. The company learned in 2019, the hard way, not to overpromise and underdeliver. By resetting baseline expectations, Pluralsight has more wiggle room to establish a predictable "beat and raise" cadence.

We note also that billings growth in Q4 not only recovered from slower growth earlier in FY20, but its current 28% y/y growth rate is three points higher than Pluralsight's FY20 revenue growth guidance. Because billings represents revenue to be recognized over the next twelve months, it's the best forward-looking indicator we have of Pluralsight's FY20 revenue growth, and it suggests there could be at least three points of opportunity (~$10 million in revenues) to Pluralsight's top line. Secular tailwinds are also supportive of Pluralsight's continued growth: businesses have continued to invest heavily in IT and automation, and tools like Pluralsight bring a lot of much-needed standardization and structure into onboarding these critical IT staff.

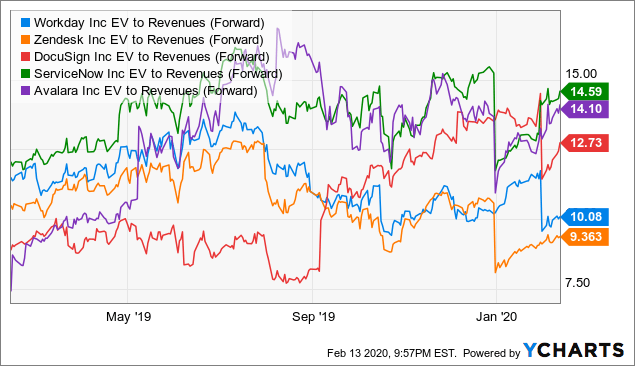

From a valuation perspective, Pluralsight's risk-reward profile is incredibly attractive at its post-earnings dip. At current share prices just under $19, Pluralsight has a market cap of $2.63 billion. After netting out the $528.5 million of cash and $470.2 million of convertible debt on Pluralsight's balance sheet, we're left with an enterprise value of $2.57 billion.

That represents a modest valuation multiple of 6.5x EV/FY20 revenues. Here's a look at where fellow SaaS companies in the ~30% growth range are trading:

Data by YCharts

With so many comps trading at far richer double-digit valuation multiples, I believe Pluralsight can easily notch a valuation of 8x EV/FY20 revenues by year-end 2020 once sentiment turns and Pluralsight has a few beat-and-raise quarters under its belt. This implies a price target of $23 and 22% upside from current levels.

Q4 download: broad-based beats across the top and bottom line

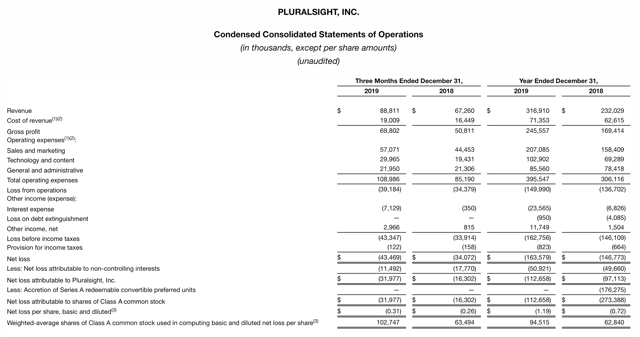

Let's now analyze Pluralsight's fourth-quarter results in greater detail. For a quarter that contained so many wins, it's surprising that Pluralsight shares reacted as they did. Take a look at the company's earnings summary below:

Figure 2. Pluralsight 4Q19 results

Source: Pluralsight Q4 earnings release

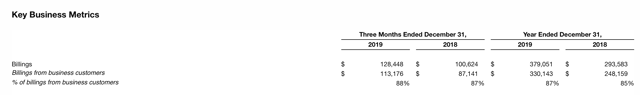

Revenue grew 32% y/y to $88.8 million, surpassing Wall Street's expectations of $87.2 million (+30% y/y). What we find more impressive, however, is the fact that Pluralsight's billings growth - which, as previously mentioned, is the truest indicator of customer demand - continued at a strong 28% y/y pace, showing no deceleration from Q3 and showing even stronger 30% y/y growth from larger business customers.

Figure 3. Pluralsight billings trendsSource: Pluralsight Q4 earnings release

Improved execution has been top-of-mind for Pluralsight's leadership after missteps made in 2019 that caused a sharp deceleration from the ~40% growth days immediately post-IPO. Aaron Skonnard, Pluralsight's CEO, offered some useful commentary on the Q4 earnings call that highlights the changes the company has made in its go-to-market strategy, in particular a fully-staffed and quota-bearing sales organization:

We made several improvements to our go-to-market in the second half of 2019, which can be boiled down to three primary areas; sales leadership, sales operations and capacity. We added a world class sales leader, Ross Meyercord, who has already made key hires in customer success and professional services leadership. He's also brought additional rigor to our sales operations, including a more frequent and thorough forecast to review process, and more discipline to ensure we consistently channel our efforts and investments toward our most strategic customers, segments and markets. We've also added considerable capacity to our sales and customer success organization to expand our coverage within our customer base. We now have over 330 quota bearing sales reps who recently participated in a world class sales kickoff and specialized product trainings, giving us confidence that we have sufficient ramp and enable capacity as we proceed through 2020."

Pluralsight has also made considerable progress on margins, which should appeal to an investing climate that has become more concerned with tech companies' bottom lines. Pluralsight managed to expand its already-high pro forma gross margins to 80% this quarter (up 3 points from 4Q18), while pro forma operating margins improved to -16%, up from -19% in the year-ago quarter. Pluralsight's pro forma EPS of -$0.09 also beat Wall Street's expectations of -$0.14 with plenty of cushion.

Key takeaways

Pluralsight should be bought on the dip. Key drivers making this stock attractive include:

- Billings growth suggests opportunity to Pluralsight's FY20 revenue outlook, which is the main drag on Pluralsight's share price. A more focused go-to-market org, plus a rising influx of IT workers, are additional growth supports

- Consistent profitability improvements as the company gains from efficiencies of scale

- Below-market valuation at just ~6.5x forward revenues, compared to double-digit multiples across similar growth peers

Consider adding this bargain stock to your portfolio.

Disclosure: I am/we are long PS. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.