Do Not Sell AT&T After The Share Price Rally

by The European ViewSummary

- In view of the price increases, investors wonder whether AT&T is now overvalued.

- This question can be approached from different perspectives and the answer depends, as always, on personal strategy.

- And indeed, there may be companies where trading and trying to time the market seems worth exploring.

- As it regards to AT&T, however, there is only one option for investors in my view and from my perspective: Keep your shares!

Introduction

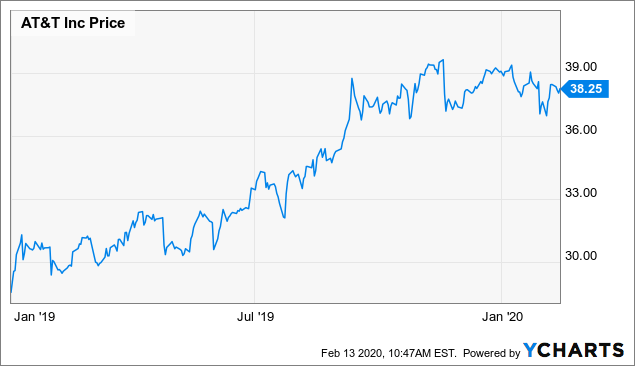

I had and still have a bullish attitude towards AT&T (T). At the moment, around 4 percent of my broadly diversified portfolio consists of AT&T shares. Right from the start, I saw the merger with Time Warner as a possible catalyst for above-average growth. The company generates so much cash flow that I did not see a red flag about the high level of debt. The favorable interest rate environment was, of course, another factor. However, as the market saw things differently to some extent and the share price fell, I had repeatedly increased my investment in the company over the past few years by making additional purchases. Since the start of last year, however, the shares of AT&T have been on an upward trend:

Data by YCharts

The high price gains naturally lead some investors to ask whether they should not collect the profits now. I have an extremely clear opinion on this which I want to share with this article. This article is therefore not aimed at investors who want to invest in AT&T, but rather at investors who, like me, have found a cheap entry and are now wondering what to do (although the arguments of course also speak in favor of entry in principle).

Is AT&T overvalued?

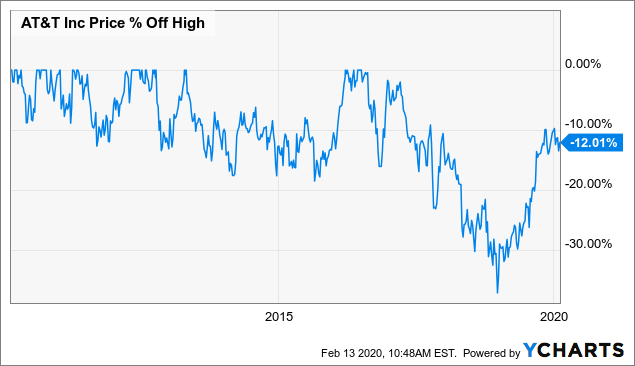

Given the price increases, investors wonder whether AT&T is now overvalued. This question can be approached from different perspectives. Looking at the share price development of the last five years so far, AT&T is still 12 percent away from its highs in this period:

Data by YCharts

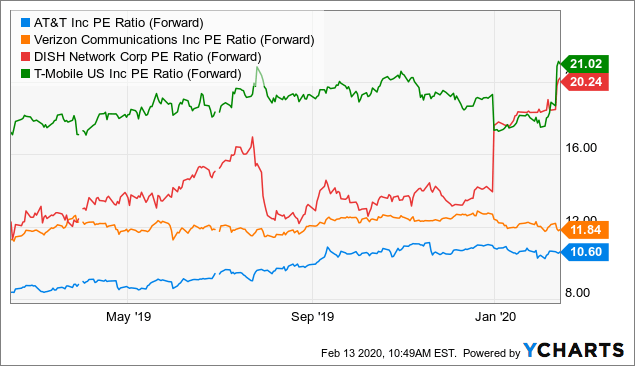

The forward P/E ratio of around 11 also speaks rather for a moderate valuation, maybe for an undervaluation, but at least not for an overvaluation. A comparison with competitors also indicates that the company is not expensive. Verizon (VZ), Dish (DISH) and T-Mobile US (TMUS) have a (much) higher forward P/E ratio:

Data by YCharts

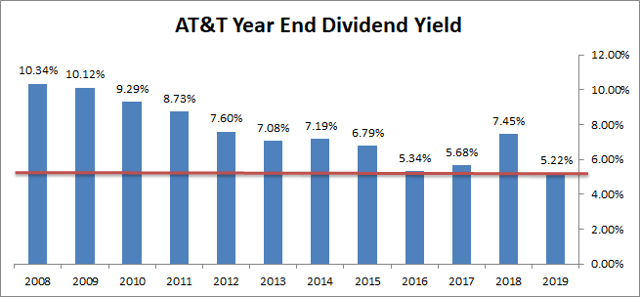

But something else emerges if you look at the year-end dividend yields of the last ten years and more. The current dividend yield of 5.5 percent is historically very low:

(Source: Seeking Alpha, Table by author)

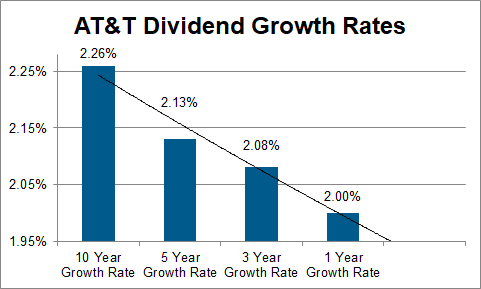

And although the dividend growth was quite low in the past, it dropped even further during the last years as you can see below:

(Source: Seeking Alpha, Table by author)

On the other hand, the dividend yield is still quite high but a further common argument regarding dividends is that a price loss of about 20 percent would take four years for the dividends to offset this loss. And just such a fall in prices is more likely in the case of overvaluation.

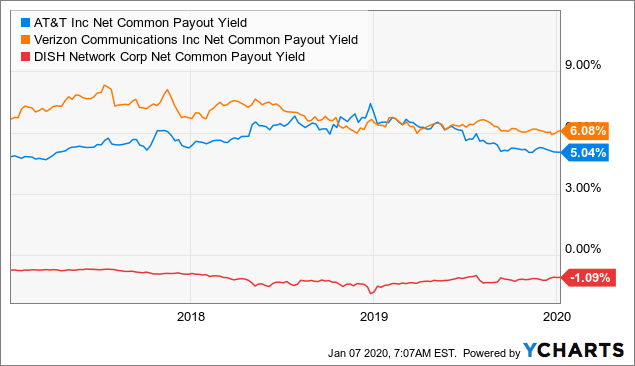

Another good rather cash flow-oriented indicator that determines the benefit of a share for investors is the net common payout yield. According to YCharts, the net common payout ratio can be defined as:

the percent a company has sent back to its shareholders through share repurchases and dividends based on a company's market cap. If a company with a 500 million market cap has purchased 50 million of stock and has a dividend yield of 10% over the last twelve months, the net payout yield would be 20%.

So with this very useful metric, we can see that the shareholders' benefit of holding AT&T shares is lower than holding Verizon at the moment:

Data by YCharts

Accordingly, there is no real black and white (as so often happens when investing) and there may be companies where trading and trying to time the market seems worth exploring. But in the following, I will explain why this does not apply to AT&T.

Why you shouldn't sell

I strongly think it would be wrong to sell just because of a possible overvaluation. There are many reasons to simply keep the stock. For investors who have not yet invested in AT&T, there may indeed be more attractive investment opportunities (given the higher net common payout yield, maybe even Verizon). Nevertheless, the following arguments for not selling also apply for building up the first position right now. So, let's get into that.

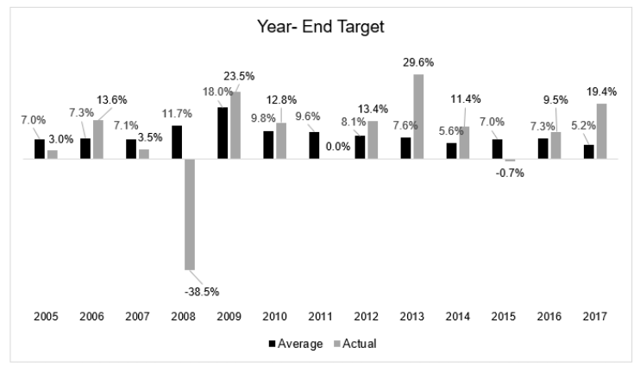

First of all, I would like to point out that when investing in the stock market, nobody knows the future. This is quite important anchor of my "how to invest"-mindset. So the predictions of some banks and some self-appointed experts regarding the right timing of investing in certain stocks are more or less superfluous. Like I said before if the cock crows all day long, it is only likely that it will hit the sunrise. So whenever investors hear someone say the crisis is emerging or the share price of a certain company is going to explode tomorrow because the company is extremely over-(or under)valued, they may have to take a look at this chart:

(Source: Year-end vs. target)

The predictions seem to be not even close to the exact development of share price movements.

Another point I would like to make is that it is a fact that prices will rise in the long run. It is just important to ride out the sometimes extremely severe crises and have the strength to deal with these crashes or cyclical downturns. And indeed, a very good example to sit out a not so good sentiment was AT&T itself. Since I was unlucky enough to buy my first shares in the middle of 2016, I was an extremely long time in the red. During that time I regularly bought more shares and now I have a nice book profit. In the meantime, I have enjoyed the juicy dividends and thus bought more shares on the way down.

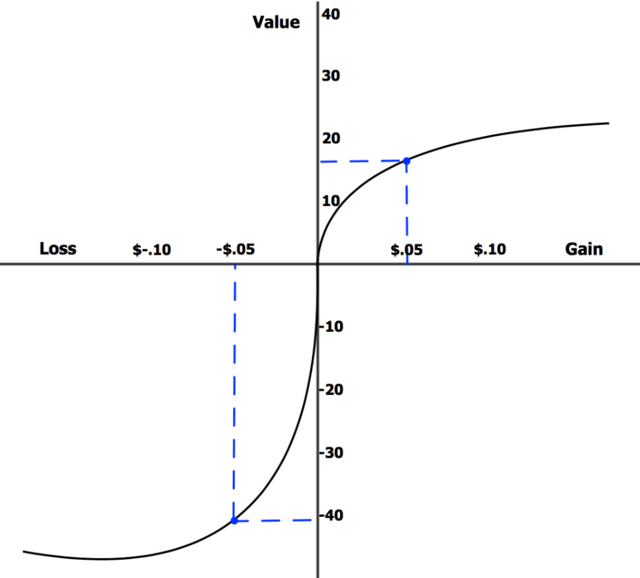

This shows that even in times of an overall uptrend, it is worthwhile to stay invested in not that great performing companies and, if necessary, simply buy more of the shares. Furthermore, it is only typical for investors to sell profits too quickly. This is because they don't know their cognitive bias so they subjectively weight the initial profit more strongly than the continuing profit and therefore sell faster to realize the book profit achieved:

(Source: For more information, see the prospect theory)

Accordingly, I have the following recommendation for AT&T investors:

Just stick to it!

With certain companies, it is simply worth staying invested, taking the above into account. What would be the worst case?

The price may lose twenty percent or more. Theoretically, it would then take 4 years before investors could offset the losses with dividends. Theoretically, they could have made much more profit with another investment. Maybe and theoretically.

But maybe the stock price will run sideways for a long time. No one knows.

On the other hand, with companies like AT&T, the risk of the company running away is otherwise simply too high. Furthermore, investors have to pay taxes on the profit. Investors also miss out AT&T's high dividend yield. AT&T has an extremely long dividend history. The company has been paying a dividend to investors for 35 years and has raised its payout each year. So why sell now, when the market recognizes the path AT&T is on and honors this with higher prices? The following points are particularly noteworthy for me:

- I think the fundamental prospects are quite good for AT&T and therefore quite promising for shareholders. The advertising business will be AT&T's future. The management of AT&T is transforming the company into a giant whose telecommunications and advertising business is generating unprecedented synergies.

- AT&T continues to make progress in this area with low-cost but sensible acquisitions.

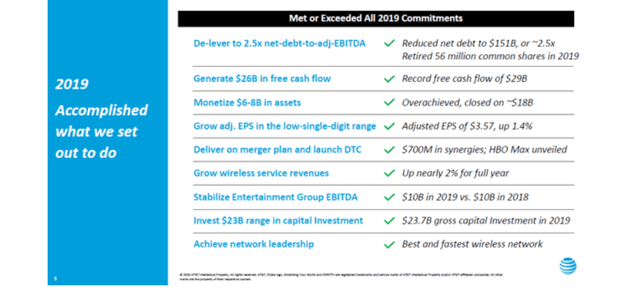

- Finally, why should investors sell, when the company is overachieving its own goals at the moment?:

(Source: Quarter results presentation)

Conclusion

Investing is not witchcraft. There may be companies where trading and trying to time the market seems worth exploring. However, this does not apply to high-quality companies. You simply leave these companies slumbering in your portfolio and buy them now and then when it seems favorable. AT&T is such a company. I am very grateful to my past self that I did not sell in 2017 or at the beginning of 2018 just to invest my money in supposedly more lucrative companies.

AT&T is part of my diversified retirement portfolio. If you enjoyed this article and wish to receive other long-term investment proposals or updates on my latest portfolio research, click "Follow" next to my name at the top of this article, and check "Get email alerts"

Disclosure: I am/we are long T. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.