Yamana Gold: I Stay Bullish After Q4 Report

by Vladimir ZernovSummary

- Yamana Gold reports Q4 2019 results.

- Higher gold prices lead to significant cash flow generation.

- Should gold stay at current levels, the company will have the capacity to further increase the dividend and decrease debt.

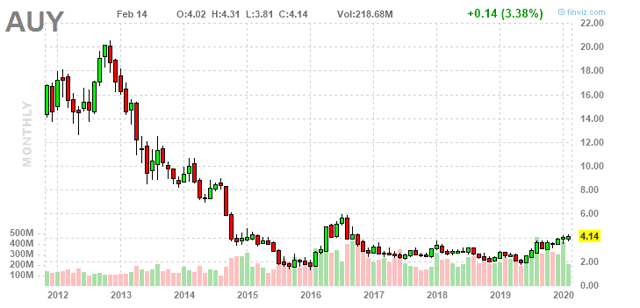

Yamana Gold (NYSE:AUY) has recently reported its fourth-quarter results and provided outlook for 2020-2022. I've been previously bullish on the stock so it's high time to evaluate the thesis and see how the company performed in the fourth quarter.

Yamana Gold reported revenues of $383.8 million and adjusted earnings of $0.03 per share, mostly in line with analyst estimates. As the company stated before, Yamana Gold exceeded production guidance and delivered 256,288 ounces of gold equivalent production (GEO) in the fourth quarter. The higher gold price boosted the company's results, and Yamana finished the year with $159 million of cash on the balance sheet. For the full year, the company generated $522 million of operating cash flow while it spent only $332 million on capex. In short, the financial situation of the company looks good, especially in the light of the current gold price which seems ready to test the $1,600 level once again. Now that we are done with the "obligatory" numbers, it's time to look at the bigger picture.

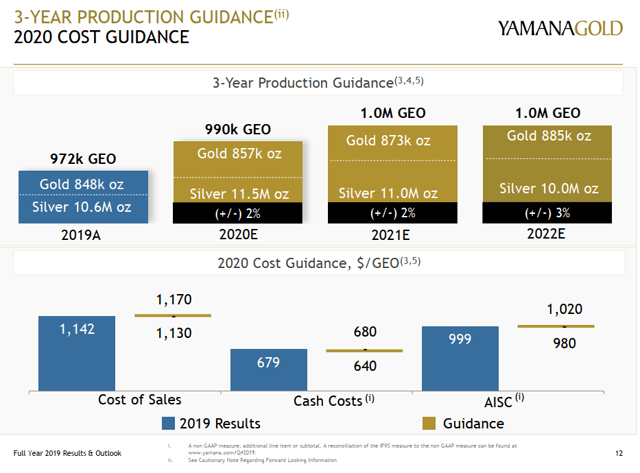

Source: Yamana Gold Q4 presentation

The company plans to produce 990,000 GEO in 2020 and then reach the level of 1 million GEO in 2021 and 2022. Yamana Gold expects that the completion of Phase 1 optimization at Jacobina mine, development successes at several mines and continued exploration success at Cerro Moro will be the main catalysts for 2020. Interestingly, there's no mention of the Agua Rica project, whose feasibility study is expected in 2020. Now that the company started to generate free cash flow, the management team is cautious about growth projects that demand capex as investors in the gold mining space have had enough of such projects in the past decade. The report clearly states that the company's primary objective is to maximize free cash flow, a task that will be easily achieved in the current gold price environment (I'm bullish on gold).

All-in sustaining costs (AISCs) are expected at to come in the range of $980-1,020 per ounce. Recent reports from Barrick Gold (GOLD) (here) and Kinross Gold (KGC) (here) indicated similar cost levels (Barrick's costs are a bit lower). In general, having AISC at or below $1,000 per ounce is the norm for leading miners in the current environment. With gold close to $1,600 per ounce, low costs in absence of major capital projects ensure significant cash flow generation.

Yamana Gold stated that it was targeting the payment of a dividend between $50 per GEO and $100 per GEO. At a run-rate of 1 million GEO per year, the company is willing to allocate up to $100 million for the dividend. Thus, if the gold prices hold around current levels, Yamana Gold will have the resources to raise the dividend again. At the same time, the company may choose to further decrease its debt position, which stood at $992 million at the end of 2019.

In my opinion, Yamana Gold is ready to continue its upside trend. The gold price environment is highly favorable, and the company does not have any major capex in the near future, which is good for the cash flow. Should the gold price hold near the current levels, the company will have the resources to raise the dividend again and/or decrease its debt position. The Agua Rica project, whose feasibility study is due in 2020, is a wild card, but I think that the management team has learned the lessons of the past decade and will be very careful when evaluating potential investments if the feasibility study looks promising. In short, I remain bullish on Yamana Gold at current levels.

If you like my work, don't forget to click on the big orange "Follow" button at the top of the screen and hit the "Like" button at the bottom of this article.

Disclosure: I am/we are long AUY. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I may trade any of the above-mentioned stocks.