Alnylam: RNAi Treatment Sales And Pipeline Excite But Profitability A Concern

by Edmund InghamSummary

- Alnylam is chiefly responsible for a resurgence amongst RNAi based drug developers after Onpattro - a treatment for hATTR amyloidosis - was approved by FDA in August 2018.

- The drug achieved sales of $166.4m in 2019 - its first full year of commercialisation. Management forecast sales of ~$300m in 2020.

- Givlaari was approved in November for treatment of acute hepatic porphyria - sales are off to an encouraging start, but there is no forecast for 2020.

- 3 further drug candidates are in late stage trials and Alnylam will earn 20% of all global revenues of Inclisiran, licensed to The Medicines Company and subsequently acquired by Novartis for $9.7bn.

- With $1.5bn of cash to fund operations, this is an exciting time for Alnylam, but the company still makes heavy annual losses and the share price is volatile.

Investment Thesis

Alnylam Pharmaceuticals' (ALNY) Q4 and FY 2019 results seem to have impressed the market as the share price grew from $114.65 on February 3rd to a high of $133 on the 10th, realising a 16% gain - it has dropped slightly to $132 at the time of writing this update.

The company's good year in 2019 - commercialising flagship drug Onpattro and matching analysts' sales expectations whilst having a second RNAi based treatment - Givlaari - approved saw the share price rise more than 62%.

2020 looks set to be a huge year for the company with 3 more commercial launches potentially in the pipeline (including inclisiran from Novartis (NYSE:NVS) which has potential blockbuster status given the $9.7bn the company paid to acquire the drug - Alnylam earns a percentage share of all revenues), a second full year of sales for Onpattro and a first for Givlaari, and early stage candidates promising to broaden the company's target market. In this article, I look at some of the challenges that lie ahead for the company. Despite the fact I am bullish overall on Alnylam's long-term prospects, I expect that a better buying opportunity (sub $115 for example) might present itself in the near future given the volatility of the stock.

Can Alnylam hit $500m in sales in 2020?

Alnylam's net product revenues in Q419 were up 21% from the previous quarter (Q319) to $55.95m, with Onpattro - the company's RNAi based treatment for the rare condition hATTR amyloidosis - driving $55.79m of the total and Givlaari - another oligonucleotide approved in late November 2019 for the treatment of acute hepatic porphyria - responsible for the remaining $150k.

On an annual basis, sales of Onpattro have risen 964% from $12.5m in 2018 to $166.5m in 2019, and the company is projecting sales of between $285m and $315m for 2020, plus revenues from its collaboration partners of $100-150m. Since Alnylam is not giving out forecasts for sales of Givlaari, we can only estimate a 2020 figure here, but based on analysts' estimates of peak sales of $425m by 2024 (Source: Evaluate Pharma) if Givlaari reaches 10% of that volume in its first full year of sales and makes $42.5m, it will be a good start I believe.

This suggests that revenues approaching $500m could be achievable for Alnylam in 2020 which would represent annual top-line growth of 180%. That's very impressive even by biotech standards, and there are several reasons for believing revenues could be higher still.

Alnylam has another candidate, lumasiran, in late stage phase 3 trials (Illuminate-A, B and C) which has shown positive results in treatment of the ultra rare kidney condition primary hyperoxaluria type 1 ("PH1"). Management say they plan to file a new drug application ("NDA") and new medicine application ("NMA") within the next few months. There are between 3,000 and 5,000 patients affected by PH1 globally whose current treatment options are very limited. Estimates suggest lumasiran represents a $500m opportunity, and a list price of between $375,000 and $575,000 - with the latter being the current list price of Givlaari - has been mooted (Source: Pharma Intelligence).

Inclisiran approval would be great news for Alnylam

The best news coming for Alnylam in 2020, however, may be the imminent commercialisation of inclisiran - a cholesterol lowering drug for treatment of hypercholesterolemia. Alnylam licensed this drug to The Medicines Company (NASDAQ:MDCO) in 2013 in exchange for an upfront cash payment of $25m plus development and commercial milestone payments of up to $180m, as well as - most importantly - royalties ranging from the low-to-high teens based on annual worldwide net sales of inclisiran. In 2019 - in an outcome that must have stung Alnylam - Novartis paid a staggering $9.7bn to acquire the rights to inclisiran from The Medicines Company. The good news, however, is that Novartis has now submitted an NDA for inclisiran and should it be approved, sales of the drug are estimated to reach $1.529bn by 2024 (Source: Fierce Pharma), with Alnylam earning a likely 15-20% of all revenues.

A Dramatic reversal of fortunes

The above provides ample justification for Alnylam's 62% annual share price gain and suggests that there may be plenty of further upside to be realised as the company transitions from a drug-developer of promise to a drug-developer-cum-seller managing a portfolio of commercialised assets and progressing novel candidates rapidly through trials. It's a scenario that an RNAi therapeutics company would hardly have dared to dream of just a few years ago when the Nobel-prize winning promise of RNAi looked dead in the water as safety concerns and cell delivery issues led to big-pharma companies pulling their funding out of the sector - Alnylam laid off 25% of its workforce after Novartis ended its partnership with the company in 2010 (according to Pharma Journal).

New issues on the horizon - controlling costs and competition

Commercialisation and the rapid development of drug candidates through clinical trials come with an entirely new set of problems and challenges to overcome, however, and despite its notable successes, Alnylam remains a heavily loss-making firm with an accumulated deficit of $3.4bn according to its Q319 balance sheet (Source: Q319 10Q submission). There are no guarantees that sales of its drugs will meet management's expectations, or generate net profits even if they do, given the company's huge R&D costs ($655m in 2019 - up 30% year-on-year) and SG&A expenses ($479m in 2019 - up 25%).

Alnylam's success has triggered intense competition in the RNAi space. Rivals include Arrowhead (ARWR), which has 9 RNAi drug candidates in the clinic with at least 3 moving towards phase 3 trials and potentially lucrative deals in place with big pharma concerns Amgen and Janssen, Ionis Pharmaceuticals (IONS) whose spin-off Akcea Therapeutics (AKCA) makes Onpattro's direct rival Tegsedi, and Dicerna, who were recently forced to pay Alnylam $25m after being found guilty of stealing trade secrets from the company (Source: Reuters) but are now developing promising treatment candidates.

The competition is particularly intensified in the RNAi field because companies are still struggling to find ways to deliver their drugs to the different organs of the body. This is an issue that has dogged RNAi therapeutics companies for more than a decade, with Alnylam eventually making a breakthrough by conjugating its double stranded siRNA ("small interfering RNA") to the sugar molecule GalNAC which allows its molecules to enter cells in the liver. This means that most RNAi treatments target diseases related to the liver only, although progress is slowly being made towards targeting alternative cell types.

The threat of Vyndaqel

Besides RNAi, Alnylam must also contend with other forms of treatment such as gene editing, monoclonal antibodies, and CAR-T cell therapy. For example, Pfizer's (NYSE:PFE) drug Vyndaqel, recently launched in the US is a direct rival to Onpattro in the ATTR cardiomyopathy and polyneuropathy spaces. In a recent survey of physicians treating hereditary transthyretin-mediated amyloidosis (hATTR) conducted by SVB Leerink, although results showed that Onpattro was generally favoured over its rival Ionis's (NASDAQ:IONS) treatment Tegsedi (outperforming Tegsedi in overall sales by nearly 4 to 1), physicians seemed to indicate a preference for Vyndaqel, suggesting that the drug would, ultimately, control around half of the ATTR cardiomyopathy market and 33% of the polyneuropathy market. Onpattro was expected to control around 19% and 27% of the two markets respectively (Source: Biopharmadive).

Analysts undecided on share price direction

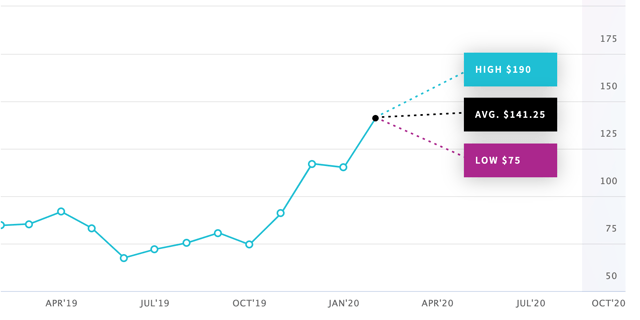

Concern about Vyndaqel may have been the reason behind a Nomura analyst's decision to issue a "sell" rating on Alnylam and set a price target of $75 (Source: SmarterAnalyst). In general, analysts seem divided on which way Alnylam's share price will move - according to Nasdaq price targets amongst 8 analysts range from a low of $75 to a high of $190.

Analyst 1-year price targets for Alnylam stock. Source: Nasdaq.

More potential in the clinic

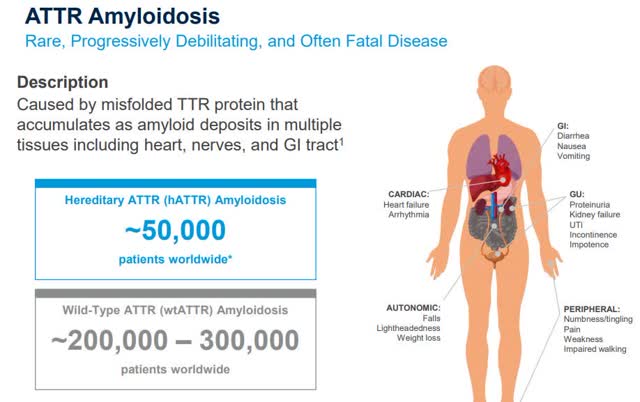

Although it won't be easy, Alnylam needs to focus on addressing larger markets with its drugs, and in this respect, the fortunes of 2 treatments - Fitusiran and Vutrisiran - currently progressing towards phase 3 trials will be worth watching closely. Fitusiran is approved in multiple markets around the world for treatment of polyneuropathy associated with hereditary ATTR amyloidosis, but Alnylam management believe that they can expand the product's label towards treatment of cardiomyopathy in both hereditary and wild-type ATTR amyloidosis patients and have initiated a phase 3 clinical study ("Apollo B") of 300 patients with the primary endpoint being a six-minute walking test.

ATTR Amyloidosis: market sizes hereditary vs. wild-type. Source: Alnylam presentation at JPM Healthcare Conference Jan 2020

Similarly, Vutrisiran has entered a phase 3 clinical study ("HELIOS-B") of hereditary and wild-type ATTR amyloidosis patients with a composite primary endpoint of all cause mortality and recurrence CV hospitalisations. Patisiran, the unbranded name for Onpattro, is also being tested as a treatment for cardiomyopathy. Alnylam CEO John Maraganore had this to say on the Q419 earnings call:

We believe that the potential opportunity for fitusiran and then vutrisiran in the ATTR amyloidosis cardiomyopathy indication assuming positive Phase 3 results and regulatory review could represent a multibillion-dollar anchor opportunity for building Alnylam, similar to what Regeneron had with Celgene with Revlimid.

For fitusiran, Alnylam has a commercial partner, Sanofi (NASDAQ:SNY), meaning Alnylam would earn royalties of between 15% and 30% on sales of the drug should it be commercialised with Sanofi - who owns a 10% stake of Alnylam - claiming the remainder.

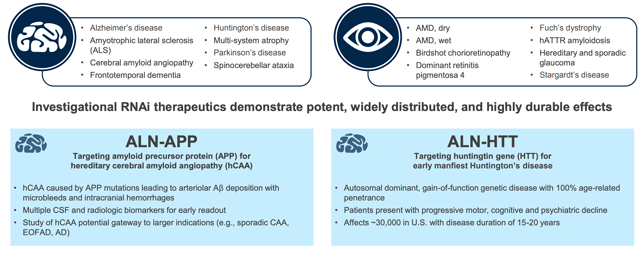

Moving beyond the liver

Alnylam management are committed to building Alnylam into a top five biopharma company bringing transformative medicine in both rare and common diseases. The company has forecast it will have 8+ approved drugs on the market by 2025, backed up by 10+ late-stage programs and hopes to increase staff from 1,000 to 2,500 over the same period (Source: JPM Healthcare presentation Jan 2020). Earlier stage drug candidates in development are targeting diseases such as Hepatitis B ("HBV") infection, hypertension, Parkinson's, Alzheimer's, and Huntington's.

Alnylam opportunities beyond the liver. Source: Alnylam presentation at JPM Healthcare Conference Jan 2020

Alnylam has built up a healthy lead in the RNAi drug commercialisation space and, therefore, investors should not be overly concerned about the company being overrun by competitors when the RNAi drug approval floodgates open, as they appear to be ready to do.

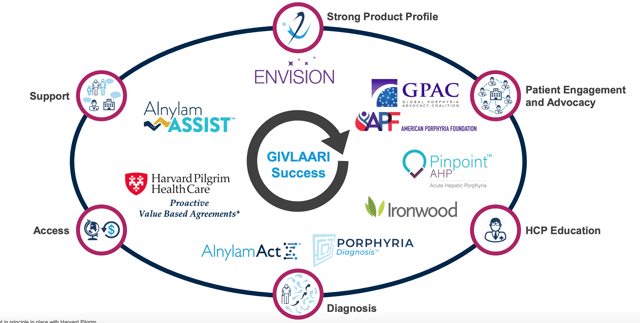

Innovative thinking on reimbursement

List prices for both Onpattro ( $450,000 based on $9,500 per vial) and Givlaari ($575,000 based on $39,000 per vial) are very high but it seems unlikely that Alnylam will compromise here given the amount of debt the company carries and its high SG&A and R&D costs (compare the $1,159 operating costs the company rang up in 2019 with rival Arrowhead - which has 9 drugs in clinical trials - and a combined annual spend of <$150m). Alnylam has managed to innovate a new strategy around reimbursement, however, by working with health insurers to offer a value based pricing solution.

Essentially, if its drugs deliver the same benefit to patients that occurred in clinical trials, then Alnylam will receive a higher level of reimbursement, and vice versa. The strategy has been well received although it will require careful policing to ensure that patients are tracked and their insurance claims settled appropriately. For its part, Alnylam will offer a range of auxiliary support services to ensure physicians, hospitals, and patients are aware of the treatment options available and the different ways to cover their costs, and, of course, to ensure that it makes insurers and hospitals formulary shortlists.

Alnylam's customer success playbook for Givlaari builds on the successful Onpattro template. Source: Alnylam presentation at JPM Healthcare Conference Jan 2020

Overseas markets

Alnylam drove overseas revenues by 61% quarter-on-quarter in Q419, to $20m. During this period, the company reported sales from Japan for the first time and have high hopes for the region in 2020 expecting it to be the largest market for Onpattro outside the US. Onpattro has also been launched in the UK and successful reimbursement arrangements have been made in Belgium, Israel, and Italy, with negotiations ongoing in Spain, Portugal, and Ireland plus unspecified markets in eastern and Central Europe (Source: BusinessWire). Approval to distribute Onpattro in Brazil is also expected to be granted sometime around mid-2020.

Conclusion - another productive year will lift the share price but there are many challenges ahead

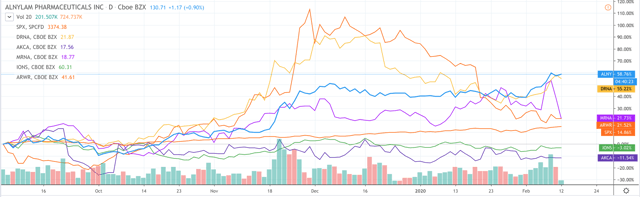

Alnylam is the current leader in the RNAi treatment field thanks to its 2 approved drugs and its exciting portfolio of late-stage candidates. Since September last year, the company's share price has reflected this, achieving better growth (60%+) than any of its rivals.

Alnylam share price growth since Sep '19 vs rivals. Source: TradingView

Does that make the company the best RNAi sector investment opportunity going forward? It's hard to say. Other companies (Arrowhead, Dicerna) may be judged more on their potential (enjoying large spikes on news of positive trial results or imminent commercialisation) than on their sales performance, which is a little unfair on Alnylam since, in my view, the company has managed the transition from drug development to commercialising 2 new drugs well given it has had no prior experience.

The commercial launch of an RNAi therapy has been 20 years in the making and Alnylam deserves huge credit for making it happen, although it should be noted, were it not for some last minute delays, Ionis Pharmaceuticals' Tegsedi would have been approved marginally before Onpattro.

But the market does not reward triers, only success stories. In the real world of competitive drug markets, 2020 feels like sink-or-swim time for Alnylam. The company must demonstrate that, for example, Onpattro can hold off the threat of Pfizer's Vyndaqel, and that it can successfully sell a treatment (Givlaari) costing nearly $600,000 without scaring off hospitals or insurers. On the development side, the company must prove again that it can navigate its way through late-stage trials as quickly as it managed to with Givlaari (the drug was approved more than 3 months ahead of schedule), and that it can find new indications for its oligonucleotide technology beyond the liver, with broader market appeal.

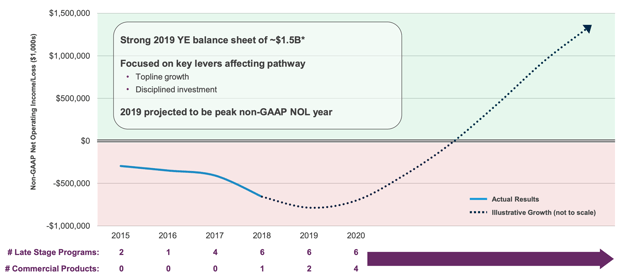

Most importantly of all, the company must show some kind of movement towards profitability and away from its debt burden in 2020.

Alnylam projected path to sustainability. Source: Alnylam presentation at JPM Healthcare Conference Jan 2020

The chart above reveals an impressively hockey-stick shaped path towards non-GAAP operating income of nearly $1.5bn and there is a persuasive argument that the company can achieve such heights. With more than $1.5bn of cash available to it, and operating costs forecast by management to come down by 12% in 2020, management say they will be able to support current operations for multiple more years. Still, it will be nice to see real evidence towards net profitability during 2020's quarterly reporting.

I believe Alnylam's progression path in 2020 will be characterised by ups and downs with falling sales or sales that do not meet expectations heavily punished by analysts (with the market likely following suit), which is why I am holding off adding to my position in Alnylam for the time being. Whilst I believe that the company is on track to make sales in the billions before 2025, I also think that there will be plenty of share price volatility to contend with until the company has at least 3-4 commercialised drugs on the market with a year of sales revenues behind them.

My expectation (and I hope to produce a detailed fair value analysis of the stock once Q4 and FY19 documents have been filed with the SEC) is that the price of Alnylam will break $150 at some point in 2020 and that $200+ is achievable before 2022 based on increasing sales revenues, broader market appeal, overseas markets opening up and the company gaining valuable market experience and insight.

I also feel however that any failure to meet analyst expectations could drag the price down below $90 (roughly the average of the stock's value over the past 5 years). There is no doubt that backing Alnylam (or indeed any RNAi-focused biotech drug-developer) to succeed is inherently risky given that the current tailwinds that are driving the sector forward could reverse at any time if alternative treatments are found to be more efficacious or if the market reverts to more traditional remedies should real world results fail to match those achieved in the clinic.

Hence, I am waiting for the next dip in price, and if I still believe the thesis is sound despite the downturn, I will be acquiring further shares at this point, but am unlikely to do so before.

Disclosure: I am/we are long ALNY. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.