Z Stock Could Win but the U.S. Might Not

Zillow has demographic tailwinds but housing stability is a concern

Over the last four-and-a-half years shares of Zillow Group (NASDAQ:Z, NASDAQ:ZG) have ticked higher. However, the ride has been a volatile one, punctuated with extreme swings toward both ends of the vertical spectrum. Since October of last year, Z stock has been on a blisteringly bullish ride. Given its recent history, though, it’s fair to ask how this rally will hold up.

As you know, Zillow Group is an online real estate database company, providing buyers and sellers valuable residential information. For me, housing is a fascinating topic because it’s where the rubber meets the road. Government agencies can finesse certain economic metrics but not real estate: you either have a home or you don’t.

Thus, the wild swings suggest that while Z stock may offer traders substantial profitability at specific intervals, Wall Street is apparently digesting housing data to get a better read on the real economy. As such, how you ultimately approach Zillow may depend on your confidence of our country’s fiscal health and performance.

Let’s take a look at both the positive catalysts for Z stock, as well as key risk factors.

Demographic Trends Strongly Favor Z Stock

Among the most significant changes in America over the last 15 years or so is the student debt crisis. With educators emphasizing college as practically the only platform for success, applications for higher education have soared. Naturally, tuitions skyrocketed, but to truly unsustainable levels.

Now society is picking up the tab. According to various studies, home ownership rates for millennials is lower than that of prior generations when adjusted for age. With many millennials starting off their careers in one of the worst job markets via the Great Recession, this has added to the frustrations many young people face.

Furthermore, the recession caused many baby boomers to bunker down, which didn’t help ease the supply-demand dynamic. With less inventory available in major metropolitan areas – where unsurprisingly millennials prefer to live due to better job opportunities — housing prices increased dramatically.

But with improving economic conditions, baby boomers are ready to downsize. Or they just might die. Either way, some analysts have termed this demographic trend a “silver tsunami.” At some point, we’ll see an influx of supply, which theoretically should help ease pricing concerns for millennials. This translates into more real estate activity, bolstering the case for Z stock.

Plus, Zillow has two related demographic catalysts. First, U.S. fertility hit a post-World War II peak in 1960, with each woman averaging 3.58 babies birthed. Those infants are now around 60 years old and rapidly facing retirement age.

Second, from 1997 through 2007, the birth rate steadily moved higher from 3.88 million newborns to 4.32 million. These people will soon be entering the workforce with gusto, if they haven’t already. Therefore, over the next few years, we’ll see more supply meeting more people with extra funds.

Affordability Remains a Huge Risk

In the last State of the Union address, Democrats took exception with President Donald Trump’s characterization of a robust economy. To be fair, they’re not entirely wrong.

Based on headline numbers, the job market is booming, the stock market is scorching hot, and housing has revived. But if the economy was truly doing well, our infrastructure wouldn’t be crumbling. I don’t know about where you live, but in my neck of the woods, I need a 24/7 access to a chiropractor because the roads are terrible.

Moreover, in several metropolitan areas, homelessness is out of control. Again, if the economy was so wonderful, we really shouldn’t see such abject poverty rippling throughout the country.

One of the reasons why we don’t “feel” Trump’s version of the economy is that we don’t have his billions (or millions). But in all seriousness, it has to do with housing affordability. Adjusted for inflation, we’re living in one of the least affordable real estate markets in American history.

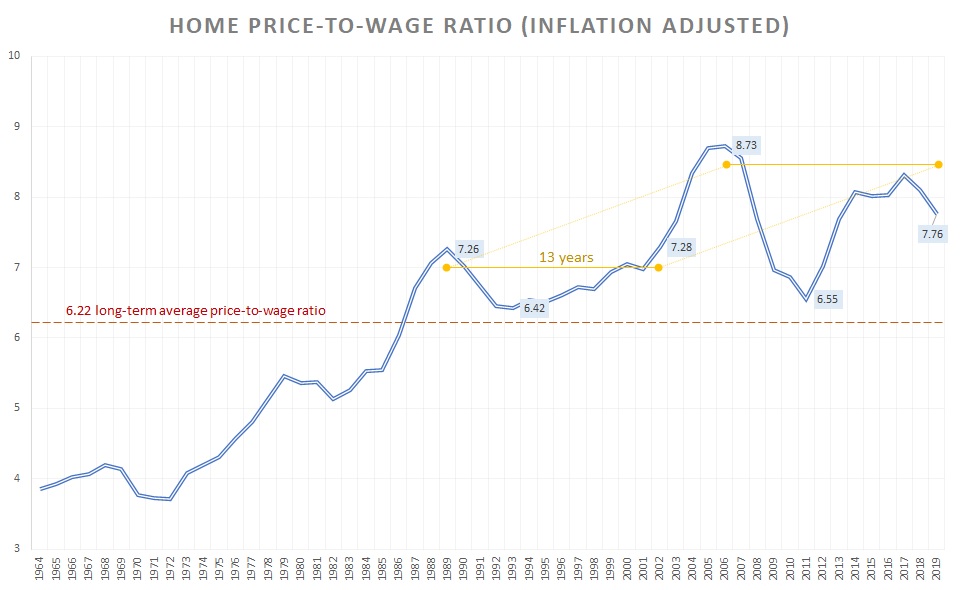

Back in 2006, lack of affordability hit an all-time peak. That was when the home price-to-wage ratio hit 8.73. Specifically, a house cost 8.73 times the average salary of a non-supervisory employee. Today, the ratio has dipped to 7.76, which is still bad. The ratio was under four between 1964 through 1970 (the U.S. went off the gold standard in 1971).

From 1964 till today, the average home price-to-wage ratio is 6.22. In order for housing to make sense now, we really need to move toward that ratio. Sure enough, the trend suggests that we are. But this also implies that we’re heading toward another housing correction, which may not help Z stock.

How to Approach Zillow

Before the 2000s era housing crisis, the last time unaffordability peaked was in 1989 at a ratio of 7.26. It took 13 years before we saw that same ratio again.

Interestingly, 13 years from 2006 is basically where we are today. But unaffordability is not growing but rather falling. Are housing prices going to correct? Perhaps.

On the optimistic side, though, Z stock may still benefit from the coming real estate transactions. Sure, younger people may not want to buy homes in areas where most baby boomers own their property. However, these millennials and members of Generation Z would by then approach an age where settling down is becoming a priority over other concerns.

It’s a strange circumstance we’re facing. The U.S. economy doesn’t look too hot in context. But we’ve got to live somewhere. Ultimately, this may lift Z stock longer term.

As of this writing, Josh Enomoto is long gold.