NewsBTC

Data Shows Bitcoin’s Progression From Retail To Institutional Asset

by Tony SpilotroAs Bitcoin matures, a wider range of investors begins to consider the asset as an investment to add to their portfolios.

New data shows exactly how Bitcoin is stepping out of the shadows of niche communities and has entered into the mainstream, attracting not only retail investors but a steady amount of institutional investors as well.

Crypto Emerges From Dark Web and Niche Community Shadows

Bitcoin is a unique asset unlike anything else that’s ever existed on the planet before it.

It’s not just a financial asset, but a technology that’s being adopted much like the internet, TV, and even the refrigerator.

Related Reading | 50% of Population To Use Bitcoin By 2043 If Crypto Follows Internet Adoption

It’s helped the asset’s value grow at a rate that’s unheard of in other financial markets, and according to logarithmic growth curves, stock-to-flow models, and power-law corridors, that value is showing no signs at stopping and is expected to increase exponentially.

In the early days of Bitcoin, early adopters were cypherpunks, developers, and evangelists enamored by the potential of the young, disruptive technology.

Following the earliest adopters, small niche communities were created on internet forums like BitcoinTalk or Reddit. Others learned of the cryptocurrency by the way of the dark web, using it to buy drugs or weapons online.

But over time, Bitcoin has increasingly stepped out from the shadows and into the mainstream public eye. And while it’s still demonized by government regulators for its illicit uses, there’s no denying the recent narrative surrounding Bitcoin has begun to elevate it in investor’s eyes.

Bitcoin Is Now on the Radar of Retail and Institutional Investors

Bitcoin is now among the best-performing assets in 2020 thus far and has shown additional value as a safe haven asset in the face of growing global economic turmoil, making it more attractive to institutional investors seeking a place to hedge their capital as traditional markets top out.

The switch from a retail dominated asset to an institutional one can be seen in the shift away from niche communities.

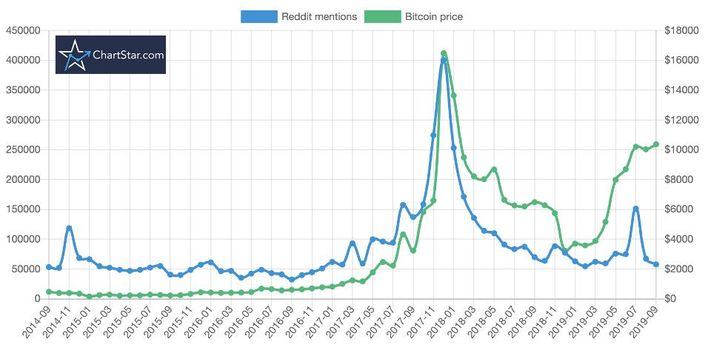

In a recent study by crypto data platform ChartStar that looked at Bitcoin-related comments trends on Reddit, there’s a clearly defined divergence between Bitcoin price and comments related to the cryptocurrency.

The niche developer and enthusiast communities are suddenly less active, while Bitcoin price continues to spike.

Speculation points to the divergence in price and community activity being a result of non-vocal institutional investors buying into the asset at low prices, in anticipation of a new bull market.

Related Reading | 10 Factors Confirm a New Crypto Bull Market Has Officially Begun

While retail investors have been burned by crypto over the last two years, institutional are just now getting in by the way of Bakkt and other platforms catering to the investors set.

As this continues, Bitcoin will only further become an asset for all people and move away from out of the shadows of niche communities and dark web markets.