Not Time To Buy KLX Energy Services Holdings

by ASB CapitalSummary

- Telling a story about a wealthy CEO and cyclicality is not enough to overcome facts on the ground.

- The entire oilfield sector faces real headwinds well into the future.

- Ongoing losses mean this company will continue to struggle.

- If the price spikes, it could be a good short in the future.

I've had a number of conversations recently with smart, experienced stock pickers who own shares of KLX Energy Services (NASDAQ:KLXE). They look at this stock and see a low valuation in a hated, cyclical industry with an extremely accomplished management team and see opportunity. I look at this stock and see terrible industry dynamics in a bad underlying business and see losses stretching out for years to come.

(The price of many micro-cap stocks swings wildly from high to low, and I expect at some point within the next year, KLXE's shares will go up in price, too. I am not currently short any shares, but after a price spike, I could be. So my goal in writing this article is to explain why it's not a "long" today and why I might choose to go "short" soon).

1. Industry Overview

KLXE provides oilfield services to onshore producers of oil and gas in the United States. The industry is capital intensive, has low barriers to entry and is highly fragmented.

Over the last 10 years, US onshore oil and gas production doubled as advances in hydraulic fracturing, generous lending and high oil prices made it desirable to produce oil and gas in large quantities. Through 2014, WTI crude prices reached over $100/barrel while the industry grew year after year. More production required more oilfield services equipment, and some of these companies even appeared profitable while growing. In 2014, oil prices began to fall from a high over $100 to a low under $30 in early 2016. US production has only increased despite prices never approaching the earlier highs (a trend which continues but may be nearing its end). Part of the reason for this increase in production despite low oil prices is because of oversupply of capital (at E&Ps, midstream companies and servicers who are all willing to put capital to work without prospects for profit), and part is because of efficiency gains from using the same equipment more effectively. As the CEO of another company in the sector explained last week:

The pricing dynamic entering into 2020 is challenging. Total industry frac stages in North America were up marginally year-over-year in 2019. However, efficiency gains across the industry have raised the number of frac stages completed by each fleet by 10% to 20%, which implies a decrease of at least 10% in the active frac fleets needed to meet demand. The slowing pace of frac activity led to progressively lower demand for frac fleets through the second half of 2019, resulting in pricing pressure on services. The substantial oversupply of frac equipment in the second half of 2019 was the pricing backdrop for 2020 dedicated fleet negotiations. The supply of staffed fracturing fleets across the industry fell meaningfully in late 2019. While this trend will be helpful in the long term, we believe the impact of attrition has not yet supported an improvement in pricing for services at the start of 2020. There remains an oversupply of frac fleets in the market and we do not expect pricing to improve materially until supply of actively staffed frac equipment better balances with demand. - Liberty Oilfield Services earnings release Feb. 5, 2020.

Other large competitors such as Schlumberger (NYSE:SLB) have a similar view that the market is oversupplied, and their decision is to disinvest in favor better opportunities:

Our ambition for North America land in 2020 has been clearly set for margin expansion despite the unfavorable activity outlook. While our strategic decision will result in revenue reduction greater than the decline in the market, they will contribute incremental earnings and cash flow compared to 2019. This will allow further prioritization of resources and CapEx allocation toward the international market. - Schlumberger earnings conference call Jan. 17, 2020.

Halliburton (NYSE:HAL) is similarly pessimistic about North American activity, saying on its conference call:

"2019 solidified the pivot from growth to capital discipline in North America" [...] U.S. production growth is slowing because of constricted capital flows. [...] Gas prices in the U.S. are below breakeven levels. U.S. drilling and completions activity may be biased lower due to the consolidation and restricted access to capital. [...] Turning to North America. The U.S. shale industry is facing its biggest test since the 2015 downturn with both capital discipline and slowing leading edge efficiency gains weighing down activity and production. As expected in the fourth quarter, customer activity declined across all basins in North America land, affecting both, our drilling and completions businesses. The rig count in U.S. land contracted 11% sequentially and completed stages had the largest drop we have seen in recent history. While holidays and weather were the usual factors, other reasons for this air pocket in activity included our customers’ free cash flow generation commitments and an oversupply of gas market. - Halliburton conference call Jan. 21, 2020

So it's fair to say that major competitors see an oversupplied market with declining customer activity. Other industry sources offer the same view, and it would be helpful to review the plans of US onshore producers saying similar things.

2. Operating Results

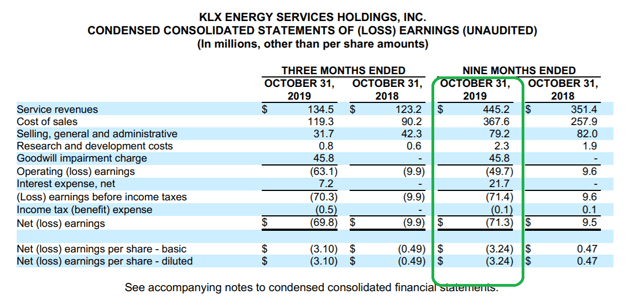

KLXE's operating results show exactly what you'd expect in an oversupplied business:

The company's operating loss of $49 million includes a goodwill impairment charge of $46 million, so we can say that the operating loss was closer to only $3 million (before another $22 million in interest payments).

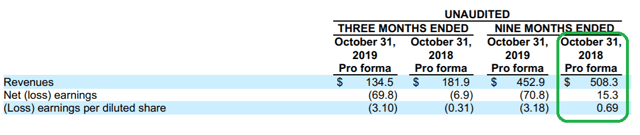

The size of the business grew substantially from 2018, but this is due in part to the acquisition of three small companies as well as the purchase of new equipment. The company provided a brief pro-forma description of what its business would have looked like if the acquisition had been made covering the same period in 2018:

As you can see, "pro forma KLXE with acquisitions" actually saw declining revenues from the same period last year.

As described in Note 3, at the end of 2018, KLXE spent $140 million in cash (and $9 million in stock) to acquire Motley Services, LLC. In 2019, it's spent another $27 million in cash and $47 million in stock to acquire Tecton Energy Services, LLC and Red Bone Services, LLC. It's these acquisitions that in fact produced the loss this quarter of the goodwill impairment charge, as the 10-Q states:

The abrupt deterioration in industry conditions, which accelerated through the end of the Company’s third quarter, was driven by a sharp sequential quarterly decline in U.S. land rig count and an unprecedented decline in active frac spreads from the second quarter to the third quarter. In fact, there was a significant sequential decline in hydraulic fracturing activity during each month of the third quarter. The decline in exploration & production activity resulted in lower demand levels and lower current and expected revenues for the Company. [...] The results of the goodwill impairment test as of October 31, 2019, indicated that goodwill was impaired because the carrying value of two of the reporting units exceeded the fair value. Accordingly, the Company recorded a $45.8 goodwill impairment charge, which is included in the condensed consolidated statements of (loss) earnings for the three and nine months ended October 31, 2019. The charges reflect the full value of the goodwill attributable to the Northeast/Mid-Con and Southwest segments, leaving the Company with $24.0 goodwill related to the Rocky Mountains segment as of October 31, 2019. - Third-quarter 10-Q, Note 5

So within 12 months of making these three acquisitions, not only has the company written down two-thirds of the total goodwill for these acquisitions, but it's also written it down completely for three out of four geographical segments in which it operates. This is not an encouraging sign.

The company's recent conference call also describes customers who are "completely cutting off spending" with particular problems in natural gas production (Third Quarter Conference Call). Oil and gas prices are much worse today than they were in December, and the reduction in Chinese demand (and disruption to supply chains and other business activity) make it difficult to expect a recovery that spurs more activity in the near future.

3. Balance Sheet and Liquidity

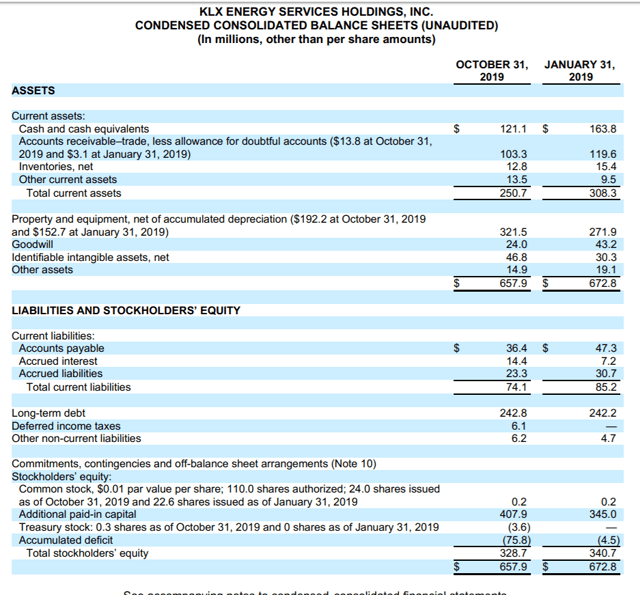

At first glance, the balance sheet doesn't look that bad:

Third-Quarter 10-Q

But there are two big problems here. First, cash and receivables at the beginning of the year were approximately $283 million, and at the end of the third quarter, they were $224 million for a decline of $59 million. At the same time, net property and equipment increased from $272 million to $321 million. So we could say it exchanged $59 million in cash for $49 million in equipment. In and of itself that only sounds like a loss of $10 million in value. The problem is that the assets themselves don't make money. We saw above that the assets acquired don't make money now and aren't likely to in the future. So that means they're worth meaningfully less than the company paid for them.

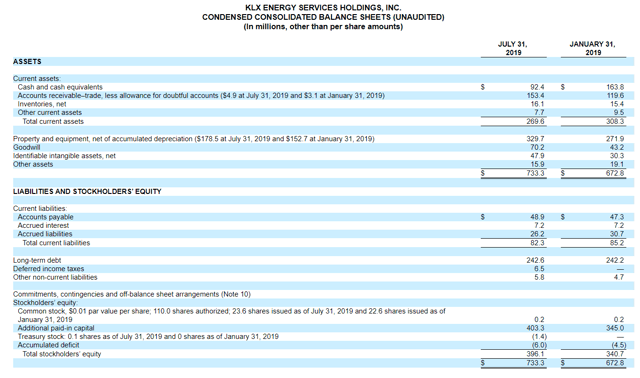

The second problem becomes clear from comparing this quarter's balance sheet with that of the previous quarter:

Second-Quarter 10-Q

As you can see here, at the end of Q2, cash was $92 million and receivables were $153 million. So a significant part of the rise in cash from $92 million to $121 million is actually related to the decline in receivables from $153 million to $103 million. My interpretation of this is that the strong cash position is set to decline as next quarter the company will have fewer receivables to collect (although the company also intends to wrap up equipment purchases, which would preserve cash). The point is that the current cash position does not reflect an ability to generate free cash flow.

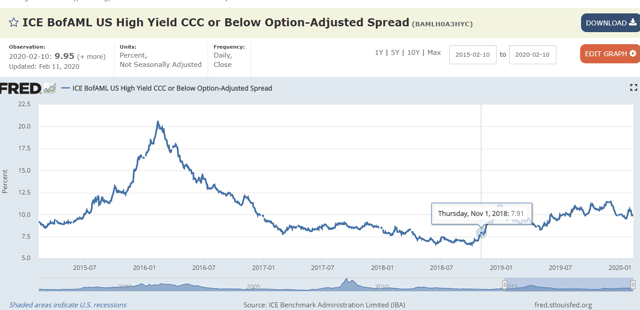

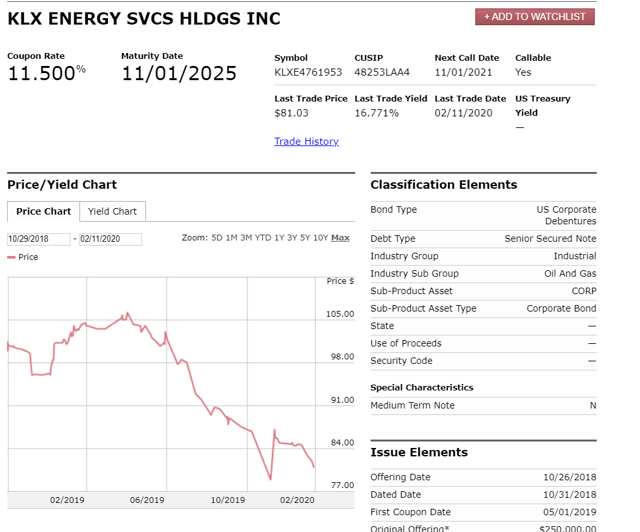

The bond market has been offering a similar assessment. In October of 2018, KLXE borrowed $250 million at a 11.5% interest to make acquisitions such as the three described above. This was high at the time, as you can see from this chart showing that the CCC high-yield bond spread was closer to 8% over Treasury yields:

So even when it borrowed the money, it was charged an interest rate as if it was among the least credit worthy borrowers. Today, things look worse and the bond prices have only moved down:

At this point, buying the bonds at 81 cents on the dollar offers a 16.77% yield to maturity. The high coupon on this bond means that you get so much returns in the interim that the risk of capital impairment is reduced (that is to say if you bought a bond today for $810, and in a year, you earn $115 in interest, you only have $695 still at risk). In my opinion, this discount to par in light of a high interest rate reflects that the marginal seller of the bond does not expect the bond principal to be repaid in full at maturity.

4. Replying to bullish arguments

As shown above, the business loses money and it is reasonable to infer that it will continue to lose money for the foreseeable future. I want to address a number of arguments people make in favor of owning this stock. (Some of these were mentioned in a recent discussion on Twitter you can see here. My original thread on why KLXE was not a good investment starts here).

First, bulls claim that having a previously successful CEO offers differentiated prospects from the rest of the industry. The CEO has definitely accomplished some amazing things and built outstanding wealth for shareholders at KLXE's former parent. But there are several important distinctions to be drawn between those cases and KLXE. Those businesses were in aircraft parts which is an entirely different industry from oilfield services. The CEO's prior success in other business and current lifestyle may actually be more of a hindrance to making this company profitable, as others have described the problem of becoming "too rich to work." Moreover, having a wealthy controlling shareholder is no guarantee of success in any business as owners of Chesapeake (CHK) and Ocwen (OCN) and many others can tell you from experience. In conclusion, as one well-known securities analyst has phrased it, "When a manager with a reputation for brilliance tackles a business with a reputation for bad economics, the reputation of the business remains intact."

Second, this CEO's strategic choices in running the business seem to be at right angles to those of his competitors. Making acquisitions at a time others are divesting is one example, but the move into the coiled tubing service line is another. As KLXE's CEO said on the most recent conference call:

While we have reduced our personnel levels substantially we're also recruiting experienced coiled tubing personnel to join the company as we have begun to receive and deploy five new large-diameter coiled tubing spreads. A continuation and expansion of the company's coiled tubing strategy to gain greater share of customer spend by pulling through our broad range of asset-light services will be a major strategic priority in 2020 [...]. - Third-Quarter Earnings Call

Compare that to what the industry's largest participant Schlumberger said this quarter:

We will cease onshore coil tubing operations in North America. A market, we believe, is commoditized and offers neither significant integration nor performance technology upside. - Schlumberger Fourth Quarter Earnings Call

Here's a comment from competitor Nine Energy Service (NYSE:NINE) in November:

"Coiled tubing saw activity declines and pricing pressures during the third quarter. Increased pricing pressure comes from a combination of overall activity decline, new units coming to market and competitors looking to buy market share."

So maybe KLXE will have a competitive advantage in this segment and maybe it would lead to other opportunities with new customers, but that would be starkly at odds with the description of the segment from competitors.

Third, bulls believe that insider ownership and a new share repurchase authorization will preserve and create value. This should not be a part of the investment calculus because the fact that insiders own stock doesn't change the dynamics of the underlying industry and it doesn't help if the business is losing money. I would point out that competitor Basic Energy Services (BAS) also bought back stock in the second quarter of 2019, and today the share price is down another 75%.

Fourth, bulls argue that there is an industry cycle at play in the North American oilfield services, and when the cycle turns, KLXE will earn substantial profits and the share price will appreciate. While I believe we are nearing a cyclical low in oil prices, I don't believe oilfield services companies will benefit from pricing increases anytime soon. As we've shown, existing companies already have excess equipment and capacity. So before prices rise substantially, equipment on the sidelines will have to come back into service. But just as importantly, the industry has become more efficient in the era of low prices. That is to say that they get more work out of the same equipment. That puts supply further in excess of demand and pushes off the part in the cycle when high oil prices lead to more drilling activity which leads to higher prices in oilfield services.

5. Conclusion

For the reasons described above, I don't believe one can draw the inference that this business is likely to earn a profit anytime soon. Rather, losses will continue in a competitive, contracting industry. Because of the company's low market cap, I expect there to be a share price spike at some point in the future. At that time, I would consider shorting the stock.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.