AT&T: When The Market Crashes

by Blue HarbingerSummary

- AT&T's 5.5% dividend yield is compelling, and the payments keep growing, but what happens when the market crashes?

- This article reviews the health of the business, valuation, risks, dividend safety, and stock performance during historical market crashes.

- We conclude with our opinion on whether long-term, income-focused investors should continue to own the shares.

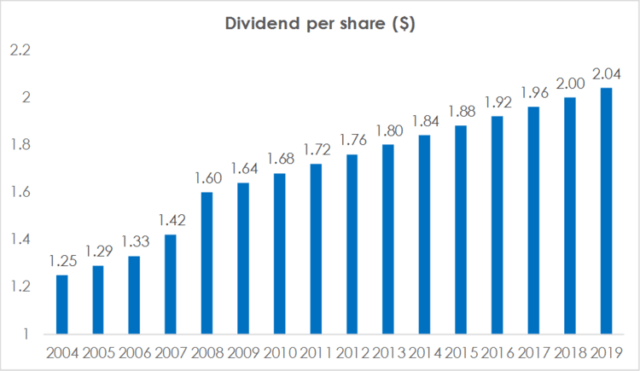

AT&T Inc. (NYSE:T) has increased its dividend for 36 years in a row, including a recent 2% increase in January 2020. But how safe will AT&T be during the next market crash? This article reviews the health of the business, valuation, risks, dividend safety, stock performance during historical market crashes, and concludes with our opinion on whether long-term, income-focused investors should continue to own the shares.

Overview

AT&T offers traditional telecom services including wireless, Internet, and cable television. It also offers DirecTV satellite television. AT&T conducts most of its business in the US, although it does have a meaningful presence in Latin America. AT&T generated ~$181 billion in revenues in 2019, and it primarily conducts its operations via four business units.

- Communications (~78.5% of revenue): This segment provides mobile, video, internet and other communications services to more than 155 million subscribers in the US.

- WarnerMedia (~18% of revenue): This segment includes Turner, HBO and the Warner Bros studio. It develops, produces and distributes feature films, television, gaming and other content. AT&T entered this business with the acquisition of Time Warner in 2018.

- Latin America (~3.8% of revenue): This segment provides entertainment and wireless services in 12 countries outside of the US.

- Xandr (~1.1% of revenue): This segment provides advertising services.

Dividend Backed by Strong Free Cash Flow

AT&T has increased its quarterly dividend for 36 consecutive years, and it just recently announced an ~2% increase to $0.52 per share. This results in an annualized dividend of $2.08, and a yield in the area of 5.5%, depending on the latest share price quote. And a dividend this large is nothing to bat your eye at, and it's backed by solid free cash flow.

(Source: Company data)

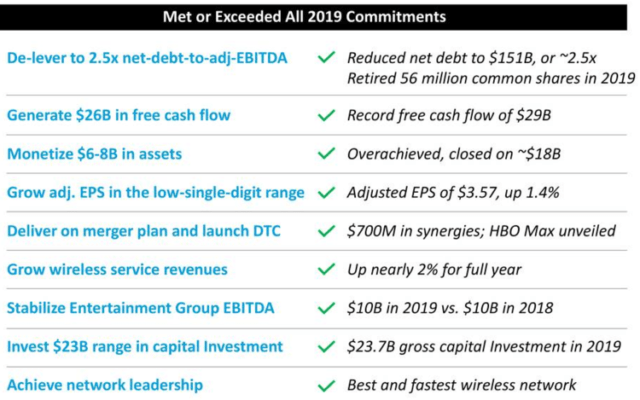

Specifically, according to the company's latest investor presentation, AT&T generated record free cash flow of ~$29 billion in 2019 (see page 3). This makes the company's free cash flow dividend payout ratio for the full year just 51%, thereby leaving plenty of room for debt repayment (more on debt concerns later), growth investments, future dividend increases, and continuing share repurchases.

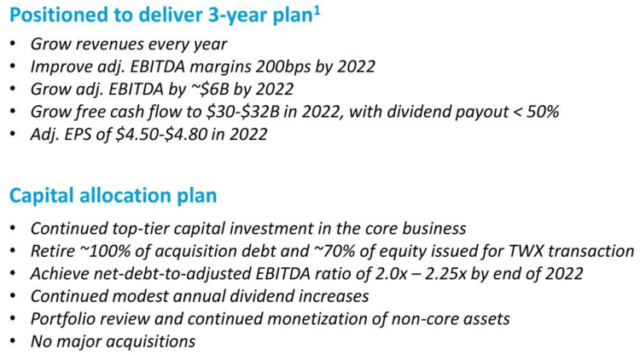

For FY 2020, AT&T is guiding for free cash flow in the $28 billion range with a dividend payout ratio in the low-50s. And as per its three-year capital allocation plan, the company will continue modest annual increases in dividends until 2022. AT&T expects free cash flow to increase to ~$30-$32 billion by 2022, and dividends as a percent of free cash flow will be less than 50% (a good sign for continuing dividend increases in the long-term).

(Source: Investor Presentation)

Debt Concerns

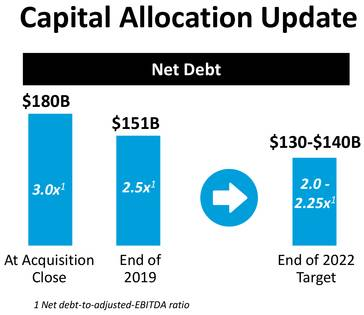

AT&T's high debt load post the acquisition of Time Warner has been a cause of concern for investors. We believe the company has enough levers (free cash flow, asset monetization) to reduce debt over time and in fact has shown considerable progress already.

(Source: Investor Presentation)

Over the last 18 months, AT&T has retired a lion's share of the debt it issued to acquire Time Warner and will continue to pay down debt. The net-debt-to-adjusted-EBITDA ratio was 2.5x by the end of 2019 (see valuation table, valuation section below) and the company expects to further reduce its debt ratio to 2.0x-2.25x by 2022 (see Capital Allocation Update graphic above). By the end of 2022, AT&T will have retired 100% of the acquisition debt and 70% of the shares from the Time Warner transaction (see "capital allocation plan" graphic above). In fact, AT&T retired 56 million of these shares in 2019 (see graphic below). It further plans to retire about 100 million more in the first quarter of 2020 and has set a 250 million share retirement target for 2020 (see page 16, Investor Presentation). And while the majority of the debt reduction will be funded by free cash flow, the company is supplementing it with non-core asset monetization. In fact, AT&T overachieved its asset monetization target for 2019 and expects to do another $5 billion to $10 billion net monetization this year, with significant efforts already under way. Overall, debt remains somewhat elevated, but we believe AT&T can manage it comfortably.

(Source: Investor Presentation)

The 5G Tailwind

AT&T plans to invest heavily in its mobility segment to benefit from 5G tailwinds (5G is the fifth generation wireless technology for digital cellular networks that began wide deployment in 2019). AT&T's low band 5G service currently covers 50 million people and is targeting nationwide 5G coverage in the second quarter of 2020. AT&T also plans to deploy its 5G+ service, which uses high-band millimeter wave spectrum, in additional cities. According to Chief Operating Officer John Stankey:

"We also have the millimeter wave spectrum we need to deploy 5G+ and its gigabit speeds and super low latency to more densely populated cities. We're in 35 cities today and we're adding more this year."

AT&T expects more customers to sign up for high value 5G unlimited plans in the second half of 2020, driven by 5G device upgrade cycle which should boost wireless revenue. In particular, the launch of popular devices such as the 5G iPhone during the second half of 2020 should result in a bump in upgrade rates. According to Stankey:

"There's an important point to be made here once we have 5G nationwide. As you know smartphone upgrades across the industry have been down for a while now. In fact, we're coming off a record low upgrade rate for any fourth quarter in our history. But fast forward to the back half of this year when popular 5G smartphones and devices should be more available at scale, you can expect higher upgrade rates and equipment revenue growth."

Also important to note, Stankey explained that AT&T expects growth in ARPU (average revenue per user):

"We also expect a higher adoption of our unlimited plans. We're at a little more than 50% penetration today, but we expect the 5G device upgrade cycle will bring into our stores lots of customers not on unlimited plans today. Increasing the adoption of our best unlimited plans is obviously an ARPU growth opportunity for us."

Interestingly, activist hedge fund Elliott Associates recently wrote to AT&T management that the 5G opportunity is one that AT&T "cannot afford to miss." In its letter Elliot explained:

"We believe that AT&T is best positioned to be the market leader in 5G. Accelerated by its FirstNet build, AT&T is differentiated with a strong spectrum positioning (both mmWave and mid-band), highly virtualized and software upgradable network, leading business solutions (both wireless and wireline) and premier IoT franchise. We believe that the upcoming shift to 5G presents a unique opportunity for AT&T to displace Verizon as the wireless market leader, a potential reset of incredible importance, and one which it cannot afford to miss."

HBO Max Launch: A Boost to Wireless Revenue

HBO Max is a high-quality premium video on-demand service that is expected to launch in May 2020. AT&T will offer HBO Max for free on its highest ARPU wireless plans. The anticipated upgrade cycle driven by 5G adoption is an opportunity to distribute HBO Max. During the fourth quarter call, management noted:

"The timing for this upgrade cycle couldn't be more perfect when you consider we'll be offering HBO Max on our highest ARPU wireless plans with features tuned for premium media consumption and at a time when people are coming into our stores to upgrade. It's a natural opportunity to further the distribution of HBO Max, while adding new mobility subscribers and improving our wireless ARPUs."

HBO Max is a natural fit for AT&T's nearly 25 million postpaid accounts. With HBO Max, AT&T will offer consumers more than twice the amount of programming for the same price as HBO. As a result, the company expects its wireless service revenue growth rate to be higher in 2020. AT&T expects that offering HBO Max for free on unlimited plans will improve the overall churn. A reduction of one basis point of wireless churn across the base is worth about $100 million annually in sales. To sum it up, the company is expecting growth of more than 2% in Mobility service revenues this year. Again, per the quarterly call:

"We have very high expectations for HBO Max. And at the same time, we're thrilled about the possibilities of increasing the adoption of higher ARPU services and strengthening the long-term value proposition of our highest quality and highest ARPU customers. We fully expect HBO Max will have a positive and immediate impact on the stickiness of our wireless and pay-TV and broadband offerings."

Valuation

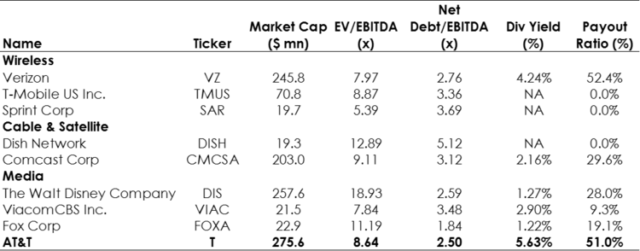

For perspective, we have compared AT&T to other wireless players as well as cable/satellite and media players (however, in our view, the primary competitors are the three main wireless players: T-Mobile (NASDAQ:TMUS), Sprint (NYSE:S) and Verizon (NYSE:VZ)). When compared to the three main wireless players, AT&T is the largest (by market capitalization) and has the highest dividend yield. And on an EV to EBITDA basis, AT&T is reasonably priced. For example, over the past 10 years, AT&T has traded in the range of 4.7-10.1x EV to EBITDA. And with the approaching 5G tailwind, we expect AT&T's multiple can return to or even exceeding its long-term average. This could mean healthy share price appreciation for investors in the years ahead.

(Source: Yahoo Finance)

Performance During Market Crashes

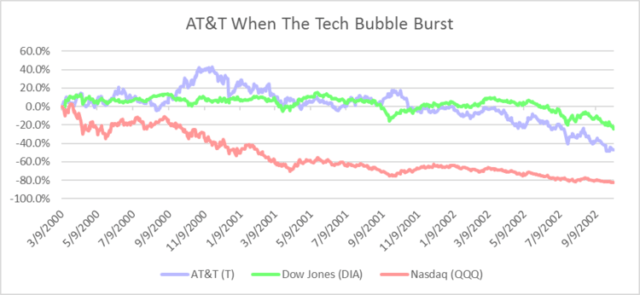

AT&T is attractive to many investors because its shares are often viewed as less volatile (thanks to its steady business and healthy dividend payouts). For example, AT&T's five-year beta (a measure of the risk arising from exposure to general market movements) was recently reported at 0.62 (the overall market has a beta of 1.0, and anything below one is said to have less "market risk"). However, it's worth taking a look at how AT&T's shares have performed during historical market crashes. For example, the "Tech Bubble."

(Total Returns. data source: Yahoo Finance)

As you can see in the above chart, AT&T fared fairly well when the Tech Bubble burst as compared to technology stocks (QQQ). And this record is even more attractive considering AT&T kept paying and raising its dividend throughout that time period. But how did AT&T shares fare during the more recent Financial Crisis?

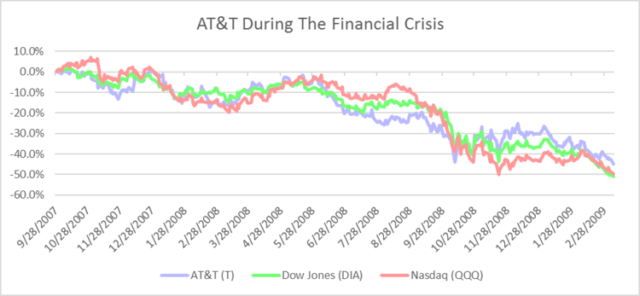

(Total Returns. data source: Yahoo Finance)

As you can see in the chart above, AT&T's share price suffered, much like the rest of the market, during the Financial Crisis. However, again, it's important to note that AT&T kept paying and increasing its dividend throughout this time period (we'll have more to say about total returns price appreciation plus dividends later in this report).

Risks

While past performance can provide valuable perspective on a stock, it's critically important to look forward as well. And in addition to the forward-looking information we have shared in the sections above, there are also forward-looking risks that investors should be aware of, as described below.

Wireless competition: Competition could intensify further in the wireless market as companies attempt to maximize market share. This could lead to pricing pressure adversely impacting ARPU growth, thereby slowing down aggregate revenue growth and free cash flows. Long-term fundamental investors should pay close attention to this dynamic going forward, but for the time being, AT&T's business remains on track.

Debt concerns: The company ended 2019 with a significant amount of debt, and this remains a concern for many investors as interest expense pressures cash flows and earnings, and also limits balance sheet flexibility to fund future growth. However, while debt remains robust, we believe it is manageable given AT&T's high free cash flows and its ongoing non-core asset monetization program. Specifically, both of these characteristics provide ample resources for AT&T to continue paring down its debt in the years ahead (as noted previously, AT&T has already been making significant progress).

Cord-cutting: Cord-cutting remains a major risk for AT&T's pay-TV and media businesses as consumers move away from traditional cable services towards streaming content. We note that AT&T is aggressively focusing on its on-streaming service via HBO Max, which is the right move. Further, it's critical for AT&T to execute on the 5G opportunity.

Stock Price Performance

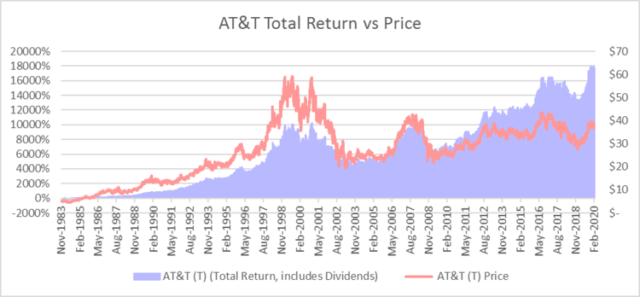

Many investors have expressed concern that AT&T's share price (the pink line in the chart below) hasn't moved meaningfully higher in recent years. However, considering the opportunities that lie ahead (mainly 5G), we expect this can change. Further (as noted earlier), the company plans to buy back 250 million shares in 2020, which should further boost returns for investors. And critically important, when you consider AT&T's total returns (price appreciation plus dividends), the stock has been powerfully delivering for investors recently (and for a very long time) as you can see in the light purple shaded region in the chart below.

(Data source: Yahoo Finance)

Conclusion

AT&T has plenty of wherewithal to comfortably continue its dividend increases. And for many long-term investors, that's what matters. As long as you keep receiving those big dividend payments, and as long as they keep steadily increasing (even during market crashes, like the Tech Bubble and the Financial Crisis) who cares what happens to the stock price. As you can see in the chart above, even though the share price has not grown as rapidly as some would like, the total return (share price increases PLUS dividends) has been extremely powerful. And if it's low-stress growing income payments that you want (which, by the way, are very challenging to find in our current low-interest-rate environment), AT&T is absolutely worth considering for long-term investment.

As per John D. Rockefeller, and particularly when the market gets volatile and sells off hard (as it inevitably will), "Do you know the only thing that gives me pleasure? It's to see my dividends coming in."

When the market eventually crashes at some point again in the future (it inevitably will), AT&T's big steady growing dividend payments will be very nice for income-focused investors (and they're nice even when the market doesn't sell off too).

Looking for more big-dividend opportunities like AT&T?...

Whether you're retired, soon to be, or just like high income, we'll help you build a steady high-income portfolio, that you can use like a paycheck, and with an account balance that grows. Big Dividends PLUS.

Try It Free for 2-Weeks, Before Prices Go Up!

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.