AutoNation - 2020 Is Shaping Up To Be A Good Year

by Leo NelissenSummary

- AutoNation not only easily beat Q4/2019 earnings expectations, but was able to report strength across the board.

- The company saw higher margins, strong same-store sales and expects this to continue due to favorable economic circumstances and company measures.

- The stock price valuation is attractive and should help the stock to continue its rally.

It's time to discuss AutoNation (AN) again. The nation's largest listed car dealership just reported solid fourth-quarter results thanks to a strong economy, low rates, and a strong consumer. I wrote my most recent article roughly one year ago. Unfortunately, I have to admit that I was too bearish back then. In this article, however, I am going to tell you why I am turning bullish and why I believe that AutoNation is going to reward its investors with further capital gains. Sales and earnings are strong, margins are rebounding, and the outlook is good. There is a lot to like while headwinds are lingering.

Source: Autonation

Here's What Happened In Q4

Let's start this article by admitting a mistake. In February of 2019, I wrote this:

I am staying far away from this stock. Not because I think management is making the wrong decisions, but only because AutoNation is one of the best stocks to track consumer sentiment. There is no way this company is going to escape from a slowing consumer sentiment trend.

While I do not regret writing that as the economy was seriously weakening back then, I regret not having the stock on my radar for a long time. While I turned bullish on a lot of other stocks, I did not look at big-ticket consumer items anymore. Back then, I avoided the stock due to economy reasons, the mistake was ignoring the stock and missing a lot of upside potential.

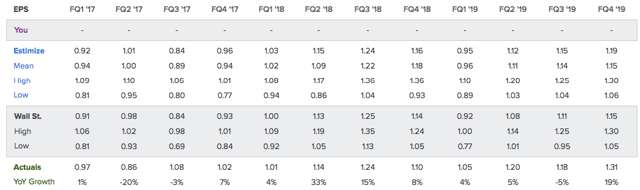

The good news for investors is that earnings contraction in the third quarter of 2019 has ended. What could have been the start of a prolonged slowing cycle has been ended by a stronger consumer, lower rates and overall optimism. As you can see below, the just-released fourth-quarter results show that adjusted EPS has jumped to $1.31. Not only this is significantly above expectations of $1.15, but it is also 19% higher compared to the prior-year quarter.

Source: Estimize

While this is good news, I am even happier that strength started all the way at the top of the income statement. The same-store fourth-quarter revenue growth rate came in at 4% as the company was very satisfied with the developments of the domestic economy.

Low unemployment and three interest rate cuts by the Federal Reserve have supported consumer demand and reduced our inventory carrying costs, and we believe industry-combined new and used vehicle sales for 2020 will be in line with last year.

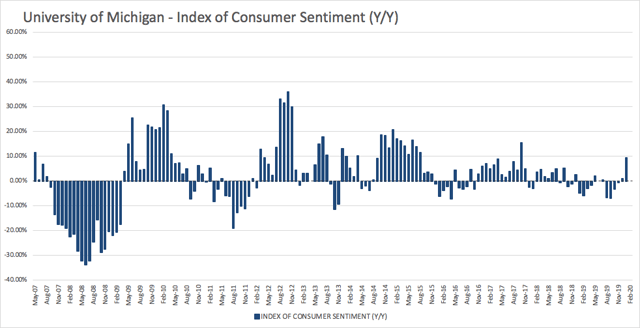

The graph below shows what is happening to the US consumer. While I was bearish in 2019 as consumer sentiment was down in almost every single month, we are seeing that strength is returning in the form of one of the highest growth rates since 2017. Consumer sentiment is clearly not giving up without a fight, and I am happy by Q1/2020 economic bottom call is getting some support from the consumer.

Source: Author's Spreadsheets (Raw Data: University of Michigan)

Anyhow, as the company reduced inventory and supported the overall cost of goods sold, the same-store gross profit growth rate was able to hit 7%. This was the result of growth in every business segment. This includes both new and used vehicles, customer care and customer financial services.

In the fourth quarter, the company reduced its inventory by more than 11,000 vehicles compared to the prior-year quarter. This allowed gross profit per vehicle to rise by $215 or 6%. New vehicle same-store sales growth hit 5%. Same-store sales for used vehicles were up 21% as used vehicle gross profit per vehicle improved by $122 or 9%. AutoNation expects (nearly) new vehicles to outperform as customers find value and affordability in used vehicles.

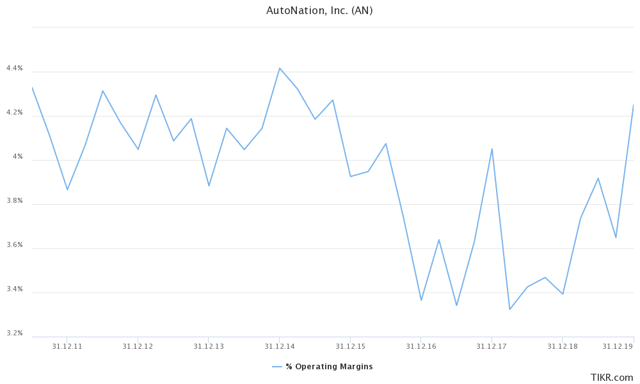

SG&A expenses, as a percentage of gross profit well by 250 basis points to 72.0%. Overall, the margin picture looks good as operating margins hit a new high in the fourth quarter. I truly hope this margin trend is able to continue as this would ease a lot of the pressure on the company after the prior three years saw much weaker operating margins.

Source: TIKR.com

The good news is that management continues to expect lower SG&A expenses. For 2020, SG&A to gross profit is expected to be equal or below the full-year 2019 result due to well-managed expenses while further investments in the company's brand extension strategy seem to pay off.

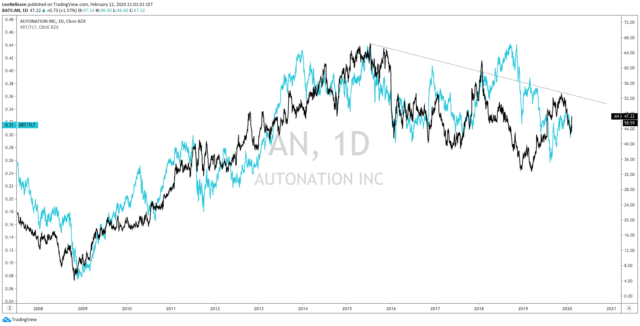

Besides that management is having a positive view on sales and earnings going forward, I believe the stock is not out of the woods yet. While I do believe that the stock is a good buy at $47 as the stock is valued at 9.8x next year's (expected) earnings and getting a much-needed boost from the recent earnings call, I think it needs more to break the resistance around $53. As you can see in the graph below, I added the ratio between retail stocks (XRT) and US 20+ year government bonds (TLT). I use this ratio to see how cyclical retail stocks behave in comparison to defensive government bonds. As it turns out, AutoNation has been stuck in a very long downtrend as investors were simply unwilling to move their money into high-ticket consumer items. Regardless of whether some of them continued to report strong results.

Source: TradingView

I expect the stock to rise towards $53 and hope to get some confirmation from outperforming retail stocks. If that is indeed the case, I think AutoNation will be able to break out and maybe even retest its all-time highs. Fundamentals are rock-solid, economic growth is supportive of further growth, and margins are expected to remain strong. On top of that, the stock is very cheap considered these circumstances. The next few weeks should be good. What comes after that is up to the economic trend.

Stay tuned!

Thank you very much for reading my article. Feel free to click on the "Like" button, and don't forget to share your opinion in the comment section down below! My long-term investments are stated in my Seeking Alpha biography.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This article serves the sole purpose of adding value to the research process. Always take care of your own risk management and asset allocation.