DBB: Coronavirus Already Priced In

by Orchid ResearchSummary

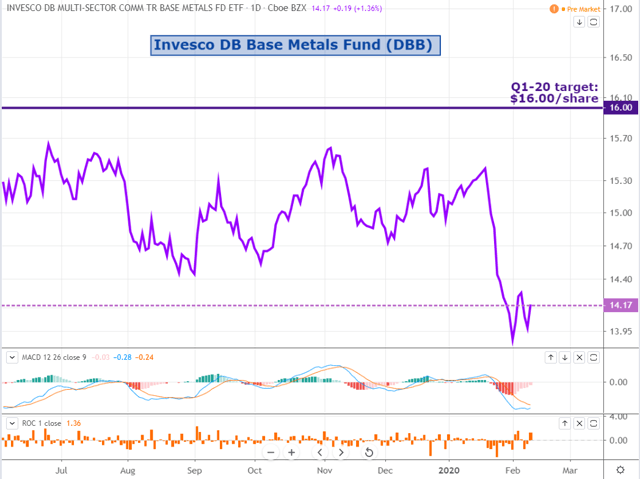

- DBB has experienced a tentative rebound since the start of February, after a sharp sell-off of 6% in January.

- Given the slowing pace of the spread of the coronavirus, macro fears, which surged in January as a result of heightened uncertainty, have begun to dissipate, albeit moderately.

- Although refined market conditions have unsurprisingly deteriorated, especially in China due to a lack of demand, the market is already positioned negatively.

- We, therefore, expect the rebound in DBB to continue into the end of Q1, driven by a further easing of macro fears, loosening financial conditions, and an eventual pick-up in demand in China.

- Our Q1-20 target for DBB is at $16 per share.

Investment thesis

In this regular note, we provide a discussion on fundamental dynamics across the industrial metals, with a special focus on copper, zinc, and aluminium, in order to formulate a clear view on the Invesco DB Base Metals Fund (DBB).

By tracking many real-time micro indicators across the base metals space, we help readers to better assess the real-time changes in refined market balances.

DBB has experienced a tentative rebound since the start of February, after a sharp sell-off of 6% in January.

Given the slowing pace of the spread of the coronavirus, macro fears, which surged in January as a result of heightened uncertainty, have begun to dissipate, albeit moderately.

Although refined market conditions have unsurprisingly deteriorated, especially in China due to a lack of demand, the market is already positioned negatively.

We, therefore, expect the rebound in DBB to continue into the end of Q1, driven by a further easing of macro fears, loosening financial conditions due to a dovish response from the Chinese central banks and other Asian central banks, and a likely pick-up in Chinese refined demand conditions as Chinese workers return to work.

It is, in this vein, that we maintain our Q1-20 target for DBB at $16 per share.

Source: Trading View, Orchid Research

About Invesco DB Base Metals Fund

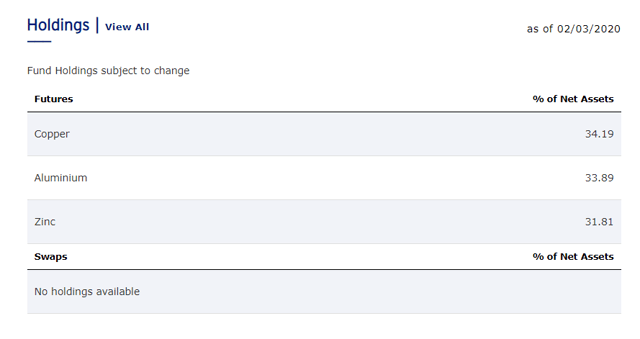

Invesco DB Base Metals Fund allows investors to assert exposure to some of the LME base metals.

The composition of the Fund is as follows:

Source: DBB, Orchid Research

DBB's assets under management total $115 million, with an average daily volume of $1.77 million and average spread (over the past 60 days) of 0.18%.

Its expense ratio is 0.80%, which makes it a relatively cheap ETF to get an exposure to the industrial metals complex.

Price trends

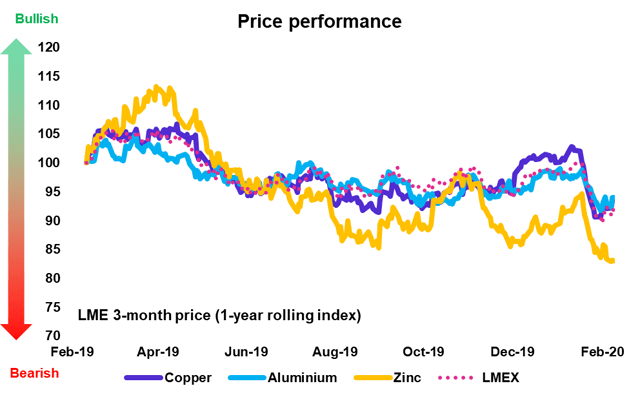

Source: Bloomberg, Orchid Research

Copper and aluminium have attempted a rebound since the start of February, with the former up 4% and the latter up 1%.

Zinc continues its decline, showing a month-to-date loss of 2.6% as we write these lines, after a drop of 3% in January. Nevertheless, the cross-correlation of zinc and its complex has trended higher since the start of February, which could suggest that the macro influence on zinc prices has become greater recently. Consequently, zinc could stabilize and push higher, alongside copper and aluminium.

We expect macro fears to gradually abate in the near term while the pace of new cases being infected by the coronavirus slows. This should result in additional upward pressure in base metals prices, which bodes well for DBB.

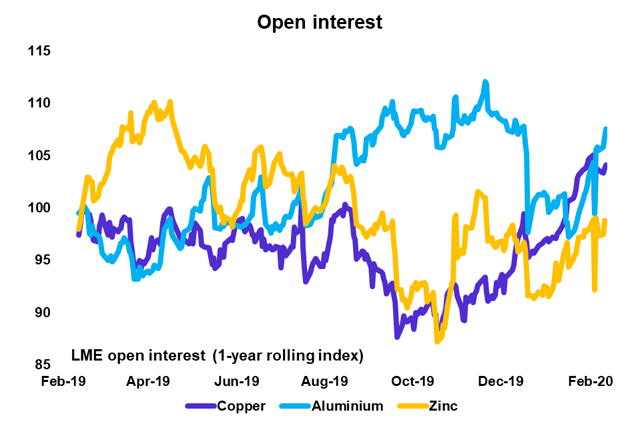

Open interest trends

Source: Bloomberg, Orchid Research

After a wave of short-covering at the start of February (as evident in the decline in open interest accompanied by firmer prices), fresh buying appears to have taken the baton (as evident by the renewed surge in open interest accompanied by firmer prices).

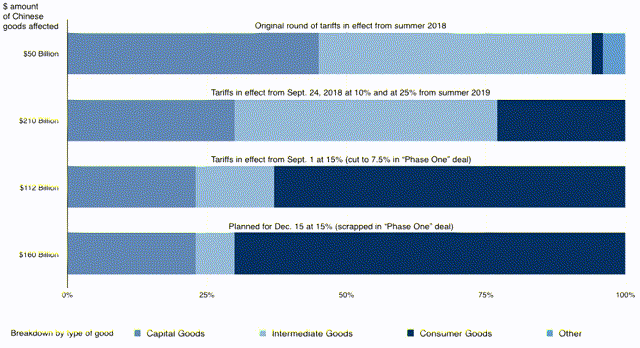

This could suggest that market participants are inclined to bet anew on the global recovery in the global economy, which was propelled by a noticeable de-escalation of trade tensions. Recent data points, which could be no longer be relevant due to the implications of the coronavirus on economic conditions, suggest that economic growth dynamics improved further at the end of 2019, including in China.

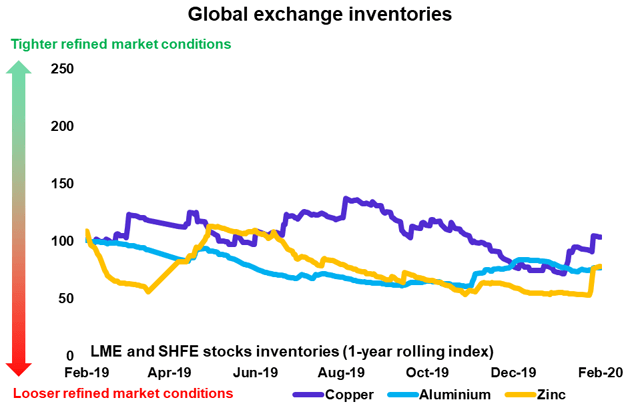

Exchange inventory trends

Source: Bloomberg, Orchid Research

Global exchange inventories in copper and zinc have surged significantly since the start of February, as a result of large SHFE inflows. This is a clear sign that onshore refined demand conditions have weakened as a result of the coronavirus outbreak.

Usually, after the Lunar New Year holidays in China, downstream buyers tend to restock, which results in SHFE outflows. This year, the pattern is different because macro fears have prompted downstream buyers to delay their restocking activity while smelters continue their operations, resulting in an increase in visible inventories.

RS Metrics confirms our view:

China copper smelters continue operations and cathode inventories grow as fabricators stop production due to mounting concerns around #coronavirus outbreak.

Source: RS Metrics

As the worst appears to be behind us, however, some restocking activity could emerge later in February (most likely in March/April), which could result in lower exchange inventories.

We will monitor closely the fluctuations in global exchange inventories to assess a possible change in refined demand dynamics in real-time.

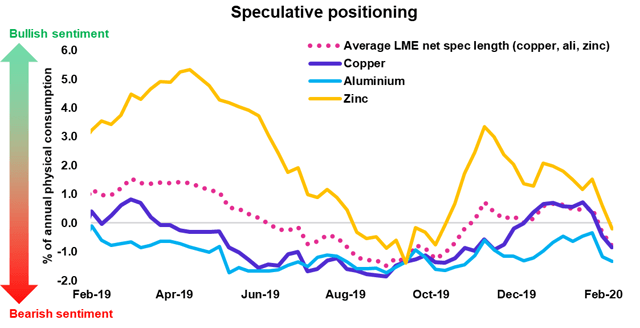

Positioning among the speculative community

Source: Bloomberg, Orchid Research

The unwinding in spec positioning in the LME base metals space continues so far this month, with speculators being net short copper, aluminium, and zinc. Spec positioning is nearly as ugly as it was at the height of the US-China trade conflict last September.

Source: Goldman Sachs

If macro fears abate, the excessively bearish spec positioning on the LME could normalize, resulting in an increase in financial demand for base metals, pushing prices higher in the process. This is, therefore, positive for DBB.

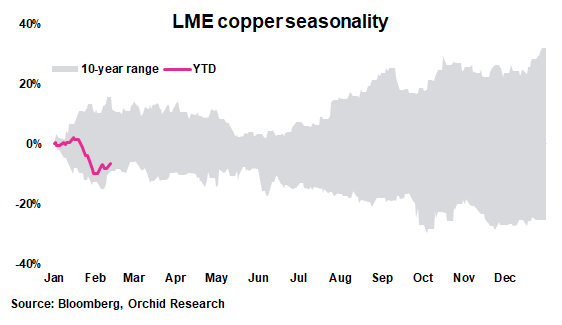

Seasonality

The seasonality is positive in Q1 for copper, aluminium, and zinc. Copper tends to rise the most in Q1. So far this year, copper (like the rest of its complex) has underperformed its seasonal patterns, as the chart below shows:

Source: Bloomberg, Orchid

The sharp deterioration in macro sentiment is to blame. However, we believe that base metals could play some catch-up to their seasonal patterns into Q1-end in case of a further easing of macro fears.

Closing thoughts

DBB has experienced a mild rebound since the start of February, after a sharp sell-off in January.

We concur that refined market conditions across the industrial metals have deteriorated recently, especially in China due to a weaker demand environment, as domestic economic activity is hindered by the coronavirus outbreak.

That said, we believe that the market is already positioned negatively, suggesting that most bearish news is already priced in. The likelihood of a short-covering rebound in base metals prices is elevated in the near term, in our view.

As the pace of the spread of the coronavirus appears to be slowing, excessive investor pessimism over the base metals outlook could normalize, which, in turn, could push DBB firmly higher.

Against this backdrop, we maintain our friendly outlook on DBB for Q1-20, expecting a high of $16.00 per share this quarter.

Did you like this?

Please click the "Follow" button at the top of the article to receive notifications.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Our research has not been prepared in accordance with the legal requirements designed to promote the independence of investment research. Therefore, this material cannot be considered as investment research, a research recommendation, nor a personal recommendation or advice, for regulatory purposes.