Ford Is In The Doghouse.

by Robert & Sam KovacsSummary

- Ford is once again in trouble after a poor quarter, with the share price back around $8.

- The dividend is well covered and the stock looks cheap, but investor sentiment is strongly against this name.

- Investing would be highly speculative, as there is still no proof that the company can effectively turn around this business.

- While a successful turnaround would generate massive value, it is unlikely to happen before 2021.

- In the meantime, Ford is likely to stay in the doghouse.

Written by Sam Kovacs

Introduction

Over the past 5 years, I’ve watched on the sidelines as Ford (F) has been kicked around by investors. A large number of bulls have repeated how undervalued Ford is. They did so when the stock price was $15, they did it again when the stock hit $12, and again at $10. Last year, when the stock went below $8, the bulls repeated one more time: Ford is cheap. And for a while, it looked like they were right, the stock bottomed out around $7.50 before recovering all the way up to $10.

Source: Open Domain

Unfortunately for shareholders, the positive momentum was short-lived. By the end of August, F had given back half of its gains. Then, earlier this month, when it reported its full year numbers, the stock plummeted back down to $8, where it currently sits.

What should investors do now? Is $7.50 - $8 the lowest Ford can go, or is it headed lower still? Is the dividend well covered, or is a cut likely anytime soon?

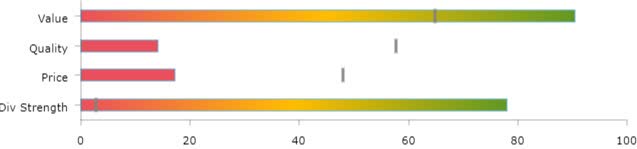

Ford has a dividend yield of 7.41% & trades around $8.10. Based on our MAD Scores F has a Dividend Strength score of 78 and a Stock Strength score of 31.

Source: mad-dividends.com

This article will present and discuss the factors which make me believe that dividend investors should avoid Ford for the foreseeable future. My article will be structured in the following way:

I will first consider the stock’s dividend profile, assessing the stock’s dividend safety and potential.

Then I will consider the stock’s potential for capital appreciation, using our value, momentum and quality factor scores.

Dividend Strength

When we look at dividend stocks, we are essentially looking for two things. The first is a safe dividend which will likely be paid for years to come. The second is a good combination of dividend yield and dividend growth potential. Some might imagine that because of Ford’s lack of dividend growth, we would naturally exclude the stock. However you’ll see in the section on dividend potential that that isn’t necessarily the case.

Dividend Safety

Last year Ford generated just $0.01 of earnings per share. Evidently, this isn’t great when you need to pay $0.60 in dividends for each share.

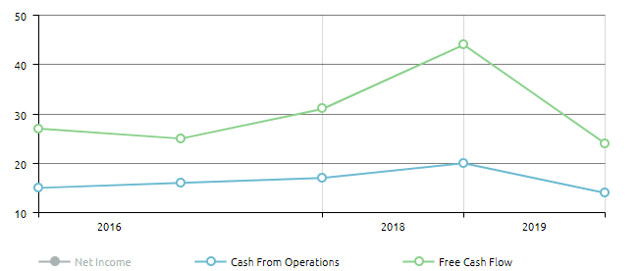

Yet the truth is, earnings payout ratios, while the preferred metric of many dividend investors, are really a secondary metric. Dividends are paid out of cashflow, not of earnings, and regardless of how well or bad Ford executes, it continues to generate enormous amounts of cashflow per share.

F pays only 14% of its operating cashflow as a dividend, putting it ahead of 76% of dividend stocks. The stock’s free cashflow payout ratio of 24% is lower than 72% of US dividend paying stocks.

| 31/12/2015 | 31/12/2016 | 31/12/2017 | 31/12/2018 | 31/12/2019 | |

| Dividends | $0.6000 | $0.7500 | $0.7500 | $0.7500 | $0.6000 |

| Net Income | $1.84 | $1.15 | $1.90 | $0.92 | $0.01 |

| Payout Ratio | 33% | 66% | 40% | 82% | 6000% |

| Cash From Operations | $4.04 | $4.94 | $4.52 | $3.75 | $4.40 |

| Payout Ratio | 15% | 16% | 17% | 20% | 14% |

| Free Cash Flow | $2.24 | $3.08 | $2.47 | $1.73 | $2.49 |

| Payout Ratio | 27% | 25% | 31% | 44% | 24% |

Source: mad-dividends.com

Ford has demonstrated that it is consistently able of generating about $4 per share in operating cashflow, and $2-$3 in free cashflow per share. This is more than enough to pay its dividend. The company has been paying its dividend since 2012. Before that, the company hadn’t paid a single cent since 2006.

This time around however, I don’t see a dividend cut happening any time soon. The company generates so much cash that it doesn’t need to divert the cash from the dividend back into the business. The company is already in the dog house, investor sentiment is against it, and the small subset of investors who still back Ford would likely give up hope if the company came to cut its dividend.

While Ford’s 7.4% yield might look scary to most, I find it highly unlikely that the dividend will be cut in the next 2 to 3 years.

Dividend Potential

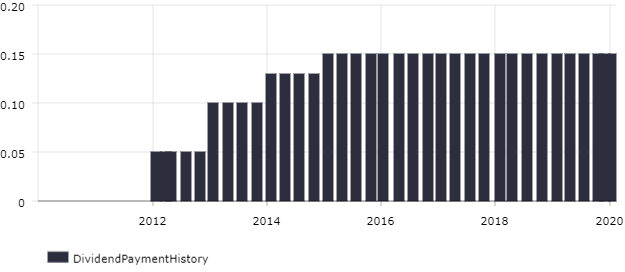

Ford's dividend yield of 7.41% is better than 91% of dividend stocks. The yield looks like an anomaly. When the company reinstated the dividend, the stock yielded just 2%. 3 years of aggressive dividend growth, and an ever receding price, have caused the stock to have this massive yield.

Source: mad-dividends.com

The dividend, which was reinstated in 2012, grew 3 straight years, but has remained flat since 2015.

Source: mad-dividends.com

With a yield of 7.4%. Nobody really needs any dividend growth. The reinvestment of dividends at such a yield often generate more income than stocks which are growing their dividend at aggressive rates.

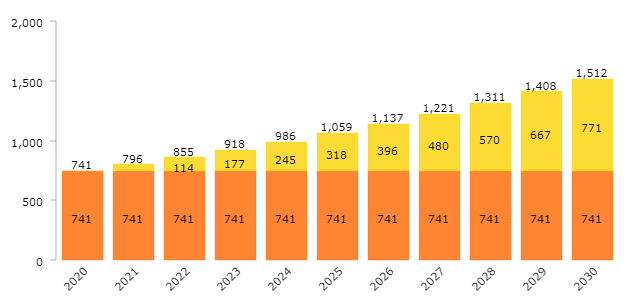

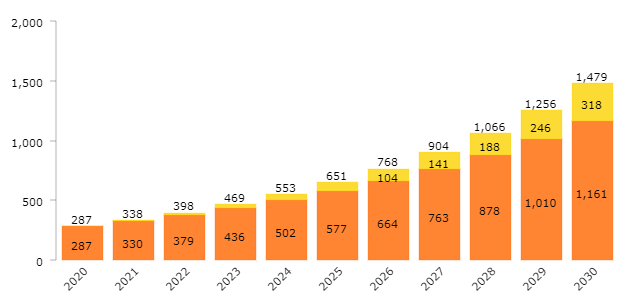

For instance, assume Ford’s dividend remains flat for the next 10 years, and you constantly reinvested that money at 7.4%, once a year. For the example, let’s say you invest $10,000

In 10 years, you’d generate $1,512 in dividend income. The orange bar shows the annual dividend on the initial $10,000, while the yellow bar shows dividends generated from reinvesting the proceeds.

Source: mad-dividends.com

If you invested in a stock which yields 2.5%, on the other hand, and that it increased its next dividend by 15%, and then continued increasing at that rate for the next 10 years, you’d still only generate $1,479 in dividends.

Source: mad-dividends.com

Now don’t get me wrong, a stock which can increase its dividend 300% in 10 years will likely appreciate much more in price than one that keeps it flat.

The caveat is that dividend growth is fleeting. Provided the dividend is safe, the current yield isn’t.

The instant income provided by high yielding positions has two advantages: it gives you more gunpowder to reinvest right now, and it requires less dividend growth in the future.

With stocks which yield 7.4% like Ford, no dividend growth is really needed for the stock’s dividend to significantly contribute to total performance.

Dividend Summary

The combination of the data presented above gives F a dividend strength score of 78 / 100. The earnings payout ratio looks awful. The dividend has been frozen since 2016. Yet neither of those facts preclude Ford from being a strong dividend stock, with a massive yield which is well covered.

Stock Strength

Ford’s dividend profile is surprisingly solid for a stock which yields so much. But what about the stock’s potential for capital appreciation in upcoming quarters? The company is undergoing a remodeling of the way it manages its business, has been making its available products a lot younger and a lot more dynamic, but it has been doing a poor job at it. In the last earnings call, CFO Tim Stone said:

While our 2019 results were not okay, I'm confident we have abundant opportunities to improve our operational execution, drive growth, strengthen our financial results, including cash flow and in the process, earn the confidence of our stakeholders.

But I must say, they haven’t earned my confidence. When asked what they would do to pinpoint the problems which led to operational underperformance, management didn’t really have an answer.

Ford is clearly a turnaround story. The question is whether or not it will be a successful one. The company is reorganizing its portfolio, which has led to lower sales, notably in the UK and in Asia. Its new Mustang Mach E apparently has as many as 32,000 pre orders all ready.

Ford’s ability to successfully market its products and regain market share in upcoming years is paramount to the company’s long term viability. In the last two quarters, the company lost money at an operating level. More losing quarters are possible, even likely in 2020.

But I now turn to my factor scores –value, momentum & quality-- to assess Ford’s potential over the next few quarters.

Value

- F has a P/E of 810.00x

- P/S of 0.21x

- P/CFO of 1.84x

- Dividend yield of 7.41%

- Buyback yield of -0.15%

- Shareholder yield of 7.26%.

These values would suggest that F is more undervalued than 90% of stocks, which, to the untrained eye makes Ford look dirt cheap. The price to operating cashflow measure is particularly damning. Investors believe the company is worth less than twice its annual operating cashflow.

While I find this hard to believe, I remember looking at Ford In 2015 and thinking: “hmm this looks quite cheap”. This happened again in subsequent years. Ford’s real value resides in its ability to turn itself around. Investors have rushed to bullish predictions time and time again, only to be on the wrong side of the trade.

Let’s take a little walk through a selected history of bullish headlines since 2015 on Seeking Alpha.

Year 2015: (price on January 1st: $15)

- “5 Reasons Why Ford Motor Is Not Dead Money In 2015”,

- “Ignore The Bears And Buy Ford”,

- “Here's Why You Should Go Long In Ford”,

- “Long Ford Into Earnings, $28 Long-Term Target Price”,

- “Time To Consider Ford Is Now: Real Gains On The Way”,

- “Ford: Exceptional Value In An Overbought Market”,

- “Why We Think Ford Is A Strong Buy”,

- “Ford Is Going To $17”,

- “Ford: The Bullish Thesis Remains Unchanged”

Year 2016 (price on January 1st: $14)

- “Ford Looks Very Well Positioned For 2016”,

- “7 Reasons To Love Ford In 2016”,

- “Reasons To Be Optimistic For Ford”,

- “Ford, Undervalued And Underappreciated”,

- “Ford Is A Steal Into Earnings”,

- “How To Buy Ford Shares At A 22% Discount To Their Already Crazy Cheap Price”,

- “Why You Should Buy Ford”

Year 2017 (price on January 1st: $12.5)

- “Ford Is A Large Company With A Small Price”,

- “2017 Will Finally Be Ford's Year”,

- “Ford Will Rebound”,

- “How Ford Could Rise To Over $13”,

- “Two Words - Buy Ford”,

- “8 Reasons Now Is The Time To Buy Ford”,

- “Ford: Rising With A Strong Foundation”

Year 2018 (price on January 1st: $12.5)

- “Ford Is A Buy”, “Ford - A Great 2018 Buy”,

- “Ford Is Going To Jump Higher”,

- “Backing Up The Truck For A 6.4% Yield”,

- “Ford: No Growth Could Still Make You Rich”,

- “Ford Motor: 6.3% Yield And Dirt Cheap”,

- “Buy Ford Stock For Its Attractive Valuation”,

- “It Is Finally Time To Buy Ford Motor Co.”

Year 2019 (price on January 1st: $8)

- “Ford: An Inexpensive Stock With A Large Dividend”,

- “Ford: This Stock Is An All-Time Bargain”,

- “Ford: 6% Dividend Yield Drives Strong Potential Returns”,

- “5 Reasons To Buy Shares Of Ford”,

- “Ford: Don't Fear The Future”,

Year 2020 (price on January 1st: $9.25)

- “4 Reasons To Like Ford For 2020”,

- “Buy Ford For The Sustainable 6.5% Dividend Yield”,

- “Ford Stock's Comeback Could Begin In 2020”,

- “Ford: A Value Play With Lots Of Upside Potential”

Many fellow Seeking Alpha authors, some of them among my favorite authors, have been bullish on Ford, mostly as a consequence of the stock’s valuation. Yet if anything, over the past 5 years, value has eroded as the stock declined time and time again.

I would caution investors that the appearance of value isn’t enough to unlock and generate it. A successful turnaround is required, and while the preliminary data of Ford’s electric vehicle branch is encouraging, it is still way too early to say which way this will go.

For the next few quarters, Ford’s stock price will be driven more by sentiment than by its valuation.

Value Score: 90/100

Momentum

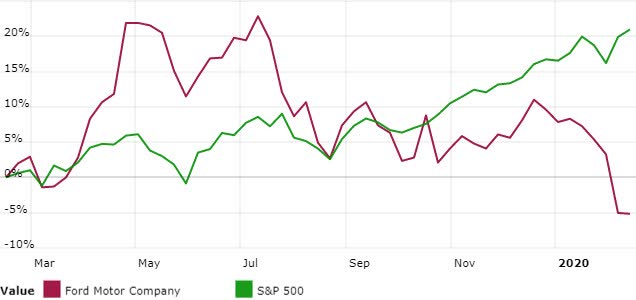

Ford's price has decreased -10.79% these last 3 months, -14.29% these last 6 months & -2.76% these last 12 months and now currently sits at $8.10.

Source: mad-dividends.com

F has better momentum than only 17% of stocks, which I find to be worrying. Historically in the stock market, poor momentum has usually been the bringer of more poor momentum.

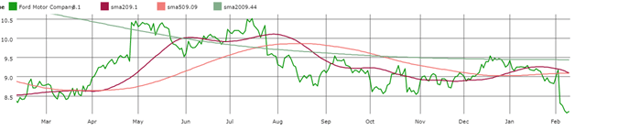

Source: mad-dividends.com

The stock price dropped like a rock after Ford released its latest earnings data. For the past 6 months, the stock was in a continuation pattern, meekly challenging the 200 day SMA unsuccessfully a few times. As far as momentum indicators go, Ford is in the dog house.

Until the company comes out with any positive numbers, it will likely stay there. Investor sentiment has pretty much vanished, and there might not be enough bottom fishers this time around to bid Ford’s stock back up to $10 on thinly spread out news.

Momentum score: 17 / 100

Quality

F's gearing ratio of 6.8 is higher than 86% of stocks, which isn’t great for a company which is undergoing a transformation. Ford's liabilities have increased by 2% this last year. Operating cashflow can cover 7.8% of F's liabilities, which is below average. Each dollar of F's assets generates $0.6 of revenue. 41.7% of F's capital expenditure is depreciated each year, which is poor. On the other hand Ford’s Total Accruals to Assets ratio of -12.1% puts it ahead of 63% of stocks.

Based on our multi metric scoring system ,F’s quality is better than only 14% of stocks. The lack of revenue and net income growth has strongly contributed to the poor quality score as well.

Quality Score: 14 / 100

Stock Strength Summary

When combining the different factors of the stocks profile, we get a stock strength score of 31 / 100 which is troublesome. While the stock has the appearance of value, it is going into its transition and transformation with a highly levered balance sheet. Investor sentiment has totally turned against the stock, and I wouldn’t risk betting against the market in this case. Further poor quarters could easily push the stock lower to $7 or even $6. If Ford’s turnaround shows any signs of success, investors should have plenty of interesting entry points, even at slightly higher prices, without all the uncertainty.

Conclusion

With a dividend strength score of 78 & a stock strength of 31, Ford is a controversial stock. The perma bulls will tell you this is Ford’s year and that the price is stupidly low. It is hard to argue with the valuation argument, yet there is no clear catalyst to the price increasing which doesn’t carry the risk of a corresponding decline in sales.

There are plenty of places to invest for dividend investors, I don’t believe taking a risk on Ford at current prices is worth it.

If you liked this article, please consider hitting the orange “follow” button at the top of the page to be notified the next time we publish articles on interesting dividend stocks.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.