Dip In TrustCo Bank's Price Provides Opportunity

by Sheen Bay ResearchSummary

- Earnings are expected to be unchanged in 2020 due to flat growth in net-interest income. Further, increase in non-interest income is likely to be countered by provisions charge.

- Quarterly dividend is expected to be maintained at the current level of $0.0681 throughout 2020. This estimate implies dividend yield of 3.4%.

- Stock price has declined this year, thereby providing an opportunity to buy TRST at a cheap price.

The stock price of TrustCo Bank Corp NY (TRST) has been on the downtrend through most of the year till date, which appears to be an overreaction to a difficult operating environment. It seems likely that the management’s expense control efforts and the maturity of expensive deposits will help sustain earnings in 2020. As a result of the expectations of flat earnings growth, the recent stock price decline appears unjustified. Consequently, the price dip provides opportunity for investors as the target price implies double-digit upside from the current market price. As a result, I’m upgrading the rating on TRST to bullish from neutral.

Expense Control to Offer Some Respite in Difficult Operating Environment

TRST focused on controlling operating expenses in 2019, which kept earnings from tanking in a hostile interest rate environment. As can be gleaned from management’s discussion in the fourth quarter conference call, TRST’s focus on expense control will continue through 2020. Areas offering opportunity for cost cutting include professional services, advertising expense, FDIC and other insurance expense, and other real estate expense. On the other hand, salary expense is likely to continue to rise due to a tight job market, which will push up non-interest expense. Overall, I’m expecting TRST’s non-interest expense to be almost flat this year, rising by only 0.8% year over year. This estimate incorporates management’s guidance for the first quarter of 2020. The management mentioned in the last conference call that they expect recurring non-interest expense to be in the range of $24.6 million to $25.1 million for the quarter.

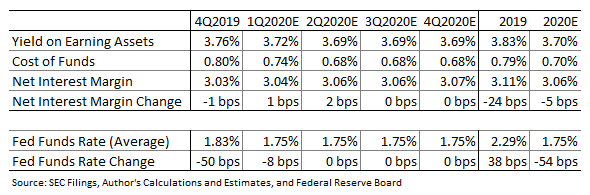

CD Maturity to Ease Pressure on Margin

TRST’s net interest margin, NIM, is expected to slightly improve in the first half of the year compared to the fourth quarter of 2019. This expected improvement is attributable to a greater reduction in funding cost compared to the anticipated fall in yields. Around $364 million, or 26% of TRST’s certificates of deposits, CDs, are scheduled to mature in 1Q2020, which will lead to a reduction in funding cost. As mentioned in the conference call, the maturing CDs carry a cost of around 2.22% on average, and the management hopes to replace them with new deposits offering much lower rates of 1.50% to 1.75%.

As a result of the support from funding cost, I’m expecting TRST’s NIM to increase by a basis point in 1Q2020 compared to the last quarter in 2019. I’m expecting NIM to improve by a further 2bps in the second quarter before stabilizing. For the full year, I’m expecting the average NIM to be 5bps below the average for 2019. The following table shows the yield, cost, and NIM estimates for all four quarters this year.

Strong Housing Market to Drive Loan Growth

TRST’s loan portfolio is concentrated in residential mortgage loans, hence the company’s loan growth is largely determined by the strength of the housing market. As per the latest reports, US housing starts reached the highest level in 13 years in December, which bodes well for the demand of TRST’s main product: mortgages. Moreover, the historically low unemployment rate has bolstered consumer confidence, which hit a 19-year high as per latest reports. This heightened consumer confidence is likely to continue to keep demand for mortgages elevated. The management also mentioned in the conference call that due to an increased backlog and continued demand, they are hopeful of having positive net loan growth for the first quarter of 2020.

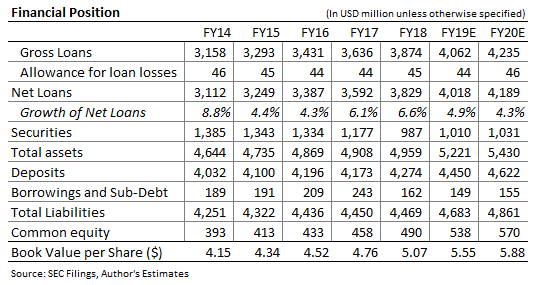

On the other hand, some pressure on loan growth is expected from political uncertainty ahead of the presidential elections. Overall, I’m expecting TRST’s loan growth to continue to remain high this year. I’m expecting the company’s net loans to grow by 4% year over year in 2020, as shown in the table below.

Flat Growth in Earnings Expected

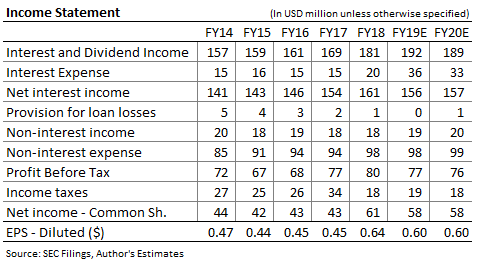

The combined effect of higher average earning assets and lower average NIM compared to last year is likely to lead to a constrained growth in net interest income. I’m expecting TRST’s net interest income to increase by a low 0.5% year over year in 2020.

The limited growth in net interest income is expected to be the major reason for flat earnings growth this year. In addition, increase in non-interest income is likely to be negated by a rise in provisions charge and non-interest expense. As a result, I’m expecting TRST’s earnings to be almost unchanged this year compared to 2019. As seen in the following table, I’m estimating TRST to post earnings of $58 million, or $0.60 per share in 2020.

Based on the expectations of flat earnings growth, I’m expecting dividend payout to remain unchanged this year. My estimated quarterly dividend payout of $0.0681 per share implies dividend yield of 3.4%.

Recent Stock Price Decline Provides Opportunity

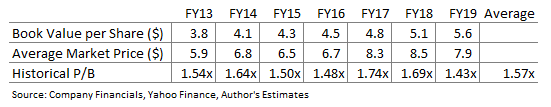

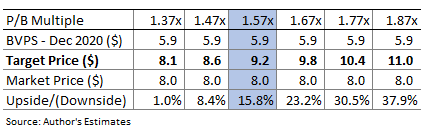

I'm using the average price to book ratio, P/B, to value TRST. As shown in the following table, the stock has traded at an average P/B multiple of 1.57 in the past.

Multiplying this average P/B ratio with the forecast book value per share of $5.9 gives a target price of $9.2 for December 2020. This price target implies a significant price upside of 15.8% from TRST's February 11 closing price of $7.95. The following table shows the sensitivity of the target price to P/B ratio.

Due to the double-digit price upside I’m adopting a bullish rating on TRST. Along with the potential for capital appreciation, the stock is also offering a decent dividend yield of 3.4%. Consequently, TRST appears to be a feasible investment. Investors should conduct further research before considering investing in the stock.

The above-mentioned target price is almost unchanged from the previous price target given in my last report on TRST. However, I have upgraded the stock from neutral to bullish as the recent decline in stock price has opened up room for price upside. TRST’s market price has declined by around 8% in calendar year 2020 to date. Due to the expected stability in earnings, I believe the stock price dip this year was not completely warranted. Therefore, the recent dip appears to be a good opportunity to gain exposure to TRST at a cheap price.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Disclaimer: This article is not financial advice. Investors are expected to consider their investment objectives and constraints before investing in the stock(s) mentioned in the article.