Best Drill Interceptions In The Metals Mining Sector For The Week Ended February 9, 2020

by Gold PandaSummary

- Walker River with Bonanza grade gold interception in Nevada.

- Gran Colombia discovers new high-grade gold zone at Marmato in Colombia.

- Erdene continues to deliver good drill results from its Mongolian properties.

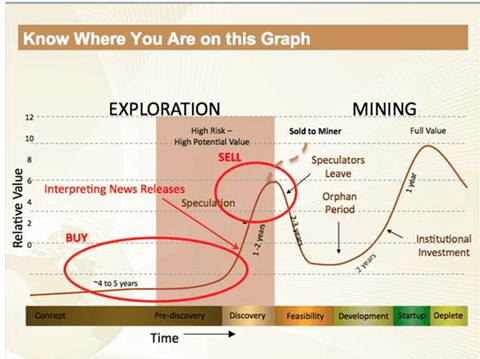

(Source: Exploration Insights)

Introduction

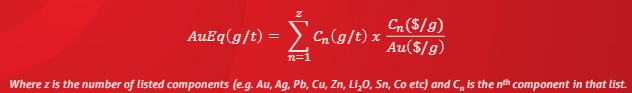

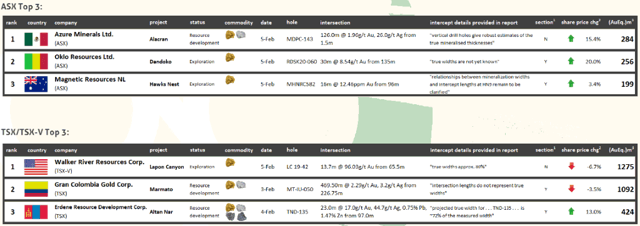

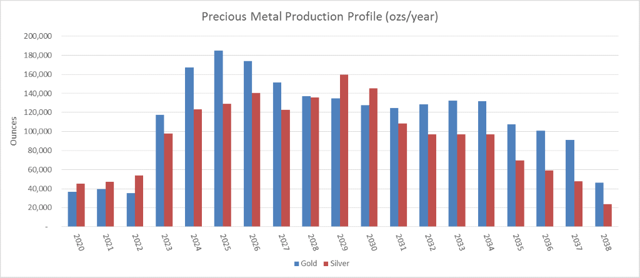

If you're into investing in the mining sector, you should know the above chart very well. This series covers the three projects with the most significant drill interceptions over the past week, as well as the prospects of the companies which own these projects. I will use data from the weekly bulletin of Opaxe, which can be found on its website. Note that the drill interceptions are converted into grades of gold equivalents using the following formula:

(Source: Opaxe)

Opaxe has chosen gold as the metal equivalent for all conversions, as it considers gold to be the most widely used and best-understood benchmark to determine or appreciate the grade tenor of a drilling intercept.

(Source: Opaxe)

1) Lapon gold project in the USA

On February 5, Walker River Resources (OTC:WRRZF) announced that it intersected 13.7m @ 96.03g/t Au from 65.5min hole LC19-42 at its Lapon project, with true width of around 80%. This is equal to 1,275(AuEq.)m and included an interval of 1.5m @ 547.05g/t Au.

Hole 42 was drilled in a new zone which was discovered in 2019 when hole 19-35 returned 22.9m @ 1.37g/t Au.

Just over a year ago, Walker's share price rose by 28% on the day it announced it intersected 13.7m @ 31.1g/t Au in hole LC18-29. However, the company's shares fell when the results from hole LC19-42 were released.

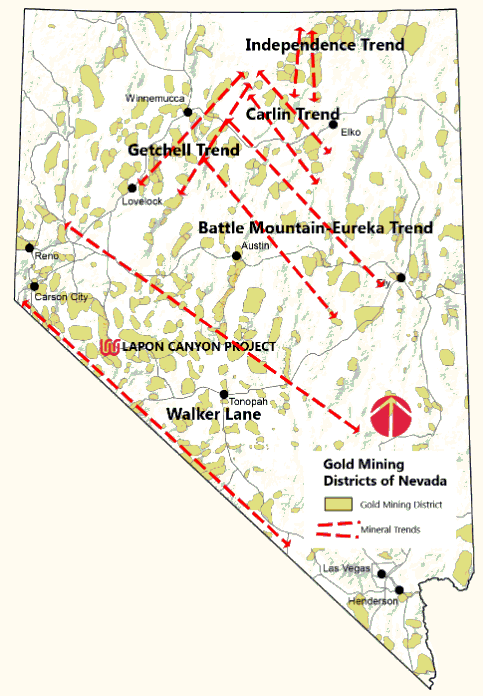

Lapon is located in Nevada, some 60 km south of the town of Yerington.

There's a state grid power transmission line that passes through the project and the property is accessible through secondary state roads from the main highway.

Lapon is located within the Walker Lane shear zone and small-scale high-grade mining as it dates all the way back to 1914.

Walker River thinks that Lapon exhibits the potential for high-grade vein type gold mineralization.

2) Marmato gold project in the Colombia

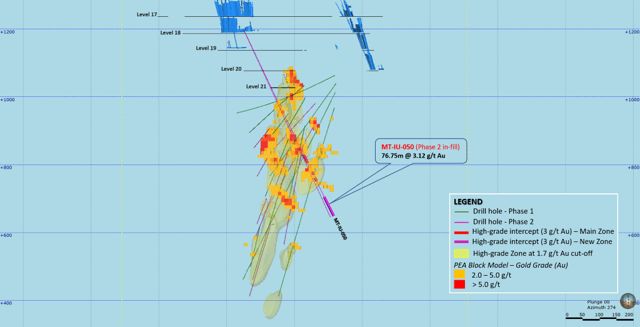

On February 3, Gran Colombia Gold (OTCPK:TPRFF) released results from the last eight holes from the 2019 infill drilling program at its Marmato gold project, and the best interception was 469.5m @ 2.29g/t Au and 3.2g/t Ag from 226.75m in hole MT-IU-050. This is equal to 1,092(AuEq.)m and the company said the hole marked the discovery of a new zone in the footwall of the Marmato Deeps Zone.

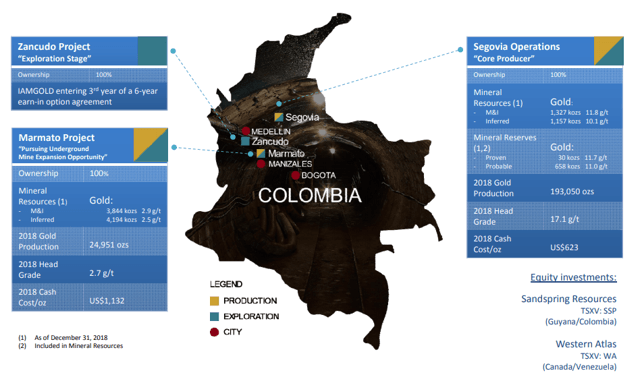

Marmato is a small underground mine located in the Caldas department in the Middle Cauca gold district. The area has been in continuous production since Spanish colonists seized control of the Marmato mines in 1527:

(Source: Gran Colombia Corporate Presentation, October 2019)

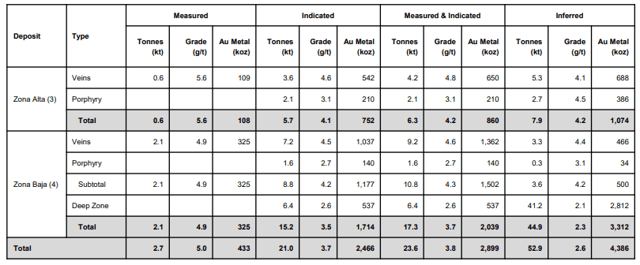

Gran Colombia considers Marmato to be among the top 20 undeveloped global gold deposits and I think the exploration potential looks amazing with gold resources of more than seven million ounces across all categories:

(Source: Gran Colombia)

In October, the company released a preliminary economic assessment for Marmato which foresees the production of 2.2 million ounces of gold at an average total cash cost of $799 per ounce over a mine life of 19 years. The initial capital cost for the Deep Zone mining operation is estimated at some $269 million.

(Source: Gran Colombia)

Gran Colombia plans to spin out a new listed vehicle in a reverse takeover transaction with Bluenose Gold (OTCPK:ALLXF). My main concern about Marmato is that it's located in a region over-run by illegal miners.

3) Altan Nar polymetallic project in Mongolia

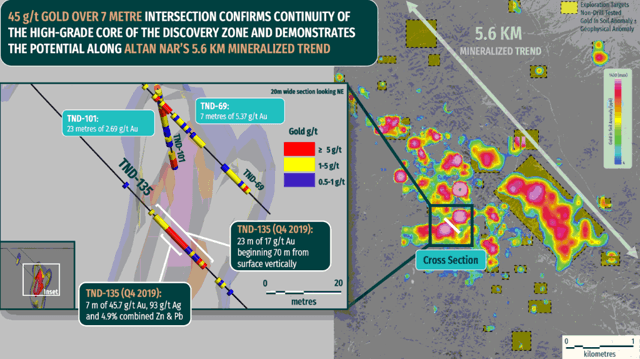

On February 4, Erdene Resource Development (OTCPK:ERDCF) released the results from the Q4 2019 exploration program on its Altan Nar, Khundii and Ulaan licenses in Mongolia and the best interception during the period was 23m @ 17g/t Au, 44.7g/t Ag, 0.75% Pb and 1.47% Zn from 97m in hole TND-135 at Altan Nar. This is equal to 424(AuEq.)m and drilling Altan Nar returned multiple shallow intersections of over 50 g/t Au in Q4.

(Source: Erdene Resource Development)

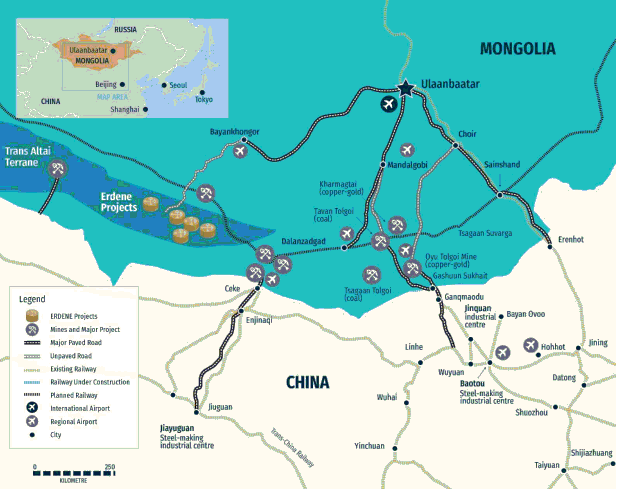

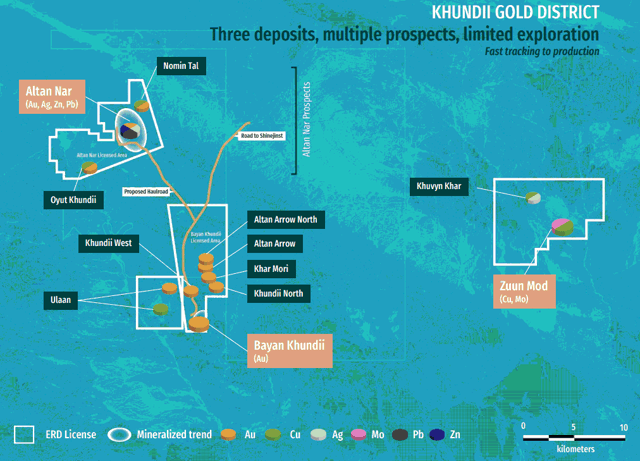

Altan Nar, Khundii and Ulaan are located in the Khundii gold district in southwest Mongolia:

(Source: Erdene Resource Development)

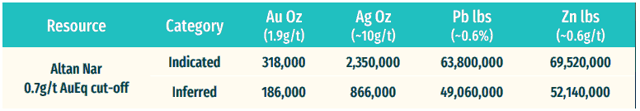

Altan Nar is open in all directions and already has a significant resource:

(Source: Erdene Resource Development)

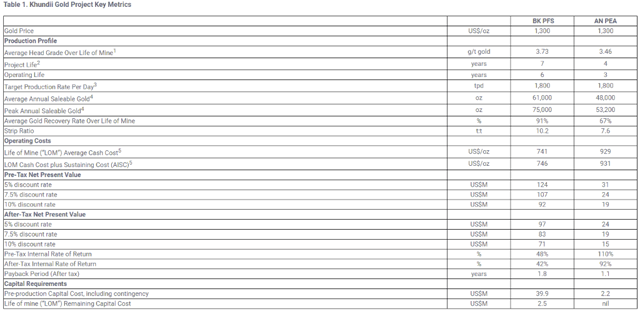

In October 2019, Erdene released an updated Preliminary Economic Assessment for the project, which showed an after-tax net present value at a 5% discount rate and a $1,300/oz gold price of $24 million and an internal rate of return of 92%. The initial capex stands at just $2.2 million.

(Source: Erdene Resource Development)

Conclusion

Walker River's Lapon project looks like a classic Nevada gold story. There's decent infrastructure around the project but this investment story is still in very early stages. Walker River itself is a pretty small company so good results like last week's can become short-term catalysts for the share price. I think this one looks like a speculative buy.

I think that Gran Colombia's Marmato gold project has amazing potential and can become a tier 1 asset in time. However, I have serious doubts that the expansion of the mine will go smoothly, as opposition from the local population seems to be strong. I covered Gran Colombia in more detail at the end of last November here.

Erdene has amassed a portfolio in Mongolia with combined resources of more than a million ounces of gold equivalent. The near-term plan is to turn Bayan Khundii into a 60,000 ounce per year open-pit mine and I think it's a relatively small-size project with a very good internal rate of return. With a market capitalization of C$53.7 million, Erdene looks undervalued.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am not a financial adviser. All articles are my opinion - they are not suggestions to buy or sell any securities. Perform your own due diligence and consult a financial professional before trading.