EXD: Still Showing Value Compared To The Other Similar Eaton Vance Funds

by Nick AckermanSummary

- EXD is still not getting the same love as other Eaton Vance option funds.

- The strategy switch it embarked on is coming up on being deployed for almost one full year.

- We are seeing similar returns to its peers, but still trading at a value.

Co-produced by Stanford Chemist

The Eaton Vance Tax-Managed Buy-Write Strategy Fund (NYSE:EXD) changed its strategy back on February 8th, 2019. It has been almost one full year with the new strategy in place. The strategy and name change made the fund's operations much more similar to two other Eaton Vance option strategy funds; Eaton Vance Tax-Managed Buy-Write Opportunities Fund (NYSE:ETV) and Eaton Vance Tax-Managed Buy-Write Income Fund (NYSE:ETB). Even their names can cause confusion if you aren't paying attention! We last looked at EXD in October and the opportunity is still there. With the one-year mark almost in the bag, I thought we would take another quick look at how things are going.

Since the fund overhauled and deployed the new strategy, the NAV performance has been quite similar to its peers. The major difference here is its persistent discount, while its peers trade at premium levels. Though, as we will see in the charts below, this has been playing out as expected.

All three funds implement a strategy of writing covered calls against indexes. For EXD specifically, it describes that it "consists of owning a diversified portfolio of common stocks and selling covered index call options." Eaton Vance also breaks its portfolio into "two segments." One in which it "seeks to exceed the total return performance of the S&P 500" and another where it "seeks to exceed the total return performance of the NASDAQ 100 Index." It will also "sell on a continuous basis S&P 500 call options on at least 80% of the value of Segment One and NASDAQ 100 call options on at least 80% of the value of Segment Two."

I'll share below what I had put in my previous article:

This strategy is very similar to ETB and ETV, hence, all three of these funds would be expected to trade around similar levels. The option strategy deployed by the three funds have a main benefit; they collect the option premium from writing these index calls and never have the underlying portfolio called away. This can be an enticing strategy as they can let their "winners continue to win." This is in contrast to funds that write underlying options on individual positions in the portfolio. However, the caveat to this is that they are "cash-settled" and, in theory, an index could trade up infinitely. Meaning that they could show large losses from the options writing strategy. However, if this were to happen that would mean that the fund's underlying holdings were also going to infinite so this is how they are "covered" from infinite liability.

We hold EXD in our Tactical Income-100 portfolio at the CEF/ETF Income Laboratory. The fund is currently rated as a "Hold." However, at its current discount of -2.45%, we aren't too far away from our "Buy" target of -5%. We would be looking to "Sell" at a 5% premium if a swap candidate presented itself.

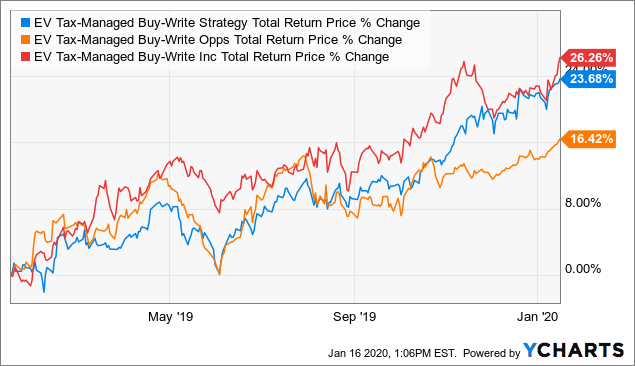

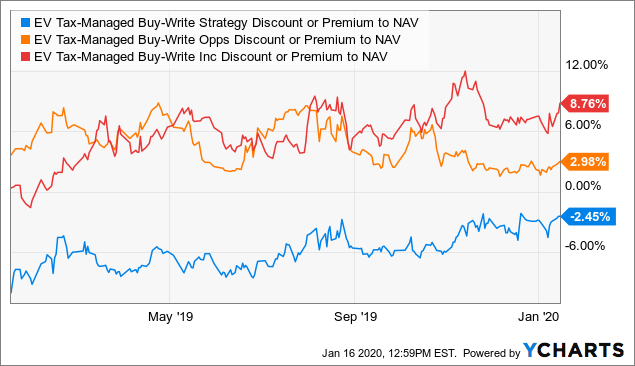

With the funds being so similarly named, it might help to clarify that the blue is EXD, orange is ETV and Red is ETB in the following charts. To also help clarify, one can see "Strategy" in the name for EXD, "Opps" for ETV, and "Inc" for ETB.

Data by YCharts

The above chart is a reflection of the total return over the last one-year period between the three funds. What we can take away from here is that EXD and ETB have both outperformed ETV on this metric by quite a large margin. This has a lot to do with the fact that ETV was the most overvalued fund for a significant period of time. This crown has now been handed off to ETB as being the richest.

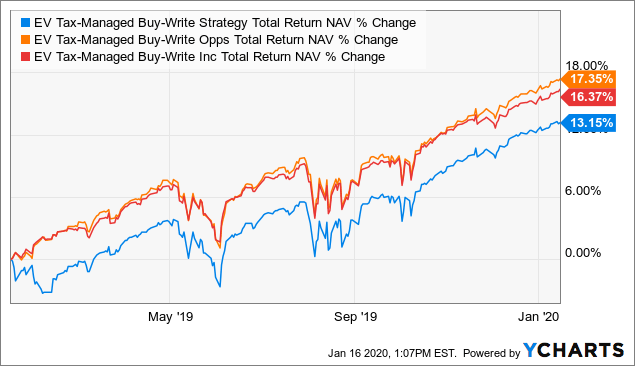

Data by YCharts

Here's a chart of total NAV return over the past one-year. At first glance, it appears that EXD has significantly underperformed. This would be correct, as the new strategy wasn't implemented until February. That means that EXD didn't get to partake in that large rebound we saw in late Q4 of 2018. At that time the fund was still utilizing an options strategy with a bond portfolio.

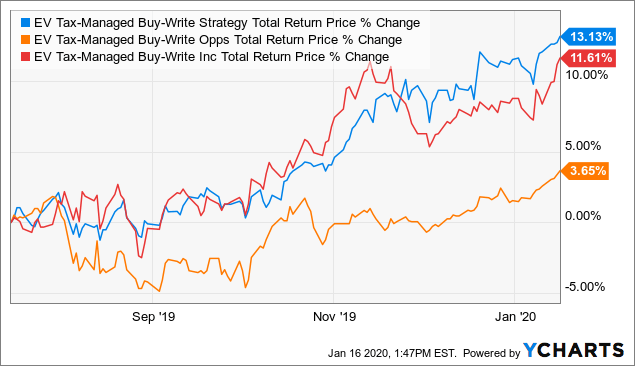

Data by YCharts

Now taking a look at the total market price return over the last six months, we see that EXD has been performing as expected. The fund has begun to experience the positive pressures of being the most undervalued of the three, in my opinion. This also helps us see that ETV's underperformance really began about three months ago. That is, on a market return basis as we see below, the NAV performance has been quite similar.

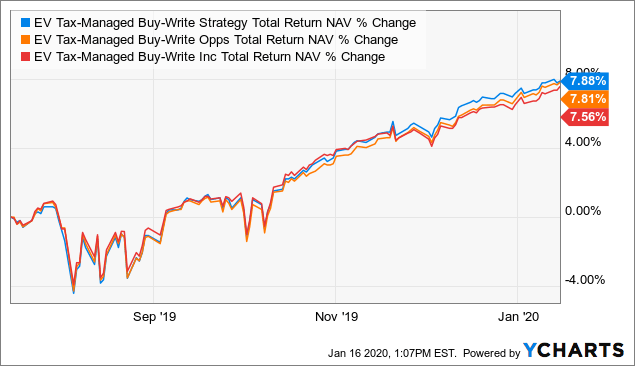

Data by YCharts

Here we are looking at a total NAV return for the last six months. This gives us a good reflection on just how similar EXD can trade to its peers. This is taking out the January rebound that ETV and ETB experienced. In fact, this puts EXD at the top of the trio ever so slightly. It is only a few basis points above ETV, but still a point to be made nonetheless.

Data by YCharts

Now, taking a look at the fund discount and premium levels. We can see for the last one-year EXD has remained the unloved EV option fund. To be fair, EXD has come a long way from a year ago and that could be making some investors nervous. The fund was hitting discount levels of over -8% a year ago. In fact, the fund has a five-year average discount of -9.76%. This type of discount/premium contraction can really distort the fund's z-score. The one-year z-score is coming in at +2.06.

However, this is why the z-score isn't of much use on its own. It is a great place to start a screening process. Although, until one starts looking into the fund and what the potential causes for such underlying moves are, it really isn't useful as a standalone metric when coming up with ideas for buying or selling.

It is also important to point out that in the prior October piece, EXD was at a -5.82% discount. Of course, this was much more appealing, but I remain confident that the gap should still come in closer. If we can continue to get an upward market, it will be in a positive direction and not a closer valuation due to lower prices.

My thoughts going forward are that EXD has a much better "buffer" of potential drawdown should we see the markets struggle in 2020. Primarily being that ETV and ETB are at premiums. ETB is actually multi-year highs that we don't see very often. Back in October, I sold out of my ETB position to add to EXD. I chose to hold onto ETV for the time being, which I still am. However, I am now considering selling out of ETV as well to add to my EXD position.

Although, we have been off to the races since the beginning of the year represented by the broader indexes. We are only in the first couple of weeks of the new year too. Since the market hasn't given us any recent pullbacks or corrections, I am hesitant to add anything significant from my cash stockpile. Though, I am still nibbling here and there where I can find opportunities. This is primarily due to my drive for increasing my cash flow month after month. If I'm not buying at least something, then my cash flow can remain stagnant. This can lead to an opportunity cost risk when holding too much cash for too long.

Conclusion

Overall, I believe investors are still playing catch-up on realizing EXD's changes to be more similar to the other EV option funds. We have seen a bit of a divergence in the discount/premium levels, but it still isn't in line with what we are seeing in ETV and ETB. If I was still a holder of ETB, I would definitely be making the switch to EXD, a switch that made sense for myself and that I executed. Additionally, I'm considering doing the same swap from ETV to EXD. The hesitation would be that ETV isn't trading at a level that is extraordinarily out of the ordinary for the fund. Hence, I could see it trading higher or similar to EXD going forward.

One word of caution for EXD though, the size of the fund. EXD is currently just over $103 million in total managed assets. This can be compared to ETV at over $1 billion and ETB with over $400 million. This is a downside, especially for larger investors, since the average daily volume is only 42k. I wouldn't be surprised if we saw Eaton Vance just merge EXD into ETB. Currently, ETB also only shows daily average trading volume at 57k. A merger could potentially help investors with liquidity needs. Of course, this is just a bit of a side tangent/speculation.

One more thing, EXD currently pays out a distribution rate of 8.21%. This works out to a monthly amount of $0.0708 per share. This is quite attractive as many other solid funds are starting to pay out less and less percentage-wise as their prices increase. Of course, EXD isn't immune to a higher share price that we have experienced over the last one year going from $10.13 a year ago to $10.35 today. This isn't too significant of a move, but also consider that it was at a distribution rate of 8.9% in October.

We should be getting our Annual Reports from Eaton Vance at the end of February if history is any guide. This would be for the period ended on December 31st. We will then be able to crack this fund open a bit more and get a bit more detail on more specifics of the fund going forward.

Profitable CEF and ETF income and arbitrage ideas

At the CEF/ETF Income Laboratory, we manage ~8%-yielding closed-end fund (CEF) and exchange-traded fund (ETF) portfolios to make income investing easy for you. Check out what our members have to say about our service.

To see all that our exclusive membership has to offer, sign up for a free trial by clicking on the button below!

Disclosure: I am/we are long EXD, ETV. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This article was originally published to CEF/ETF Income Laboratory members on January 16th, 2020.