Yamana Gold: Digging Into The FY-2019 Report

by Taylor DartSummary

- Yamana Gold reported FY-2019 production results, meeting both cost and annual production guidance, and is expecting similar operating metrics for FY-2020.

- The company raised its dividend yet again last week, with the company now having a 1.25% yield at current prices based on a $0.05 annual dividend.

- While the company has certainly made progress reducing net debt and increasing its yield, earnings were flat year-over-year, and the company remains a cost laggard compared to peers.

- Based on this, while I see Yamana Gold as a Hold, I continue to favor other gold majors in the sector with higher margins.

It's been a solid start to the Q4 earnings season for the gold majors (GDX), with Yamana Gold (AUY) being the most recent name to report. The company came roughly in line with cost and production guidance for FY-2019, with gold-equivalent production [GEO] of 972,000 ounces, and all-in sustaining costs of $999/oz. Similar to last year, the 100% owned Jacobina Mine and the 50% owned Canadian Malartic Mine were the star performers among operations, with costs coming in 17%, and 9% below the industry average, respectively. While the company met its target and raises its dividend more than 150% last year from $0.02 to $0.05, the company continues to be slightly inferior to other gold majors as it operates out of Tier-2 jurisdictions, has lower margins, and pays a lower yield. Based on this, I continue to prefer the other gold majors in the sector, but view Yamana Gold as a Hold.

(Source: Company Presentation)

Yamana Gold finished 2019, meeting the majority of its targets, with guidance in line and a significant improvement de-leveraging its balance sheet. The company's net debt dropped from $1.66 billion to $889 million, down 46% year-over-year. Meanwhile, the bonus for shareholders was the massive increase in the dividend, from $0.02 this time last year to $0.05 on an annual basis going forward from Q1 2020. This has given the company a small separator from Tier-2 jurisdiction gold major Kinross Gold (KGC), which pays no yield currently. However, Yamana Gold was one of the only gold companies with flat annual earnings per share [EPS] year-over-year, despite a nearly 20% rise in the price of gold. When compared to Barrick Gold's (GOLD) 45% growth in annual EPS, Agnico Eagle's (AEM) 209% growth in annual EPS, and Kinross Gold's 240% growth in annual EPS, it pales in comparison. Therefore, while Yamana Gold has made some progress with a higher yield, it's lacked its peers in growth. Let's take a closer look at Yamana's operations below:

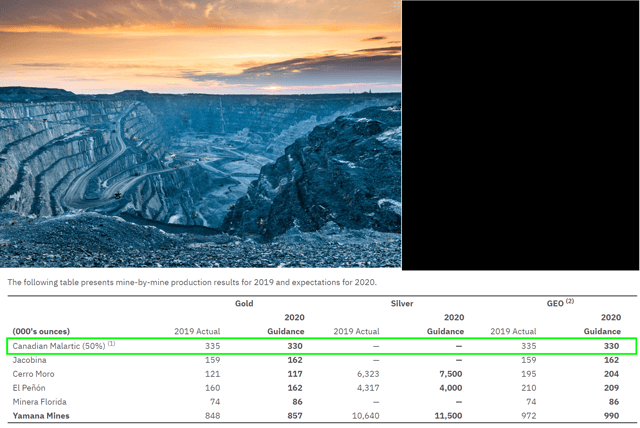

(Source: Company News Release, CanadianMalartic.com)

Yamana Gold's most significant contributor to annual GEO production continues to be its 50% owned Canadian Malartic mine, with the other 50% of the mine owned by Agnico Eagle. Yamana Gold's share of gold production for FY-2019 came in at 335,000 ounces at all-in sustaining costs of $782/oz. These are exceptional numbers, and well below the industry average of $970/oz. If we look ahead to FY-2020, annual production at Canadian Malartic is expected to be roughly flat year-over-year at 330,000 ounces of gold production, and costs are going to trend higher, given the guidance mid-point of $835/oz.

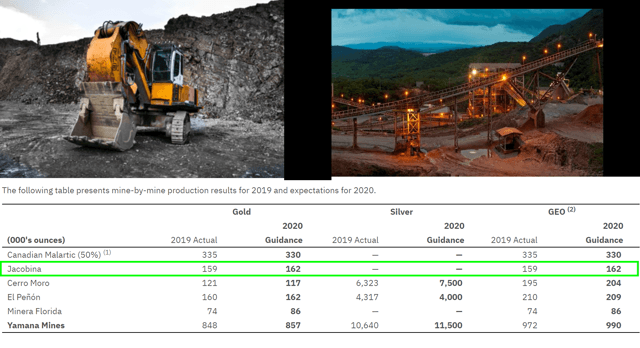

(Source: Company Presentation, Company News Release)

Elsewhere, in Brazil, Yamana Gold's Jacobina Mine had an exceptional year, with record annual production of 159,500 ounces. This figure was more than 4% above production guidance of 152,000 ounces, and production was up just over 10% year-over-year from the 144,000 gold ounces produced in FY-2018. Annual gold production is expected to trend higher over the next couple of years, with FY-2020 guidance of 162,000 ounces, with the potential for 170,000 ounces of gold production in FY-2021. All-in sustaining costs for Jacobina came in at $845/oz, with a slight increase expected for FY-2020 based on the guidance mid-point of $875/oz. Yamana Gold is currently exploring the possibility of increasing throughput dramatically at Jacobina in 2023, with the potential for a ramp-up to 7,500 to 8,500 tonnes per day. Assuming a positive Feasibility Study with economics in favor of this, Jacobina could be producing over 200,000 ounces of gold per year by 2023, with a stretch target of 225,000 ounces. A production increase at Jacobina would undoubtedly help to lower company-wide costs, as Jacobina remains the 2nd lowest cost mine in Yamana Gold's portfolio.

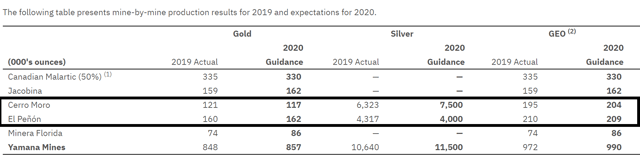

(Source: Company News Release)

Unfortunately, both Cerro Moro and El Penon continue to be cost laggards in Yamana Gold's portfolio, with all-in sustaining costs of $970/oz and $1,003/oz, respectively, in FY-2019. These two mines made up just over 40% of GEO production combined, and dilute the benefits of having Canadian Malartic and Jacobina in the portfolio, with weighted average costs across the two mines of roughly $820/oz. While El Penon's costs are expected to trend slightly lower in FY-2020 based on a guidance mid-point of $945/oz, it won't do much to move the needle from a consolidated standpoint across the company's total operations.

Yamana Gold's FY-2020 production guidance calls for 990,000 gold-equivalent ounces, up slightly from the 972,000 gold-equivalent ounces produced in 2019. Meanwhile, all-in sustaining costs are expected to remain the same, with guidance provided of $980/oz to $1,020/oz, in line with the $999/oz reported for FY-2019. Therefore, while Yamana Gold has entered 2020 with a much higher dividend yield, it's still the same Tier-2 jurisdiction gold major with slightly higher costs than its peers. Let's move over and see how the company's earnings trend looks below:

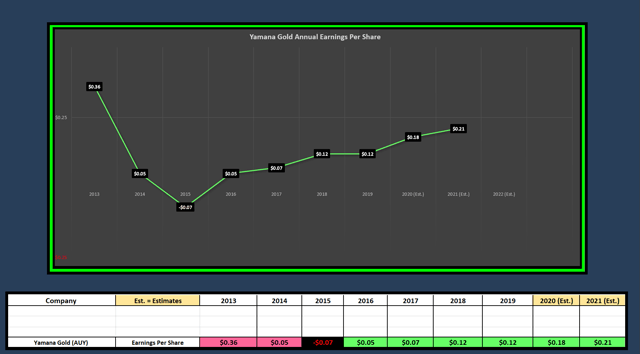

(Source: YCharts.com, Author's Chart)

As we can see from the chart above of annual earnings per share, Yamana Gold's annual EPS continues to trend higher, though it was flat year-over-year in FY-2019. Fortunately, FY-2020 earnings estimates are looking for growth of 50% ($0.12 to $0.18), and this is undoubtedly a step in the right direction. However, even if the company manages to grow annual earnings per share by 50% next year to $0.18, the stock is trading at 23x forward earnings, a valuation that's not particularly cheap here. Therefore, investors are going to want to see Yamana Gold beat annual EPS estimates of $0.18; otherwise, it's hard to imagine the stock justifying a share price above $4.50.

(Source: Company News Release)

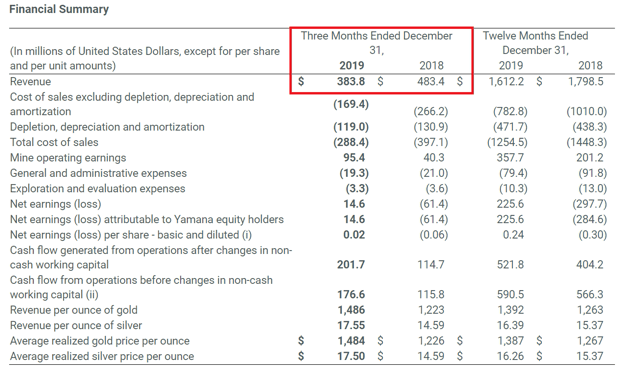

Typically, I prefer to own the highest growth names in an industry, and those that are growing both annual EPS and revenues at the same time. While Yamana Gold's annual EPS is likely to increase substantially next year, revenues have declined in the past two quarters on a year-over-year basis, with the most recent quarter coming in at $383.8 million, down 21% year-over-year from Q4 2018's $483.4 million. This significant drop-off is due to the sale of its Chapada mine, which was necessary to help pay down debt and de-leverage the balance sheet, but it's been a massive drag on revenues in FY-2019. Fortunately, the company should be up against easier comps next year, so this should be less of a problem starting in Q2 2020.

(Source: Mining.com)

Overall, Yamana Gold had a solid year in FY-2019, but with so many gold producers out there in Tier-1 jurisdictions with better cost structures, Yamana Gold is a tough sell. While the significant jump in the annual dividend to $0.05 has given the company a 1.25% yield at current prices, this still pales in comparison to Barrick Gold's 1.50% yield, and Newmont Goldcorp's (NEM) 1.35% yield with a buy-back program in place. Therefore, while Yamana Gold certainly made some steps in the right direction with the increased dividend, I continue to give the stock a Market Perform rating and see the stock as a Hold in the sector. When it comes to the gold majors, I prefer the Tier-1 producers with lower costs, and Yamana Gold is still not one of them. The key going forward for the company will be finding a way to reduce costs or materially increase annual GEO production above 1.2 million ounces. This would serve as a differentiator among peers, as the company would then have production growth going for it, something the majority of the gold majors are lacking.

Disclosure: I am/we are long GLD. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Disclaimer: Taylor Dart is not a Registered Investment Advisor or Financial Planner. This writing is for informational purposes only. It does not constitute an offer to sell, a solicitation to buy, or a recommendation regarding any securities transaction. The information contained in this writing should not be construed as financial or investment advice on any subject matter. Taylor Dart expressly disclaims all liability in respect to actions taken based on any or all of the information on this writing.