Abercrombie & Fitch's Restructuring Is Attractive At The Current Price

by Enrique GarciaSummary

- While searching stocks in the US retail sector, we detected Abercrombie & Fitch fulfills many requirements to increase chances of a successful turnaround.

- One of them is the clear net cash position, which represents a financial cushion for challenges ahead.

- Another key reference: its market capitalization is close to book value. This is an interesting sign, as its assets could be gradually recovered over time.

- Abercrombie & Fitch seems to have found a new shop model to adapt to the new competitive environment. As old leasings expire, its management expects a better performance from new establishments.

Nowadays, one the most interesting areas of research for long-term ideas is the traditional retail sector. Many companies are suffering the new competition and closing down stores, while its assets are often funded by debt. This is a dangerous combination and it justifies the low valuations of many stocks. It is important to determine what the problem is, in order to detect some interesting stocks with special qualities. Our first ideas in retail have been based on the strong competitive position of Scandinavian retailers, as illustrated in the SA article about Europris (OTC:ERPSY). However, we also explore possible turnarounds on the US market.

Basically, we are looking for companies with low or no debt, but also situations in which the market capitalization is close to or lower than book value - after making some necessary adjustments. This indicates that, if the company is able to liquidate or recover its assets at balance sheet price/cost, investors will gradually recover part of their investment as the firm converts its illiquid assets into cash. This goal can be achieved through asset sale, but also by the natural process of amortization and depreciation.

The main requirement is avoiding losses. It does not matter if the company obtains a lower net income in one year or another, we just need it to stay away from structural losses in the income statement. If the business is being restructured, it is likely that the investment in new fixed capital - CAPEX - will be lower than the amortization of old assets, meaning free cash flow higher than net income ceteris paribus.

In summary, the requisites of our initial filter in this sector are:

- Good financial position, low net debt or net cash.

- Market capitalization close to or lower than book value.

- Possibility to gradually convert illiquid assets into cash. This can be achieved by: 1) Paying off old assets while simultaneously avoiding losses, 2) selling assets at higher prices than those registered in the balance sheet. Usually, this is more easily accomplished when the company owns old buildings that are quoted at cost price, as inflation has probably produced nominal appreciation of those assets - therefore, they could be liquidated with extraordinary gains.

After fulfilling this criteria, we can also explore the possibility of a business turnaround. We do not expect to recover our total investment through liquidations as mentioned above, that view is applied to detect safety nets or insurance, in case the business does not improve over time. Although we are looking for turnarounds or successful restructuring, it is important to evaluate how much we could recover through well-organized liquidations, compared to market capitalization.

After evaluating dozens of retail stocks, we found a few of them that meet these criteria. And there is one of them that is restructuring its stores and has a new business model that could work: Abercrombie & Fitch (NYSE: ANF).

Basics of Abercrombie & Fitch

Abercrombie & Fitch is an international apparel distributor with three main chains: Hollister with 542 stores, Abercrombie & Fitch and Abercrombie Kids with 319 stores. 64.7% of its revenue comes from the US, followed by 21.8% from Europe and 13.5% from the rest of the world.

The business model is based on niche markets. The company does not target all kind of customers, it specializes in specific groups - usually youngsters or, as the CEO states, Gen Z and millenials. This means that it is not a fragile giant retailer which needs to close down hundreds of stores per year, its infrastructure is not so extended. We will see more details in Abercrombie & Fitch CEO explanations.

Net cash

At the beginning of November 2019, Abercrombie had $410.8 million in cash, clearly higher than its $241.3 million financial debt. Although some cash is necessary for the operating business, it is evident that the company does not have financial problems. This cash position means flexibility and time to develop long-term plans, improving the chances of success. It also allows an immediate remuneration for shareholders via dividends and share repurchases.

For the final assessment, we will consider that the company could operate with less cash, that is why it is distributing relevant dividends and making share repurchases. We assume the company could distribute an $80 million dividend without borrowing anymore, so we will subtract that amount to the market capitalization when comparing it to profit generation.

Book value vs. market capitalization

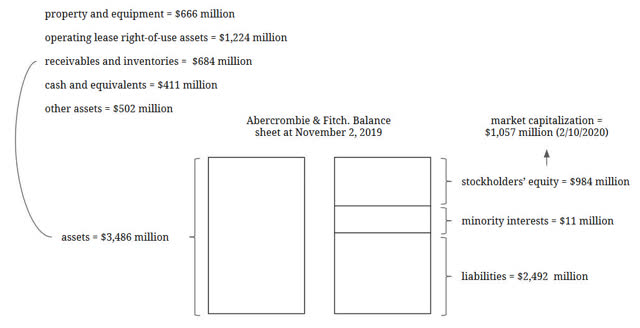

Abercrombie & Fitch's market capitalization is $1.07 billion and its book value was $994 million at the beginning of November. Is it possible to recover most of the assets? The good news is that there is no goodwill in the balance sheet, which is a kind of asset difficult to liquidate and it is not depreciated as the rest. The rest of the assets can be converted into cash through the natural process of amortization or, in some cases, liquidation. Abercrombie & Fitch does not own many buildings, therefore, we cannot expect big asset sales with extraordinary gains.

Let's have a look at the comparison between the balance sheet and market capitalization:

*Data from Abercrombie Financial Reports - Own calculations.

Most assets can be recovered if the company reduces its size. In that case, it would require less cash, receivables and inventories to operate the business. The operating leasings are paid off, therefore, they will be converted into cash over time, unless the company produces losses. We are not considering a liquidation scenario in the short term, only highlighting that restructuring would generate additional cash for the company - which could be distributed via dividends or share repurchases. It is interesting to note that the paid price for those assets is currently close to the figure registered in the balance sheet.

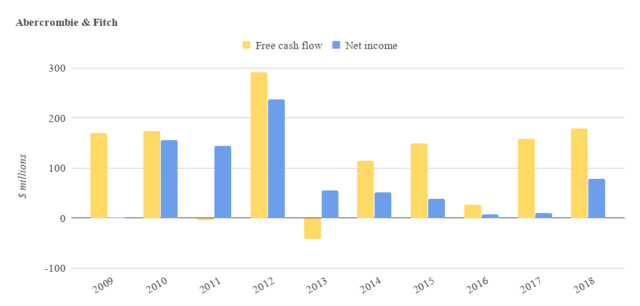

In summary, if Abercrombie & Fitch reduces its scale and avoids losses, free cash flow will be significantly higher than net income, a phenomenon that has already been observed in the last 5 years:

*Data from Abercrombie Financial Reports - Own calculations.

However, this is not all that matters. We would prefer that the company is able to increase its profits again. In fact, its management is not thinking about liquidating the business; they are restructuring it in order to adapt to the new economic conditions. And there are some interesting ideas to achieve that goal.

Restructuring efforts and transition to a new business model

The last decade has not been positive for Abercrombie from the point of view of sales: the new competition has affected the traditional stores profitability. But the physical store is not dead, maybe it just needs changes and a new business model. Abercrombie & Fitch management has a model for its new openings: one of the changes is the square footage reduction. According to Fran Horowitz, CEO of the company:

We believe in stores and our customers do too. With the majority of our sales occurring in these channels, it is highly relevant, especially to Gen Z which represents our largest target customer base. Research shows that Gen Z visits stores more often than millennials. However, with the evolution of digital and omni-channel capabilities, their expectations have shifted. We remain focused on providing the right experience for them and being there, whenever, wherever and however, they choose to engage with us. Reflecting our commitment to providing the best seamless omni-channel experience, global store network optimization is and has been one of our top priorities. There are several key components to this strategy including, rightsizing, remodeling, opening and closing stores. Since 2010, we have closed over 475 underperforming locations. Over the same period, we've provided our customer with approximately 300 productive new store experiences, while reducing gross square footage by roughly 17%. This has been achieved while growing digital revenues to over $1 billion in fiscal 2018. This year, we remain on track to deliver 85 new experiences, including 36 in the first half and close up to 40 locations ending the year with company-wide gross square footage down to the last year. Our updated store formats continue to perform well both quantitatively and qualitatively across brands and we view them as a critical step in our ongoing evolution. Abercrombie & Fitch Co. (ANF) CEO Fran Horowitz on Q2 2019 Results - Earnings Call Transcript

Therefore, it is just not a matter of low valuation compared to book value, there are opportunities to recover profitability, adapting its infrastructure and experimenting with new business models

For instance, management has a plan of closing its flagship stores, as they are the least profitable. This indicates that management is not just looking for growth, but is also considering the importance of invested capital returns. In the words of the CEO, the business model needs to reduce inputs used to operate those establishments:

While we've made significant progress on optimizing our mall-based stores, our flagships which are mostly Abercrombie's have been harder to impact. These flagships, the first of which opened in 2005 and the last in 2014 represents a different era. At that time, we built large-format beautiful stores in highly trafficked premium tourist locations. These were incredibly successful, but carried a considerable price performance, elevated construction cost, high rents well-above average, operating costs and unfavorable lease terms that tended to be significantly longer than those of our mall stores. We're evaluating our flagship fleet today. Many are large and outdated. The old model in terms of size, location, build-out and tenor did not make sense for the majority of the remaining flagships. The cost involved to modernize is significant and oftentimes without promise of a return. As we continue to move closer to our customer, our strategy is to open smaller-format, omni-channel locations with shorter and more flexible lease terms that cater to both local and tourist customers alike. Abercrombie & Fitch Co. (ANF) CEO Fran Horowitz on Q2 2019 Results - Earnings Call Transcript

How much could profitability improve with these measures? The main problem is that many leasings do not expire immediately, so the company is forced to operate some establishments, despite their lower profitability. However, as the leasings expire, the company can find other attractive locations with more appealing economic conditions. The potential is larger in its more traditional brand Abercrombie, as Hollister is already partially renowned:

At Hollister, approximately 50% of our global store fleet has been updated. We've been able to meaningfully impact Hollister given the size of its existing stores which on average are more closely aligned with the new build-outs. The modernized Hollister's on average generate high single-digit sales lift against older-format control stores. At Abercrombie, approximately 10% of our global fleet has been updated, leaving significant runway. When the stores were built, they tended to have very large footprints averaging 8,000 to 10,000 square feet. New stores are roughly 30% smaller. It is early days and we are taking learnings and applying them. Thus far, the modernized smaller-footprint stores generally achieve sales that are comparable to or slightly below larger-format control stores. Abercrombie & Fitch Co. (ANF) CEO Fran Horowitz on Q2 2019 Results - Earnings Call Transcript

In conclusion, the new business model is take advantage of the physical store, while reducing the investment in square footage and inventories. Besides, the slowdown in retail is offering better economic conditions to open new stores, as the supply of physical stores is increasing. The last 5 year data shows a stabilization in Abercrombie & Fitch profitability, after adjusting for asset impairments. This is consistent with the described process.

Dividends and share repurchases

Abercrombie & Fitch is using its cash to remunerate shareholders through dividends and share repurchases. As we consider the stock is currently attractive, share repurchases are creating additional value for shareholders in the long-run. This is the advantage of a net cash position and a positive cash generation.

The dividend has been stable and is now yielding 4.82%. Taking into account the strong cash position of Abercrombie, it is easy for the company to continue this policy in the coming years.

Connecting the dots

The potential of Abercrombie & Fitch is a combination of 1) paying off old assets without losses and 2) the opportunities to improve profitability through restructuring. This would mean free cash flow higher than net income and recovery of profits, as long as the company is successful in its new investments. If the recovery is weak, it is likely that the reduction of the store network will accelerate and the first effect - amortization and liquidation - will be still more important.

Assuming that the net adjusted profit - adjusted for asset impairments - will continue stabilizing at about $75 million in the years ahead and a net cash position of $80 million, the current earnings yield is 7.7%. It is true that 2019 is showing worse data than 2018, but we also take into account an improvement in costs as the company closes down the least profitable stores. Considering the safety net of liquidation/amortization of assets, a possible recovery of profitability, the non-cyclical nature of the business and a very strong financial position, it is a very interesting candidate for a turnaround.

Disclosure: I am/we are long ANF. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This article does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. As we have no knowledge of individual investor circumstances, goals, and/or portfolio concentration or diversification, readers are expected to complete their own due diligence before purchasing any stocks mentioned.