HubSpot: A Growth Stock For The Long Term

by Gary AlexanderSummary

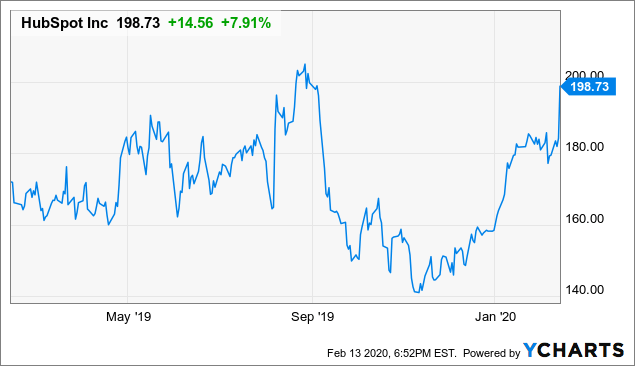

- Shares of HubSpot rocketed up more than ~7% after the company reported Q4 results and released FY20 guidance.

- The company is also projecting continued strong ~25% y/y revenue growth in FY20.

- Perhaps more importantly is HubSpot's rising profitability. Operating margins have consistently trended upward since HubSpot's IPO and are now long past the breakeven point.

- In an expensive market, HubSpot offers the right combination of growth, value, and profitability.

This article was highlighted for PRO+ subscribers, Seeking Alpha’s service for professional investors. Find out how you can get the best content on Seeking Alpha here.

One of the growth software stocks that I've continued to be bullish on even as the market ascends to new all-time highs in HubSpot (HUBS). Most enterprise SaaS companies are trading at astronomical double-digit revenue valuations, leading many pundits to proclaim a second dot-com bubble. The trick amid rising markets is to deploy careful stock selection into reasonably valued names that still have plenty of fundamental tailwinds.

HubSpot, which just closed out its fiscal 2019 with a strong fourth quarter and a bullish outlook for FY20, checks off all the boxes in this regard. The market response to HubSpot's most recent quarterly results was incredibly positive, with HubSpot shares rising more than 7% on the news, and taking its year-to-date gains above 20%:

Data by YCharts

Last quarter, I called out HubSpot as a heavily undervalued stock at ~6x forward revenues despite strong growth/profitability metrics. Since then, shares have gained a rapid 40%, beating a ~10% rise in the S&P 500 over the same time period. The question for investors now: does the rally still have steam?

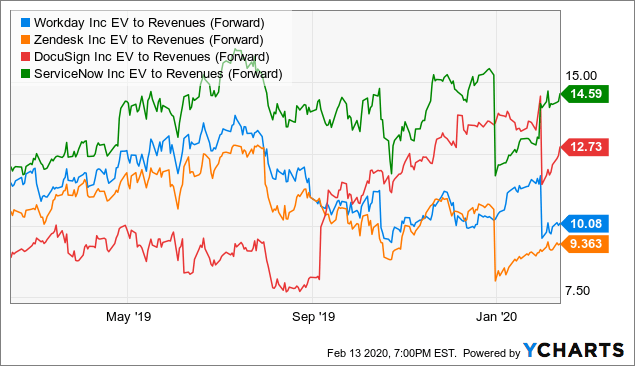

In my view, HubSpot still has plenty of head room to rise higher. We'll get into HubSpot's fundamental supports shortly, but we'll first illustrate this rally potential from a valuation perspective. At current share prices just under $200, HubSpot has a market cap of $8.45 billion. After netting off the $1.02 billion of cash and $340.6 million of debt on HubSpot's balance sheet, we're left with an enterprise value of $7.71 billion.

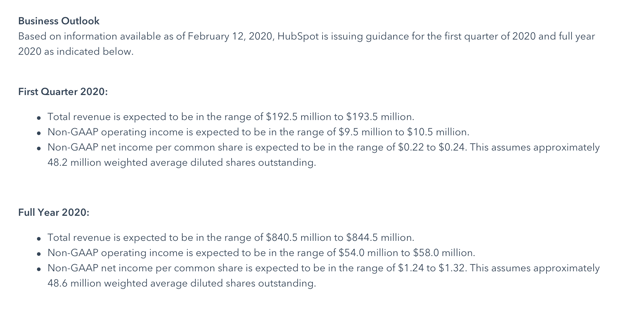

For the coming fiscal year, HubSpot has guided to total revenues of $840.5-$844.5 million, representing 25% y/y growth. Considering HubSpot exited Q4 at a 29% y/y growth rate, and the fact that the company has barely seen any deceleration over the past several quarters, there's likely a few points of upside opportunity on top of this guidance forecast.

Figure 1. HubSpot FY20 guidance updateSource: HubSpot Q4 earnings release

Regardless, if we use the midpoint of this revenue range, we arrive at a current valuation of 9.2x EV/FY20 revenues. While that's several turns higher than last quarter, it's also still several turns cheaper than competitor SaaS companies in the ~30% growth range:

Data by YCharts

In my view, there's plenty of room for HubSpot to stretch a few turns higher. My year-end price target on the stock is $234, representing a valuation multiple of 11x EV/FY20 revenues and 18% upside from current levels. Stay long here.

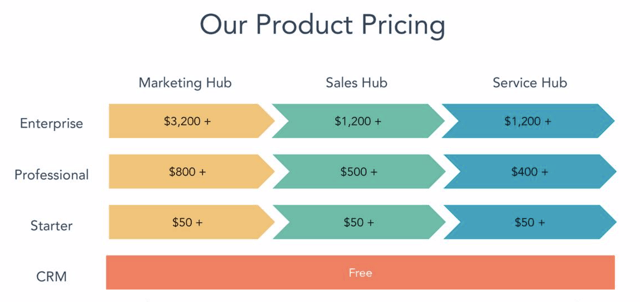

Wide-open TAM driven by platform conversion

One of the key reasons to stay invested in HubSpot is due to the fact that the company has recently shifted its product positioning from a single flagship product (its inbound marketing-focused CRM tool, which in itself already distinguished it from much of the competition like Salesforce.com (NYSE:CRM), which is primarily focused on outbound sales) to a more holistic platform.

This change only started in 2019, and is generating plenty of cross-sell opportunities for HubSpot. One of the reasons that HubSpot has become far more compelling is because its product is widely applicable across industry verticals, company sizes, as well as end-use cases through its platform of sales, marketing, and customer service solutions. Brian Halligan, HubSpot's CEO, described the company's key achievement in 2019 as putting itself "the center of our customers' flywheel."

Figure 2. HubSpot product stackSource: HubSpot Q4 earnings deck

Think fo HubSpot more or less as a less-mature Salesforce, and one that has carved out a niche for itself by positioning itself as an industry leader in inbound marketing (or the art of following up on leads that have already interacted with your brand, as opposed to outside cold calls).

Without a doubt, customer relationship management (or CRM) is one of the largest categories of enterprise software. Third-party reports peg CRM's TAM at north of $40 billion in 2023, with the largest market share currently held by Salesforce. To a well-regarded up-and-comer like HubSpot, the room for growth is still broad.

Q4 download

What's additionally appealing about HubSpot is its ability to balance steady growth with continued improvements in profitability - a trait that will become incredibly important as investors shy away from risk at new all-time market highs.

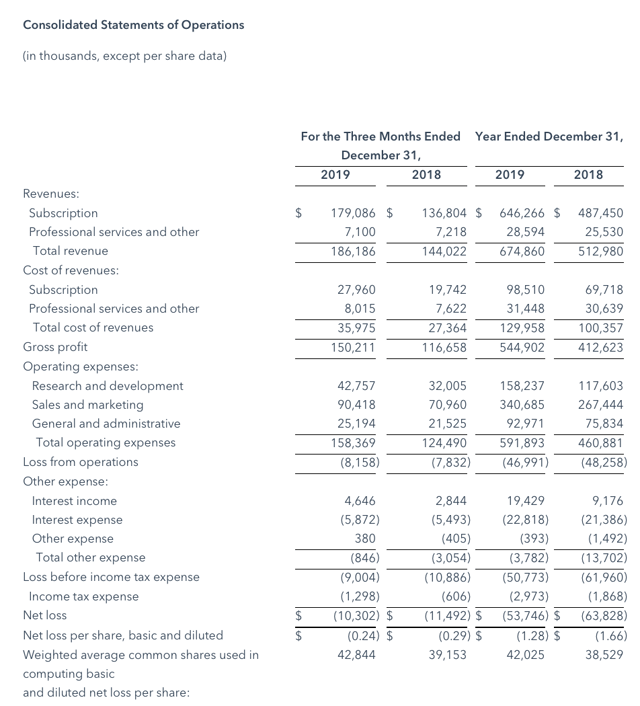

Take a look at HubSpot's latest results in the table below:

Figure 3. HubSpot 4Q19 resultsSource: HubSpot Q4 earnings release

Revenues grew 29% y/y to $186.2 million, blasting past Wall Street's expectations of $181.0 million (+26% y/y). One of the key areas of growth to note here is on the international front. While domestic growth clocked in at just 23% y/y, International revenues grew at a stunning 43% y/y on a constant currency basis. HubSpot's revenue contribution from overseas markets has become a huge driver of its overall business, comprising a 41% mix of overall revenues (almost twice than at the time of its IPO). Additionally driving HubSpot's go-to-market focus is a new Chief Customer Officer, with experience transforming Workday (NASDAQ:WDAY) and Dropbox (DBX) into global companies.

We note as well that HubSpot notched 30% y/y growth in billings, which is one point faster than revenues. The fact that billings growth is keeping pace ahead of revenue growth gives us confidence that HubSpot isn't headed for major deceleration in 2020.

Engagement and retention were also highlights of the fourth quarter. Per CEO Halligan's prepared remarks on the Q4 earnings call:

We closed out Q4 with revenue retention above 100% and a nice uptick in customer dollar retention year-over-year, which reached at a record high in the second half of the year. One of the most gratifying things we saw in Q4 were record high Net Promoter Scores from our customers. We've been working on improving Net Promoter Scores for years and it's been a stubborn metric. We saw a big lift in Q4 from the investments we made. This bodes well for future retention word of mouth. I'm really proud of the efforts to improve our customers' experience across the HubSpot platform in 2019."

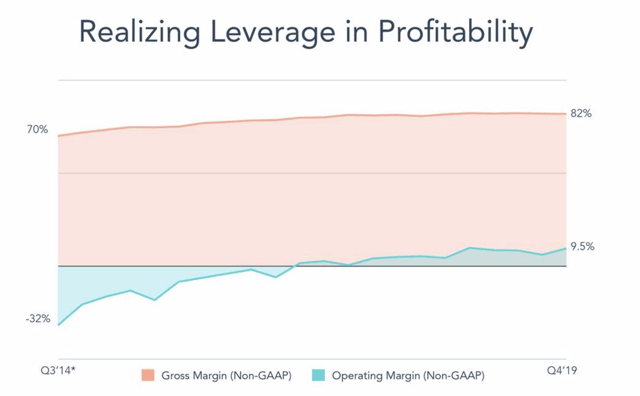

Unlike many SaaS companies, however, HubSpot isn't exclusively a growth story. The chart below helps to illustrate how HubSpot has leveraged its strong growth (even as it continued to develop new products to aid its transition into becoming a platform company) in driving margin gains. Pro forma operating margins hit 8.1% in FY19, up 180bps relative to 6.3% in FY18. That gain has been consistent over time, as shown in the chart below:

Figure 4. HubSpot margin trendsSource: HubSpot Q4 earnings deck

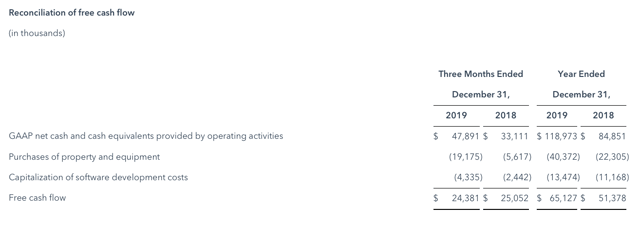

The company has also been a reliable cash flow generator. FY19 FCF clocked in at $65.1 million; the company expects FCF to grow to at least $75 million (+15% y/y) in FY20:

Figure 5. HubSpot FCFSource: HubSpot Q4 earnings deck

Key takeaways

With a solid growth profile and wide-open TAM driven by its new comprehensive three-pronged platform, as well as a trend of consistently raising profitability margins at a time when investors are dedicating more focus to tech companies' bottom lines, there's plenty of fuel left in the HubSpot rally. This is especially true with HubSpot's valuation currently sitting in the single-digits, though many similar-sized peers have notched revenue multiples in the low teens.

Keep riding HubSpot higher.

Disclosure: I am/we are long HUBS. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.