Momo: Cheap By Any Metric

by Matthew ZeetsSummary

- MOMO is a fast growth, Chinese tech company with a gigantic addressable market that is priced like a value stock.

- MOMO is cheap compared to other dating app/site companies and other Chinese social media companies.

- There are risks to be aware of if investing in MOMO.

Momo Inc. (MOMO) is a Chinese social media/technology company that primarily makes its money from dating apps Momo and Tantan (dubbed the Chinese Tinder). When I first started reading up on it, I assumed it would be another high expectation stock that would take years to grow into its valuation.

Quite frankly as I started to dive into the financials of Momo, I started wondering what I was missing. Every valuation metric I've been looking at has me scratching my head why Momo has been left in the dust as every other high growth stock I've taken a look at over the last 2 years has traded at crazy high valuations.

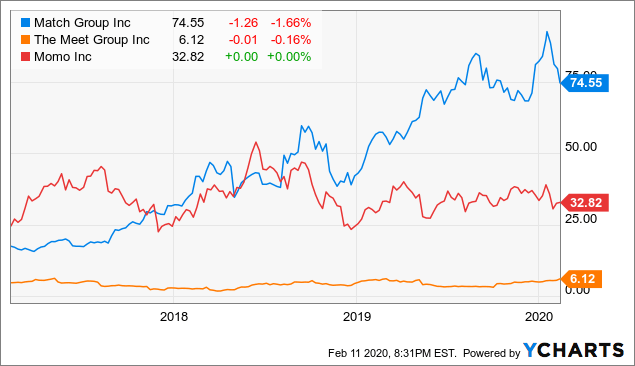

Dating App Peers

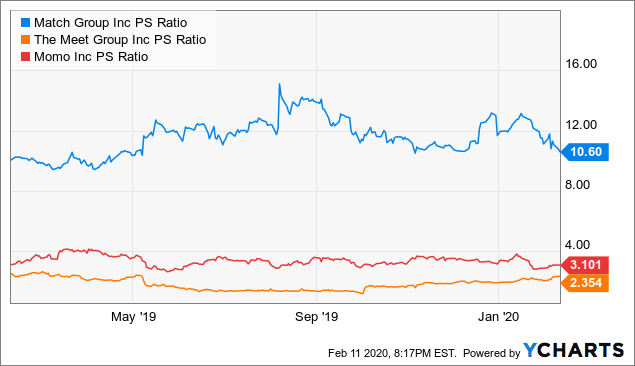

For comparisons to American based dating app companies I am using Match Group (MTCH) and Meet Group (MEET). Match group is by far the largest dating platform conglomerate owning Tinder, Match, PlentyOfFish, OurTime, OKCupid, Hinge, and others. Meet Group owns lesser known dating apps like MeetMe, LOVOO, Skout, Tagged, and Growlr but is the only other American dating app company I know of to compare to. On to the are the valuation comparisons. Here are the Price to Sales ratios of each company:

Data by YCharts

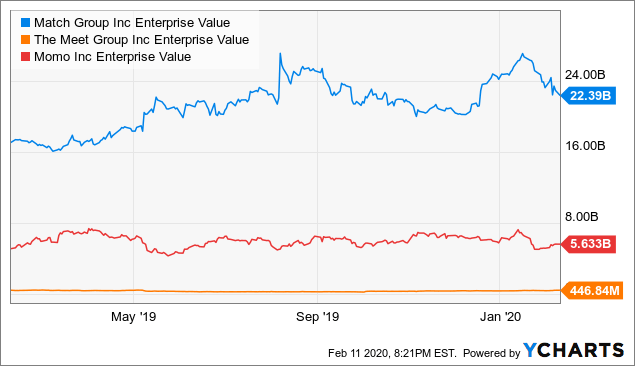

Okay, those seem like reasonable P/S ratios given that Meet actually trades at the lowest P/S ratio, with Momo at a slightly higher multiple and Match trading at a large premium. This made me wonder about the size of these companies. By enterprise value, Match is the largest, then Momo, with Meet being the smallest by far:

Data by YCharts

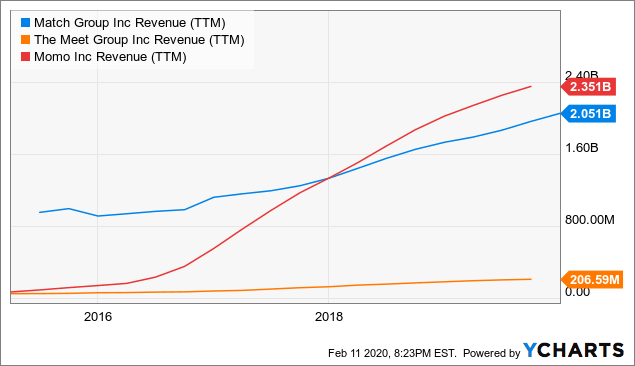

But enterprise value is largely made up of market cap, which is what people are willing to pay. Let's take a look at which company is the largest by revenue:

Data by YCharts

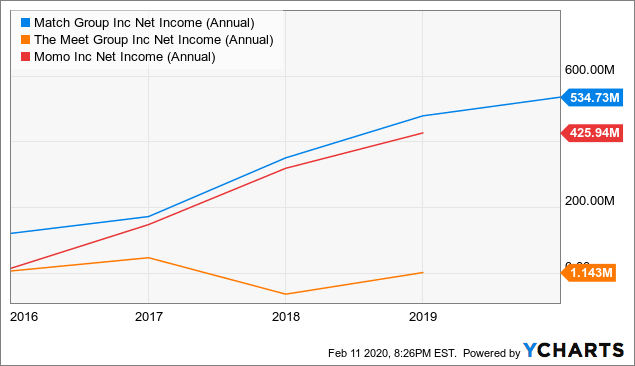

Wow! I did not expect that until I started writing this article. How can Match trade at such a high P/S premium, yet Momo have the higher revenues and much higher growth over the last 5 years? Perhaps net income will paint a different picture:

Data by YCharts

This chart at least helped explain to me why Momo shouldn't trade at a premium to Match, but I still don't get why it should not trade in line with them. They both have extremely good growth and make a lot of profit, yet Momo's stock has stayed pretty steady over the last 3 years while Match has continued to climb higher:

Data by YCharts

So the next questions for me became: What am I missing? What risks do I not know about for Momo? Is this premium purely from so many American growth stocks flying high? Perhaps Chinese peers just trade at much lower multiples.

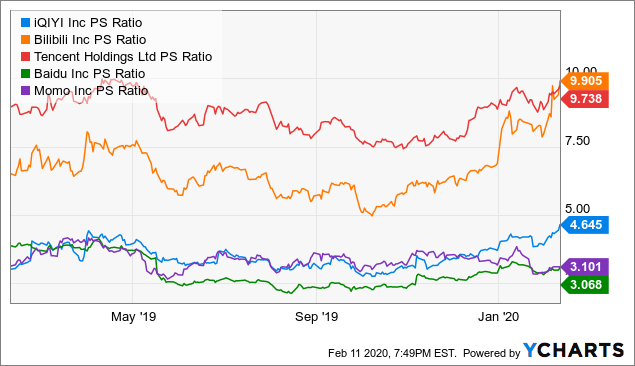

Chinese Peers

In terms of Chinese peers there may not be a perfect comparison. When I searched "largest Chinese dating apps" in Google, the first link listed Tantan, Momo, and Let's Have Dinner as the top 3. So at least from this source, 2 of the top 3 Chinese dating apps are owned by Momo. I also found some articles talking about how Tencent (OTCPK:TCEHY) is trying to make a big push into the dating app world, but they are still lagging their much smaller peer in name recognition so far. I mean that in terms of dating app name recognition only. Tencent is a giant among Chinese tech companies and much larger than Momo by any metric measuring the entirety of their operations.

I also found some other Chinese tech/social media companies of similar size to Momo to get some comparisons that way. The following list is what I came up with for peers: Tencent, iQIYI (IQ), BiliBili (BILI), Baidu (BIDU). Here are the Price to Sales ratios of those companies:

Data by YCharts

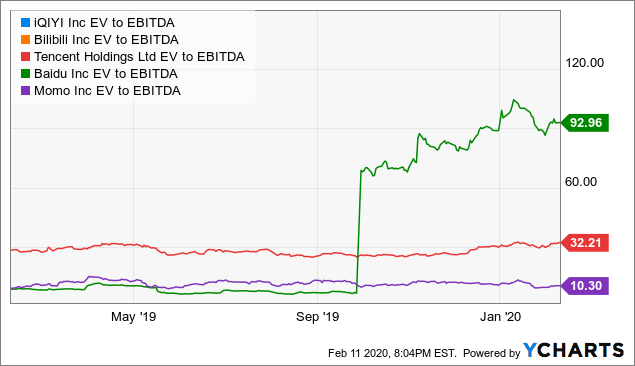

So in a similar fashion, almost every company trades at a premium to Momo. Only Baidu trades at a similar P/S ratio. And now the EV/EBITDA comparisons:

Data by YCharts

IQ and BILI don't even show up on the chart because they don't turn an operating profit yet. This is quite frankly what I expected when I looked at MOMO. I figured a high growth, Chinese tech company in a field with lots of room for growth trading at such a low P/S multiple surely wasn't turning a profit yet or had balance sheet issues or both. However what I found was a profitable stock, with future estimates for continued growth, with a strong balance sheet, but still trading like a value stock with an EV/EBITDA of 10.3 and Forward EV/EBITDA of 7.2.

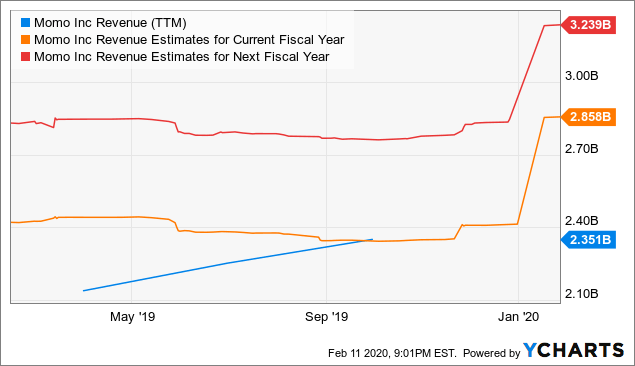

Future Estimates

Now lets take a look at Momo's growth estimates. Revenues are expected to grow over 15% in 2020 and over 10% in 2021.

Data by YCharts

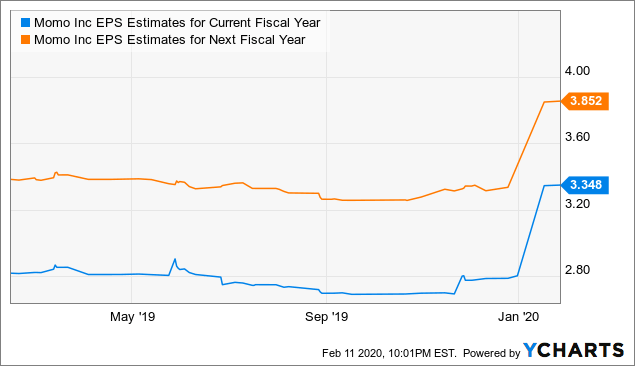

But revenue isn't everything; earnings are of course what eventually allows companies to grow and return money to shareholders. Here are the EPS estimates going forward.

Data by YCharts

As you can see the EPS estimate for 2019 was ~$2.80 before the estimates moved to the current year 2020. With the 2020 and 2021 estimates of $3.35 and $3.85 respectively, that is almost 20% and 15% growth estimates. Even using the expected 2019 P/E of ~12x and the lower growth rate of 15%, that still makes for a very attractive PEG of 0.8.

Risks

The biggest risk I see to owning MOMO is that it has an enormous, well-funded competitor in Tencent. It's never ideal to have to go up against such a gigantic company, with deep pockets, but Momo has a nice lead in dating app name recognition.

Another risk has to do with past regulatory problems. In April 2019 Tantan was removed from app stores for app store for violations. I can certainly see why the stock price dropped following this news. It posed a very large risk for the revenues associated with Tantan specifically and gave markets a scare that there could be further crack downs on dating apps, by app stores themselves and by the Chinese government. However Tantan returned to app stores just over two months later. Based on how net income has not kept pace with revenue so far in 2019, I am guessing Momo is investing to keep this from becoming a bigger issue, much the same as Facebook (FB) has done over the last couple years.

A risk that I personally have is the fact that I do not understand Chinese companies that well and don't have a pulse on what apps are used there. Sure Tantan and Momo came up as the top Chinese dating apps on a quick Google search. But trends change fast and if there are other more popular ones among young adults there, I wouldn't know it. I purely am analyzing past numbers and forward estimates. I will have to keep an eye on financials going forward to ensure my Buy thesis does not fall apart.

Lastly, I have heard of risks in trusting the financials of Chinese companies. MOMO trades on the NASDAQ, but it still gets its numbers from overseas and Momo Inc. is based in Bejing. I haven't seen fraud in other Chinese companies I've followed so far, but I also haven't followed that many.

Conclusion

Just as most markets in China, the dating app market has the long term potential to be several times larger than the Unite States. If Momo just keeps growing the way it has been, there is room for both Momo and Tencent in the market. Momo can continue to take its first mover advantage to keep growing and continue increasing profits. They already trade like a value company, so the risk of them falling by valuation alone is minimal. I'd have to see a reversal in growth for me to be worried on that front.

I am considering MOMO a Buy currently, having recently bought them, based on current valuation and on expected growth. I will continue to watch the quarterly numbers and will likely only consider my Buy thesis busted if I see one of the risks I mentioned materialize. This is not investment advice and everyone should, of course, do their own due diligence.

Disclosure: I am/we are long MOMO, MEET, FB. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.