Lonestar Resources: Likely To Be Overwhelmed By Debt Burden And Interest Costs

by Elephant AnalyticsSummary

- Lonestar is capable of maintaining production in 2020 while generating a bit of positive cash flow.

- Its high interest costs prevent it from being able to scale up more though.

- With debt at 3.9x unhedged EBITDAX at $51 WTI oil, it is likely to eventually restructure.

- Unhedged breakeven point is estimated at around $58 WTI oil including its preferred dividends being paid in cash.

- Well-level results look solid, but interest costs are likely too much of a burden.

Lonestar Resources (LONE) has been able to increase production significantly in 2019 and looks poised to at least maintain production in 2020 while generating slight amount of positive cash flow. Its well-level results are solid, but it is severely hampered by its debt, as interest costs add up to 33% of its unhedged EBITDAX at $51 WTI oil. Lonestar's preferred shares could have dividends adding up to another 7% of EBITDAX if they are paid in cash.

The interest burden and modest remaining liquidity makes it likely that Lonestar will need to restructure, with its January 2023 unsecured note maturity serving as a very challenging barrier.

Lonestar's Portfolio

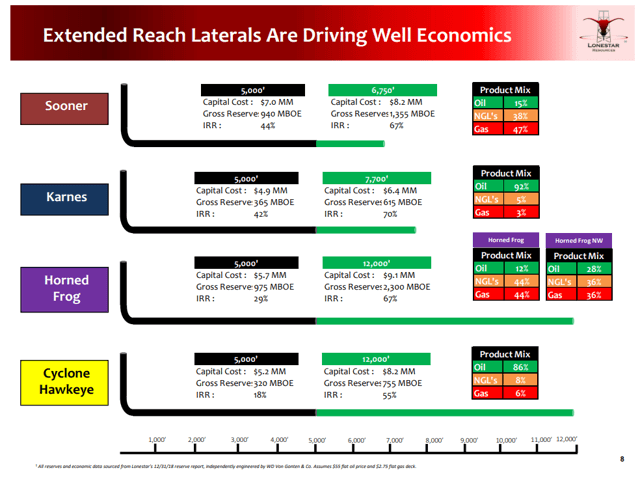

Lonestar claims the ability to generate solid returns from its wells. It has a portfolio of assets that includes some very oil-heavy inventory and also some inventory with a high percentage of natural gas and NGLs. Lonestar's extended reach laterals look pretty good with the prices it used ($55 oil and $2.75 natural gas) in its December 2019 presentation. Current strip prices are noticeably lower, but Lonestar's wells still look decent overall.

Source: Lonestar Resources

However, as we will see later, Lonestar's problem is not well quality, but instead its high debt and interest costs.

2020 Outlook

At current strip prices for 2020 (including $51 WTI oil), Lonestar may be able to generate around $190 million in revenue before hedges and $209 million in revenue after hedges. This assumes production of 17,500 BOEPD (46% oil), which was Lonestar's previously disclosed target for 2020. I've also assumed no oil differential to WTI and a minimal natural gas differential.

As noted above, Lonestar's oil percentage can vary substantially depending on what wells it puts into production. Its oil percentage was 44% in Q3 2019 and may be lower in Q4 2019. It expects to start receiving production from three Cyclone wells (with 85% to 90% oil) in early 2020 though, which should help boost its oil percentage despite older wells typically having an increased gas/oil ratio over time.

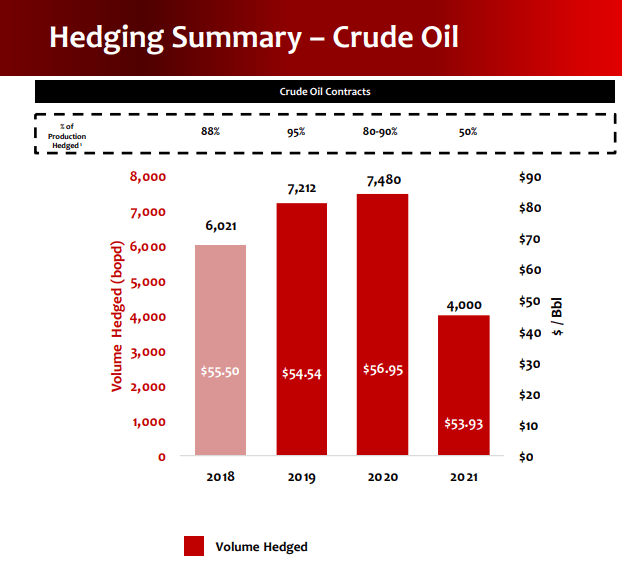

Source: Lonestar Resources

Lonestar is hedged on around 91% of its oil production (by my calculations) for 2020, so changes in WTI oil prices will have minimal impact on its results. Changes in the LLS premium to WTI will affect its financial results though since it doesn't have basis swaps in 2020.

| Barrels/Mcf | $ Per Barrel/Mcf (Realized) | $ Million | |

| Oil | 2,938,250 | $51.00 | $150 |

| NGLs | 1,533,000 | $12.00 | $18 |

| Natural Gas | 11,497,500 | $1.95 | $22 |

| Hedge Value | $19 | ||

| Total Revenue | $209 |

With a $102 million capital expenditure budget, Lonestar is expected to end up with $206 million in cash expenses, allowing it to generate $3 million in positive cash flow in this scenario. Since Lonestar is highly hedged on oil, it should be able to generate a fairly similar amount cash flow at $40 or $60 WTI oil, assuming the other inputs are unchanged.

| $ Million | |

| Lease Operating Expense | $36 |

| Production and Ad Valorem Taxes | $11 |

| Cash G&A | $15 |

| Cash Interest | $42 |

| Capital Expenditures | $102 |

| Total Expenses | $206 |

This scenario involves roughly flat total production growth (comparing 2020 to Q4 2019), but potentially some oil production growth (perhaps mid-single digits).

Breakeven Point

Lonestar's breakeven point without hedges is estimated at approximately $55 WTI oil (assuming it realized $1 above WTI). This also assumes $2.25 NYMEX natural gas, and a $0.25 change in natural gas prices would change Lonestar's oil breakeven point by around $1.

Lonestar's wells appear to have solid productivity, but it is hampered by high interest costs. Interest on its debt accounts for approximately 33% of its projected 2020 unhedged EBITDAX at $51 WTI oil.

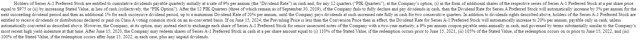

This doesn't include the potential payment of the 9% preferred dividends on Lonestar's $98 million in Series A-1 preferreds. Lonestar has been electing to pay these dividends in-kind, and it is allowed to do so for three more quarters (as of Q3 2019) without penalty. After that, the dividend rate will increase to 14% if it doesn't pay the dividend fully in cash, and then increases by 1% per quarter (up to a max of 20%) until it pays the dividend fully in cash for two consecutive quarters.

Source: Lonestar Resources - Q3 2019 10-Q

Including preferred dividends would increase Lonestar's oil breakeven point by around $3.

Valuation

Valuing Lonestar at 3.0x unhedged 2020 EBITDAX would give it a total valuation of $384 million. This is a higher multiple than the roughly 2.6x unhedged 2020 EBITDAX multiple that fellow Eagle Ford producer Penn Virginia is currently trading at.

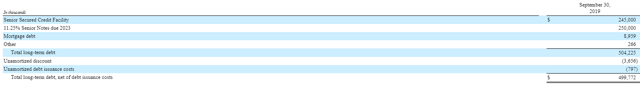

Source: Lonestar Resources

Lonestar does have a higher amount of drilling inventory (based on years) than Penn Virginia, so that may justify a moderately higher multiple. A 3.0x multiple would give its $250 million in unsecured notes a value of around 52 cents on the dollar after its $245 million in credit facility borrowings and small amount of other debt are accounted for.

Lonestar's common stock appears out of the money as its debt plus preferred shares add up to around 4.7x EBITDAX at $51 WTI oil.

Conclusion

While Lonestar's well-level results have been solid and have allowed it to significantly increase production during 2019, its large amount of debt (with the unsecured notes maturing at the beginning of 2023) is likely to be its downfall. Lonestar had $44.6 million in credit facility availability at the end of Q3 2019, so it will need to operate at close to neutral cash flow going forward. At $51 WTI oil, it can maintain or slightly increase production without cash burn due to its hedges for now. Without hedges, it would require mid-$50s WTI oil (and $2.25 NYMEX natural gas) if it continues to pay its preferred dividends in-kind.

Lonestar's high interest costs (and limited liquidity) will likely prevent significant further production growth. Lonestar is also well hedged on oil through 2021, which reduces risk, but also prevents it from benefiting if oil prices rise substantially. I am bearish on Lonestar's equity given those factors.

Free Trial Offer

We are currently offering a free two-week trial to Distressed Value Investing. Join our community to receive exclusive research about various energy companies and other opportunities along with full access to my portfolio of historic research that now includes over 1,000 reports on over 100 companies.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.