USD/CHF Price Analysis: Greenback off fresh 2020 highs, trades above 0.9800 figure

by Flavio Tosti- USD/CHF bulls are keeping the market above the 0.9800 figure.

- The rising wedge pattern can limit extra gains on USD/CHF.

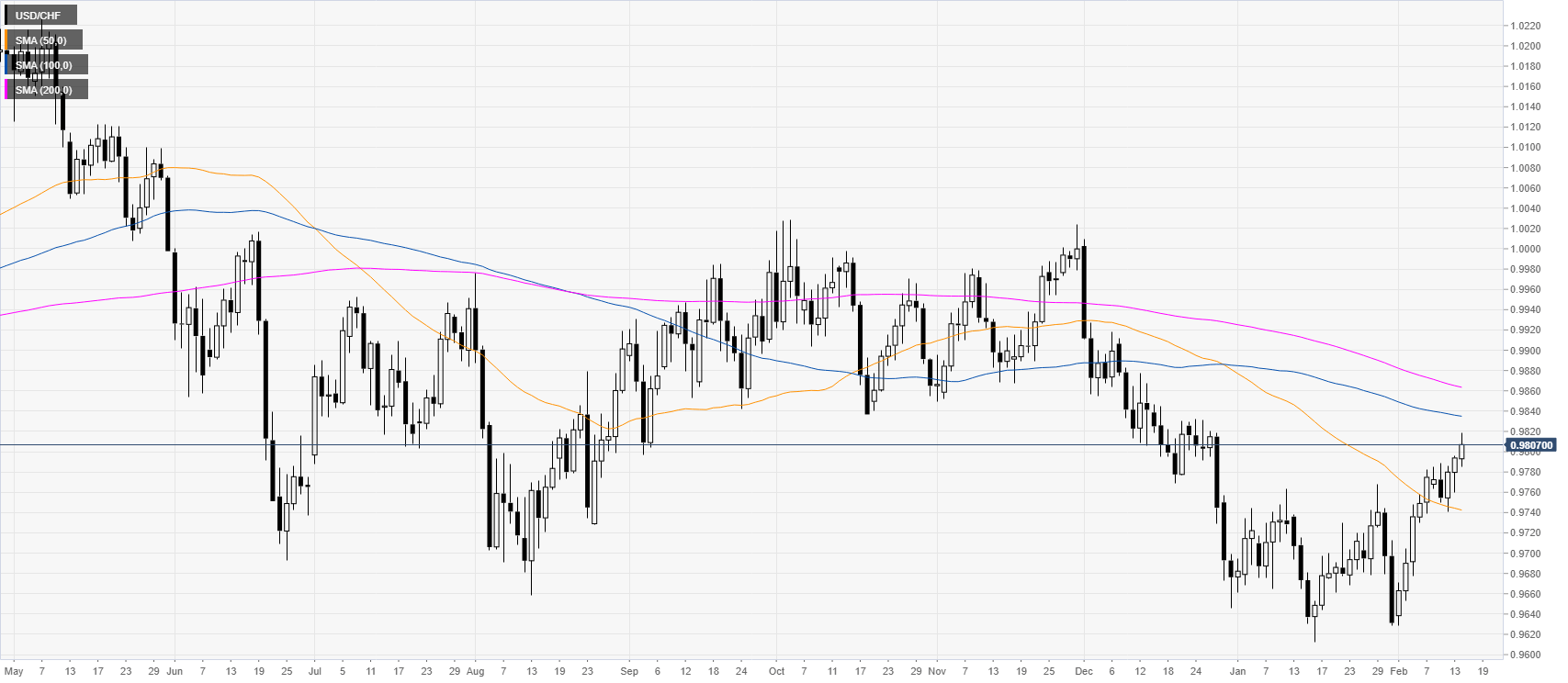

USD/CHF daily chart

USD/CHF is easing after hitting new 2020 highs this Friday. The quote is trading below the 100/200-day simple moving averages suggesting an overall bearish bias.

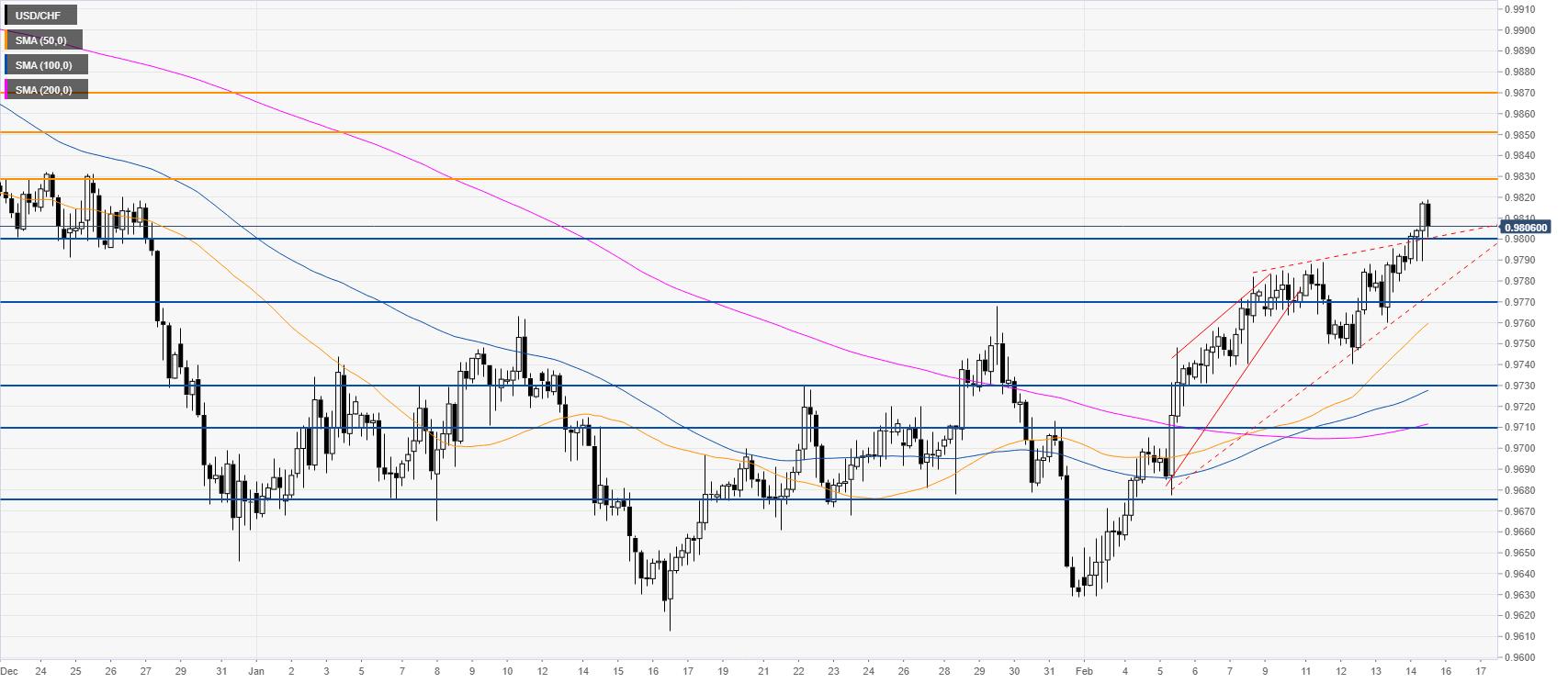

USD/CHF four-hour chart

The market broke above the 0.9800 figure and the rising wedge upper trendline. If bulls maintain the market above the 0.9800 figure it would be considered a bullish sign which can lead to further gains towards the 0.9830 and 0.9850 levels. On the flip side, a daily close below the 0.9800 figure could see a re-integration of the wedge with a potential decline towards the 0.9770 level.

Resistance: 0.9830, 0.9850, 0.9870

Support: 0.9800, 0.9770, 0.9730

Additional key levels

USD/CHF

| Overview | |

|---|---|

| Today last price | 0.9803 |

| Today Daily Change | 0.0009 |

| Today Daily Change % | 0.09 |

| Today daily open | 0.9794 |

| Trends | |

|---|---|

| Daily SMA20 | 0.9717 |

| Daily SMA50 | 0.9744 |

| Daily SMA100 | 0.9836 |

| Daily SMA200 | 0.9866 |

| Levels | |

|---|---|

| Previous Daily High | 0.9796 |

| Previous Daily Low | 0.976 |

| Previous Weekly High | 0.9782 |

| Previous Weekly Low | 0.9629 |

| Previous Monthly High | 0.9768 |

| Previous Monthly Low | 0.9613 |

| Daily Fibonacci 38.2% | 0.9782 |

| Daily Fibonacci 61.8% | 0.9774 |

| Daily Pivot Point S1 | 0.9771 |

| Daily Pivot Point S2 | 0.9748 |

| Daily Pivot Point S3 | 0.9735 |

| Daily Pivot Point R1 | 0.9806 |

| Daily Pivot Point R2 | 0.9819 |

| Daily Pivot Point R3 | 0.9842 |