2 Well-Covered 8% Yields Below Call Value: DCP Midstream LP

by Double Dividend StocksSummary

- DCP has two preferred issues with 12.92X distribution coverage in 2019.

- Both are below their $25 call value.

- DCP's 15%-plus common unit yield's coverage also is detailed.

- Earnings, growth projects, analysts' price targets also are detailed.

- Two option-selling short-term trades are detailed.

Sometimes you have to look past the bright lights and neon to find something more lasting. This may be the case with the three attractive dividend yields for Denver-based DCP Midstream, LP (DCP), which is owned by Phillips 66 (NYSE:PSX) and Enbridge (ENB).

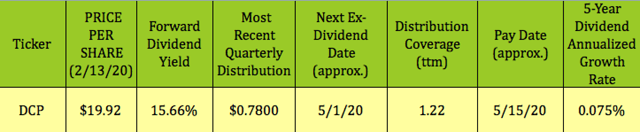

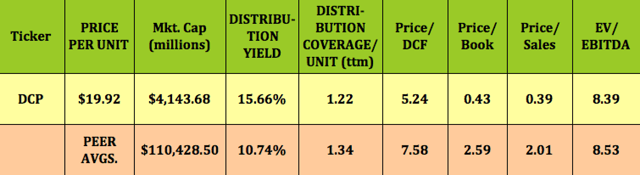

DCP has a very high common distribution yield of 15.66% due to losing ~32% on its price/unit over the past year, while management maintained the $.78 quarterly payout, as they have since Q1 2015.

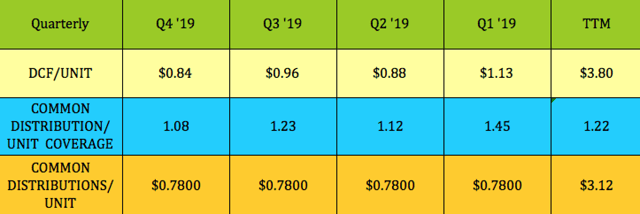

The coverage for the common distribution was quite lumpy in 2019, running from a high of 1.45X in Q1, to a low of 1.08X in Q4. Q4's coverage declined due to 65M additional units being issued as part of an IDR elimination, which was done to ultimately lower DCP's cost of capital.

Preferred Distributions:

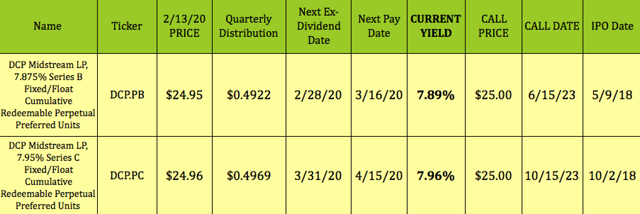

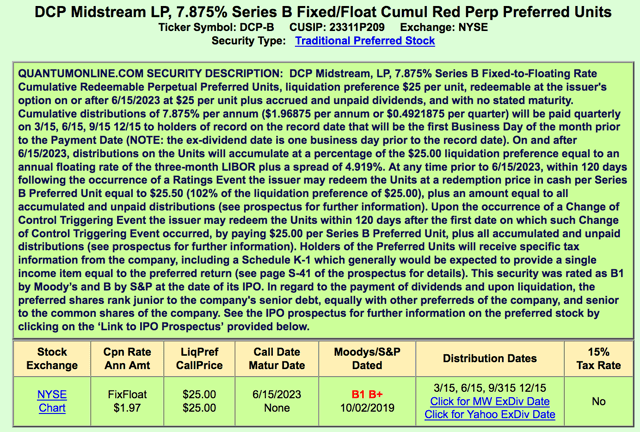

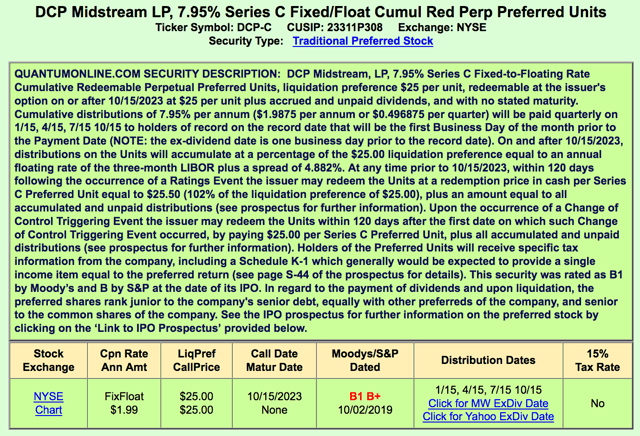

Meanwhile, DCP also has two preferred issues - the DCP Midstream LP, 7.875% Series B Fixed/Float Cumulative Redeemable Perpetual Preferred Units (DCP.PB), and the DCP Midstream LP, 7.95% Series C Fixed/Float Cumulative Redeemable Perpetual Preferred Units (DCP.PC), both of which have been much more stable than the common.

The B units' closing 52-week range is $22.60 to $25.04, while the C units' range is $23.47 to $25.20.

Both preferred units are currently below their $25.00 call value, with the B units yielding 7.89% and the C units yielding 7.96%. The B units go ex-dividend in a Feb/May/Aug./Nov. schedule and pay in March/June/Sept./Dec. The C units schedule go ex-dividend in a March/June/Sept./Dec. schedule, and pay in April/July/Oct./Jan.

These are cumulative shares, with no maturity dates, but they both have call dates in 2023 - 6/15/23 for the B units, and 10/15/23 for the C units:

They also both have a floating rate feature, which kicks in on their call dates. This floating rate is tied to the three-month LIBOR rate, which is currently at 1.71%.

The B units' floating rate is 4.919% above the 3M LIBOR, while the C units' floating rate is 4.882% above it.

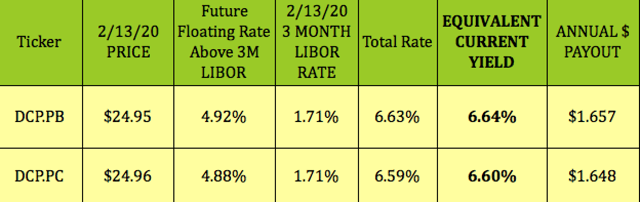

This table details what the equivalent yields would be for both units, if the 3M LIBOR rate is 1.71% when their respective floating periods commence.

At the current 1.71% 3M LIBOR rate, the B units would yield 6.64%, and the C units would yield 6.60%, vs. their current 7.89% and 7.96% yields:

The floating periods are a bit over three years away, in Q2 and Q4 2023, so no one knows what the 3M LIBOR rate will be at that time. LIBOR rates have been falling since ~early 2019 - the rate was 2.69% a year ago. The rate also went below .50% for an extended period of time during the recession.

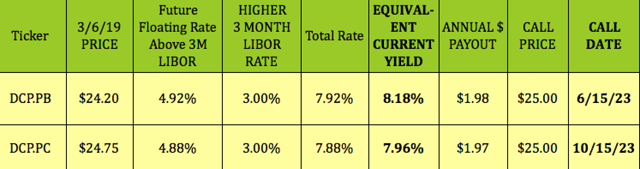

Here's what these two preferreds would yield if the 3M LIBOR rate goes to 3% in 2023. The B units would yield 8.18% and the C units would yield 7.96%.

The "parity" 3M LIBOR rate for the B units is ~2.7%, and is 3% for the C units, at which point they'd maintain their current yields.

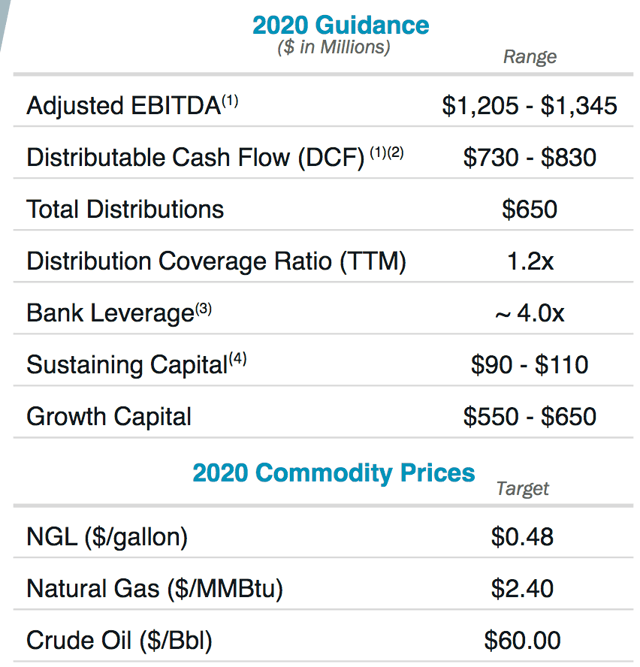

Guidance:

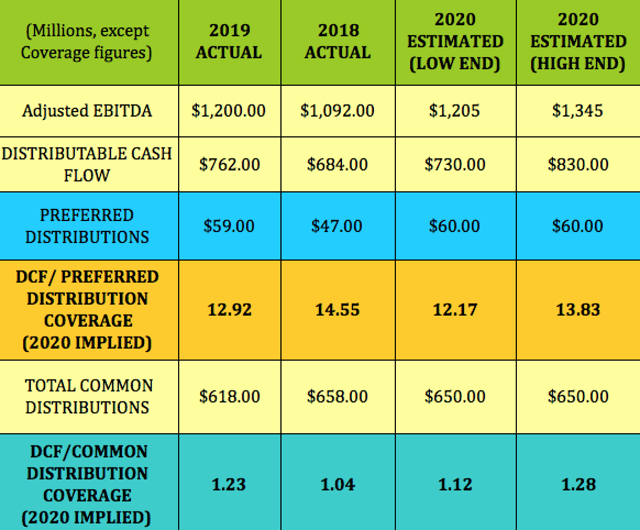

The coverage for these two preferreds continues to be quite strong on a distributable cash flow basis, even with a decline in 2019 from 14.55 to 12.92X.

Management issued a broad DCF guidance range of $730M to $830M for 2020, which implies a DCF/preferred distribution coverage range of 12.17X to 13.83X.

Common distribution coverage improved to ~1.23X in 2019, vs. 1.04X in 2018. The 2020 DCF guidance implies a common coverage range of 1.12X to 1.28X if the $.78 distribution is maintained.

Management's 2020 adjusted EBITDA guidance implies a growth range of up to 12%, while its DCF guidance implies growth of -4% to 8.9%.

(DCP site)

Earnings:

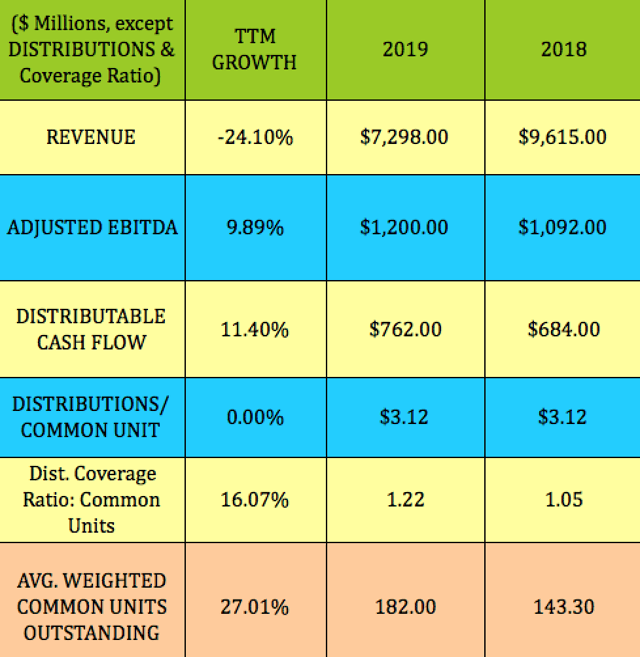

DCP's revenue fell -24% in 2020 due to a combination of asset sales and lower commodity prices. The company sold ~$185M of its non-core assets. Adjusted EBITDA grew 9.89% while DCF grew 11.40%. The common unit coverage factor improved by ~16%, while the unit count grew by 27%, due to the IDR swap deal.

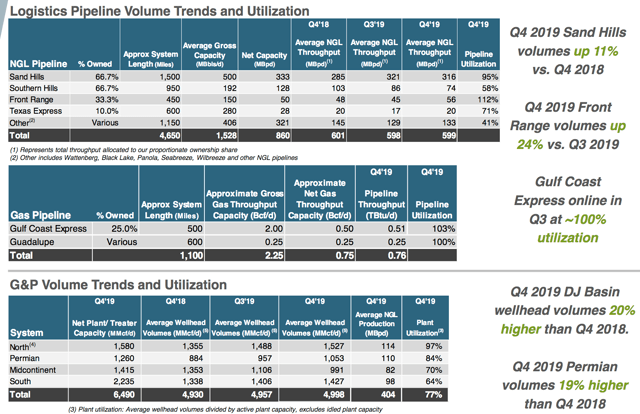

Throughput volume was down ~8% in Q4 '19, but rose at DCP's Sand Hills and Front Range operations. Its new Gulf Coast Express pipeline came online in Q3 '19, with 100% utilization.

Overall G&P volumes rose 1.3% in Q4 '19 vs. Q4 '18, with the DJ Basin up 20% and the Permian Basin up 19%:

(DCP site)

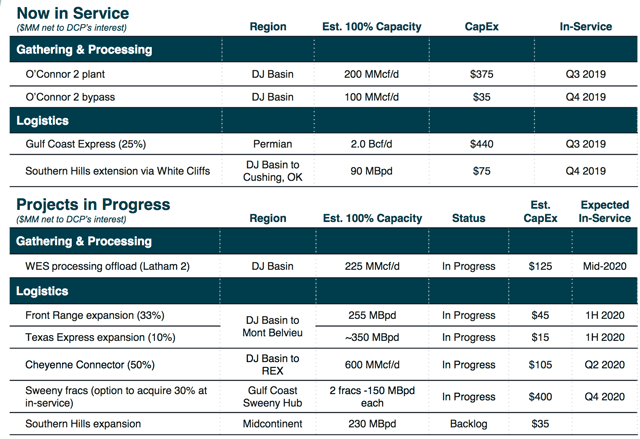

Capex Projects:

DCP has completed four new projects in the past two quarters, with six additional ones due to come online in 2020, mostly in its Logistics segment:

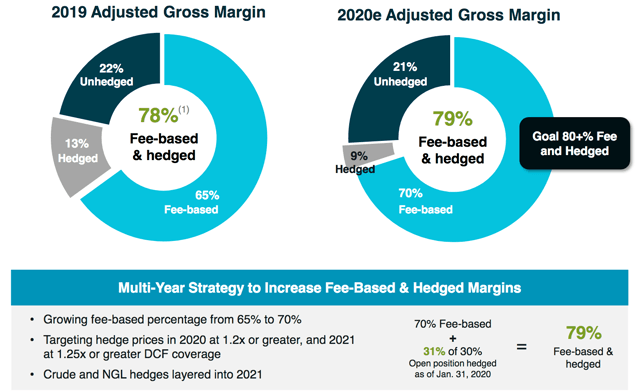

Management has been moving the company more toward fee-based earnings over the past few years, and currently has a target of ~80% fee and hedged gross margin for 2020:

(DCP site)

Analysts' Price Targets For Common Units:

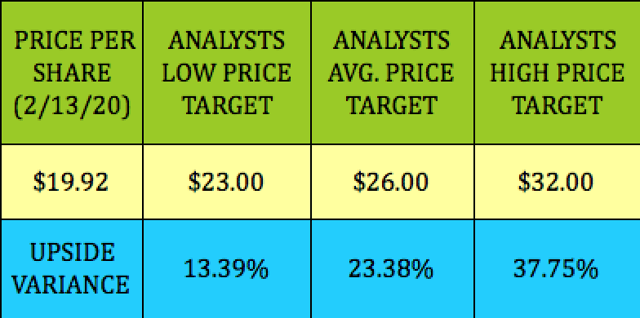

At $19.92, the DCP common units are 13.39% below analysts' lowest price target of $23 and 23.4% below the average $26.00 price target.

Valuations:

DCP's beaten-down price has pushed its price/DCF valuation to 5.24X, much lower than other midstream firms we cover. Its price/book is .43X, which also is much lower than the 2.59X average. Its price/sales also is very low, while its EV/EBITDA is similar to the average valuation.

Financials:

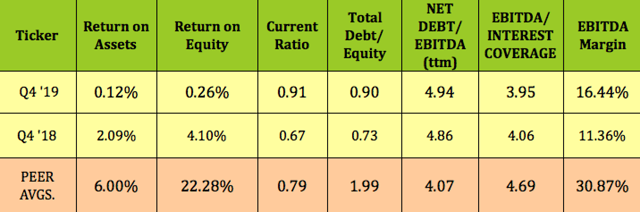

DCP's financials come up short, including ROA, ROE, interest coverage, and EBITDA margin. Its net debt/EBITDA leverage of 4.94X is above the 4.07 peer average, although management shows a much lower ratio of 3.96X, due to not counting $550M in Jr. Subordinated Notes, which it counts as part of equity.

Debt:

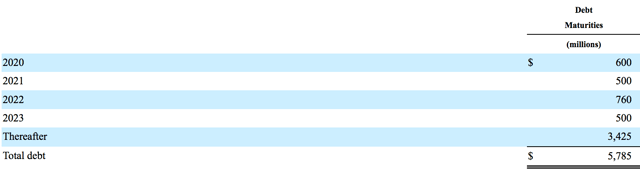

DCP didn't release its 2019 10Q yet, but here's its debt schedule as of 9/30/19, which looks fairly evenly apportioned through 2023, with the majority of its maturities due thereafter:

(Source: DCP 10Q)

Options:

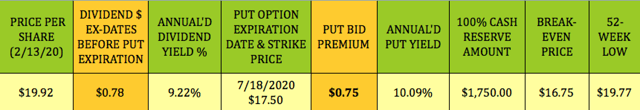

Although we favor the preferred units, DCP does have options available. If you're looking to dabble in a near-term trade, its July $17.50 put strike pays $.75, giving you a $16.75 breakeven, which is ~15% below its 52-week low.

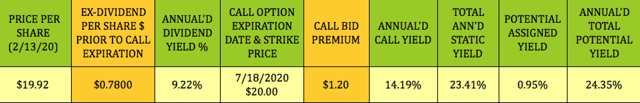

Conversely, if you're looking to hedge some of the common units, this July $20.00 call strike pays $1.20, and offers a total static yield of ~10% in ~5 months, or 23.41% annualized.

You can see more details for these two trades on our Covered Calls and Cash Secured Puts tables.

Summary:

We're keeping an eye on the DCP preferred units, which could be a potential 1-2 year play, if the 3M LIBOR rates stay low, or keep declining. In that scenario, we'd want to get out long before the 2023 call dates roll around, due to the probability of a falling payout when the floating rates kick in.

Hidden Dividend Stocks Plus, covers undercovered, undervalued income vehicles, with dividend yields from 5% to 10%+.

Our latest success story a 51% total return from inception for one of our core holdings, a little-known 124-year old US microcap dividend stock, which is getting bought out at a 34% premium. In addition to the buyout premium, HDS+ subscribers received 2 years of fat dividends, yielding over 8%.

We publish exclusive research articles weekly for the HDS+ site that you won't see anywhere else. Find out now how we can help your portfolio. There's a 20% discount for new members.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in DCP.PB, DCP.PC over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Our DoubleDividendStocks.com service has featured options selling for dividend stocks since 2009.

It's a separate service from our Seeking Alpha Hidden Dividend Stocks Plus service.

Disclaimer: This article was written for informational purposes only, and is not intended as personal investment advice. Please practice due diligence before investing in any investment vehicle mentioned in this article.