Future Industry Consolidation Could Be Good News For Macerich

by ValuentumSummary

- On February 10, the shopping center REIT giant Simon Property Group announced it was acquiring a majority equity stake in Taubman Centers, Inc.

- Future consolidation in the industry could be good news for Macerich Co., another shopping center REIT.

- In this note, we cover the Simon Property-Taubman Centers deal and why this news could be very important for Macerich going forward.

- We caution that while Macerich's shares have moved significantly higher on the news, nothing is for certain at this stage.

Image Source: Macerich Co. - September 2019 IR Presentation

By Callum Turcan

On February 10, Simon Property Group (SPG) effectively created an earthquake in the shopping center and mall real estate investment trust ("REIT") world by announcing it's acquiring an 80% equity stake in Taubman Centers, Inc. (TCO) for a 51% premium over where shares of TCO were trading at as of the market close on February 7, and almost double where shares of TCO were trading at before the rumors started. We wrote a note for SA titled Simon Property Has Some Moves Up Its Sleeve To Protect Its Nice Payout (link here) in early-February and wanted to revisit the "premium" shopping center space in light of recent events. In particular, we want to draw readers' attention to Macerich Co. (MAC), which is one of the bigger shopping center REITs whose properties are clustered around the US West Coast, Arizona, Chicago, and the New York-DC metropolitan areas.

First, the Big Acquisition

For reference, please note that Taubman Centers owns an interest in 26 shopping centers in the US and Asia. Most of those properties are in the US, and some are in South Korea, and these shopping centers cater to more affluent consumers in both regions. Out of those 26 properties, 24 are considered "high quality retail assets" with 21 of those in the US and three in South Korea, according to the acquisition press release. Simon Property is paying $52.50 per share in cash to acquire an 80% equity stake in Taubman Centers, and the Taubman family will retain the remaining 20% equity stake. Given Simon Property's strong financials, funding a deal of this size should be easy for a REIT of its caliber to handle.

What Simon Property likely found appealing in Taubman Centers is that the REIT's sales per square foot stood at $876 in 2019, up ~10% annually, and on par with (or in many instances, better than) other top-tier shopping center property owners. Simon Property reported sales per square foot of $693 in 2019, up ~5% annually.

By acquiring Taubman Centers, Simon Property is keeping true to its commitment to acquire and invest in shopping center and mixed-use properties that are considered "premium," meaning that these locations cater to more affluent customers. By pursuing this strategy, the goal is to keep occupancy rates up (a product of premium properties drawing in the kind of consumers that have recession-resistant spending patterns and tend to spend a lot more on discretionary goods than the "average" consumer) as that allows for meaningful rent increases over time, thus enabling a REIT like Simon Property to grow its cash flows (which are already quite large) substantially on an organic (rent increases, higher occupancy rates) and inorganic basis (acquisitions). Rising cash flows improve dividend payout coverage on a forward-looking basis and provide room for per share dividend increases, generally speaking.

Potential Acquisition Target

Pivoting to some of the other mall and shopping center REITs out there, Macerich comes to mind as this REIT had an interest in 47 regional shopping center housing 51 million square feet of real estate as of its fourth-quarter 2019 earnings report. In 2019, the REIT's sales per square foot came in at $801, up ~10% annually. That figure is below Taubman Center's but well ahead of Simon Property's, which indicates Macerich could potentially be an interesting acquisition target.

We want to stress here that while rumors will abound, which is largely why shares of MAC surged 11% on February 10 after the acquisition news between Simon Property and Taubman Centers broke, it isn't certain that Macerich will be acquired in the foreseeable future. However, if consolidation is coming to the mall and shopping center industry, Macerich appears to be a prime candidate given its premium properties, rising rental rates, and consistent occupancy rates.

Occupancy Rate Commentary

When it comes to occupancy rates, Simon Property (95.1% as of the end of 2019), Taubman Centers (94.3% as of the end of 2019 on a comparable center basis, which climbs to 95.7% when looking at leased space and not occupancy rates), and Macerich (94.0% as of the end of 2019) all perform well on this metric. However, please note that all three mall and shopping center REITs have faced a tremendous amount of pressure from retail bankruptcies and changing consumer dynamics. With foot traffic falling at malls and shopping centers, particularly in the US, creativity (i.e. adding novel entertainment offerings, such as e-sports, to these properties) and a focus on more affluent areas is key to staying relevant in the 21st Century.

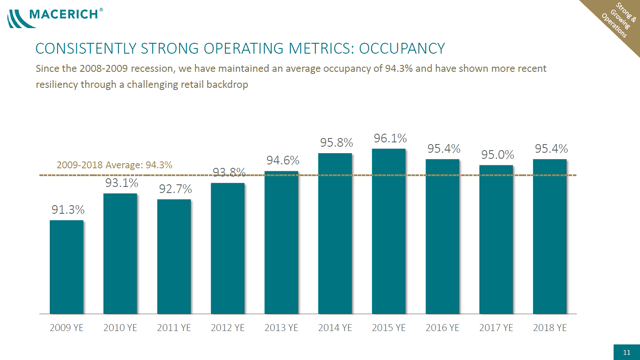

Since emerging from the Great Financial Crisis ("GFC"), Macerich's occupancy rates have been quite steady, even in the face of tremendous headwinds that the retail industry has been dealing with since the rise of e-commerce. While e-commerce represents ~11% of total US retail sales according to data from the Federal Reserve Bank of St. Louis (as of the third quarter of 2019), Morningstar (MORN) noted in a October 2019 article that when looking at just the kinds of goods consumers would go online to purchase (meaning goods such as gasoline and building materials, which largely are purchased at physical locations, are excluded from the upcoming figure), that rises to something closer to ~20% or a bit higher. With that in mind, Macerich's historical performance looks a tad more impressive as you can see in the upcoming graphic down below.

Image Shown: The stability of Macerich's occupancy rates could be attractive to a potential acquirer, should consolidation in the premium mall and shopping center space pick up pace. While we caution that this is just speculation, Simon Property's purchase of Taubman Centers has fundamentally altered the industry's outlook. Image Source: Macerich - September 2019 IR Presentation

Concluding Thoughts

The news that Simon Property would acquire a majority equity stake in Taubman Centers (at a very hefty premium no less to TCO's recent share price) has fundamentally altered the outlook for the mall and shopping center REIT space going forward. Additional consolidation efforts could arise over the coming years, which could potentially be good news for Macerich given its premium properties, high average sales per square foot metric, and consistent occupancy rates. We will continue to monitor this space going forward.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This article or report and any links within are for information purposes only and should not be considered a solicitation to buy or sell any security. Valuentum is not responsible for any errors or omissions or for results obtained from the use of this article and accepts no liability for how readers may choose to utilize the content. Assumptions, opinions, and estimates are based on our judgment as of the date of the article and are subject to change without notice.