Exxon Mobil: A Great American Company With A 5.66% Dividend Worth Investing In

by Steven FiorilloSummary

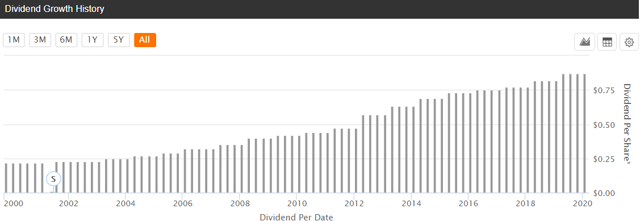

- Exxon Mobil has increased its dividend for 37 consecutive years and with yields closing in on 6% it is an income lover's dream.

- Exxon Mobil is positioning itself for the future as its recoverable resource base in Guyana has increased to more than 8 billion oil equivalent barrels.

- Fossil fuels are embedded in society as hydrocarbons touch our lives in numerous ways. The chances of eliminating fossil fuels anytime soon is worse than a crapshoot.

- Investors can pick up shares of Exxon Mobil at discount prices and enjoy a large dividend with the potential of seeing shares increase to $70 by 2021.

In 1870, John D. Rockefeller and his partners formed the Standard Oil Company and over the past 149 years evolved into what is now Exxon Mobil Corporation (XOM). Over the course of those 149 years, XOM has evolved from a regional marketer of kerosene to the largest publicly traded petroleum and petrochemical enterprise in the United States. XOM operates in the upstream, downstream and chemical business segments delivering products that drive modern transportation, power cities, lubricate industry and provide petrochemical building blocks which are the cornerstones of consumer goods by the thousands. Over the past 149 years, XOM has grown into an organization with a $260.26 billion market cap but the past decade has not been kind to this great American company.

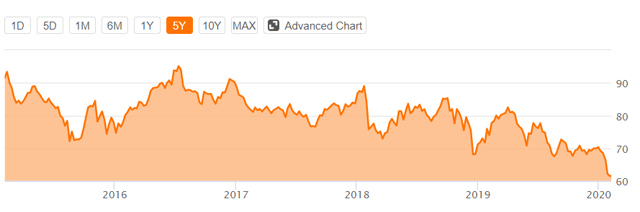

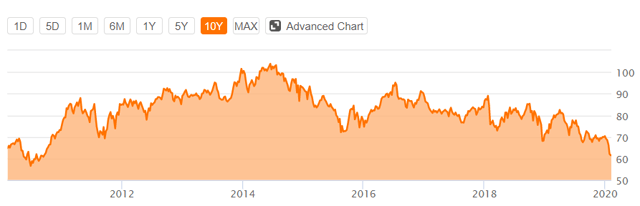

Over the past five years, XOM’s share price has declined 34.17% from $93.37 on 2/9/2015 to $61.47 at the close of business on 2/7/2020. Looking at the past decade, XOM has been a negative investment in share price going from $64.9 on 2/8/2010 to $61.47 on 2/7/2020 while reaching a high of $102.59 on 6/30/14. Someone who parked their money in an S&P 500 fund such as the SPDR S&P 500 Trust ETF (SPY) over the past decade would have seen returns of 207.48% as shares increased from $108.04 on 2/8/2010 and closed at $332.20 on 2/7/20.

Over the past decade, XOM has not been a good investment for share appreciation. Most likely the only group of people who are currently happy with XOM is the ones who own shares strictly for the amount of cash its dividend throws off every quarter. As a dividend investor and yield hunter, I love companies that throw off large amounts of cash to shareholders but not at the sacrifice of share appreciation.

I believe XOM is finding a bottom and its downward spiral is coming to an end. I don’t see XOM retreating under the $60 mark and if it does I believe it will be short-lived. XOM’s share price has dropped so much that the $3.48 per share it throws off as a dividend has reached a forward yield of 5.66%. With 37 years of dividend growth, a growing global demand for energy and hundreds of bankruptcies happening in the oil patch I would be a buyer of XOM at these levels. I think XOM can recover to the $70 range in 2020 while appreciating to $80 in 2021. XOM is an iconic American company that shouldn’t be discarded as trash.

I believe there is a complete misconception about oil companies and fossil fuels in general and while renewable energy will continue to increase its share in the global energy mix, fossil fuels will be here for decades to come. According to JJ Kinahan, Chief Market Strategist for TD Ameritrade, XOM was one of the most purchased stocks by their millennial investors. The elimination of hydrocarbon products is just not feasible and XOM is not on the brink of extinction.

(Source: Seeking Alpha)

(Source: Seeking Alpha)

Just because 2019 wasn’t exceptional for Exxon Mobil doesn’t mean 2020 or 2021 will have the same fate

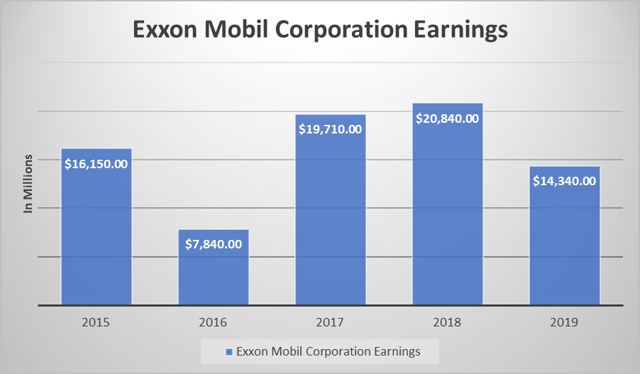

Fiscal year 2019 saw declines in many areas when you compare 2019 to 2018. Three major areas XOM saw significant decreases were in total revenue and other income, income before taxes and net income attributable to Exxon Mobil. XOM saw its total revenue and other income decrease by just over $25 billion from $290.21 billion to $264.94 billion which is equivalent to an 8.71% reduction year over year. XOM’s income before income taxes was reduced by $10.9 billion as it saw a reduction from $30.95 billion to just over $20 billion for a decline of 35.2% year over year. XOM’s net income attributable to Exxon Mobil was lower by $6.5 billion seeing a decline of 31.2% year over year as it slid from $20.84 billion to $14.34 billion. The one positive decline XOM recognized was in the amount of taxes it paid in 2019. XOM’s effective tax rate was reduced by 4.46% as in 2018 the company paid 30.8% on its income while in 2019 XOM paid 26.34%.

XOM’s 2019 earnings were $14.3 billion which was a reduction of $6.5 billion from 2018. The upstream segment increased by $360 million which was driven by its divestment in Norway and larger liquid volumes. Its downstream segment saw its earnings decrease by $3.7 billion which is attributable to lower refining margins, increased scheduled maintenance, absence of the Germany retail and Augusta divestments from 2018. The chemical business segment has an earnings decrease by $2.8 billion which was driven by weaker margins and higher expenses. 2019 was a difficult year for XOM as cyclically low prices and margins across its businesses were large factors to a lackluster 2019.

Just because 2019 was disappointing doesn’t mean 2020 will be. If you go back and look at the past five years, XOM’s average earnings or net income attributable to XOM was $15.78 billion. XOM missed its five-year average by 9.1%. 2016 was actually the worst year over the past five years as its net income came in at just $7.84 billion. For a company such as XOM, an underperforming year here and there isn’t going to wreck the company as we saw with 2016. Fiscal year 2019 was nothing special but it isn’t something to worry about either.

(Source: Steven Fiorillo) (Data Source: Exxon Mobil Q4 2019 report)

Exxon Mobil has tremendous momentum going into 2020 with its world-class projects

XOM is capitalizing on its global portfolio to generate additional profit streams. Recently XOM increased its estimated recoverable resource base in Guyana to more than 8 billion oil-equivalent barrels. XOM made another oil discovery northeast of the Liza field at the Uaru exploration well which is the 16th discovery on the Stabroek Block. In the coming months XOM is projecting that the gross production from the Liza Phase 1 development in the Stabroek Block will reach 120,000 gross barrels of oil per day. The Liza phase 2 development which is under construction will consist of a second floating production, storage and offloading vessel with 220,000 gross barrels of oil per day production capacity.

XOM is currently seeking government approvals to start a third development in the Payara field north of the Liza discoveries which could start in 2023 and reach an estimated 220,000 barrels of oil per day. XOM is predicting that by 2025 at least five floating production, storage and offloading vessels will be producing 750,000 gross barrels of oil per day at the Guyana project.

XOM also acquired more than 1.7 million acres for exploration offshore of Egypt during the 4th quarter of 2019. The acreage includes 1.2 million acres in the North Marakia Offshore Block and the remaining 500,000 acres are situated in the North East El Amriya Offshore Block in the Nile Delta. XOM has 100% interest in the 1.7 million acres and exploration is scheduled to begin in 2020 with seismic testing.

XOM and its partner Qatar Petroleum reached a final investment decision to proceed with the development of the Golden Pass LNG export project located in Sabine Pass, Texas. Construction of this facility has started and is expected to start up in 2024. The Golden Pass will cost in excess of $10 billion and the project will have the capacity to produce 16 million tons of LNG per year. Through this initiative, XOM will deliver an additional long-term supply of LNG to the global gas markets.

XOM is arguably the greatest exploration company in the oil patch and through its efforts has built a global empire. XOM continues to invest in its future with millions of barrels of black gold ready to be extracted from the earth. XOM’s mojo hasn’t been lost and it is refueling for the next decade in my opinion. I believe XOM is investing in the right projects and I believe the depleting share price is only temporary.

(Source: Exxon Mobil)

The global energy landscape sets up well for Exxon Mobil

One common thing across every country globally is that sustainable energy is needed. Regardless of the form of energy, it is needed from the most basic to complex day to day tasks. Could you imagine turning on the light switch and not knowing if the lights would come on, going to the gas station and not knowing if gasoline was going to come out of the pump, or turning the burners on and not knowing if there would be a flame to cook? How about if hydrocarbons became scarce? A hydrocarbon is a molecule where its structure includes only hydrogen and carbon atoms. Many of the plastics we use every day are made from long chains of monomers which are formed from petrochemicals. Petrochemicals are chemicals that are made from crude oil and natural gas which are both made up of hydrocarbon molecules. Petrochemicals are essentially the building blocks that are critical to manufacturing the goods which make modern-day life possible from paints to plastics to mobile phones. Oil and gas are currently the main inputs for creating petrochemicals because they are the least expensive raw materials to utilize while being the most commonly available and are processed easily into petrochemicals.

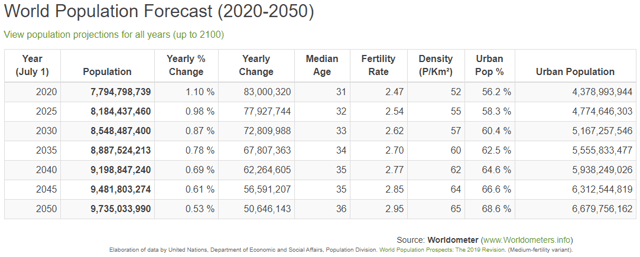

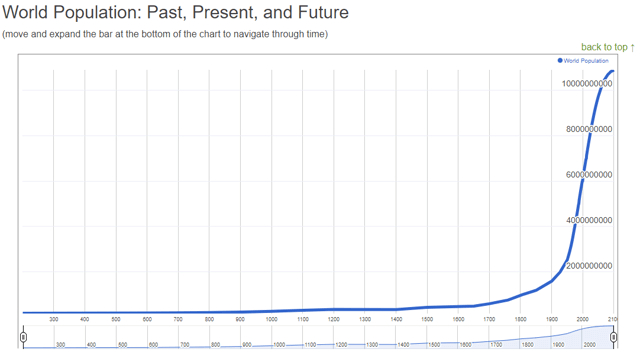

The global population is closing in on 7.8 billion people across the planet. The estimates from Worldometers are that there will be over 8.5 billion people globally by 2030 and by 2050 there will be just over 9.7 billion people on this planet. The United Nations is projecting that the world population will reach 10 billion in the year 2057. Over the next 37 to 38 years the global population is going to grow by 28.81%, adding over 2.23 billion people to the current population. The three largest countries by population today are China with 1.43 billion people, India with 1.37 billion people and the U.S. with just over 330 million people. To put this in perspective, the increase in population over the next 38 years will be larger than adding a 2nd China and U.S. on the map and almost as big as adding two additional Indias on the map. The common theme won’t change and there will need to be sustainable energy to accommodate the population growth the global scale is going to encounter.

(Source: Worldometers)

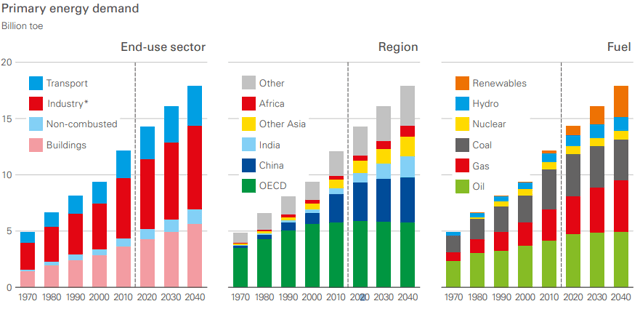

I personally feel that BP p.l.c. (BP) does a phenomenal job each year delivering its annual energy outlook. It provides a roadmap of where BP sees the energy industry going in the future. BP is projecting that by the year 2040, the amount of energy needed globally will continue to increase led by China and India. If BP is correct, by 2040, we will see a large increase in renewables and natural gas with oil increasing marginally, then flatlining while the use of coal is reduced. The two largest increases on the end-use side will be buildings and industry. The recent trade deal agreement is a win for US energy as China has pledged to purchase an additional $50 billion in energy exports from the U.S. The growing global demand compounded with growing U.S. exports and the growing global population should work out well for XOM. As XOM increases its production the company should be in a prime spot to help fill the needed capacity on a global scale.

(Source: BP 2019 Energy Outlook)

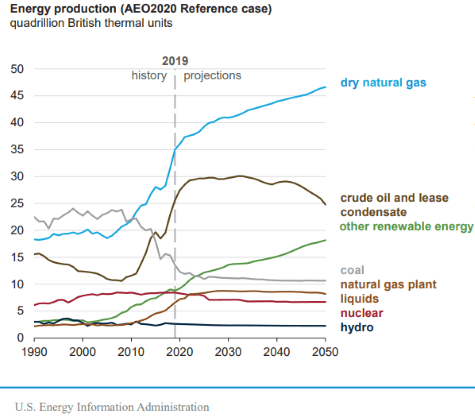

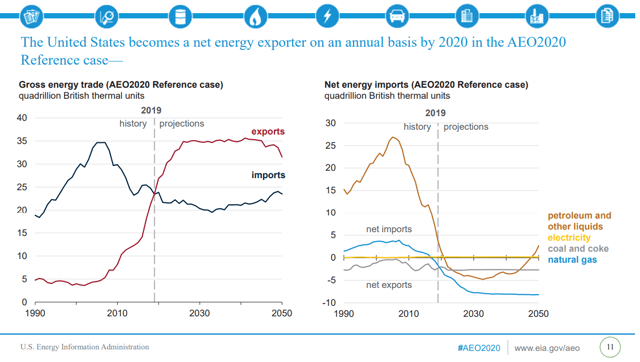

The EIA recently released its 2020 annual report and it supports the need for fossil fuels in the global energy mix for years to come. The EIA is projecting that the energy production in the U.S. will see a reduced amount of coal with dry natural gas and renewables increasing the most. Crude oil will increase in the short term, then production will be sideways until around 2035 where it starts to decline. The EIA is also indicating that the U.S. will see its exports continue to increase until about 2025, then stay at a stable level into the 2040s before starting to decline. XOM’s increasing production helps position the company as a clear winner as the U.S. continues to increase the production of natural gas and crude oil while increasing exports on a global scale.

(Source: EIA Energy Outlook 2020)

Exxon Mobil has a world-class dividend which has recently exceeded 5% forward yield

XOM has been an income seeker's dream as it became a dividend aristocrat in 2008 and is working on joining the prestigious dividend king club. For the past 37 years, XOM has increased its dividend to shareholders and over the past five years, the dividend growth rate has been 4.9%. XOM’s dividend currently pays shareholders $3.48 per share which makes the forward yield in excess of 5%. If you are looking for quality companies that pay a dividend, don’t look past XOM. With a long history of dividend increases you should consider carving out a position in your portfolio for this American juggernaut. XOM’s track record speaks for itself and if you don’t mind volatility in the share price there aren’t many reasons to skip over XOM. Fossil Fuels will play an important role in the global energy mix for years to come and as long as XOM is a premier super-major, the dividend should continue on its path to becoming a dividend king.

(Source: Seeking Alpha)

Conclusion

I believe XOM is a buy at its current levels. As XOM threatens to descend through the $60 level the dividend is closing in on 6%. I feel XOM is bottoming and an opportunity to pick up shares at discount prices won't last very long. The global demand for energy should grow year over year and I don’t see fossil fuels disappearing. If you look at the data from the EIA and BP’s energy outlook, fossil fuels should continue to play an important role in the global energy mix for years to come. XOM is positioned well to weather the storm and investors get to feast on a dividend which is approaching 6% while the energy markets correct. I am long XOM and think shares could rebound to at least $70.

Disclosure: I am/we are long BP, XOM. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Additional disclosure: Disclaimer: I am not an investment advisor or professional. This article is my own personal opinion and is not meant to be a recommendation of the purchase or sale of stock. Investors should conduct their own research before investing to see if the companies discussed in this article fits into their portfolio parameters.